-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: BoE's Bailey Sees "Issues" With UK Negative Rates

EXECUTIVE SUMMARY:

- BOE'S BAILEY SAYS THERE ARE "LOTS OF ISSUES" WITH NEGATIVE RATES

- MERKEL EXPECTS GERMAN LOCKDOWN TO LAST UNTIL EARLY APRIL (BILD)

- INFLATION NOT DEAD, BUT NO IMMINENT THREAT: ECB'S SCHNABEL

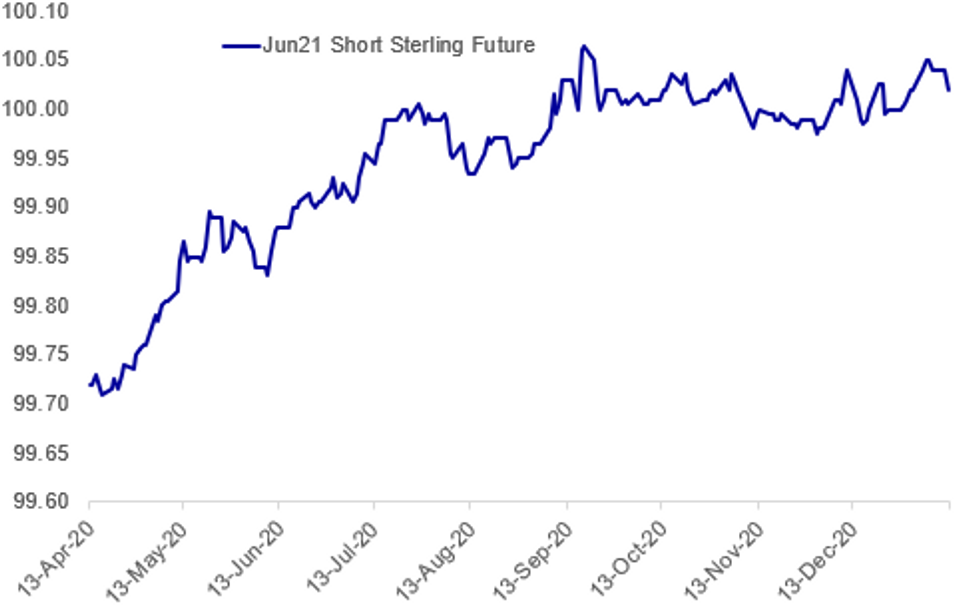

FIG.1: UK 2021 Rate Cut Expectations On A Knife's Edge

BBG, MNI

BBG, MNI

NEWS:

BOE (RTRS): Bank of England Governor Andrew Bailey said on Tuesday there were "lots of issues" with cutting interest rates below zero and such a move could hurt banks." In simple economics and maths terms, there is nothing to stop it at all," Bailey said when asked about negative rates after an online speech to the Scottish Chambers of Commerce. "However there are a lot of issues with it." Bailey said negative rates - the subject of a feasibility review by the BoE - would complicate banks' efforts to earn a rate of return, potentially hurting their lending to companies, and that it was not easy to draw a direct parallel with similar action in the euro zone.

GERMANY/COVID (BBG): Germany still "needs eight to 10 weeks of hard lockdown measures," Bild reports German Chancellor Angela Merkel as saying, citing people who took part in a meeting of the CDU/CSU party.

ECB: Inflation is not 'dead' and there will likely be some upward pressure on prices in 2021 as the downward impact from energy prices and the German VAT cuts dissipate, ECB Executive Board member Isabel Schnabel said in an interview published Tuesday. However, despite the unprecedented amounts of monetary stimulus in recent times, Schnabel isn't yet concerned about high price levels. "At present there are no indications that we need to be concerned about inflation being too high. We see a pronounced weakness in demand. There is a danger that the crisis will have a scarring impact on the labour market. All in all, the main problem is probably that economic demand is too weak, rather than that capacity bottlenecks may arise, which is why prices are more likely to rise too slowly," she told Austria's Der Standard.

