-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI US Open: Better Roads Lead To Higher Taxes

EXECUTIVE SUMMARY:

- BIDEN TO LAY OUT $2.25TRN ECONOMIC PLAN, 28% CORPORATE TAX RATE

- LAGARDE SAYS INVESTORS CAN TEST E.C.B. RESOLVE "AS MUCH AS THEY WANT"

- B.O.J. CUTS FREQUENCY AND SCALE OF J.G.B. BUYS IN APRIL

- MNI CHINA LIQUIDITY INDEX: CONDITIONS LOOSEN; CURVE NORMALIZES

- FRANCE'S MACRON TO ADDRESS NATION ABOUT HEALTH SITUATION

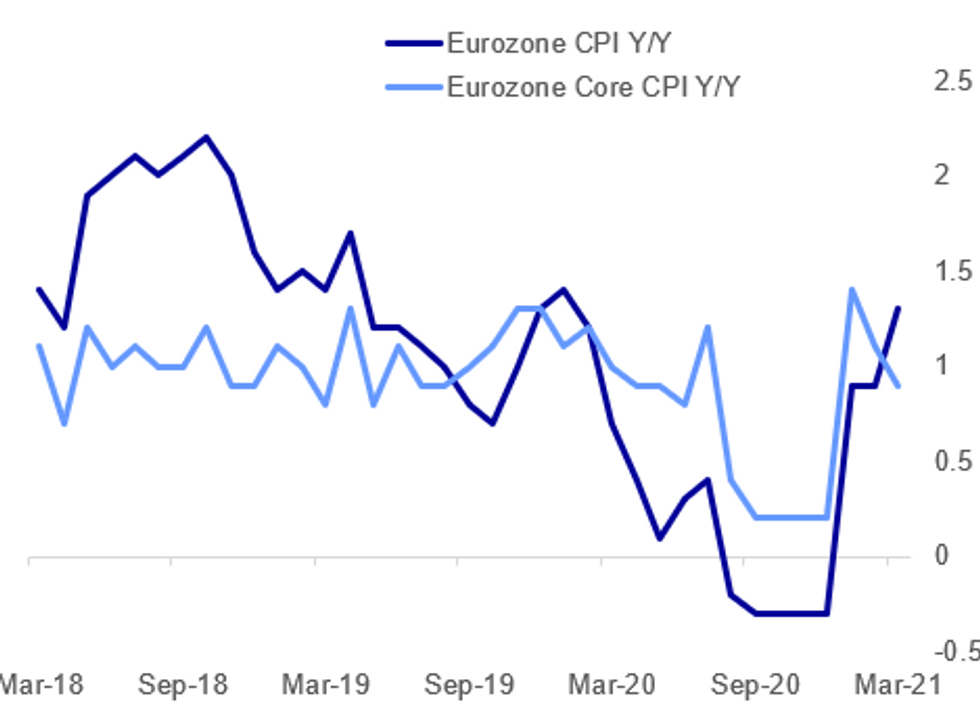

Fig. 1: Eurozone Core Price Pressures Remain Soft

Source: Eurostat, MNI

Source: Eurostat, MNI

NEWS:

U.S. (BBG): President Joe Biden released a sweeping plan to pump money into transportation, renewable energy, manufacturing and efforts to combat climate change -- funded by undoing some of the tax breaks that corporations received during the Trump administration. The $2.25 trillion, eight-year proposal is a follow-up to the $1.9 trillion economic relief bill passed earlier this month. To cover the costs, Biden wants to raise corporate taxes to 28% from 21%. The plan also seeks a minimum tax on profits U.S. corporations earn overseas, increasing the rate to 21% from roughly 13%. The White House plans a second major package, which could cost $1 trillion or more, later in April to focus on social measures, including expanding health care and paid-leave access and extending the child tax credit --offset by tax increases on wealthy individuals.

ECB (BBG): European Central Bank President Christine Lagarde said her institution won't shy away from using all its tools if investors try to push bond yields higher. "They can test us as much as they want," she said in a Bloomberg TV interview with Francine Lacqua on Wednesday. "We have exceptional tools to use at the moment. We will use them as needed." Lagarde said that the pandemic bond-buying program known as PEPP can be extended beyond March 2022 if the central bank decides that's necessary. "It's not as if it were set in stone," she said. When the ECB does decide to wind down the program, policy makers will give "sufficient early notice to avoid the anxiety, the tantrum, or any of those movement" she says, that have happened in the past.

ECB (BBG): European Central Bank President Christine Lagarde says she hopes the process of rolling out a digital currency will take around four years. ECB will shortly release an analysis of 8,000 responses from a public consultation process and communicate that to the European Parliament. On basis of that consultation and the ECB's own work, the Governing Council will debate and decide mid-2021 whether to go ahead with a digital currency.

