-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI US OPEN: Bunds Higher On Mixed Inflation Data

EXECUTIVE SUMMARY:

- BOJ BOOSTS BOND BUYING IN APR-JUN QUARTER

- CHINA TO BEND NOT BUCKLE IN U.S. LISTING STANDOFF: ADVISORS (MNI)

- FRENCH INFLATION ABOVE EXPECTATIONS, FRESH EURO-ERA HIGH; ITALY BELOW EXPECTED

- GERMAN UNEMPLOYMENT BACK AT PRE-PANDEMIC LEVELS; EUROZONE RECORD LOW

- ECB'S LANE: POLICY MUST ADJUST IF INFLATION TOPS 2% IN MID TERM

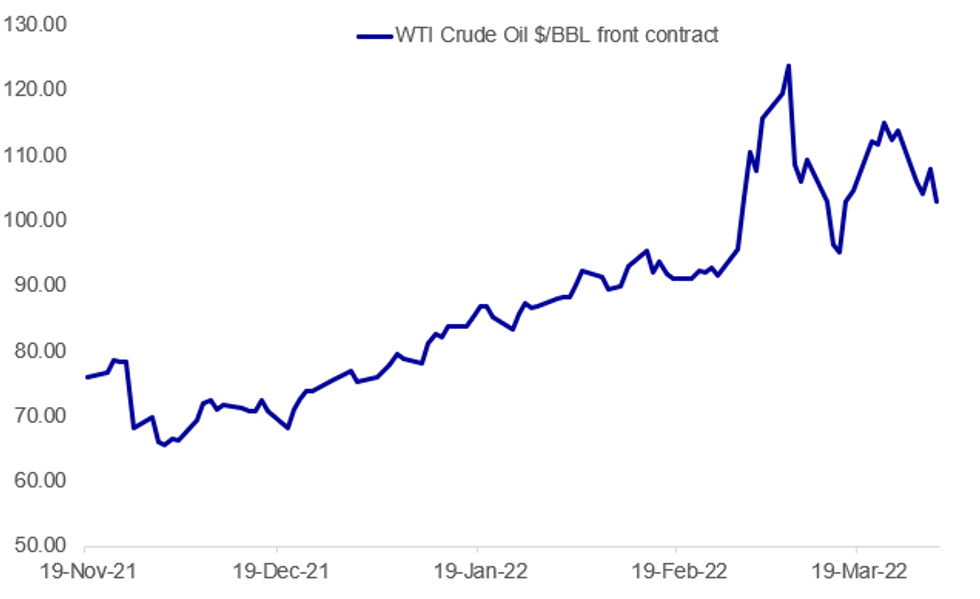

Fig. 1: WTI Tumbles Toward $100

Source: BBG, MNI

Source: BBG, MNI

NEWS:

BOJ (BBG): The Bank of Japan will raise the amount of bond purchases for maturities between one and 10 years in the April-June period from the current quarter, it said in a statement Thursday. It will also more frequently buy maturities from 10-25 years and those due in over 25 years, thereby increasing the total amount of purchases. It is the first change in the plan in three quarters after it cut some purchase amounts for the July-September period as it shifted to a quarterly plan. The move comes as the bank aggressively bought bonds from Monday as yields surged amid a global bond selloff, raising the benchmark 10-year yield to the 0.25% ceiling of a range allowed for the maturity.

CHINA-US (MNI): Signs China wants a deal with U.S. authorities to allow firms including Weibo to keep listings on U.S. stock markets do not mean Beijing will allow full access to information contained in the companies' audit papers which it regards as sensitive to its national security, policy advisors and a market analyst told MNI.

ECB (BBG): The European Central Bank should be ready to adjust monetary policy in either direction as spiking energy costs and the conflict in Ukraine send inflation soaring but also weigh on growth, according to Chief Economist Philip Lane.“We should ensure that our policy settings are adjusted if deanchored inflation expectations, an intensification in catchup wage dynamics or a persistent deterioration in supply capacity threaten to keep inflation above target in the medium term,” Lane told the Paris School of Economics in a speech Thursday.

ECB: Lane reiterated on Thursday its readiness to look through credit agency ratings if necessary and to use bond-buying programmes to shore up Greek sovereign debt in order to prevent renewed market fragmentation. Reinvestments from the Pandemic Emergency Purchase Programme could be used to buy more GGBs at a faster pace than redemptions in order to avoid an interruption of purchases and impair the transmission of monetary policy to the Greek economy, he said.

