-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Equity Bounce Continues

EXECUTIVE SUMMARY:

- RIKSBANK SEES INTEREST RATES AT ZERO FOR FORECAST PERIOD

- CANADIAN ELECTION RESULTS IN LITTLE CHANGE

- U.S. HOUSE SET TO VOTE TODAY ON BILL AVERTING GOV'T SHUTDOWN

- ECB LIKELY TO BUY GREEK DEBT EVEN AFTER CRISIS: STOURNARAS

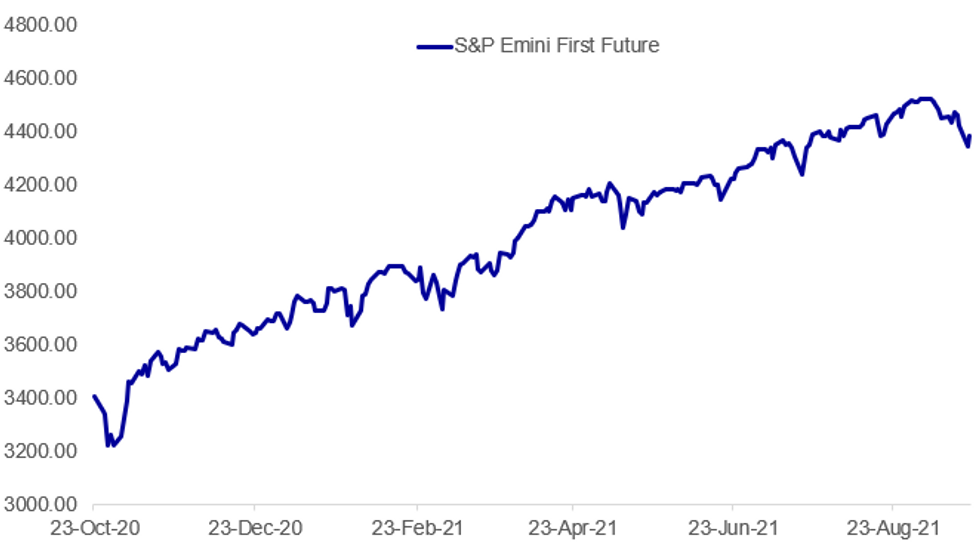

Fig. 1: Stocks See Nascent Bounce

Source: BBG, MNI

Source: BBG, MNI

NEWS:

SWEDEN RIKSBANK: The Riksbank Executive Board left the policy rate at zero following its September meeting and stuck to its forecast that it would stay at zero throughout its three year forecast horizon despite predicting that inflation would stay above target over the next year. The Riksbank's forecasts in the Monetary Policy Report showed inflation on the CPIF measure, consumer prices with a fixed interest rate, peaking at 3.15% in November this year and staying above the 2.0% target until August 2022, when it was shown plunging back to 1.36% as base effects from higher inflation this year kick-in. The board's position was that expansionary monetary policy was needed to keep inflation close to target in the longer run.

CANADA: Canada's electorate delivered less of a message to its political leaders and more of an apathetic shrug as the snap general election billed as either a chance to give PM Justin Trudeau the opportunity to build on his policies of the last few years by giving him a majority, or allow voters to remove him from office ended up with the parties standing still, with only a handful of seats changing hands. Trudeau's centre-left Liberal Party failed to win a majority, indeed winning just one additional seat from the 2019 election result to lift the party's total to 158. The centre-right Conservatives of Erin O'Toole won 119 seats, the same total as the party held prior to the election and down two on the2019 result. With the Liberals as the largest party, Trudeau is set for a third term in office and his second at the head of a minority gov't. He will require support from either the leftist New Democratic Party (NDP, 25 seats, up one from 2019) or the Quebec regionalist Bloc Quebecois (BQ, 34 seats, up two) in order to pass legislation.

U.S.: Chad Pergram at FOX News tweets: "House Rules Cmte resumes mtg today to prep bill to avert gov't shutdown and also suspend debt ceiling. House likely to vote on that bill today" Widespread expectation is that the bill will pass comfortably in the House with Democrat majority. However, Senate could be more difficult should the bill involve the raising of the debt ceiling. Senate Republican leadership has said its members will not vote for an increase, only a suspension.

ECB (BBG): The European Central Bank is likely to continue purchasing junk-rated Greek sovereign debt even after the pandemic crisis has passed, according to Governing Council member and Greek central bank chief Yannis Stournaras."This is not a question of Greece's ability to service debt, but a question of even transmission of monetary policy," Stournaras told Politico in an interview published Monday. He added it was his "expectation" that the ECB's older asset-purchase program, known as APP, would take over some of the flexibility of the emergency program launched in March 2020.