B.O.J.: The Bank of Japan said Wednesday it will reduce the frequency and scale of its purchase of JGBs in April from March operations to help increase flexibility for JGB yield moves, as laid down in the March policy statement. The frequency of JGB buying with a remaining life of 1 to 3 years, 3 to 5 years and 5 to 10 years was reduced to four times in April from five times in March. The frequency of JGB buying operations with longer-end was reduced to one time from two times in March. The BOJ also announced a specific amount to be purchased for each bucket of operations in April, instead of a broader range.

MNI CHINA LIQUIDITY SURVEY: Liquidity conditions were little changed across China's interbank money markets in March as the People's Bank of China kept a firm grip on policy levers, the latest MNI Liquidity Conditions Index shows. The Liquidity Condition Index eased lower for a second month, falling to 26.2 in March from 31.6 in February, with just over half of the traders surveyed reporting better condition compared to last month. The higher the index reading, the tighter liquidity appears to survey participants. For full analysis please contact sales@marketnews.com.

FRANCE/COVID (BBG): French President Emmanuel Macron will address the nation about the coronavirus situation on Wednesday at 8 p.m. in Paris, according to a text message from his office. The government is holding a defense council meeting early on Wednesday to discuss options to fight a surge in infections. Macron has sought to avoid another full national lockdown, which he said would be a last resort, but has been under pressure from doctors and scientists. Measures on the table include closing schools in the most affected districts, which are currently under lockdown, according to several news reports.

EQUITIES (BBG): Stocks at the center of the Archegos Capital Management crisis extended a rebound in premarket trading as fallout from the fund's liquidation appeared to be contained and no further block trades were reported. American depositary receipts of GSX Techedu Inc. and Vipshop Holdings Ltd.both gained more than 3% after about 20 minutes of trading. ViacomCBS Inc., Discovery Inc. and Tencent Music Entertainment Group also rose, paring their recent slump. An air of calm has descended on the stocks, which also include Baidu Inc., Farfetch Ltd. and Iqiyi Inc., after the extreme volatility caused by the forced liquidation of positions linked to Bill Hwang's Archegos. While investors remain nervous about the potential for more liquidations, there have been no signs yet of a broader contagion.

EQUITIES (BBG): Deliveroo Holdings Plc shares plunged as much as 31%, the worst performance in decades for a big U.K. initial public offering, dealing a blow to London's efforts to establish itself as a hub for technology listings in the wake of Brexit. The stock dropped 23% to 299.55 pence at 9:49 a.m. in London after the 1.5 billion-pound ($2.1 billion) sale, which was priced at 390 pence, the bottom end of the initial range. Trading was halted twice for several minutes due to volatility.

GERMAN DATA (BBG): German joblessness declined in March, signaling economic resilience even as thousands of businesses remain affected by recently-extended pandemic restrictions. The drop of 8,000 put the total number of unemployed people at 2.75 million and kept the rate at 6%, according to the Federal Labor Agency. Economists surveyed by Bloomberg had expected a drop of 3,000.

DATA:

EZ Flash Inflation Weaker Than Expected

EZ MAR FLASH HICP +0.9% M/M; +1.3% Y/Y; FEB +0.9% Y/Y

EZ MAR FLASH CORE HICP +1.0% M/M; +0.9% Y/Y; FEB +1.1% Y/Y

- EZ inflation accelerated to 1.3% in Mar, coming in slightly weaker than markets expected (BBG: +1.4%) and marking the highest level since Jan 2020.

- Core inflation eased to 0.9%, showing a three-month low and registering below market forecasts (BBG: +1.1%)

- Energy inflation was the main driver of Mar's uptick, rising by 4.3% after falling by 1.7% in the previous month.

- Services inflation ticked up by 0.1pp to 1.3% in Mar, while food prices decelerated by 0.2pp to 1.1%.

- Non-energy industrial goods prices fell to 0.3% in Mar, down from 1.0% seen in Feb, hitting a three-month low.

- Among the member states, Luxembourg (2.4%), Germany and Austria (both +2.0%) showed the largest HICP rates, while Greece (-2.0%) saw the only decline in consumer prices.

IT Annual Inflation Weaker Than Expected

- Prel Mar HICP +1.8% m/m, +0.6% y/y (Feb +1.0% y/y), coming in below expectations (BBG: +0.8%)

- End of winter sales drove m/m HICP increase--Istat says

- Main domestic index (NIC) Mar +0.3% m/m, +0.8% y/y (Feb +0.6% y/y)

- 3rd consec. NIC CPI y/y uptick matched May 2019 levels--Istat says

- Non-regulated energy speed-up fueled y/y NIC rise--Istat says

- Mar core HICP inflation +0.6% y/y vs Feb +1.4% y/y.

