-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Tsy Curve Steeper Ahead of Busy Day

MNI US OPEN - Lawmakers Move to Impeach South Korea President

MNI China Daily Summary: Wednesday, Dec 4

MNI US MARKETS ANALYSIS - Yield Slide Hits Reverse

Highlights:

- Yield slide hits reverse, German regions point to hot CPI

- CNH stronger as state banks put on intervention notice

- ECB speak continues to point to 75bps as likely October move

US TSYS: Sizeable Retracement On Continued European Drivers

- Cash Tsys retrace approximately half of yesterday’s rally, with impetus coming from strong regional German CPI prints and gilts also moving lower after PM Truss continued to defend the mini budget.

- 2YY +7bps at 4.205%, 5YY +11.1bps at 4.059%, 10YY +9.5bps at 3.826%, and 30YY +6.8bps at 3.767%.

- TYZ2 trades 30 ticks lower at 111-29+ within yesterday’s wide range of 110-19 to 112-30, with volumes cooling after an above average European morning.

- Fedspeak from ’22 voters Mester and Bullard plus ’24 voter Daly, all of whom have spoken since the Sep 21 FOMC.

- Data: Final GDP print for Q2, with likely some attention on revisions vs GDI, plus weekly jobless claims data after the recent trend decline has pushed back against imminent recession fears.

- Bill issuance: US Tsy $50B 4W, $45B 8W bill auctions – 1130ET

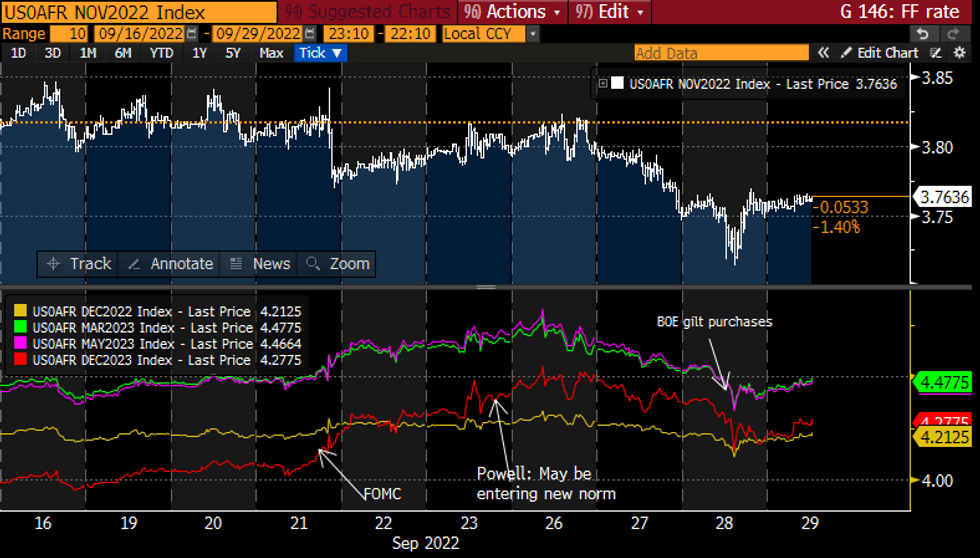

STIR FUTURES: Fed Hike Expectations Helped Higher By German Regional CPI

- Fed Funds implied hikes take their cue from strong German regional inflation and ECB commentary, nudging higher from yesterday’s intraday recovery but still well off Monday highs.

- 68bps for Nov (+0.5bp) and rates of 4.22% for Dec’22 (+2.5bp), 4.49% for Mar’23 (+5bp) and 4.28% for Dec’23 (+7bp). Monday US session highs of 4.75% for the terminal and 4.52% for Dec’23.

- Fedspeak: Starts with Mester (’22) on CNBC at 0800ET before again with ECB’s Lane at 1300ET, along with Bullard (’22) and Daly (’24).

