-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Significant Two-Way Risk From Payrolls

Highlights:

- Payrolls takes focus, with AHE to shape market reaction

- Markets in a holding pattern pre-NFP, with Fed implied hike path edging higher

- Biden and Fed's Williams, Kashkari and Bostic all due to speak post-payrolls

Key Links: NFP Preview / Global Macro Outlook / UST Issuance Deep Dive

MNI US Payrolls Preview: Significant Two-Sided Risk

- Consensus sees NFP growth moderating to 260k in Sept after the 315k from August’s ‘goldilocks’ report.

- Indications of tightness from AHE and the u/e rate combined with recovery in participation will help shape the market reaction after the u/e rate ticked up two tenths and wage growth cooled moderately in Aug.

- Analyst expectations imply a reasonable chance of small beats for the u/e rate and wage growth, at least at a first glance on rounding, potentially paving way for an initial overreaction to small surprises.

- That said, recent market moves open significant two-sided risk to larger surprises in the report, even with CPI and other important data releases still to come before the Nov 2 FOMC decision.

- Full MNI preview here.

US TSYS: Consolidation Of Significant Cheapening Ahead Of Payrolls

- Cash Tsys sit 1-2bp cheaper across the curve, consolidating the sizeable sell-off over the past two days as mon pol ‘pivot’ expectations have been firmly reversed. 2YY are now within 6.5bps of early last week’s highs whilst 10YY are 17bps off the prior breach of 4%.

- 2YY +1bps at 4.266%, 5YY +2.3bps at 4.09%, 10YY +1.5bps at 3.839%, and 30YY +0.8bps at 3.792%.

- TYZ2 trades 5 ticks lower at 111-25 on moderating volumes as we move nearer to payrolls, having briefly cleared near-term support at 111-20+ (Sep 29 low) after which sits 110-19 (Sep 28 low).

- Data: Payrolls for Sept dominates the session – preview here – followed by final wholesale inventories for Aug and then late on consumer credit for Aug.

- Fedspeak: Williams (1000ET), Kashkari (1100ET) and Bostic (1200ET) with repeat appearances for the week.

- No issuance

Source: Bloomberg

Source: Bloomberg

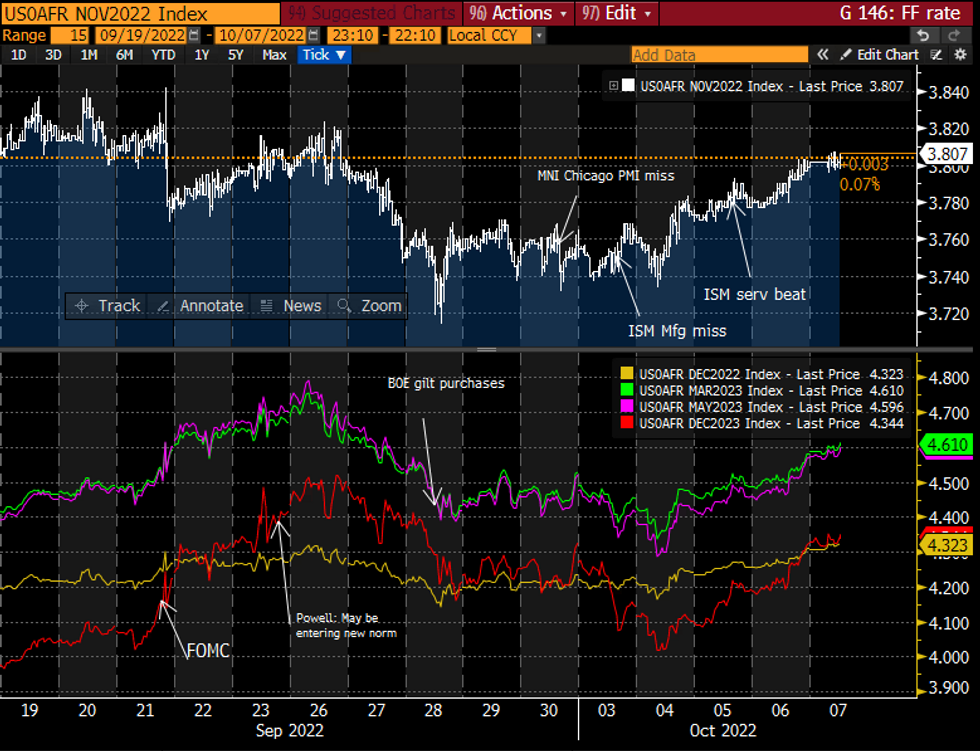

STIR FUTURES: Fed Path Edges Higher Pre-NFP After Sizeable Gains Yesterday

- Fed Funds implied hikes have edged to 72bp for Nov and a cumulative 124bp to an implied effective 4.32% for Dec’22 (+1bp), consistent with the median dot of 4.4%. Followed by a terminal 4.61% in Mar’23 (+2.5bp) and then 4.34% in Dec’23 (+1bp).

