-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Brainard Speculation Boosts Bonds

EXECUTIVE SUMMARY:

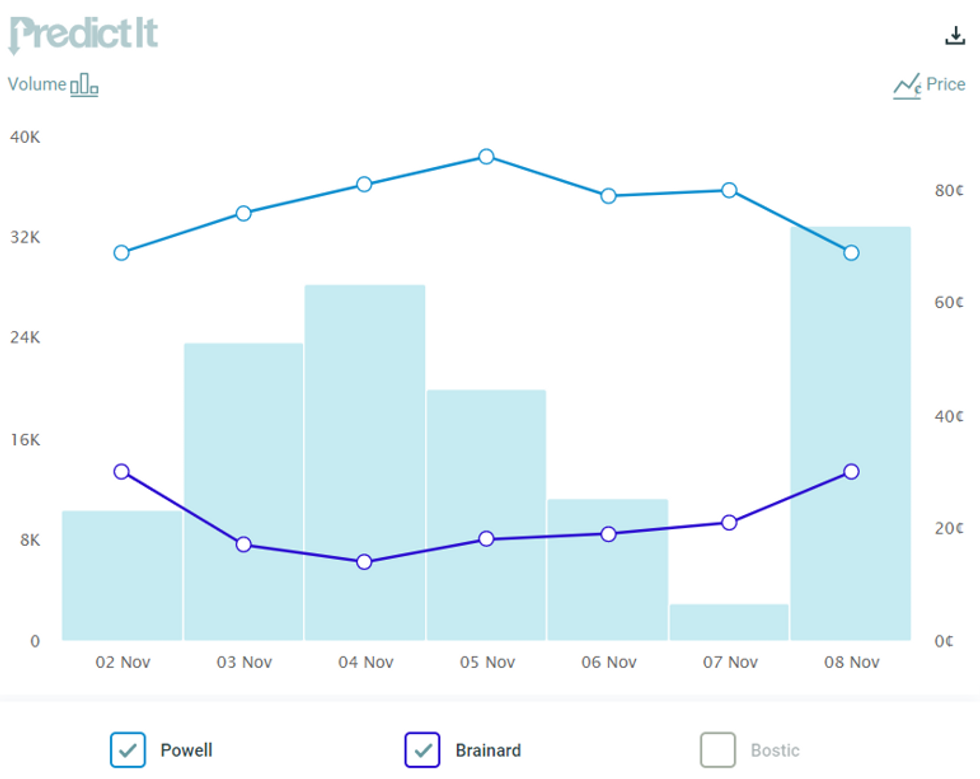

- BRAINARD IMPLIED ODDS OF BECOMING FED CHAIR IMPROVE ON REPORT SHE INTERVIEWED W BIDEN

- GAZPROM SET TO BEGIN FILLING EUROPEAN GAS STORAGE SITES

- CHINA OCTOBER CPI SEEN UP ON FOOD, FUEL COSTS (MNI REALITY CHECK)

- GERMAN ZEW INVESTOR SURVEY MIXED

Fig.1: Brainard Odds Of Becoming Fed Chair Boosted Overnight (Implied PredictIt Probability)

Source: PredictIt

Source: PredictIt

NEWS:

FED (BBG, REPEATED FROM OVERNIGHT): Federal Reserve Governor Lael Brainard was interviewed for the top job at the U.S. central bank when she visited the White House last week, according to people familiar with the discussions, signaling that Chair Jerome Powell has a serious rival as President Joe Biden considers who will lead the Fed for the next four years. Powell and Brainard are the only people who have publicly surfaced as being in the running for chair. Powell's current term in that post expires in February and Biden said on Nov. 2 that he'd make a decision "fairly quickly." Bloomberg News has previously reported that Brainard was also under consideration for the position of Fed vice chair for supervision. The White House and Fed both declined to comment.

