-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD Dip Moderates as Equities Roll Off Highs

Highlights:

- Jobs data in view following tough ISM manufacturing read

- EUR/USD rejects major test of bear channel top

- USD dip moderates, with equity bounce fading off highs

Key Links: RBA Review / RBNZ Hikes 50bps, Shows No Signs of Slowing / MNI Europe Positioning Indicator

US TSYS: Treasuries Bear Steepen Ahead Of ADP, ISM

- Cash Tsys bear steepen as long end yields make greater inroads at retracing Monday’s rally and lag European FI on the day, whilst the reversal in real yields after two days of moving lower weighs on risk assets.

- 2YY +2.5bps at 4.117%, 5YY +5.3bps at 3.907%, 10YY +5.6bps at 3.689%, and 30YY +4.7bps at 3.741%. 2s10s of -42bps (+3bp) is near the top of the week's range.

- TYZ2 trades 17+ ticks lower at 112-30+, back in the middle of Monday’s wide range albeit on below average volumes. Resistance is seen at yesterday’s high of 113-30 and support at 111-20+ (Sep 29 low).

- Data: ADP (0815ET) and ISM Services (1000ET) headline but also see weekly MBA mortgage applications/rate, the final trade balance for August and final PMIs for September.

- Fedspeak: Limited to Kashkari (0915ET) and Bostic (1600ET) after recent stacked schedules.

- Bill issuance: US $30B 119-Day CMB auction – 1130ET

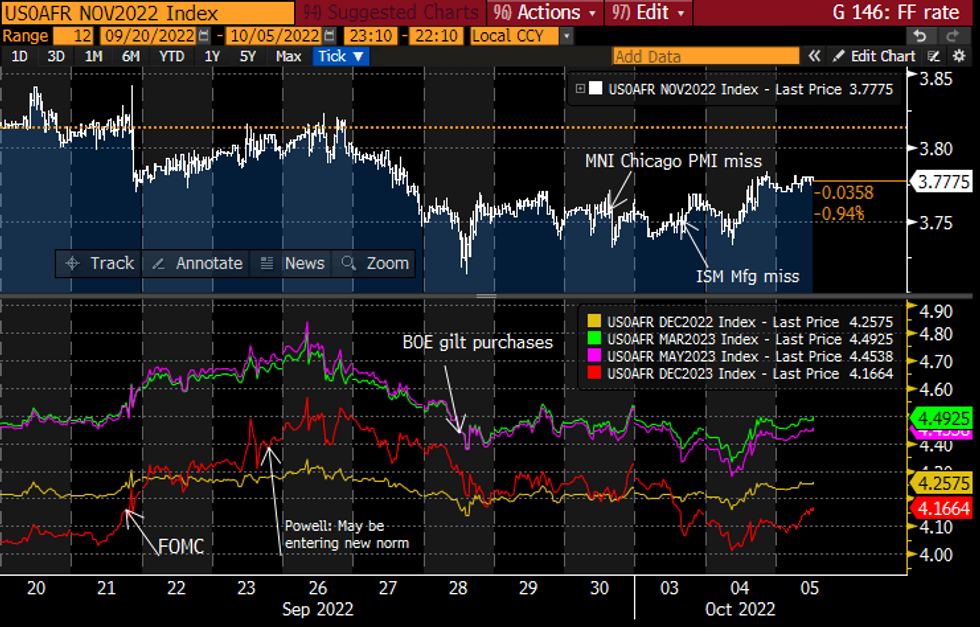

STIR FUTURES: Fed 2023 Rate Expectations Drift Higher

- Fed Funds implied hikes keep yesterday’s climb to 70bp for Nov but drift higher further out: 4.26% for Dec’22 (+1.5bp), terminal 4.49% Mar’23 (+2.5bp) and 4.17% Dec’23 (+6bp).

- Contrary to the RBA slowing to a 25bp hike on Tue, the RBNZ overnight kept to 50bps with no signal of an imminent slowdown, albeit with limited immediate impact on Fed expectations.

- Kashkari (’23 voter) speaks in moderated Q&A at 0915ET before Bostic (’24) discusses inflation including text late on. Kashkari said Sep 27 that must not make the mistake of easing policy prematurely, at a time when terminal pricing was a little over 4.6% and Dec’23 ~4.4%.

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

OIL: US Administration Pushing Against OPEC+ Cuts

The US is pushing OPEC+ nations not to cut production ahead of reports that the group could announce deep cuts later today.

- The Biden Administration has been under intense pressure to keep prices down at the pumps after record high prices this summer.

- The US is arguing to OPEC+ that economic fundamentals do not support an output cut.

- Sources suggest OPEC+ is working on cuts of over 1mn bpd – though the impact of them could be far less given the group has struggled to even come close to current targets.

- Russia is reported to be in favor of cuts to support higher prices. It would also support Russia with signs it is struggling to find destinations for all of its crude flows – which would be exacerbated after the EU import ban.

FOREX: EUR/USD Slips After Failed Test of Bear Channel Top

- EUR/USD trades lower headed into the NY crossover, with the pair fading following the challenge of the bear channel top at 0.9998. The dip lower in the pair is primarily USD driven and part of broader market consolidation after the sharp equity rally posted since the beginning of the week.

- GBP's post-Mini budget bounce is similarly fading, with GBP lower against most others in G10. Markets look to the PM's conference appearance later today (1100BST/0600ET) for direction, with Truss expected to double-down on her government's pro-growth strategy.

- The moderation in risk sentiment has seen the USD Index decline bottom out, with prices bouncing slightly off the Tuesday low at 110.055. Labour market data may determine the longevity of any bounce, with ADP employment change and ISM Services later today, ahead of NFP on Friday.

