-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: China Slowdown Casts Cautious Global Tone

EXECUTIVE SUMMARY:

- PBOC CUTS RATES AS CHINA JULY MACRO DATA MISSES FORECASTS

- NO SIGN OF COOLING US-CHINA TENSIONS AS TAIWAN DRILLS RESUME

- TRUSS LIKELY TO CUT TAXES BEFORE CRISIS BUDGET (MNI INTERVIEW)

- IRAN TO DELIVER OPINION ON EU NUCLEAR DEAL TEXT BY END-DAY

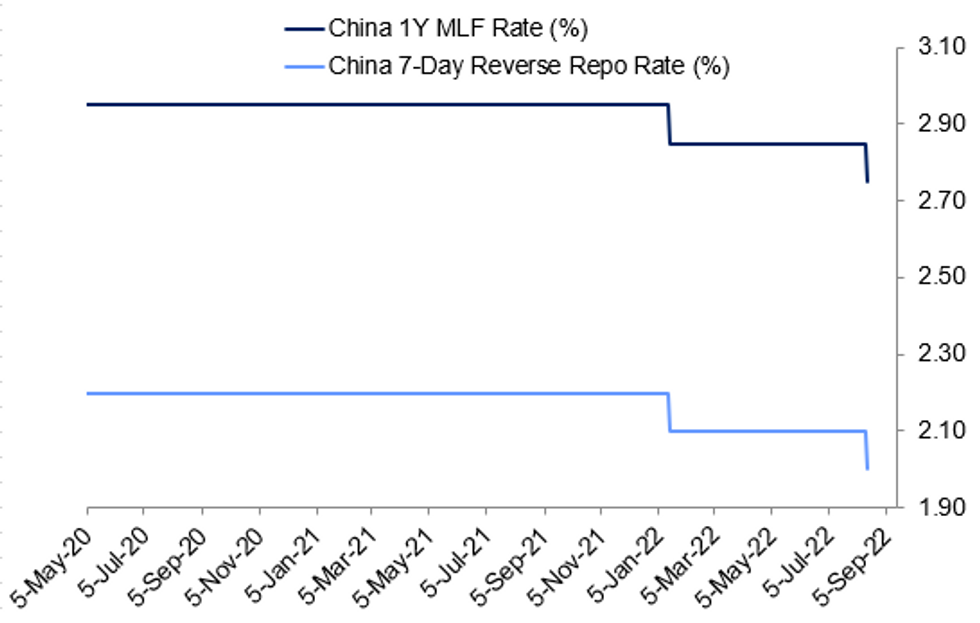

Fig. 1: China Rate Cuts

Source: BBG, MNI

Source: BBG, MNI

NEWS:

CHINA - PBOC: The People's Bank of China (PBOC) unexpectedly lowered two key policy interest rates on Monday, after total social financing fell to a six-year low in July. The easing of the MLF and 7-day reverse repo rates represented the first such cuts since January of this year. The PBOC cut the rate applied to the one-year medium-term lending facility by 10 bps to 2.75%, while it injected CNY400 billion in gross liquidity via the instrument. Meanwhile, it also lowered the rate applied to 7-day reverse repos by 10 bps to 2.00% while injecting CNY2 billion in gross liquidity via the instrument. This resulted in a net drain of CNY200 billion given today's maturity of CNY600 billion of MLFs and CNY2 billion of reverse repos, according to Wind Information.

- The operations aim to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.6395% at 9:51 am local time from the close of 1.3486% on Friday.

- The CFETS-NEX money-market sentiment index closed at 42 on Friday vs 40 on Thursday.

US - CHINA (MNI POLITICS): China has launched a new series of military drills around Taiwan following the latest US Congressional Delegation (CODEL) trip to the island.

- China Defence Ministry Spox: "PLA Eastern Theater Command organized a multi-service joint combat readiness & actual combat drills in waters and airspace around Taiwan island on Monday. This is a deterrence act toward the US and Taiwan, who are sabotaging cross-Straits stability."

- The five-strong CODEL is led by Sen Ed Markey (D-MA) and is formed of four Democrats and one Republican. The group has met with Taiwanese President Tsai Ing-wen, and it set to hold talks with gov't and private sector representatives.