ECB (BBG): European Central Bank Vice President Luis de Guindos says there are "good news" with respect to the euro-area recovery after a strong development in the second and third quarter. There are still some medium-term vulnerabilities in the financial sector even as the picture is brighter in the short term due to the recovery. Great majority of rise in inflation is temporary, technical. Inflation may peak around November at 3.4%-3.5%.

BOE (MNI STATE OF PLAY): The Bank of England, faced with a lingering Covid pandemic and with its monetary policy committee split down the middle over whether a key hurdle for tightening has been met, looks set to leave policy untouched at its September meeting which concludes with an announcement Thursday. For full article contact sales@marketnews.com

BANK INDONESIA: Bank Indonesia's Board of Governors has kept its benchmark seven day repo rate unchanged at 3.5% as the two day meeting concluded on Tuesday. The central bank also maintained its overnight deposit and lending facility rates at 2.75% and 4.25%, respectively. No change was expected at the meeting, with the Bank looking to the easing of lockdowns and momentum for vaccinations to help the economy rebound.

DATA:

UK DEBT-TO-GDP AT 97.6% IN AUG: ONS

MNI: UK AUGUST CGNCR GBP8.391 BLN

UK DATA: Aug Borrowing Tops Expected As Debt Costs Soar

UK borrowing surged to GBP20.514 billion in August, far exceeding analysts' forecasts of a jump to GBP15.6 billion as rising inflation lifted government borrowing costs. Debt interest payments rose to GBP6.3 billion, the highest August on record, from an upwardly-revised GBP3.7 billion in July, as RPI rose by 0.6 percentage points between May and June. That's less than the record-high GBP8.7 billion paid out in June, but interest payments will continue to lift borrowing in the months to come, as inflation continues to rise.

VAT receipts rose by 5.0% in the year to August, below the upwardly-revised 18.6% surge in July, leaving VAT 5.6% below August 2019 levels. VAT may have been depressed by the relaxation of levies on eating out through the Eat Out to Help Out Scheme. July borrowing was revised sharply downward to GBP6.940 billion from the initially-reported GBP10.33 Bln.

The overall debt-to-GDP level stood at 97.6%, revised lower as overall borrowing levels were revised lower and growth continues to recover.

UK debt-to-GDP levels

.

FIXED INCOME: EGB/Gilts Better offered on the Equity bid

A more subdued session for EGBs and Bund, with contract taking their cue from the Equity price action.

- Bund has been better offered as Risk recovers from their worst levels. Peripheral spreads have all tightened against the German 10yr.

- Greece by a decent 5bps, following ECB's Stournaras saying that he expects the ECB to buy Greek debt in APP after the end of PEPP.

- Gilts have traded in line with Bund, initially wider by 0.6bp, but now 0.3 tighter at the time of typim.

- Similar price action for Treasuries, with better selling on the margin on the back of higher Equities.

- Looking ahead, we have no tier 1 data, nor speakers left for the session.

- Later sees US Auction with $24bn 20yr.

- US President Biden will be speaking with the Australian PM (Scott Morrison), and UK Johnson

- Dec Bund futures (RX) down 12 ticks at 171.43 (L: 171.27 / H: 171.71)

- Germany: The 2-Yr yield is up 0.7bps at -0.711%, 5-Yr is up 0.6bps at -0.629%, 10-Yr is up 1.4bps at -0.306%, and 30-Yr is up 1.7bps at 0.189%.

- Dec Gilt futures (G) down 4 ticks at 127.41 (L: 127.21 / H: 127.5)

- UK: The 2-Yr yield is up 1.2bps at 0.268%, 5-Yr is up 1.3bps at 0.476%, 10-Yr is up 1bps at 0.804%, and 30-Yr is up 0.6bps at 1.108%.

- Dec BTP futures (IK) steady at at 153.73 (L: 153.73 / H: 154.02)

- Dec OAT futures (OA) down 11 ticks at 167.74 (L: 167.63 / H: 168.05)

FOREX: Sentiment Stabilizes, But No Sea Change in Appetite

- Markets are reversing course Tuesday, with equities recovering off the Monday low and adding pressure to haven currencies. As a result, the JPY, USD and EUR are the poorest performers ahead of the NY open.

- At present, the turnaround in sentiment looks more like a stabilisation of investor appetite rather than any sea change, with the e-mini S&P still below 4400 and south of yesterday's highs. Similarly, European indices are a touch firmer but are yet to erase the losses suffered Monday.

- A bottoming out of commodity markets (WTI, Brent higher by over 1.5% apiece) is assisting the AUD, CAD and NOK strength. This solidifies the 50-dma in USD/NOK as solid resistance at 8.7965 - a level challenged, but not topped, earlier in the week.

