-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Big Tech Earnings In Focus

EXECUTIVE SUMMARY:

- SWEDISH RIKSBANK HOLDS POLICY STEADY

- ALPHABET, MICROSOFT AMONG EARNINGS REPORTS DUE TODAY

- FRANCE AND GERMANY SUPPORT U.S. 21% TAX PLAN FOR CORPORATIONS

- ITALIAN BUSINESS AND CONSUMER SENTIMENT IMPROVE IN APRIL

- BANK OF ENGLAND AND B.I.S. SET UP STERLING LIQUIDITY FACILITY

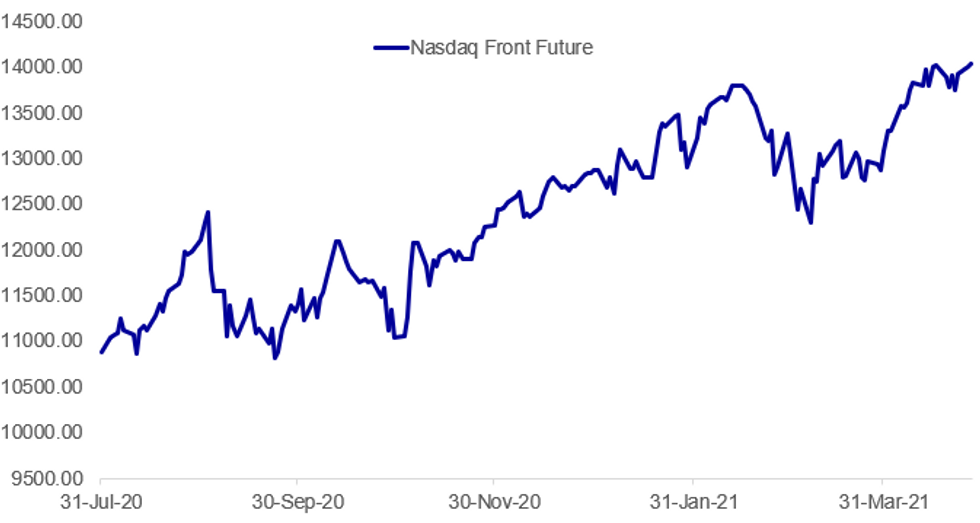

Fig. 1: Tech Earnings In Focus

Bloomberg, MNI

Bloomberg, MNI

NEWS:

RIKSBANK: The Swedish Riksbank's monetary policy decision Tuesday was overall in line with expectations:

- The repo rate forecast is at zero throughout the forecast horizon.

- The CPIF forecast ticks above 2.00% for the first time, but only in June 2024 (the last month of projections). It now takes until May 2024 to get to 2.00% (previously it was reached in March 2024 at the end of the previous forecast horizon).

- Nevertheless, CPIF moving even marginally above target is the first real sign of optimism and a return to normality. This is the first step to having a tick up in the repo rate forecast at the end of the forecast horizon.

- QE for Q3 set at SEK75bln (the expectations we had seen had generally been between SEK72-80bln so this is in the middle of the range).

- Language is still cautious even though the Riksbank point to some optimism. They make it clear easy monetary policy is needed for a sustained period of time still.

B.O.E.: "The Bank of England (BoE) has entered into a facility with the Bank for International Settlements (BIS) to ensure the provision of Sterling liquidityduring any future periods of market stress, complementing the BoE's existingestablished network of standing bilateral swap lines."* "Under the terms of the facility, the BoE will provide collateralised short-term Sterling liquidity to the BIS. The BIS may use the facility toprovide Sterling liquidity to their eligible existing central bankcustomers." "Together with the swap lines the BoE has with a number of central banks,this new facility will provide a further liquidity backstop in Sterling to help ease any potential future strains in funding markets." Not hugely significant for the market but basically means that the BIS takes on credit risk of providing sterling liquidity to central banks the BOE doesn't have a direct agreement with.

GLOBAL TAXATION (BBG): France and Germany support the U.S. proposal of a 21% minimum tax on multinational companies, French Finance Minister Bruno Le Maire and his German counterpart Olaf Scholz told Le Figaro and Die Zeit in a joint interview released on Tuesday."If the Biden administration proposes a 21% rate and there is consensus, it would be acceptable for us," Le Maire is quoted as saying."It is important that we agree on a percentage -- where exactly that will lie, the talks in the next few weeks will determine," Scholz said. "Personally I would have nothing against the U.S. proposal."