- Comes as speculation rose on 12 Aug of a meeting of Presidents Xi Jinping and Joe Biden at the G20 leaders' summit in Indonesia in November following story in WSJ. If the two can arrange a face-to-face it could prove a major moment in relationship that has seen tensions reach multi-year lows in recent weeks following Speaker Nancy Pelosi's (D-CA) trip to Taiwan earlier in August.

UK (MNI INTERVIEW): Heavy favourite to be the next UK Prime Minister Liz Truss is likely to unveil a tax cut and measures to help with the cost-of-living crisis early in her government, leaving a full emergency budget and borrowing plans to a later date, Ben Zaranko, senior economist at the Institute for Fiscal Studies, told MNI.

IRAN NUCLEAR DEAL: Wires carrying comments from Iranian Foreign Minister Hossein Amirabdollahian on the proposed nuclear deal from the EU:

- "[We] are exchanging messages with the US side through intermediaries on three issues."

- "[Iran] has shown relative flexibility on two issues and in the third issue, which is guarantees, we are waiting for the flexibility of the U.S. side"

- "I anticipate that by the end of today we will submit our final opinion on the text proposed by the European Union to the Coordinator."

- [Iran is] looking for a good, stable and strong agreement, but if the other party speaks of plan B, we also have plan B."

- Earlier today, FM spox Nasser Kanani was more downbeat: "Whether we're close to an agreement and that this round of talks can near an agreement depends on the other side, particularly the US, meeting Iran's rightful demands,"

POLAND (MNI POLITICS): Latest opinion polling from Poland shows the governing right-wing Law and Justice Party (PiS) and its United Right coalition allies remain the single most popular grouping, but could be vulnerable to an alliance of opposition parties come the next legislative election. The next vote is not due until November 2023 at the latest, but PM Mateusz Morawiecki's administration governs as a minority, propped up by smaller parties in a confidence and supply agreement. Therefore, it could prove vulnerable to collapse.

DATA:

No key data releases in the European morning session

MNI BRIEF: China July Macro Data Misses Forecasts

China's economy struggled in the resumption of normality in July, as sporadic outbreaks of Covid-19 and unfavorable hot and rainy weather weighed, helping economic indicators fall short of expectations, data by the National Bureau of Statistics released Monday showed.

Industrial production rose 3.8% y/y in July, decelerating from June's 3.9%, missing the forecast 4.5%. Retail sales eased moderately to 2.7% y/y in July from June's 3.1%, underperforming the forecast 5.0% gain. The surveyed urban unemployment rate stood at 5.4% in July, down 0.1 percentage point from June. Youth unemployment set a new high of 19.9%.

Fixed-asset investment eased to 5.7% y/y in the first seven months, from the 6.1% gain in H1, also lower than the 6.2% forecast. Property investment fell 6.4% y/y to hit the lowest level since March 2020, sliding further from the previous 5.4% fall. Infrastructure investment accelerated to 7.4% y/y from the previous 7.1% growth, while manufacturing investment decelerated to 9.9% from the previous 10.4% growth.

FIXED INCOME: Trading at intraday highs

- EGBs and Bund continues to recover from their overnight lows, although volumes are very limited with plenty of European countries on holiday (Assumption day), Bund is trading in a 114 ticks range.

- In peripherals, semi core are wider, while Italy leads, by 3.9bps against the German 10yr.

- BTP/Bund spread has so far found support just ahead of 203.57bps, now at 207.8bps.

- Gilt future underperforms Bund somewhat, but overall, the Yield spread, is trading close to flat (0.6bp tighter).

- Volumes in Treasuries have also been subdued, 140k lots traded at the time of typing, and US curves lean bull flatter.

- Looking ahead, there's no tier 1 data to start the week.

- Notable data for this week, sees UK employment, Canada CPI, US IP (tue), UK CPI, EU GDP, US retail sales (wed), Australia employment, Norway GDP, EU final CPI (thu), Japan CPI, UK retail sales (fri).

- Sep Bund futures (RX) up 77 ticks at 156.11 (L: 155.08 / H: 156.22)

- Germany: The 2-Yr yield is down 2.7bps at 0.581%, 5-Yr is down 3.7bps at 0.718%, 10-Yr is down 4.8bps at 0.939%, and 30-Yr is down 5.5bps at 1.182%.

