-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Dollar Back To Euro Parity

EXECUTIVE SUMMARY:

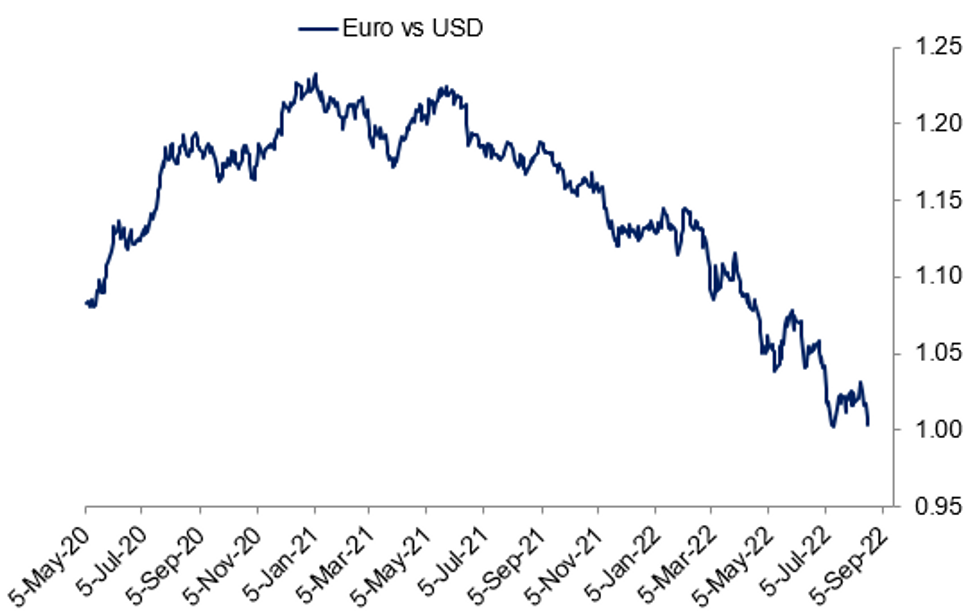

- EURO DROPS THROUGH PARITY VS USD AS EUROPEAN ENERGY PRICES SOAR

- BOJ POLICY SEEN ON HOLD DESPITE CPI RISE - MOMMA (MNI INTERVIEW)

- PBOC LOWERS LOAN PRIME RATES; YUAN FALLS TO WEAKEST SINCE SEPT 2020

Fig. 1: Euro Briefly Dips Through 1.00 vs USD

Source: BBG, MNI

Source: BBG, MNI

NEWS:

EUROPE ENERGY (BBG): European gas prices surged after Moscow’s move to shut a major pipeline ramped up fears of a prolonged supply halt, leaving Germany once again guessing as to how much Russian fuel it can count on this winter. Benchmark futures rose as much as 16%, also driving up electricity prices to fresh records. The key Nord Stream pipeline will stop for three days of maintenance on Aug. 31, again raising concerns that the link won’t return to service as planned after the works. Europe has been on tenterhooks about shipments through the link for weeks, with flows resuming only at very low levels after it was shut for works last month. Germany warned Moscow could further reduce supplies, and reiterated a call for conserve energy. “We have a very critical winter right in front of us,” German Economy Minister Robert Habeck told public broadcaster ZDF in Montreal, during a visit to Canada with Chancellor Olaf Scholz. “We must expect Putin to further reduce gas.”

EUROPE ENERGY (BBG/ECHOS):Spanish energy company Iberdrola canceled contracts to thousands of French customers, citing higher energy prices, Les Echos reported, citing a Reuters report. The biggest rival to EDF in France asked the clients to look for another supplier, saying they risk a cut in power at the end of their contract with the company: Echos. The company told Agence France-Presse that fewer than 10,000 clients, or about 2% of its French customers, were affected by the notice: Echos.

BOJ - MNI INTERVIEW 1: The Bank of Japan will repel any speculative attacks mounted by non-Japanese traders looking to push the central bank into policy adjustments at the September 21-22 meeting, just as the central bank achieved in previous attempts in April and June, former BOJ Chief Economist Kazuo Momma told MNI in an interview.

BOJ - MNI INTERVIEW 2: Consumer inflation will continue rising for a further six months, perhaps as high as 3%, as businesses have still to pass higher costs through to retail prices, but Bank of Japan policymakers will hold their nerve and keep policy unchanged, ex-BOJ Chief Economist Kazuo Momma predicts.