- NZD is the firmest currency in G10 following a hawkish turnout from the RBNZ decision. The bank raised rates by 50bps - as expected - but confirmed the bank also examined a 75bps step to tackle stubborn inflation.

- Focus turns to US and Canadian trade balance data as well as the final September US stats. ISM services index will also be watched closely for any repetition of the weak employment component posted as part of the manufacturing release on Monday.

UK: Truss Outlines Three Policy Objectives Of Her Government

UK Prime Minister Liz Truss has outlined the three pillars of her agenda in a speech at the Conservative Party Conference in Birmingham.

- Truss: "First of all we will lower our tax burden. Over the summer we had a robust debate. The Conservative Party will always be the party of low taxes. Cutting taxes is always the correct thing to do, morally and economically."

- "We need to be internationally competitive on tax."

- "The abolition of the 45p rate of tax became a distraction to our growth plan."

- Second: "We will keep an iron grip on public finances. I believe in fiscal responsibility."

- "We will bring down debt as a proportion of our national income."

- "It is right for the BOE to set interest rates independently."

- Third: "We will drive economic reforms and break down barriers to growth."

- "We will back business to the hilt."

- "By the end of the year all EU red tape will be consigned to history."

ASIA: Elevated September CPI Reads Point To Further Tightening

September CPI inflation releases in Asia have been mixed with Korea and Thailand showing headline inflation peaking but the Philippines and Indonesia posting further increases. Underlying inflation has tentatively peaked at elevated rates in a number of countries and continued to rise in others, thus implying that Asian central banks have more tightening to do.

- The Bank of Korea already began tightening in 2021, one of the first central banks to do so, but September inflation moderated for only the second consecutive month to 5.6% from 5.7%. Core actually rose slightly to 4.5% driven by stronger services prices. Inflation remains well above other countries in the region. Higher utility bills should drive a tick up in the October CPI.

- Inflation in Thailand moderated more than expected in September to 6.4% from 7.9% due to lower food and energy costs, which was a welcome development given the August rate was the highest since July 2008. However core inflation was steady at 3.1% (also a high since 2008).

- Philippines September CPI rose to 6.9%, as expected, from 6.3% with the core falling slightly to 4.5%.

Source: MNI - Market News, Refinitiv

Other Asia Core CPI y/y%

Source: MNI - Market News, Refinitiv

PRICE SIGNAL SUMMARY: Bullish Engulfing Candle In S&P E-Minis StillIn Play

- In the equity space, S&P E-Minis traded higher Tuesday. Monday's candle pattern is a bullish engulfing line and this highlights an important short-term reversal. It signals scope for a stronger corrective bounce and attention is on the 20-day EMA at 3815.27. A break would open the 50-day EMA at 3931.31. Key support has been defined at Monday's low of 3571.75. EUROSTOXX 50 futures have established a bullish short-term tone. The strong recovery this week suggests the contract has entered a corrective cycle. The 20-day EMA has been cleared and the break exposes 3510.30, the 50-day EMA. Key support is at 3236.00, the Oct 3 low.

- In the FI space, Bund futures remain in a downtrend, however, the contract has entered a short-term bullish corrective cycle. Price has cleared the 20-day EMA. This opens 143.68, 38.2% retracement of the Aug 2 - Sep 28 bear leg. A strong rally on Sep 28 in Gilt futures led to a short-term reversal. In pattern terms, the Sep 28 session was an engulfing candle and signals scope for a continuation higher near-term. Attention is on resistance at the 20-day EMA, at 101.29.

- In FX, EURUSD traded higher again Tuesday. The pair has arrived at a key short-term resistance - 0.9998 marks the top of a bear channel drawn from the Feb 10 high. Note too that the 50-day EMA intersects at 1.0004. A break of these resistance points would strengthen bullish conditions and highlight a more significant reversal. Initial support to watch is 0.9806, yesterday's low. GBPUSD traded higher Tuesday, extending the latest recovery from 1.0350, Sep 26 low. The 20-day EMA has been cleared and this signals scope for an extension towards the 50-day EMA at 1.1572 - a key resistance. Initial firm support is seen at 1.1025, the Sep 30 low. USDJPY key support is 140.36, the Sep 22 low. Attention is on the bull trigger at 145.90, the Sep 22 high. A break would confirm a resumption of the uptrend and open 146.03, 2.764 projection of the Aug 2 - 8 - 11 price swing. Initial support is 143.20, the 20-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/10/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 05/10/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 05/10/2022 | 1230/0830 | * |  | CA | Building Permits |

| 05/10/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 05/10/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/10/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/10/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 05/10/2022 | 2000/1600 |  | US | Atlanta Fed's Raphael Bostic | |

| 06/10/2022 | 0030/1130 | ** |  | AU | Trade Balance |

| 06/10/2022 | 0600/0800 | ** |  | SE | Private Sector Production |

| 06/10/2022 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 06/10/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 06/10/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/10/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/10/2022 | 0900/1100 | ** |  | EU | retail sales |

| 06/10/2022 | 1230/0830 | * |  | CA | Ivey PMI |

| 06/10/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 06/10/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 06/10/2022 | 1250/0850 |  | US | Cleveland Fed's Loretta Mester | |

| 06/10/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 06/10/2022 | 1535/1135 |  | CA | BOC Governor Macklem speech | |

| 06/10/2022 | 1700/1300 |  | US | Fed Governor Lisa Cook | |

| 06/10/2022 | 1700/1300 |  | US | Chicago Fed's Charles Evans | |

| 06/10/2022 | 2100/1700 |  | US | Fed Governor Christopher Waller | |

| 06/10/2022 | 2230/1830 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.