NORGES BANK: The Norges Bank will purchase the equivalent of NOK2 billion per day of foreign exchange on behalf of the government in April, the central bank announced Thursday, sending EUR/NOK surging as high as 9.7105. The Norwegian krone had appreciated in recent weeks following the war in Ukraine and the rise in oil prices. Thursday's announcement is part of Norway's fiscal strategy rather than direct FX intervention.

GERMANY-CHINA: German manufacturing firms would like to reduce dependence on supply chain links to China, an Ifo institute survey published Thursday finds. “In German manufacturing, 46 percent of all companies say they source significant inputs from China. Of these companies, almost one in two is planning to reduce these imports from China in the future,” Lisandra Flach, Director of the Ifo Center for International Economics, said. China, Flach noted, plays an important "but by no means dominant" role as a supplier and sales market for Germany. Flach called on Berlin and Brussels to push harder to finalise trade deals currently being negotiated to help German -- and wider EU -- firms diversify their sources of supply more, reduce costs and risks in logistics, and be prepared for political uncertainty. China and EU officials meet Friday to discuss matters, although trade may be further down the list than normally.

DATA:

MNI: FRANCE FLASH MAR HICP +1.6% M/M, +5.1% Y/Y; FEB +4.2% Y/Y

HICP at Fresh Euro-Era High

FRANCE FLASH MAR HICP +1.6% M/M, +5.1% Y/Y; FEB +4.2% Y/Y

FRANCE FLASH MAR CPI +1.4% M/M, +4.5% Y/Y; FEB +3.6% Y/Y

FRANCE FEB PPI +1.1% M/M, +22.4% Y/Y; JAN +22.2% M/M

- The March flash estimate saw French inflation accelerate faster than forecasts, at +1.6% m/m (forecast +1.4%)from +0.9% m/m, and jumping 0.9pp to +5.2% y/y (forecast +4.9%) in the harmonised readings.

- MNI noted upside surprised to be expected on the March print, as this inflation includes the energy price surge of the Ukraine war and associated Russian sanctions.

- These stark accelerations increase pressure on the ECB to move out of negative interest rate territory, despite growth prospects appearing subdued.

- French factory-gate inflation ticked-up to a new record high of +22.4% y/y (Jan +22.2%), and rose +1.1% m/m in February. Substantial PPI growth is to be expected in coming months due to heightened oil prices and supply-chain disruptions intensifying on the back of the Ukraine invasion.

MNI: FRANCE FEB PPI +1.1% M/M, +22.4% Y/Y; JAN +22.2% M/M

MNI: FRANCE FEB CONS. SPENDING +0.8% M/M, -2.3% Y/Y; JAN -2.0%r M/M

MNI: GERMANY MAR UE RATE (SA) 5.0%; FEB 5.0%

German Unemployment at Pre-Pandemic Levels

GERMANY MAR UNEMPLOYMENT RATE (SA) 5.0%; FEB 5.0%

GERMANY MAR UNEMPLOYMENT CHANGE (SA) -18K; FEB -32Kr

GERMANY MAR UNEMPLOYMENT TOTAL (SA) 2.298MN; FEB 2.316MNr

GERMANY MAR JOB VACANCIES (SA) +4K; FEB +11Kr

- Germany's March labour report came in largely as expected, with only the unemployment change seeing a slightly softer reduction of -18K (consensus forecast -20K), down from -32K seen in February.

- This is the softest unemployment reduction since April 2021, and below pre-pandemic levels as the German labour market becomes more saturated with pandemic recovery all but complete.

- The unemployment rate remained unchanged from February at 5.0%, which also represents the pre-pandemic level seen in the second half of 2019.

- Continued easing of Covid-related restrictions, in particular in the service industry, has boosted this month's labour data.

- The German Labour Office (Bundesargentur fuer Arbeit) noted that the initial impacts of the Ukraine war were not seen having labour market spillover effects.

Source: Eurostat, Statistisches Bundesamt

MNI: GERMANY FEB RETAIL SALES +0.3% M/M, +7.0% Y/Y; JAN +10.4%r

MNI: EZ FEB UNEMPLOYMENT RATE 6.8%; JAN 6.9%r

Eurozone Unemployment at Record Low

EUROZONE FEB UNEMPLOYMENT RATE 6.8%; JAN 6.9%r

JAN UNEMPLOYMENT REVISED UP 0.1PP

- Seasonally-adjusted unemployment inched down to 6.8% in February, from 6.9% in January, bringing it below pre-pandemic levels and to a record low for the bloc.