PBOC (MNI): China’s reference lending rates were lowered on Monday, according to a statement on the People's Bank of China website, with the move coming after the central bank cut key policy rates last week (See: MNI STATE OF PLAY: Analysts See PBOC Point To Lower August LPR). The one-year Loan Prime Rate was reduced by 5bp to 3.65%, while the five-year Loan Prime Rate fixed 15bp lower, at 4.30%. The steps were slightly out of line with the wider consensus, which looked for at least 10bp cuts to both rates, although there was a clear risk of a larger step for the 5-year benchmark. The Loan Prime Rates are based on the rate of the PBOC’s Medium-term Lending Facility and quotes submitted by 18 banks.

DATA:

*BELGIUM AUG. CONSUMER CONFIDENCE RISES TO -11 - BBG

(BBG): Belgium's consumer confidence rose to -11 in August from -13 in July, according to the National Bank of Belgium.

FIXED INCOME: Round trip

- Bunds, gilts and Treasuries all moved lower on the European open despite another spike higher in European natural gas futures this morning. Since the early moves, core fixed income has reversed and is now closer to flat on the day.

- Lookin ahead, today's calendar is relatively quiet with market participants looking forward to Jackson Hole later in the week and the flash PMI data tomorrow.

- TY1 futures are up 0-3 today at 118-06+ with 10y UST yields down -0.3bp at 2.972% and 2y yields up 4.6bp at 3.281%.

- Bund futures are up 0.01 today at 152.18 with 10y Bund yields unch at 1.227% and Schatz yields down -1.5bp at 0.793%.

- Gilt futures are down -0.13 today at 112.96 with 10y yields up 2.4bp at 2.433% and 2y yields down -0.1bp at 2.492%.

FOREX: Early action is in FX

- Most of the early action has been in FX, in early trade.

- The Dollar remains king, helped by the early Risk Off tone.

- The move in Equity, saw some safe haven bid into the Yen and the CHF.

- EURCHF was the early focus, as it tested the 0.9600 figure, printed 0.95833 low, and another lowest print since January 2015.

- Further out, would see support at 0.9500, and 0.93404 for the EURCHF.

- The Pound was also under pressure with the EUR in early trade.

- Cable broke below Friday's low, but failed to test the next key support at 1.1760, printed 1.1782 low.

- EURUSD tested parity, with a 0.9990 low printed so far today.

- The pair printed a 0.9952 low in July, also the lowest print since December 2002.

- For the Scandies, despite the move lower in Oil, NOK extended gains, and leads versus the SEK, up 0.64% in early trade.

- NOKSEK sees next upside resistance at 1.0897, 76.4% retrace of the March May fall.

- NOKSEK is at session high, at 1.0868.

- Looking ahead, there's nothing of real interest to start the week, but there's plenty of focus looking forward.

- NOTABLE DATA: Japan services PMI, Singapore CPI, FR/GE/EU/UK/US prelim services PMIs (tue), SA CPI, US Durable goods (wed), German final GDP, US (2nd) GDP, Core PCE (thu), FR/IT cons conf, US Wholesale Inventories, PCE core deflator, final Michigan

- MAIN EVENTS: ECB minutes and Jackson Hole.

EQUITIES: Tech Stocks Underperforming In Broader Risk-Off Move

- Asian markets closed mostly weaker: Japan's NIKKEI closed down 135.83 pts or -0.47% at 28794.5 and the TOPIX ended 1.93 pts lower or -0.1% at 1992.59. China's SHANGHAI closed up 19.716 pts or +0.61% at 3277.794 and the HANG SENG ended 116.05 pts lower or -0.59% at 19656.98.

- European equities are sharply lower, with tech and consumer discretionary stocks badly underperforming (some defensives like health care are seeing more moderate drops): German Dax down 246.89 pts or -1.82% at 13847.56, FTSE 100 down 50.42 pts or -0.67% at 7521.73, CAC 40 down 116.32 pts or -1.79% at 6573.53 and Euro Stoxx 50 down 62.81 pts or -1.68% at 3795.33.

- U.S. futures are weaker too, with the Dow Jones mini down 303 pts or -0.9% at 33402, S&P 500 mini down 48.75 pts or -1.15% at 4182.25, NASDAQ mini down 204.25 pts or -1.54% at 13062.75.

COMMODITIES: Oil, Copper Weakness Reflect Renewed Global Growth Concerns

- WTI Crude down $1.3 or -1.43% at $91.95

- Natural Gas up $0.2 or +2.16% at $9.312

- Gold spot down $13.12 or -0.75% at $1774.56

- Copper down $4.05 or -1.1% at $366.1

- Silver down $0.13 or -0.67% at $19.1478

- Platinum down $12.98 or -1.44% at $895.55

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 22/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/08/2022 | 2300/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

| 23/08/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 23/08/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 23/08/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 23/08/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 23/08/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 23/08/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 23/08/2022 | 1100/1300 |  | EU | ECB Panetta at ECB Policy Panel at EEA Annual Congress | |

| 23/08/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/08/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/08/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/08/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/08/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 23/08/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/08/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.