FED (POLITICO, REPEATED FROM OVERNIGHT): Powell's seat is up in February, but there are whispers the announcement is coming soon. Two sources with knowledge of the process said they expect a decision to be made by Thanksgiving at the latest. Fed officials will be in their so-called blackout period - in which officials refrain from making any public remarks or appearances - from Dec. 4 through their next policy meeting on Dec. 14-15. An announcement would likely need to come before then to leave enough time for the Senate to consider the nomination before Powell's current term expires in February. Given the market jitters that can accompany such a nomination, previous administrations have forecast a potential successor at the central bank well in advance. This White House, however, has dragged out the "will he, won't he" anticipation surrounding Powell, a Trump nominee, while remaining largely mum on it's timeline and leanings, both in public and private. A Democratic consultant with close ties to the administration, meanwhile, seemed dubious that Brainard, who was also mentioned as a possible pick to lead the Treasury Department under Biden, would get the nod. "Seems like the only push is coming from Lael herself," the consultant said, although some progressive groups have also advocated for Brainard to replace Powell. (POLITICO)

GAZPROM / EUROPE ENERGY: Russian gas giant Gazprom's official twitter account tweets: "Gazprom has approved and launched a plan to pump gas into five European underground storage facilities for November." The issue of Gazprom filling European storage sites has been top of mind for many EU member state gov'ts. This is due to the extremely low stockpiles in Europe that are exacerbating a price spike ahead of the cold winter months.

CHINA (MNI REALITY CHECK): China's consumer price index likely edged higher in October, as both food and energy prices rose on tighter supply, industry insiders and market analysts told MNI. For full article contact sales@marketnews.com.

ECB / CBDC: The creation of a digital euro is key to preserving the monetary transmission mechanism by maintaining a well-functioning payment system, ECB Executive Board member Fabio Panetta said in a speech Tuesday, but he he noted such a move carries significant potential implications for financial stability. Among the challenges posed by a central bank digital currency (CBDC) significant shifts from bank deposits into CBDC, abrupt changes in the structure of the financial system and increased latent risk of bank runs, Panetta said. Equally, a CBDC would also help facilitate the creation of new payment services, make international payments easier, and lead a diversification of financial services and service providers.

JAPAN / BOJ (MNI INTERVIEW): Financial institutions should complete their transition away from LIBOR, as a year-end deadline to switch away from the interbank lending tool nears, a senior Bank of Japan official said. For full article contact sales@marketnews.com

CRYPTOCURRENCY (BBG): Bitcoin and Ether hit all-time highs Tuesday in an ongoing cryptocurrency rally that some analysts attributed partly to the search for investments to hedge risks from inflation.Bitcoin, the world's largest digital token, jumped as much as 3.6% to $68,513, while Ether posted a more modest advance to about $4,840. The total value of digital tokens tracked by CoinGecko reached some $3.1 trillion.

UK POLITICS: Chris Curtis at opinion pollster Opinium tweets some of his latest views on the decline in support for PM Boris Johnson's Conservative Party: "...we now have enough polling to be confident there has been a shift.Opinium - 1 pt Tory lead. from 5 pts, YouGov - 1 pt Tory lead, from 6 pts, R&W- 1 pt Tory lead, from 5 pts, Ipsos - 1 pt Labour lead, from 3 pts torylead. Exception is Deltapoll - 3pt Tory lead, from 1 pt." We also know the latest stories have also had an impact on the views of the Tories and the PM: % who think Boris Johnson is Clean and honest 22% (-8),Corrupt 47% (+5); % who think the Conservative Party isClean and honest 22%(-6), Corrupt 48% (+7), (Changes on April)."

CHINA BONDS (BBG): China's higher-quality dollar bonds are suffering their worst selloff in about seven months as property woes spill into the broader credit market. Spreads on the investment-grade notes -- which account for the bulk of offshore dollar securities from Chinese issuers -- widened about 8 to 10 basis points Tuesday, traders said. That would be the biggest daily expansion since April after a widening of 7 basis points Monday, according to a Bloomberg index.

IRAN NUCLEAR (BBG): French Foreign Affairs Minister Jean-Yves Le Drian spoke with Iranian counterpart Hossein Amirabdollahian by phone on Tuesday, his office said in an emailed statement.Le Drian urged Iran to renew talks interrupted on June 20 with goal of quickly restoring nuclear deal known as Joint Comprehensive Plan of Action

EUROPE HOUSING MARKET: Europe's housing market has proved resilient in the face of successive waves of Covid-19 and related containment measures, according to the latest ECB Economic Bulletin, thanks to a combination of continued demand, monetary and fiscal support. Prices exceeded their pre-crisis levels in the fourth quarter of 2019 by 4.3% and 2.6% in the third quarter of 2020, and by around 6% in both the fourth quarter of 2020 and the first quarter of 2021, a pace not seen since mid-2007.

