-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI US OPEN: Partially Retracing Post-Payrolls Moves

EXECUTIVE SUMMARY:

- CHINA EXTENDS MILITARY EXERCISES NEAR TAIWAN WITH NEW DRILL

- BOJ LOOKS AT GUIDANCE AS OTHERS DROP THEIRS (MNI INSIGHT)

- SENTIX EUROZONE ECONOMIC SENTIMENT IMPROVES IN AUGUST

- CHINESE EXPORTS JUMPED IN JULY

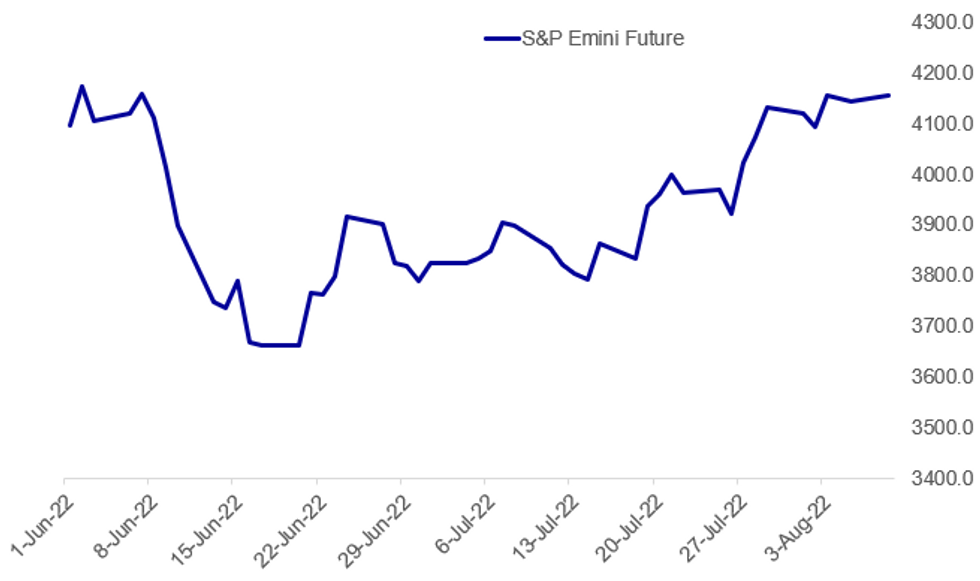

Fig. 1: Stocks Set To Start Off Week A Little Higher

Source: BBG, MNI

Source: BBG, MNI

DATA:

CHINA - TAIWAN (BBG): China’s military announced a new exercise “near Taiwan” on Monday, signaling that Beijing wanted to keep up pressure on the island past a series of drills announced immediately after US House Speaker Nancy Pelosi’s visit. The People’s Liberation Army practiced antisubmarine operations and air-to-sea strikes in the “space near Taiwan Island,” the Eastern Theater Command said in a statement Monday. The regional military headquarters didn’t specify where the drill was being held or whether it was part of an unprecedented four-day series of exercises around Taiwan that were due to have concluded Sunday.

BOJ (MNI INSIGHT): The Bank of Japan is looking at revising its monetary policy statement forward guidance following recent moves by its central banking peers to drop theirs, but is unlikely to abandon it entirely in the immediate future, MNI understands.

JAPAN: Japanese economic sentiment for both current and 2/3 month ahead outlooks posted declines for the second straight month in July, with the government also lowering its assessment from June, the Economy Watchers survey released by the Cabinet Office Monday showed. The Economy Watchers sentiment index for the current economic climate fell a seasonally adjusted 9.1 points to 43.8 in July from 52.9 in June, while the outlook for two to three months ahead fell 4.8 points to 42.8 from 47.6.

EUROZONE SENTIMENT (MT): The euro area's Sentix economic sentiment index climbed to -25.2 points in August from -26.4 points in July, according to a Monday release. Analysts predicted the index to stand at -24.7 points for the month.

US POLITICS (MNI POLITICS): Betting markets on the upcoming November midterm congressional elections have recorded a notable shift in sentiment in recent days, with political bettors now viewing a Republican-controlled House of Representatives but a Democrat-controlled Senate as the most likely outcome post-election according to data from Predictit. There is around a 45% implied probability of a Dem-Senate, GOP-House according to bettors, up from a 17% implied probability in late-June. The prospect of the GOP gaining both chambers has fallen from 75% to 43% in the same time frame.