FOMC-dated Fed Funds futures implied rates at specific meetingsSource: Bloomberg

FOMC-dated Fed Funds futures implied rates at specific meetingsSource: Bloomberg

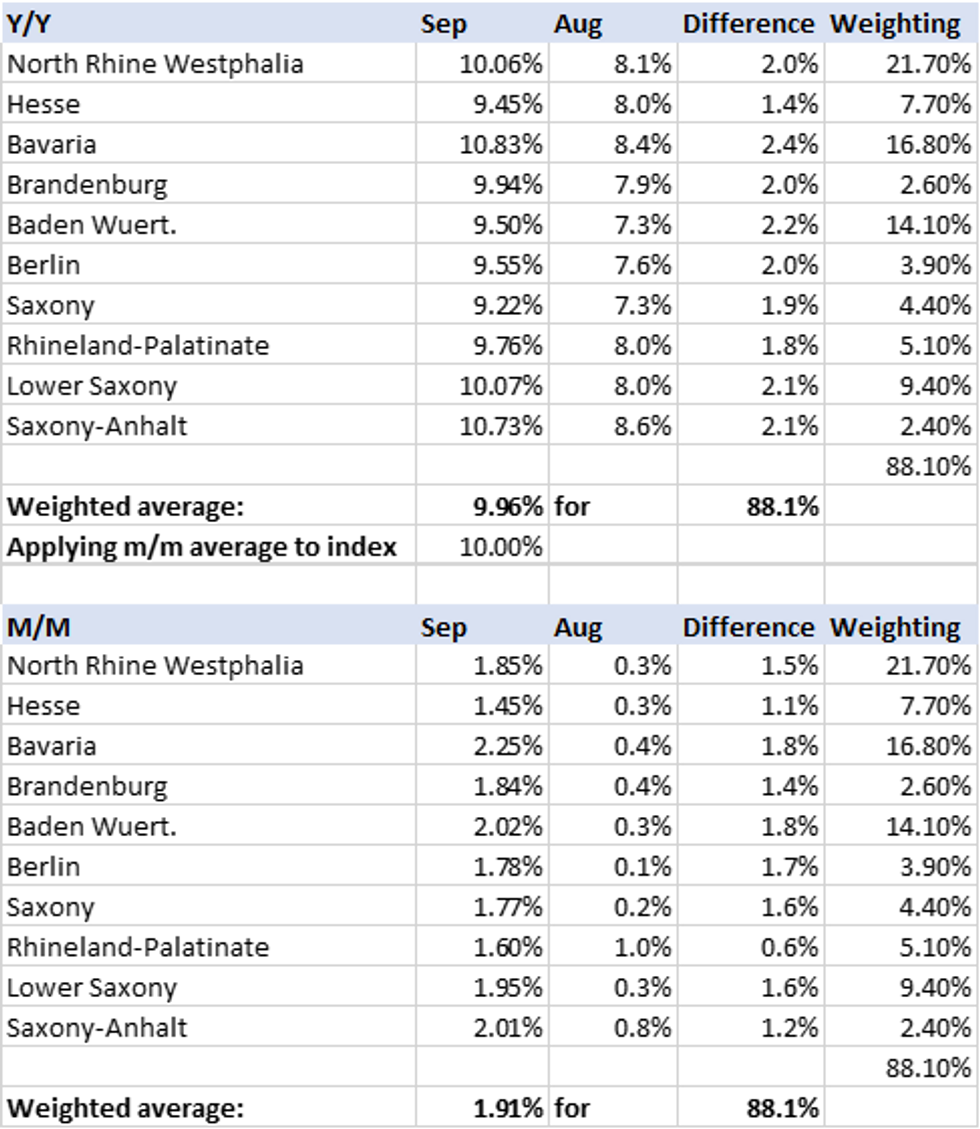

GERMANY: September Flash CPI Likely To Hit 10% Y/Y

- Following a slew of higher-than-anticipated state CPI data this morning, the implied German flash CPI print for September should be in the order of +1.9% m/m and +10.0% y/y. This is based on 88.1% of regional data available prior to the release.

- This implies a hot beat on headline inflation, while consensus was looking for +9.5% y/y and +1.5% m/m.

- Numerous regional reports highlighted the upward price pressure associated with the expiration of subventions including the 9-euro transport ticket and fuel rebate.

- Markets are currently pricing in 71bp of tightening at the ECB's October meeting for the ECB's late October, with the latest German inflation data further supporting a 75bp hike.

- Furthermore, the German government is set to announce an energy relief package at 1300 BST.

- French, Italian and the Eurozone aggregate flash CPIs are due tomorrow morning.

Source: MNI / individual state sources

Gov't To Announce EUR150-200bn Energy Price Relief Package @ 1400CET

Wires reporting that the German government is set to announced a 'comprehensive solution' to high gas and electricity prices at 1400CET [0800ET/ 1300BST] in Berlin.

- Handelsblatt reports that the relief package could cost EUR150-200bn.

- Chancellor Olaf Scholz (SPD), Economy Minister Robert Habeck (Greens) and Finance Minister Christian Lindner (FDP) are reported to have been negotiating the package in recent days. Lindner, from the pro-business liberal FDP and the most hawkish of senior ministers, is believed to have held out on a deal, raising concerns of compliance with this year's debt brake.

