-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD Bounces Back, Dragging Equities Off Highs

Highlights:

- USD resumes incline, dragging equities off overnight highs

- Core bonds resume slide, with UK long-end yields returning to highest level since BoE intervention

- Focus turns to more jobs data, with weekly jobless claims and Challenger data due

KEY LINKS: Global Macro Outlook / RBNZ Review / Fed Model Sees Substantial Decline in Hiring

US TSYS: Drifting Cheaper With Fedspeak Eyed

- Cash Tsys see a calmer overnight with front end yields drifting higher with Fed rate expectations and the longer end paring an earlier rise for also limited moves on the day. It sees marginal underperformance to core EU FI (weak German factory orders, EZ retail sales after revisions) but notable outperformance of Gilts on further fiscal plan fears.

- Yields sit towards the high end of yesterday’s range through 2-10Y tenors, having increasingly clawed back the early week rally on at the longer end. · 2YY +2.3bps at 4.171%, 5YY +2.4bps at 3.991%, 10YY +2bps at 3.773%, and 30YY +0.7bps at 3.761%.

- TYZ2 trades 4+ ticks lower at 112-12+, near both session and yesterday’s lows of 112-09/112-08+ but not troubling support at 111-20+ (Sep 21 low). Below average volumes continue from yesterday.

- Fedspeak: Governors: Cook (text + Q&A), Waller (text + Q&A, late). '22 voter: Mester x2. ’23 voters: Kashkari x2, Evans.

- Data: Light calendar ahead of payrolls tomorrow. Challenger jobs cuts for Sep and weekly initial jobless claims for Oct 1.

- Bill issuance: $50B 4-W bills, $45B 8-W bills

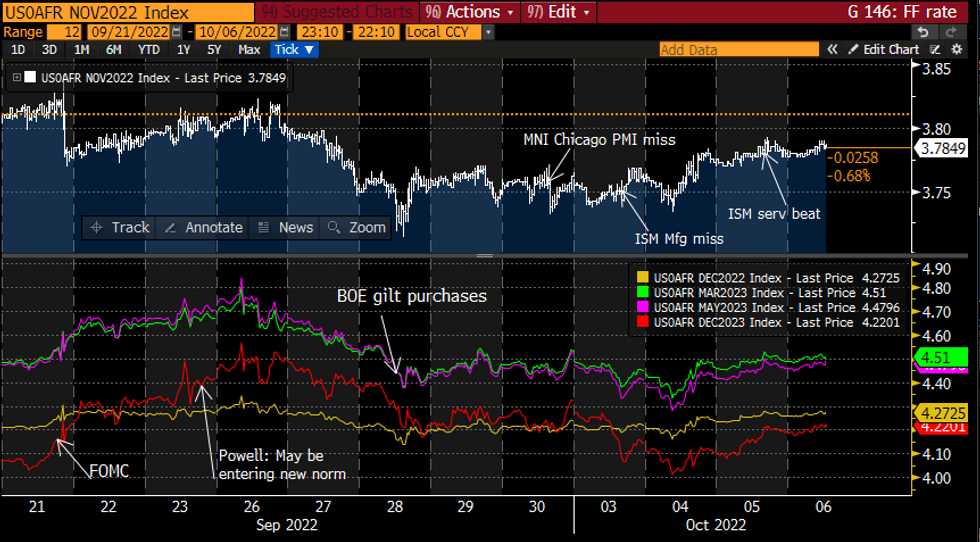

STIR FUTURES: Fed Rate Path Grinds Higher, Keeps To 2023 Cut

- Fed Funds implied hikes edge further higher after yesterday’s gains, especially in 2H23, although moves came before both the ISM beat and 2024 voters Bostic and Daly pushing back on 2023 rate cut pricing.

- 70.5bp for Nov (+0.5bp) and a cumulative 119bp to 4.27% Dec’22 (+1.5bp) before terminal 4.51% Mar’23 (+2bp) and 4.22% Dec’23 (+3bp). Still below the 4.6% median dot for end-2023.