- Net-of-energy Mar HICP index +0.6% y/y vs Feb +1.4% y/y

- Flash Mar HICP data provides +0.9% "acquired" inflation.

UK Final GDP Revised To Up +1.3% Q/Q

Q4 GDP +1.3% Q/Q; -7.3% Y/Y, PRELIM +1.0% Q/Q, -7.8% Y/Y; Q3 +16.9%% Q/Q

Q4 BUSINESS INV +5.9% Q/Q, -7.4%Y/Y; Q3 +13.2% QQ, -12.8%YY

Q4 CONSUMER SPENDING -1.7%% Q/Q, -9.2% Y/Y; Q3 +19.7% QQ, -7.9%YY

Q4 GOVT SPENDING +6.7% Q/Q, +0.3% Y/Y; Q3 +15.8% QQ, -6.0%YY

- The second estimate of Q4 GDP was revised up to 1.3% q/q from the previously reported 1.0% gain. Due to revised education output in the previous quarters, Q2 was revised down by 0.5pp to -20.8% and Q3 was revised up by 0.8pp to 19.7%.

- The annual rate was revised up to -7.3% from -7.8% reported previously. Over 2020, GDP was down 9.8%, which is 0.1pp higher than recorded in the flash estimate.

- Government expenditure contributed positively to growth, adding 1.3pp, while consumer spending shaved off 1.03pp from GDP growth. Household consumption was weaker than markets expected (BBG: -0.2% q/q), while government expenditure came in slightly stronger (BBG: 6.4%).

- Net trade contributed negatively to economic growth in Q4, subtracting 1.44pp from GDP growth.

- The household savings ratio rose to 16.1% in Q4, up from 14.3% seen in Q3. Over 2020, the savings ratio recorded a record high of 16.3%, compared to 6.8% in 2019.

MNI: FRANCE MAR FLASH HICP +0.7% M/M, +1.4% Y/Y; FEB +0.8% Y/Y

MNI: GERMANY MAR UE RATE (SA) 6.0%; FEB 6.0%

MNI: UK MAR NATIONWIDE UK HOUSE PRICE -0.2% M/M; +5.7%Y/Y

FIXED INCOME: Serene start to the day with subdued inflation data

After some volatile sessions recently, today has seen core fixed income markets in a more serene mood. Futures are generally down with cash yields higher.

- European inflation data this morning has been a little on the soft side, with the pan-Eurozone flash HICP coming in at 1.3%Y/Y (1/4% exp) and core CPI at 0.9% (1.1% exp). HICP readings from France and Italy were also a little lower than expected.

- Looking ahead, ADP employment is due for release while month-end and quarter-end flows will be in focus.

- TY1 futures are down -0-2+ today at 131-03+ with 10y UST yields up 2.9bp at 1.735% and 2y yields up 0.1bp at 0.149%.

- Bund futures are down -0.12 today at 170.88 with 10y Bund yields up 2.0bp at -0.268% and Schatz yields up 0.7bp at -0.691%.

- Gilt futures are down -0.07 today at 127.51 with 10y yields up 2.3bp at 0.846% and 2y yields up 2.0bp at 0.088%.

FOREX: Month-end Flow Reverses Stronger Start for USD

- EUR/USD hit new cycle lows of $1.1704 early Wednesday before price action reversed and USD weakness is seen across the G10 board. Month-end flows likely picking up, with continue to point toward general USD sales into the month-end fix against most others except for JPY. The JPY selling signal is playing out this morning, with USD/JPY touching new 2021 highs and narrowing the gap with Y111.00.

- NOK and GBP are moderately stronger so far. The price action has helped press EUR/NOK to the lowest levels of the year, touching 10.0030. A break below the 10.00 handle would be the first since early last year.

- Focus turns to US ADP Employment Change numbers, the MNI Chicago Business Barometer, pending home sales numbers and Canadian GDP for January. US President Biden also speaks on his economic plans for the US. Reports this morning see Biden announcing plans for a $2.25 trillion economic plan, with the spending offset by a hike in the corporate tax rate to 28%.

EQUITIES: Mixed Start To Last Day Of Quarter

- Asian stocks closed lower, with Japan's NIKKEI down 253.9 pts or -0.86% at 29178.8 and the TOPIX down 23.86 pts or -1.21% at 1954. China's SHANGHAI closed down 14.765 pts or -0.43% at 3441.912 and the HANG SENG ended 199.15 pts lower or -0.7% at 28378.35.

- European equities are flat/lower, with the German Dax up 0.8 pts or +0.01% at 15000.32, FTSE 100 down 17.85 pts or -0.26% at 6769.89, CAC 40 down 6.51 pts or -0.11% at 6091.2 and Euro Stoxx 50 down 3.9 pts or -0.1% at 3918.49.