- The decline in unemployment was in line with market expectations.

- EU unemployment also stepped down 0.1pp to 6.2% in February.

- Youth unemployment continued to improve, reducing by 0.3pp to 14.0% in both the EU and eurozone.

- The lowest unemployment rates were seen in Czechia at 3.2%, followed by Poland (3.7%), and Germany (3.9%).

FIXED INCOME: Germany outperforms UST/gilts as inflation fails to match yday's surprise

- The German curve is outperforming the UST and gilt curves this morning after first French inflation failed to see the same magnitude of upside surprise as yesterday's German and Spanish inflation data and then Italian inflation data saw a small downside surprise. The 2s10s German curve has largely moved in a parallel fashion.

- Treasuries have drifted higher through the session with gilts opening higher after the French inflation data (and disappointing UK consumption / investment data in Q4) and remain above yesterday's close but have drifted a little lower through the session.

- US data will take the mantle this afternoon with personal income / spending data, PCE, weekly claims data and the Chicago PMI all due for release.

- TY1 futures are up 0-10+ today at 122-30+ with 10y UST yields down -1.4bp at 2.338% and 2y yields down -1.6bp at 2.293%.

- Bund futures are up 0.71 today at 157.87 with 10y Bund yields down -3.8bp at 0.605% and Schatz yields down -3.3bp at -0.36%.

- Gilt futures are up 0.26 today at 121.07 with 10y yields down -2.6bp at 1.638% and 2y yields down -2.6bp at 1.344%.

FOREX: Minor Bounce in Greenback

- The greenback is staging a minor bounce Thursday, rising against all others in G10 but doing little - so far - to work against the downtick posted since the beginning of the week. Strength in the USD comes alongside furtive gains for equities. Futures markets point to a positive open on Wall Street later today, with Biden's plans to relieve the spike in gas prices helping buoy sentiment.

- EUR, JPY and GBP trade more mixed, with GBP/USD holding either side of the 1.3100 handle after better-than-expected final GDP data early Thursday.

- Oil prices remain a key driver for commodity-tied currencies, with NOK and CAD among the weakest in G10. The downtick in WTI prices follows reports late yesterday suggesting the White House could take much more aggressive action to counter the strength in oil prices, with the impact compounded by confirmation that the Norges Bank are to sell as much as NOK 2bln per day in April as part of the government's FX management plans. EUR/NOK has traded a high of 9.7105 so far.

- Weekly US jobless claims data crosses later today, alongside the latest PCE and personal income/spending release. GDP numbers from Canada cross ahead of the MNI Chicago PMI for March. The speaker slate is quieter relative to recent sessions, with just ECB's de Guindos and Fed's Williams on the docket.

EQUITIES: Flat Session, With Non-Cyclicals Leading

- Asian markets closed weaker: Japan's NIKKEI closed down 205.82 pts or -0.73% at 27821.43 and the TOPIX ended 21.2 pts lower or -1.08% at 1946.4. China's SHANGHAI closed down 14.393 pts or -0.44% at 3252.203 and the HANG SENG ended 235.18 pts lower or -1.06% at 21996.85.

- European equities are a little weaker, with the German Dax down 21.1 pts or -0.14% at 14585.06, FTSE 100 up 2.64 pts or +0.03% at 7576.94, CAC 40 down 6.74 pts or -0.1% at 6728.52 and Euro Stoxx 50 down 12.61 pts or -0.32% at 3946.78.

- U.S. futures are mixed: Dow Jones mini down 4 pts or -0.01% at 35113, S&P 500 mini up 4.75 pts or +0.1% at 4600.75, NASDAQ mini up 62 pts or +0.41% at 15133.5.

COMMODITIES: WTI Falls Sharply On Potential US Release

- WTI Crude down $5.63 or -5.22% at $102.03

- Natural Gas down $0.09 or -1.52% at $5.517

- Gold spot down $9.11 or -0.47% at $1925.95

- Copper down $2.2 or -0.46% at $472.55

- Silver down $0.15 or -0.62% at $24.7538

- Platinum down $8.69 or -0.87% at $987.65

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/03/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 31/03/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 31/03/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 31/03/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/03/2022 | 1300/0900 |  | US | New York Fed's John Williams | |

| 31/03/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 31/03/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 31/03/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 31/03/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 31/03/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 31/03/2022 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 31/03/2022 | 1600/1200 | *** |  | US | USDA PROSPECTIVE PLANTINGS - NASS |

| 01/04/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.