EUROPE BANKS (BBG): European banks have used the pandemic to start tackling long-standing issues that weigh on their profitability compared to U.S. competitors, according to their top regulator. "There has been a long period in which European banks seemed to be waiting for the Godot of interest rates increasing and rebuilding their margins," Andrea Enria, who chairs the European Central Bank's Supervisory Board, said in an interview with Bloomberg TV's Maria Tadeo. "With the pandemic they understood that they need to take action."Enria said European banks' lagging profitability is rooted in "structural weaknesses" like cost inefficiency, business models that lack focus and insufficient investments in digital technology. Still, Enria welcome the fact that European banks have beat earnings estimates for six straight quarters and are generating profits at pre-pandemic levels two years ahead of their own expectations.

DATA:

GERMANY NOV ZEW CURRENT CONDITIONS 12.5

GERMANY NOV ECONOMIC SENTIMENT INDEX 31.7

FIXED INCOME: Looking ahead to PPI

Core fixed income is all a little higher from yesterday's close, but USTs, Bund and gilts are generally trading around the mid-point of yesterday's range.

- There have not been many market-moving headlines this morning and data has been mixed (German exports disappointing and the ZEW survey pointing to a worse than expected current situation, but expectations higher than expected).

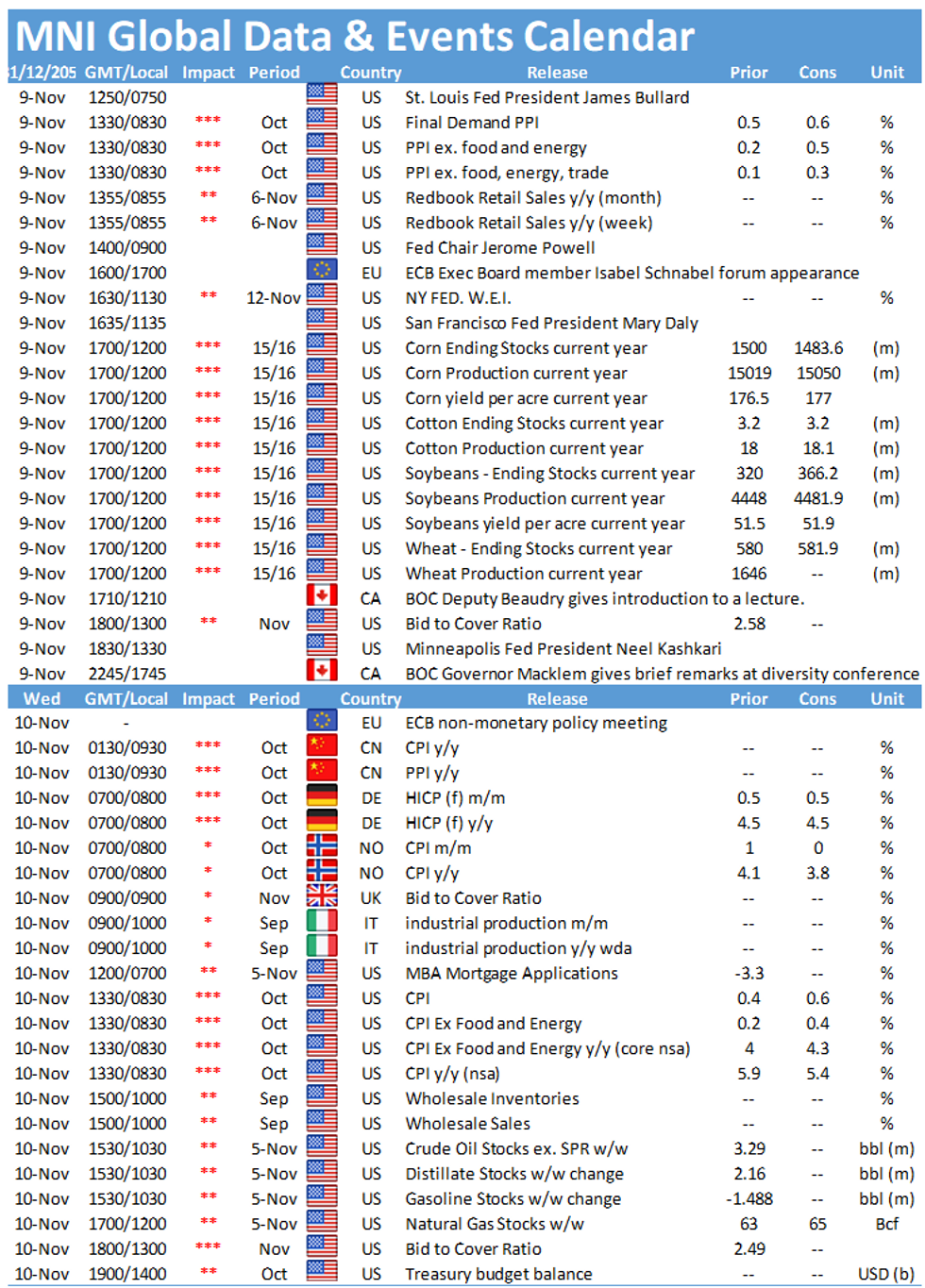

- Looking ahead we have a slew of central bank speakers including the heads of the Fed, ECB and Bailey.

- We also look ahead to US PPI data, probably the key event of the day.

- TY1 futures are up 0-8 today at 131-17+ with 10y UST yields down -2.3bp at 1.468% and 2y yields down -2.7bp at 0.418%.

- Bund futures are up 0.17 today at 170.86 with 10y Bund yields down -1.9bp at -0.264% and Schatz yields down -0.4bp at -0.769%.

- Gilt futures are up 0.04 today at 127.01 with 10y yields down -0.7bp at 0.847% and 2y yields up 1.2bp at 0.418%.

FOREX: Markets Chew Through CB Speak Ahead of US PPI