ITALY (BBG): Snap elections would be a disaster for Italy, Nicola Zingaretti, leader of the Democratic Party, a member of Prime Minister Giuseppe Conte ruling coalition, says in an interview on Sky TG24 on Tuesday. " I still hope there won't be a government crisis, it would be a serious political mistake that would penalize Italy, a tunnel with no way out in sight"

EUROZONE DATA: The household savings rate in the Eurozone declined by 7.3pt to 17.3% in Q3 2020, down from the 24.6% seen in the second quarter. However, Q3's reading is still the second largest since the series began in 1999. The savings rate is 4.4pp higher than a year ago. The decrease was driven by a sharp recovery of individual consumption expenditure (+13.9%) as economies reopened through the summer months, while household's gross disposable income increased at a slower pace (+3.9%).

JAPAN DATA: Household sentiment in Japan rose in December from three months ago for the first rise in 10 quarters although the level remained low, the Bank of Japan's quarterly consumer survey released Tuesday showed. The BOJ's diffusion index to gauge households' sentiment on current economic conditions rose 5.4 points to -70.2 in December with more people saying sentiment had worsened judging from incomes, media reports and the business performance of employers. Still, it was an improvement from September when the index declined 4.4 points to -75.6.

DATA:

No key data in the European morning.

FIXED INCOME: Huge supply the talking point

- Supply has been the biggest talking point in markets this morning with Belgium holding a syndication and bond auctions from the Netherlands, UK, Austria and Germany. In addition there has been a surge in corporate and SSA issuance.

- Gilts have underperformed. Futures breached key support while comments from BoE Governor Bailey that sounded cautious on negative rates have pushed rate hike expectations further out.

- Looking ahead there are a number of Fed speakers scheduled with George and Rosengren probably the most topical for FI markets.

- TY1 futures are down -0-6 today at 136-07+ with 10y UST yields up 0.9bp at 1.156% and 2y yields up 0.2bp at 0.149%.

- Bund futures are down -0.35 today at 176.58 with 10y Bund yields up 2.1bp at -0.477% and Schatz yields up 0.7bp at -0.696%.

- Gilt futures are down -0.30 today at 133.89 with 10y yields up 2.7bp at 0.334% and 2y yields up 2.5bp at -0.100%.

FOREX: Bailey Dampens Rate Cut Expectations

Implied vols receded early Tuesday, with markets resuming the recent trend of selling USD in favour of growth proxies including AUD and NZD. Equities are mixed, although US futures are pointing to a mildly positive open later today, which has given markets the greenlight to resume their USD-selling bias. A lower close for the USD index today would be the first down-day since Jan 5th.

GBP trades well following a speech from BoE governor Bailey who highlighted the difficulties and uncertainties when it comes to negative interest rates. Bailey stated that while there "nothing to stop" the imposition of negative interest rates, there would be lots of issues including complicating the outlook for the banking sector. Markets read these comments as a firm indication that the MPC are still well away from seriously considering NIRP, resulting in markets pushing out rate cut expectations and boosting GBP in the process. GBP/USD showed above $1.36.

The data schedule is particularly quiet Tuesday, with just US JOLTS job openings data on the docket. Fed's Brainard, George & Rosengren speak as well as ECB's de Cos.

EQUITIES: Mixed Start W Tech, Energy, Financials Leading

- Asian stocks closed higher, with Japan's NIKKEI up 25.31 pts or +0.09% at 28164.34 and the TOPIX up 3 pts or +0.16% at 1857.94. China's SHANGHAI closed up 76.841 pts or +2.18% at 3608.339 and the HANG SENG ended 368.53 pts higher or +1.32% at 28276.75.

- European equities are mixed, with the German Dax up 9.79 pts or +0.07% at 13981.53, FTSE 100 down 17.64 pts or -0.26% at 6798.48, CAC 40 up 5.98 pts or +0.11% at 5662.43 and Euro Stoxx 50 down 0.57 pts or -0.02% at 3630.86.

- U.S. futures are higher, with the Dow Jones mini up 70 pts or +0.23% at 30972, S&P 500 mini up 10.25 pts or +0.27% at 3802.5, NASDAQ mini up 53 pts or +0.41% at 12950.5.