GERMANY: The mood amongst German exporters brightened further in April, rising to the highest level in over a decade as the continued strength of the global manufacturing sector is underpinning sales, the Munich-based Ifo Institute said Tuesday. "The pandemic is barely having an effect on manufacturing. This is clearly driving demand for German exports," the Ifo survey said.

NOMURA / ARCHEGOS (BBG): Nomura Holdings Inc. will book $2.9 billion in losses tied to the collapse of Archegos Capital Management, as Japan's biggest brokerage vows to beef up risk management in the wake of the debacle.Of the total, 245.7 billion yen ($2.3 billion) was logged in the three months ended March 31, leading to a quarterly net loss of 155.4 billion yen, its biggest since 2009. The remaining 62 billion yen will be booked in the current fiscal year, the Tokyo-based company said in a presentation Tuesday.

CHINA: China will step up iron ore mining at both domestic and offshore operations to curb rising prices, Qu Xiuli, the vice chairwoman of the China Iron and Steel Association told a press conference Tuesday. China imported 283 million tonnes of iron ore in Q1, up 8% y/y and the average import price was at USD150.79, increasing 64.51% y/y, according to Qu. MNI previously reported that the government ordered coal mines to increase supplies in response to fast-rising prices.

DATA:

Italy Business Sentiment Improved in Apr

- Apr SA manufacturing morale 105.4 vs Mar 101.9, surpassing expectations (BBG: 102.1)

- Apr composite business sentiment indicator 97.3 vs Mar 94.2

- Apr SA bus. sentiment rose for 5th consecutive month--Istat says

- Apr m/m intermed., capital, consumer gds ticked up--Istat

- Manufacturing current orders -6.6 in Apr vs -13.2 in Mar

- 3-month manuf. output outlook +8.3 vs +5.4 in Mar

- Current manufacturing inventory levels +1.1 vs. Mar +1.6

Italy Consumer Confidence Rose in Apr

- Apr SA consumer confidence 102.3 vs Mar 100.9; beating market expectations (BBG: 101.6)

- Consumers' sentiment on economy rose to 91.6 from Mar 90.2

- Confidence in future outlook up to 109.6 from Mar 107.1

- Sentiment on their personal climate climbed to 105.9 vs Mar 104.5

- Sentiment on the current climate fell to 97.4 from Mar 96.7

FIXED INCOME: US tech earnings in focus

Volumes in EGBs have stayed fairly subdued during the early European session, running at just over 50% of the 15 day averages.

- On the margin the German curve is tilting steeper, but we continue to trade within the last Month's range.

- Peripheral are mixed against the German 10yr, with Greece 0.8bp tighter and Italy 0.9bp wider.

- Upside has been limited ahead of the new 7yr German supply for EU4bn (Equates to 48.5k Bobl or 20.7k Bunds)

- Gilts are trading inline with Bund, down 12 ticks t the time of typing.

- "The Bank of England (BoE) has entered into a facility with the Bank for International Settlements (BIS) to ensure the provision of Sterling liquidity during any future periods of market stress, complementing the BoE's existing established network of standing bilateral swap lines".

- US Treasuries have are traded within overnight ranges, with the curve leaning bear steeper.

- Volumes have also been fairly low as the street gears up for the Fed tomorrow.

- Looking ahead, no tier 1 data of real note, and focus this week is on Tech earnings, which today includes, UPS, GE, 3M, Texas Instrument, Visa, Alphabet, Microsoft, Starbucks.

- Tonight sees US $62bn 7yr and $28bn 2yr (but a FRN)

FOREX: Greenback Regains Some Poise

- Having traded at new multi-month lows earlier this week, the greenback has regathered some poise Tuesday, rising against most others in G10. The move coincides with renewed momentum in US equity markets, with the e-mini S&P pushing higher to touch another record level overnight. Earnings season continues, with UPS, General Electric, 3M, Visa, Alphabet, Starbucks due, among others, today.

- Yesterday's outperformers are at the bottom of the table Tuesday, with AUD and NZD mildly weaker against most others. AUD/USD has dipped back below 0.78 in recent trade.

- Sweden's Riksbank kept policy unchanged in a decision that was largely alongside expectations. While keeping the repo rate path at zero across the forecast horizon, the Riksbank warned that, while the Swedish economy will normalize toward the end of 2021, the pandemic is "not over". SEK trades weaker against most others in G10.

- Focus Tuesday turns to US consumer confidence numbers for April as well as speeches from ECB's de Cos and BoC's Macklem.