- Germany's ZEW survey came in mixed, with current situation falling short of forecast while expectations recorded a decent beat on expectations. The read through for EUR was muted however, with EUR/USD continue to trade just either side of the 1.16 handle.

- A weaker greenback today twinned with a stronger JPY has extended the streak of lower lows, with the pair on track to record four consecutive sessions of losses. 112.34 undercuts as first support as the 50-day EMA ahead of 112.08 which marks the Sep 30 high and recent breakout level.

- NZD is the poorest performing currency in G10, partially reversing the outperformance from the Sunday open as markets responded to the government's announcement of re-opening for a number of the larger cities. NZD/USD remains comfortably above Monday's low of 0.7104 as well as the 200-dma of 0.7100.

- US PPI data crosses later today, with M/M price pressures expected to tick higher ahead of Wednesday's possibly more influential CPI release. Central bank speak remains dominant, with Fed's Bullard, Powell Daly & Kashkari due as well as ECB's Lagarde, Knot and BoE's Bailey. Topics are varied, with speeches ranging from inequality to diversity to banking supervision.

EQUITIES: Futures Bouncing From Overnight Lows

- Asian markets closed mostly lower, with Japan's NIKKEI down 221.59 pts or -0.75% at 29285.46 and the TOPIX down 16.45 pts or -0.81% at 2018.77. China's SHANGHAI closed up 8.371 pts or +0.24% at 3507.002 and the HANG SENG ended 49.36 pts higher or +0.2% at 24813.13

- European stocks are a little stronger, with the German Dax up 35.86 pts or +0.22% at 16046.52, FTSE 100 up 4.96 pts or +0.07% at 7300.4, CAC 40 up 11.79 pts or +0.17% at 7047.48 and Euro Stoxx 50 up 1.73 pts or +0.04% at 4352.53.

- U.S. futures are off overnight lows, with the Dow Jones mini down 21 pts or -0.06% at 36291, S&P 500 mini up 0.75 pts or +0.02% at 4694.75, NASDAQ mini up 24.25 pts or +0.15% at 16351.75.

COMMODITIES: Oil And Copper Lead Gains

- WTI Crude up $0.67 or +0.82% at $81.98

- Natural Gas down $0.06 or -1.03% at $5.393

- Gold spot up $1.52 or +0.08% at $1820.36

- Copper up $4.55 or +1.03% at $438.45

- Silver down $0.01 or -0.06% at $24.3032

- Platinum up $0.67 or +0.06% at $1052.35

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.