- Handelsblatt: "A solution has now been found: the gas price brake is to be financed via the Economic Stabilization Fund (WSF). This was set up during the corona pandemic to help companies. It actually expired in the summer, [but] now it should receive additional funds."

CHINA: USD/CNH Edges Lower as State Banks Ordered to Take Inventory

- USD/CNH slips away from session highs as Reuters cite sources in reporting that state banks have been told to take stock ahead of CNY offshore intervention.

- The piece writes that state banks were told to ask their offshore branches to review their holdings of both CNH and the USD, to make sure they are ready to be deployed.

- The pieces further adds that the scale of this round of dollar selling will be "rather big".

FOREX: Lofty German Regional Inflation Prompts Renewed Risk-Off

- German regional CPI data has unsettled risk sentiment further this morning, with just over 2/3 of regions having reported so far. The regional data - and in particular Bavaria - are posing upside risks to the national reading later today, and has prompted renewed core bond sales and some resilience in the EUR.

- Nonetheless, the USD is rallying against all others, partially reversing the rare downtick in the USD Index posted yesterday. Wednesday's high at 114.778 remains the cycle high, and EUR/USD's recovery off the day's lows may keep that mark out of reach for now.

- Further evidence of unsettled markets in equity space, with core indices off 1.5-2.0% in Europe. High beta and growth proxy currencies including the NOK are therefore suitably lower, putting EUR/NOK again within range of key resistance and the bull trigger at the mid-June highs of 10.5402.

- Focus looking ahead turns to the national German CPI print as well as Canadian monthly GDP, the weekly US jobless claims data as well as the tertiary Q2 GDP from the US.

- Central bank speakers include no fewer than 16 scheduled ECB appearances (a handful of governing council members appear more than once) as well as speeches from BoE's Pill, Ramsden, Tenreyro and Fed's Bullard, Mester and Daly.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/09/2022 | 0815/1015 |  | EU | ECB Elderson Speech at Nederlandsche Bank & OMFIF | |

| 29/09/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/09/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/09/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 29/09/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 29/09/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 29/09/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 29/09/2022 | 0930/1130 |  | EU | ECB de Guindos Opens ECB Research Workshop | |

| 29/09/2022 | 1130/1230 |  | UK | BOE Ramsden Panels Lithuania CB/BIS Conference | |

| 29/09/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 29/09/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/09/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 29/09/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 29/09/2022 | 1230/0830 | *** |  | US | GDP (3rd) |

| 29/09/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 29/09/2022 | 1330/0930 |  | US | St. Louis Fed's James Bullard | |

| 29/09/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 29/09/2022 | 1500/1600 |  | UK | BOE Tenreyro Panellist at Centre for Economic Policy Research | |

| 29/09/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 29/09/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 29/09/2022 | 1700/1300 |  | US | Cleveland Fed's Loretta Mester | |

| 29/09/2022 | 1700/1900 |  | EU | ECB Lane Panels ECB/Cleveland Fed Conference | |

| 29/09/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

| 29/09/2022 | 2045/1645 |  | US | San Francisco Fed's Mary Daly | |

| 30/09/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 30/09/2022 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 30/09/2022 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 30/09/2022 | 0630/0830 | ** |  | CH | retail sales |

| 30/09/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 30/09/2022 | 0645/0845 | ** |  | FR | PPI |

| 30/09/2022 | 0645/0845 | ** |  | FR | Consumer Spending |

| 30/09/2022 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/09/2022 | 0755/0955 | ** |  | DE | Unemployment |

| 30/09/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 30/09/2022 | 0900/1100 | ** |  | EU | Unemployment |

| 30/09/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 30/09/2022 | 1100/1300 |  | EU | ECB Elderson in Discussion at Uni Amsterdam | |

| 30/09/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 30/09/2022 | 1230/0830 |  | US | Richmond Fed's Tom Barkin | |

| 30/09/2022 | 1300/0900 |  | US | Fed Vice Chair Lael Brainard | |

| 30/09/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 30/09/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 30/09/2022 | 1500/1100 |  | US | Fed Governor Michelle Bowman | |

| 30/09/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 30/09/2022 | 1530/1730 |  | EU | ECB Schnabel Panels La Toja Forum | |

| 30/09/2022 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 30/09/2022 | 1630/1230 |  | US | Richmond Fed's Tom Barkin | |

| 30/09/2022 | 2015/1615 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.