- Gov. Waller and Mester continued to indicate full steam ahead for the hiking cycle, with Waller if anything more hawkish than in the past (Bloomberg headlines below).

- NY Fed Williams, Kashkari (’23) and Bostic (’24) ahead, all of whom have this spoken this week. No prepared text, potential reaction to NFP but with an eye on CPI next week.

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOREX: USD Softer Pre-Payrolls, With Focus on AHE

- The greenback is fading into the NY crossover, with a brief blip higher for the USD Index being largely erased into US hours. EUR/USD neared the weekly low of 0.9753, coinciding with a fade in GBP/USD to 1.1116.

- GBP is the firmest currency in G10, but recent ranges are largely being respected. EUR/GBP is within range of yesterday's lows at 0.8718, a break below which opens key support and the bear trigger at 0.8649.

- AUD/USD sits higher, narrowing the gap with first resistance at 1.1373 - the 23.6% retracement for the August - September upleg. A break above here opens 1.1434 ahead of the cycle high at 1.1491.

- Focus turns to nonfarm payrolls, with markets looking for ~260k jobs added this month, while the unemployment rate is seen unchanged at 3.7%. Fedspeak takes focus following the figure, with Fed's Williams, Kashkari and Bostic due after the release.

ECB Consumer Inflation Expectations Steady - a Lull Before the Storm?

The ECB Consumer Expectations Survey saw some signs of improvement from the July slump. However, with CPI surging to 10.0% in the September flash, upticks in optimism appear fleeting.

- Income & consumption grew, nominal income (+1.0% over 12-months) and spending growth expectations increased to a fresh high of 5.8% (up from 5.4% in July). As these rates are nominal, this constitutes another marked increase in living costs and implies more of a contraction in household purchasing power than growth-inducing improvements in consumption.

- Labour & growth outlooks saw marginal improvement, with 12-month economic contraction outlooks edging up to a pessimistic -1.7% from -1.9% in July. Unemployment expectations edged down, yet consumers continue to await an increase in unemployment. The robust labour market and record-low unemployment rate provide substantial confidence in the current ECB hiking cycle.

- Mortgage rate expectations increased to 4.4% for 12 months ahead, 1.1pp higher than levels at the beginning of 2022. Credit access is anticipated to tighten further, which implies further cooling of investment.

- The ECB Consumer Expectations Survey saw some signs of improvement from the July slump. However, with CPI surging to 10.0% in the September flash, upticks in optimism appear fleeting.

- Inflation expectations remained unchanged at 5.0% (12-month) and 3.0% (3-year) outlooks, both substantially lower than the current perceived rate of CPI. Uncertainty regarding inflation stabilised, although the fresh September CPI surge is likely to unanchor this.

- The ECB is due to meet at the end of the month. With 70bp is currently priced by markets, a 75bp hike is a solid contender if the ECB continues to see inflation concerns as outweighing the imminent winter recession.

- Executive Board member Isabel Schnabel, who has also advocated keeping a much closer policy tie to actual inflation outcomes as well as expectations, will have noticed that consumers have correctly assessed the rising level of current prices gains, with perceived inflation over the last 12 months seen at 8.0%, edging up from 7.9% in July.

TURKEY-Tensions Ratchet Up After Erdogan-Misotakis Spat At Summit

Outlets reporting that at the European Political Community meeting in Prague, Czechia yesterday, Greek PM Kyriakos Misotakis left the group dinner during a speech from Turkish President Recep Tayyip Erdogan.

- Ouest France reports that, according to Erdogan, "I made a speech, the gentleman [Misotakis] appeared very uncomfortable. Because of this discomfort, [...] he came out and spoke outside...[Misotakis] said that we used somewhat harsh expressions. But there is nothing serious."

- Georg von Harrach at Channel 4 News: "Greek PM Misotakis overheard this morning after reports of a stormy exchange with Turkish President at European Political Community [Misotakis]: "Stood up and said to Erdogan...in your face"."

- Tensions between the two nations at multi-year highs after Erdogan made veiled threats of taking military action against Greece. Notable risk of naval conflagration in the East Med.

- Could develop into a major problem for Europe and US, given that both Greece and Turkey are NATO members and the alliance is keen on maintaining a united front in the face of Russia's war in Ukraine. EU would almost be forced into aligning with Greece, but this would threaten NATO links between EU members and Turkey. Expect Brussels and Washington to seek major de-escalation.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/10/2022 | 1025/1125 |  | UK | BOE Ramsden Speech at Securities Industry Conference | |

| 07/10/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 07/10/2022 | 1230/0830 | *** |  | US | Employment Report |

| 07/10/2022 | 1400/1000 |  | US | New York Fed's John Williams | |

| 07/10/2022 | 1500/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 07/10/2022 | 1900/1500 | * |  | US | Consumer Credit |

| 08/10/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 09/10/2022 | - |  | DE | Lower-Saxony Regional Election | |

| 09/10/2022 | - |  | AT | First Round of Presidential Election |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.