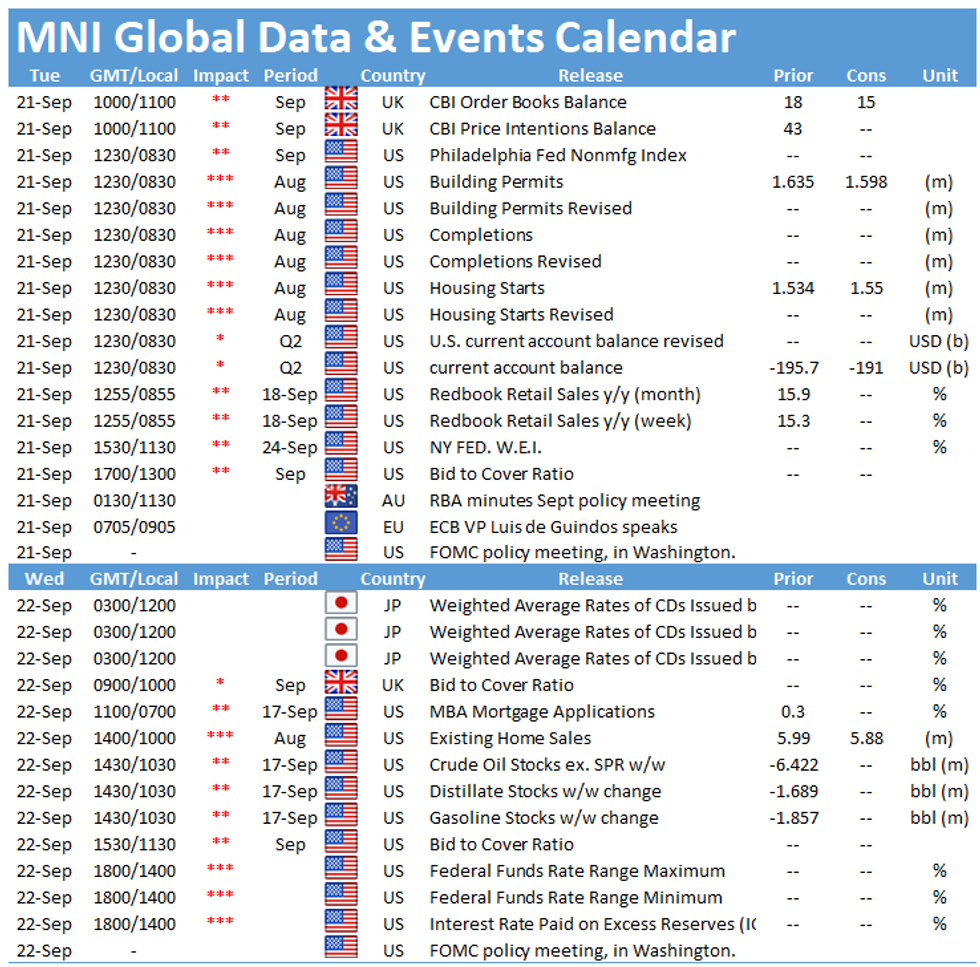

- US housing starts and building permits data is the calendar highlight Tuesday, with the OECD also releasing their interim economic outlook. There are no central bank speakers of note.

EQUITIES: Bounce Continues

- Asian stocks closed mixed (Japan returned from Holiday), with Japan's NIKKEI down 660.34 pts or -2.17% at 29839.71 and the TOPIX down 35.62 pts or -1.7% at 2064.55. The HANG SENG ended 122.4 pts higher or +0.51% at 24221.54.

- European futures are gaining, with the German Dax up 197.99 pts or +1.31% at 15329.25, FTSE 100 up 72.97 pts or +1.06% at 6977.19, CAC 40 up 94.4 pts or +1.46% at 6550.89 and Euro Stoxx 50 up 46.88 pts or +1.16% at 4090.1.

- U.S. futures continue to bounce, with the Dow Jones mini up 341 pts or +1.01% at 34178, S&P 500 mini up 40 pts or +0.92% at 4388.25, NASDAQ mini up 133.25 pts or +0.89% at 15143.25.

COMMODITIES: Gaining Across The Board On Broader Risk-On Move

- WTI Crude up $1.11 or +1.58% at $71.4

- Natural Gas up $0.01 or +0.14% at $4.99

- Gold spot up $0.21 or +0.01% at $1764.22

- Copper up $5.45 or +1.32% at $416.9

- Silver up $0.25 or +1.13% at $22.5205

- Platinum up $10.37 or +1.13% at $924.74

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.