MNI BRIEF: China July Exports Jump 18.0% Y/Y

China's exports jumped by 18.0% in July from a year ago, following the previous 17.9% increase and beating the market forecast of 14.2%, China Customs data showed on Sunday. Imports rose 2.3% in July, faster than the 1.0% growth marked in June and missed the consensus of a 4.0% gain, the data showed. Exports in the first seven months reached USD2.06 trillion, up 14.6%, while imports grew by 5.3% to USD1.68 trillion. The trade surplus in the first seven months was USD482.30 billion, with July contributing USD101.27 billion.

SWISS JUL UNEMPLOYMENT RATE +2.2%

MNI: SWISS JUL UNEMPLOYMENT -1.1% M/M, -28.7% Y/Y

FIXED INCOME: Italian politics helps drive risk-off sentiment

- Core fixed income is moving higher this morning, although still well below Friday's pre-payrolls levels. Concern over Italian politics are driving moves - Italy's outlook was downgraded to negative by Moody's on Friday and the centre left coalition is already looking in peril after the Azione party pulled out.

- Bunds are outperforming Treasuries (and gilts outperform Bunds on risk-off fears too). Peripheral spreads are widening, led by BTP-Bund spreads with 10-year BTP yields now back at similar levels to GGBs.

- There's a couple of fairly quiet days in terms of scheduled events coming up ahead of US CPI on Wednesday with thin data and speaker schedules.

- TY1 futures are up 0-10 today at 119-22 with 10y UST yields down -2.8bp at 2.802% and 2y yields down -2.0bp at 3.208%.

- Bund futures are up 0.84 today at 156.78 with 10y Bund yields down -6.4bp at 0.888% and Schatz yields down -4.7bp at 0.409%.

- BTP futures are down -0.24 today at 127.90 with 10y yields up 0.9bp at 3.026% and 2y yields up 2.7bp at 1.302%.

- Gilt futures are up 0.70 today at 117.36 with 10y yields down -8.1bp at 1.966% and 2y yields down -9.1bp at 1.854%.

FOREX: A mixed start in FX ahead of US CPI Wednesday

- A mixed start for FX, EUR and USD started the session in the red, with some market participants fading some of the post US NFP price action.

- EURUSD traded back above the 1.0200 figure, and printed a 1.0215 high, but failed to pullback towards pre NFP level, was trading circa 1.0231 pre data.

- EURUSD has since faded and is now trading at 1.0182 at the time of typing.

- Similar for Cable, traded above 1.2100 in early trade, and printed 1.2123, just short of the pre NFP levels at around 1.2140.

- Cable is now trading at 1.2082.

- Some desks have likely squared, locked some positions in early trade, but liquidity, turnovers remains on the very low side.

- Market participants will likely position for the US CPI, with consensus going for a slowdown median reading of 0.2% MoM versus 1.3% last Month.

- Range for the data is 0.0% to just 0.4%.

- Looking ahead, there's no tier 1 data for the session, and notable data for the week, sees Norway CPI, German CPI final, US CPI, Czech CPI, Russia CPI (wed), US PPI (thu), Swedish CPI, UK GDP, French and Spain final CPIs, US prelim Michigan (fri).

EQUITIES: Early Europe Gains Led By Tech And Real Estate

- Asian markets closed mostly higher: Japan's NIKKEI closed up 73.37 pts or +0.26% at 28249.24 and the TOPIX ended 4.24 pts higher or +0.22% at 1951.41.China's SHANGHAI closed up 9.907 pts or +0.31% at 3236.934 and the HANG SENG ended 156.17 pts lower or -0.77% at 20045.77.

- European equities have gained to start the week, with Tech and Real estate names leading: the German Dax up 39.63 pts or +0.29% at 13632.63, FTSE 100 up 30.59 pts or +0.41% at 7470.07, CAC 40 up 42.03 pts or +0.65% at 6514.34 and Euro Stoxx 50 up 17.85 pts or +0.48% at 3748.87

- U.S. futures have edged higher too, with the Dow Jones mini up 54 pts or +0.16% at 32811, S&P 500 mini up 9.5 pts or +0.23% at 4156.25, NASDAQ mini up 55.5 pts or +0.42% at 13284.25.

COMMODITIES: Silver Gains Stand Out Amid Broader Softness

- WTI Crude down $0.7 or -0.79% at $88.42

- Natural Gas down $0.2 or -2.52% at $7.86

- Gold spot down $1.57 or -0.09% at $1773.38

- Copper down $0.4 or -0.11% at $354.8

- Silver up $0.14 or +0.68% at $20.0257

- Platinum down $4.2 or -0.45% at $931.77

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/08/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 08/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 08/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 09/08/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 09/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 09/08/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/08/2022 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 09/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/08/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 09/08/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 09/08/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.