-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: All Eyes on Jackson Hole

EXECUTIVE SUMMARY:

- ALL EYES ON JACKSON HOLE WITH POWELL'S SPEECH AT 10:00ET/15:00BST THE HIGHLIGHT

- PBOC SET FOR ANOTHER RRR CUT (CHINA SECURITIES JOURNAL)

- BIDEN BEING ADVISED TO PAIR POWELL AS FED CHAIR WITH BRAINARD AS FED'S CHIEF REGULATOR (BBG)

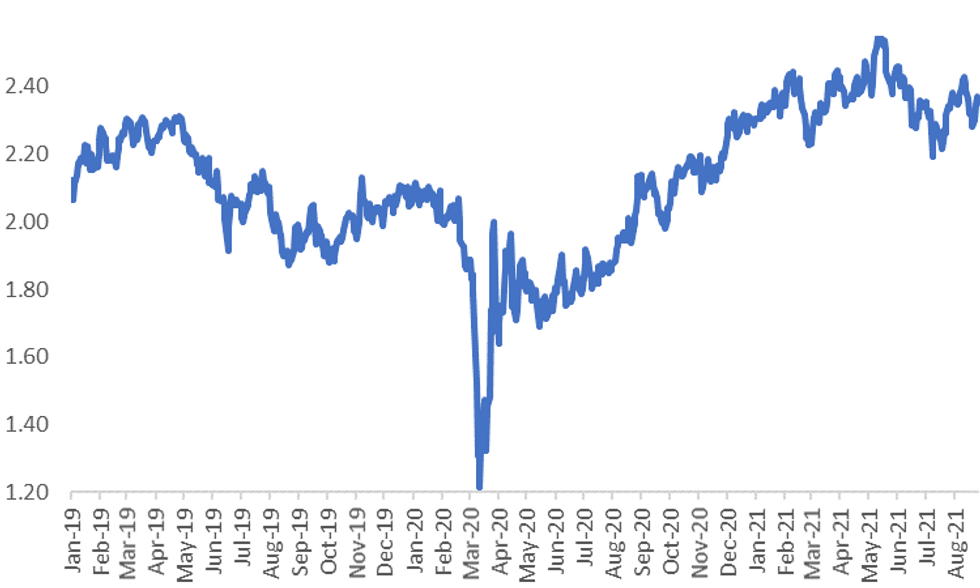

Fig 1. US 5y5y Forward Inflation Swap

Source: MNI, Bloomberg

NEWS:

CHINA-US (WSJ): China plans to propose new rules that would ban companies with large amounts of sensitive consumer data from going public in the U.S., people familiar with the matter said, a move that is likely to thwart the ambitions of the country's tech firms to list abroad.

FED (BBG): Joe Biden's advisers are considering a recommendation to the president that would pair a second term for Jerome Powell as Federal Reserve chair with the nomination of Lael Brainard as the central bank's chief regulator, people familiar with the matter said, a plan that could assuage progressives resistant to Powell.

PBOC (CHINA SECURITIES JOURNAL): The People's Bank of China has sent stronger signals for loosening credit with another round of RRR cut very likely, the China Securities Journal said citing analysts.

BOJ (MNI): A future digital yen could bear interest, a senior Bank of Japan official told MNI, with payments linked to deposits in commercial banks to avoid disruption to the financial system.

BOJ/PBOC (MNI): A fast-approaching digital yuan from the People's Bank of China would not immediately jolt the status of the U.S. dollar as the global reserve currency, a senior Bank of Japan official said.

DATA:

French consumer confidence slips in August

- French consumer confidence retreated for the second-straight month in August, sliding to a level of 99 from a downwardly-revised 100 in July, according to Insee.

- That follows a decline in French business confidence, which slipped to 110 from 113, in data released on Thursday, echoing ebbing corporate confidence in Germany reported earlier in the week.

- Consumers were gloomier about both past and future situations. The index for households' past financial situation declined to -14 from -13 in July, while financial prospects slipped to -3 from -1.

Italian Confidence Levels Slip in August

Consumer and business confidence both slipped in August, although retail traders reported a slightly brighter outlook, according to Istat.

- Consumer confidence retreated to 116.6 from 116.2, but remained well above the sub-100 level held through the first four months of the year

- Business confidence, as measured by the IESI, declined to 114.2 from 115.9, with a rise in retail outlook failing to overcome declines in other sectors.

- Manufacturing confidence declined to 113.4 from 115.2, while services weakened to 111.8 to 112.1 and construction fell to 153.8 to 158.6

- However, confidence in retailing improved to 113.9 from 111.3, with expectations of future conditions comprising much of the gain.

Source: Istat

FIXED INCOME: Marginal Firming Ahead of JH

Sovereign bonds have broadly firmed this morning alongside uneven trading in equity and FX markets.

- The UST curve has slightly bull flattened with the 2s30s spread 1bp narrower. TYU1 trades at 133-19, near the middle of the day's range (L: 133-16 / H: 133-20+).

- The gilt curve has steepened a touch on the back of the short end firming and longer end trading slightly weaker.

- Bunds started off on a strong footing before giving back the early gains to now trade just above yesterday's close.

- BTPs have traded higher, with the longer end outperforming and the curve 1bp flatter.

- The European data calendar was light this morning. The focus today will be on US PCE data for July and the latest University of Michigan Consumer Confidence reading for August.

- Following yesterday's bombing in Kabul, US President Joe Biden has pledged to continue with the planned evacuation of US troops from Afghanistan.

FOREX: Awaiting Jackson Hole and Powell

- A calmer trading session for FX and across other assets, with investors waiting to hear from Fed Powell at 10.00ET/15.00BST.

- Most crosses have stayed within ranges.

- USD saw some downside extension, a small continuation from the overnight session, but USD has faded some of the losses at the time of typing.

- USD is up 0.12% against the SEK and down 0.24% versus the AUD.

- We had a few questions regarding a sudden bid going through in the British Pound, which wasn't fix related.

- It was unclear on the trigger, with no headline or new news seen crossing our screens.

- The move seems to have been led by the leg lower in EURGBP, but price action has since reversed.

- GBP is also mixed across G10.

- Looking ahead, out the US, Wholesale Inventories and PCE deflator are the highlight, while Michigan will be final reading.

- Although, these will likely be superseded by Powell.

EQUITIES: Stocks mixed as we head into Jackson Hole

- Japan's NIKKEI down 101.15 pts or -0.36% at 27641.14 and the TOPIX down 6.58 pts or -0.34% at 1928.77

- China's SHANGHAI closed up 20.493 pts or +0.59% at 3522.157 and the HANG SENG ended 7.8 pts lower or -0.03% at 25407.89

- German Dax down 6.28 pts or -0.04% at 15788.39, FTSE 100 up 1.73 pts or +0.02% at 7127.01, CAC 40 down 4.95 pts or -0.07% at 6661.46 and Euro Stoxx 50 up 1.61 pts or +0.04% at 4171.64.

- Dow Jones mini up 84 pts or +0.24% at 35244, S&P 500 mini up 14.5 pts or +0.32% at 4481.25, NASDAQ mini up 52.75 pts or +0.35% at 15328.

COMMODITIES LEVELS UPDATE: Heading higher led by oil and platinum

- WTI Crude up $1.02 or +1.51% at $68.37

- Natural Gas up $0.04 or +0.91% at $4.222

- Gold spot up $3.35 or +0.19% at $1795.92

- Copper up $2.3 or +0.54% at $428.35

- Silver up $0.08 or +0.35% at $23.6544

- Platinum up $12.07 or +1.23% at $993.45

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.