- U.S. futures are mixed, with the Dow Jones mini down 14 pts or -0.04% at 32911, S&P 500 mini down 0.25 pts or -0.01% at 3947.5, NASDAQ mini up 23.75 pts or +0.18% at 12902.

COMMODITIES: Metals Gain As Dollar Softens Slightly

- WTI Crude down $0.02 or -0.03% at $60.91

- Natural Gas up $0.01 or +0.19% at $2.627

- Gold spot up $0.8 or +0.05% at $1685.85

- Copper up $2.7 or +0.68% at $399.9

- Silver up $0.1 or +0.42% at $24.1318

- Platinum up $19.5 or +1.68% at $1176.6

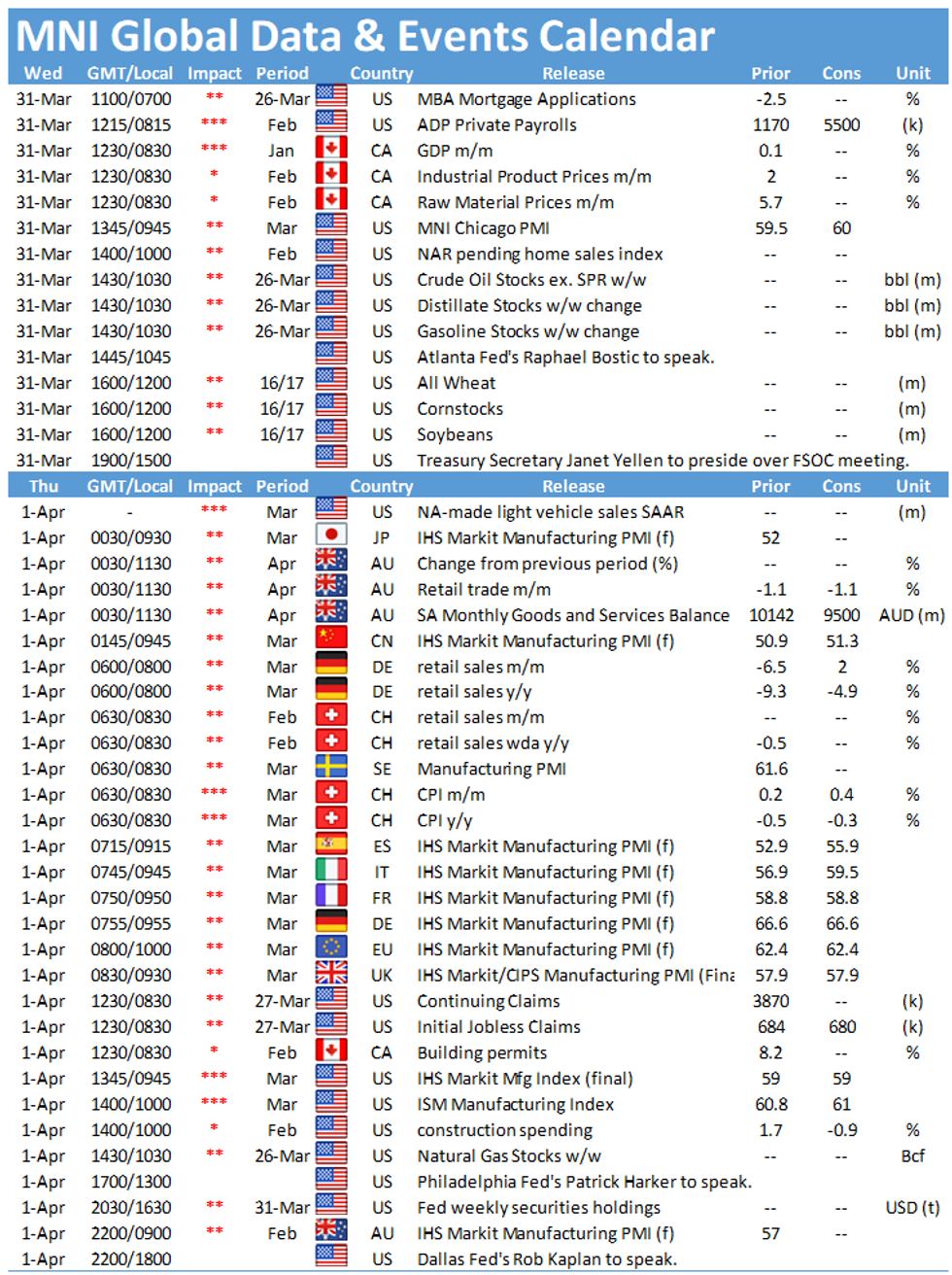

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.