EQUITIES: U.S. Futures Up Slightly Ahead Of Earnings

- Asian stock markets closed mostly lower, with Japan's NIKKEI down 134.34 pts or -0.46% at 28991.89 and the TOPIX down 14.6 pts or -0.76% at 1903.55. China's SHANGHAI closed up 1.445 pts or +0.04% at 3442.611 and the HANG SENG ended 11.29 pts lower or -0.04% at 28941.54.

- European stocks are a little weaker, with the German Dax down 31.48 pts or -0.21% at 15285.19, FTSE 100 down 5.28 pts or -0.08% at 6963.12, CAC 40 down 6.33 pts or -0.1% at 6275.52 and Euro Stoxx 50 down 6.21 pts or -0.15% at 4018.51.

- U.S. futures are up slightly, with the Dow Jones mini up 28 pts or +0.08% at 33905, S&P 500 mini up 4.75 pts or +0.11% at 4184.25, NASDAQ mini up 21.25 pts or +0.15% at 14032.75.

COMMODITIES: Copper Continues To Impress

- WTI Crude up $0.49 or +0.79% at $62.32

- Natural Gas up $0 or +0.04% at $2.788

- Gold spot down $1.89 or -0.11% at $1781.31

- Copper up $6.05 or +1.36% at $450.95

- Silver down $0.03 or -0.11% at $26.1873

- Platinum down $2.63 or -0.21% at $1245.15

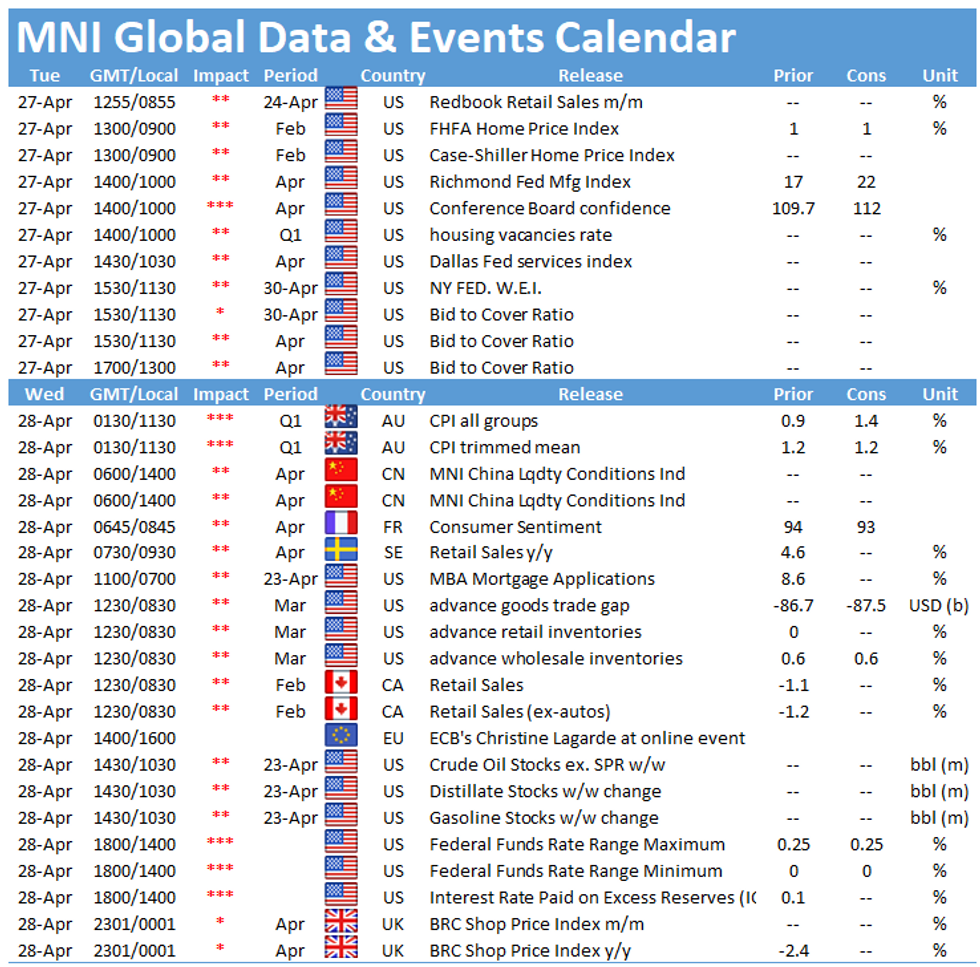

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.