- Stacked Fedspeak today. Governors: Cook (text + Q&A), Waller (text + Q&A, late). '22 voter: Mester x2. ’23 voters: Kashkari x2, Evans.

FOMC-dated Fed Funds rate at specific meetingsSource: Bloomberg

FOMC-dated Fed Funds rate at specific meetingsSource: Bloomberg

UK: Yields are pushing higher

- UK Yield continue to rise, with Gilt futures pushing through a new low, down 171 ticks and another 180 ticks range for the session.

- UK 30yr is slowly edging back towards 4.382%, the 50% retrace of the BoE intervention.

Chart source: MNI/Bloomberg

FOREX: Major Pairs Near Wednesday Support, Keeping USD Bias Pointed Higher

- Trends are extending across currency markets ahead of the Thursday NY crossover, with the greenback recovering off Asia-Pac session lows and pushing most major pairs toward Wednesday's lowest levels. These levels mark a key support ($0.9835 in EUR/USD, $1.1227 in GBP/USD, Y144.85 in USD/JPY) and a break through these marks could prompt an extension of the dollar bounce and target 111.8592 for the USD Index, the 38.2% retracement for the downleg off late September's cycle high.

- At the bottom end of the table, NOK is slipping against all others in G10 as the currency partially reverses the oil-inspired strength seen since the beginning of the week. EUR/NOK targets 10.5165 initially, and a break above here opens 10.5375, the 1.0% 10-dma envelope.

- GBP is faring poorly, slipping against most others and allowing EUR/GBP to extend the bounce off Tuesday's 0.8649 low, keeping the 50-dma resistance exposed. Next key levels cross at 0.9066/9266 the High Sep 28 / High Sep 26.

- Focus turns to the weekly jobless claims data as well as challenger job cuts for September as markets watch for clues ahead of this Friday's US jobs report. The central bank speakers slate is busier, with seven FOMC members due as well as BoE's Haskel and BoC's Macklem.

FX OPTIONS: Expiries for Oct6 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9900-02(E1.3bln)

- USD/JPY: Y142.00($1.1bln), Y144.00($800mln), Y145.00($836mln), Y145.50($1.2bln), Y145.90-00($855mln)

- EUR/GBP: Gbp0.8700(E649mln), Gbp0.8850(E695mln)

- AUD/USD: $0.6475(A$590mln)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/10/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/10/2022 | 0900/1100 | ** |  | EU | retail sales |

| 06/10/2022 | 1230/0830 | * |  | CA | Ivey PMI |

| 06/10/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 06/10/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 06/10/2022 | 1250/0850 |  | US | Cleveland Fed's Loretta Mester | |

| 06/10/2022 | 1315/0915 |  | US | Minneapolis Fed's Neel Kashkari | |

| 06/10/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 06/10/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 06/10/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 06/10/2022 | 1535/1135 |  | CA | BOC Governor Macklem speech | |

| 06/10/2022 | 1700/1300 |  | US | Fed Governor Lisa Cook | |

| 06/10/2022 | 1700/1300 |  | US | Chicago Fed's Charles Evans | |

| 06/10/2022 | 1700/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 06/10/2022 | 2100/1700 |  | US | Fed Governor Christopher Waller | |

| 06/10/2022 | 2230/1830 |  | US | Cleveland Fed's Loretta Mester | |

| 07/10/2022 | 0545/0745 | ** |  | CH | Unemployment |

| 07/10/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/10/2022 | 0600/0800 | ** |  | DE | Retail Sales |

| 07/10/2022 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 07/10/2022 | 0600/0800 | ** |  | NO | Norway GDP |

| 07/10/2022 | 0645/0845 | * |  | FR | Current Account |

| 07/10/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/10/2022 | 0800/1000 |  | EU | ECB Consumer Expectations Survey Results - August | |

| 07/10/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 07/10/2022 | 1025/1125 |  | UK | BOE Ramsden Speech at Securities Industry Conference | |

| 07/10/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 07/10/2022 | 1230/0830 | *** |  | US | Employment Report |

| 07/10/2022 | 1400/1000 |  | US | New York Fed's John Williams | |

| 07/10/2022 | 1500/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 07/10/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.