- Sep Gilt futures (G) up 57 ticks at 116.54 (L: 115.94 / H: 116.64)

- UK: The 2-Yr yield is down 1.7bps at 2.036%, 5-Yr is down 5.2bps at 1.879%, 10-Yr is down 5.5bps at 2.056%, and 30-Yr is down 6.6bps at 2.47%.

- Sep BTP futures (IK) up 63 ticks at 127.92 (L: 126.91 / H: 128.05)

- Sep OAT futures (OA) up 72 ticks at 145.14 (L: 144.25 / H: 145.25)

- Italian BTP spread up 0.7bps at 209bpsSpanish bond spread unchanged at 111.1bps

- Portuguese PGB spread down 0.1bps at 100.7bps

- US 2-Yr yield is up 1.3bps at 3.255%, 5-Yr is up 0.2bps at 2.958%, 10-Yr is down 0.5bps at 2.8258%, and 30-Yr is down 1.1bps at 3.0964%.The Sep 22 T-Note future is up 5/32 at 119-13+, having traded in a range of 119-04+ to 119-14

FOREX: Sour China Data Undermines Commodity-Tied Currencies

- The greenback continues to bounce off the post-CPI lows, with the USD Index close to 1.5% off last week's lows. A sour set of economic data from China has prompted a wave of risk-off across currency markets. The price action has favoured the USD, JPY and CHF, with AUD and NZD the biggest losers in G10.

- Both industrial production and retail sales data from China fell below expectations for June, with retail sales now in negative territory on a YTD basis. In response, the Chinese central bank cut both the 7-day reverse repo and the 1-year MLF rate by 10bps apiece, looking to arrest the slowing economy.

- In response, the CNH is sliding, putting USD/CNH north of 6.78 and within range of next resistance at the 6.7954 August high. A clean break above here would be the highest level for the pair since early May.

- Commodity- and high-beta currencies are sliding alongside the weakness in Chinese economic data, putting AUD/USD below 0.7050 and within range of 0.7030 support (23.6% retracement for the Jul - Aug upleg). CAD is exhibiting similar price action, with USD/CAD now just shy of the 1.2888 50-dma.

- US Empire manufacturing crosses later today, with the index expected to slow to 5.0 from 11.1 prior. Canadian manufacturing sales also crosses as well as the NAHB housing market index. There are no notable central bank speakers due.

EQUITIES: Defensives Outperform In Holiday-Thinned European Trade

- Japan's NIKKEI closed up 324.8 pts or +1.14% at 28871.78 and the TOPIX ended 11.78 pts higher or +0.6% at 1984.96. China's SHANGHAI closed down 0.801 pts or -0.02% at 3276.087 and the HANG SENG ended 134.76 pts lower or -0.67% at 20040.86.

- European equities are near session lows, though with holidays throughout Europe today, trading is unusually thin: defensives are leading (utilities, healthcare, consumer staples) with the German Dax up 18.39 pts or +0.13% at 13810.49, FTSE 100 up 14.41 pts or +0.19% at 7514.56, CAC 40 up 19.81 pts or +0.3% at 6570.59 and Euro Stoxx 50 up 8.75 pts or +0.23% at 3784.95.

- U.S. futures are a little softer, with the Dow Jones mini down 116 pts or -0.34% at 33602, S&P 500 mini down 17.25 pts or -0.4% at 4263.75, NASDAQ mini down 53.75 pts or -0.4% at 13524.

COMMODITIES: Copper Drops On Weak China Data

- WTI Crude down $1.95 or -2.12% at $90.13

- Natural Gas down $0.15 or -1.75% at $8.639

- Gold spot down $16.74 or -0.93% at $1787.1

- Copper down $7.35 or -2% at $358.9

- Silver down $0.32 or -1.54% at $20.5372

- Platinum down $18.8 or -1.95% at $950.27

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/08/2022 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/08/2022 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 15/08/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/08/2022 | 1300/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 15/08/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 15/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 15/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 15/08/2022 | 2000/1600 | ** |  | US | TICS |

| 16/08/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 16/08/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 16/08/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 16/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 16/08/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 16/08/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/08/2022 | 1230/0830 | *** |  | CA | CPI |

| 16/08/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 16/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 16/08/2022 | 1315/0915 | *** |  | US | Industrial Production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.