COMMODITIES: Broad Gains, Metals Leading

- WTI Crude up $0.89 or +1.7% at $52.61

- Natural Gas up $0.08 or +3.02% at $2.821

- Gold spot up $17.9 or +0.97% at $1861.82

- Copper up $7.05 or +1.98% at $361.5

- Silver up $0.64 or +2.58% at $25.3272

- Platinum up $29.82 or +2.88% at $1059.2

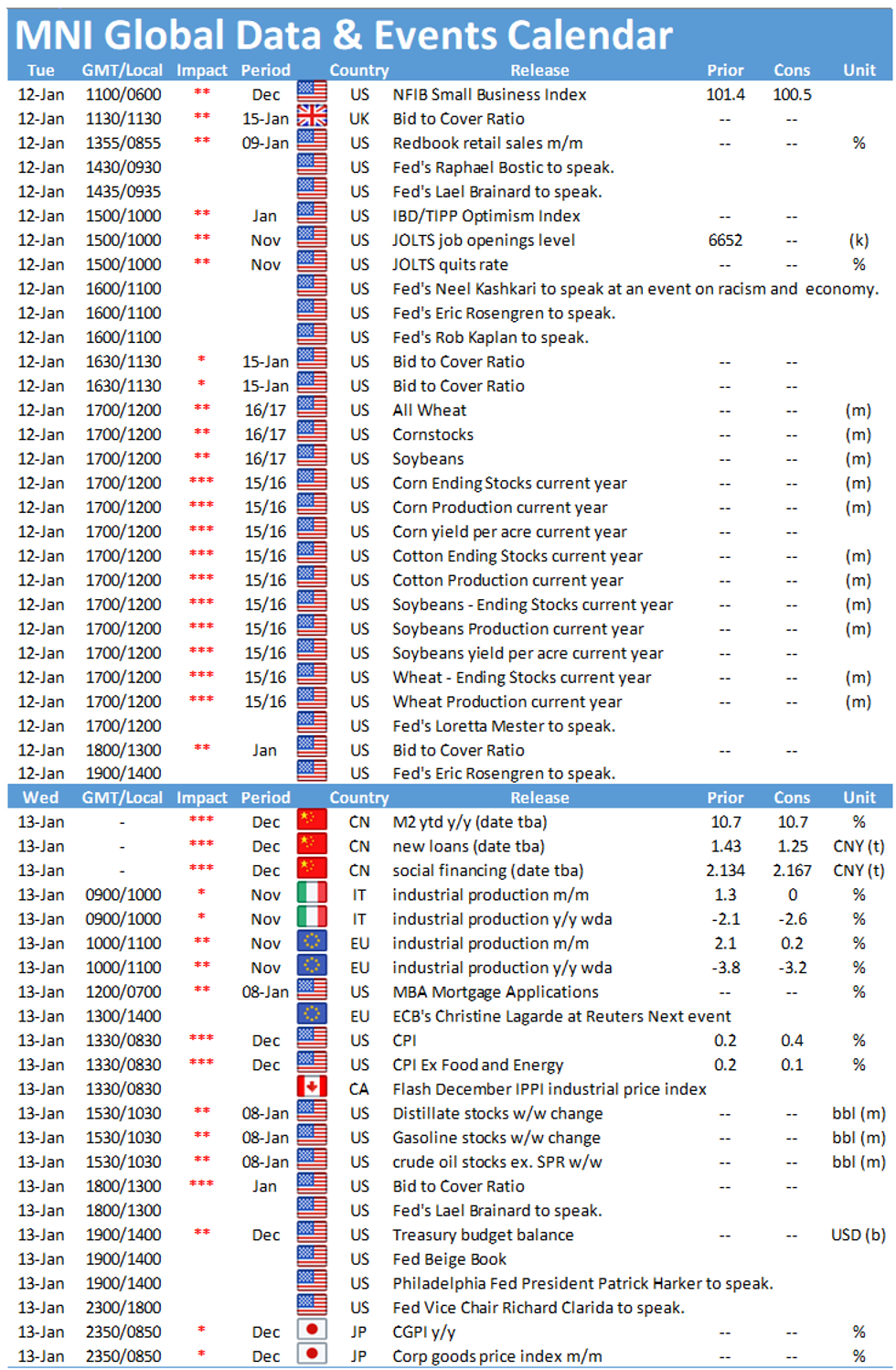

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.