-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: COVID Weighing On Confidence (Again)

EXECUTIVE SUMMARY:

- US DOLLAR STRONGER, STOCKS WEAKER AS WEEK BEGINS

- GERMAN BUSINESS MORALE FALLS ON ANGST ABOUT RISING VIRUS NUMBERS

- U.K.'S HANCOCK: EXPECT COVID-19 VACCINE ROLLOUT IN 1H 2021

- OXFORD COVID VACCINE PROMPTS IMMUNE RESPONSE AMONG OLD AND YOUNG ADULTS: ASTRAZENECA

- EUROPEAN TECH STOCKS SEE WORST DAY SINCE MARCH AFTER SAP SHARES CUTS OUTLOOK

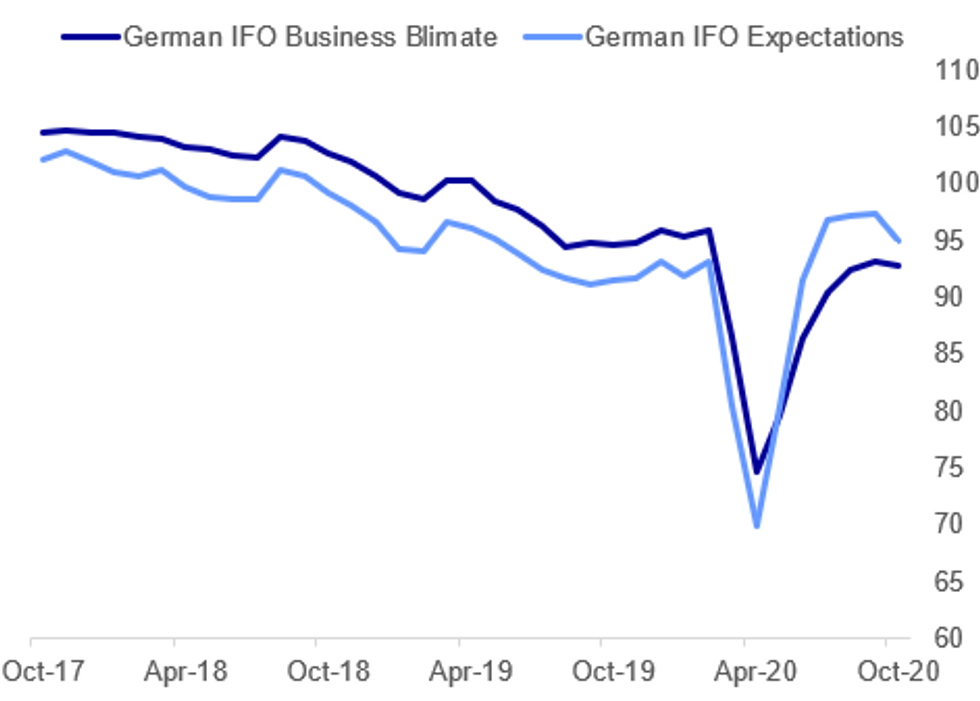

Fig.1 German Business Confidence Weakens Slightly In October - IFO

IFO/BBG/MNI

IFO/BBG/MNI

NEWS:

GLOBAL MARKET/OPINION: USD on the front foot to start off the week:

* ELECTION POLLING: Just over a week to the election, support among Trump's base of rural voters is waning, with his lead over Biden slipping from 28 to 15 points among rural likely voters.

* CHINA: The four-day China Central Committee Plenum is due this week, with the leadership to decide on a new 5- and 15-year economic plan.

* BREXIT: Observer reported that PM Johnson could be waiting until the US election results to decide on whether to conclude a trade deal with the EU, with 10 Downing Street concerned about the consequences of a less-UK friendly Biden White House.* EARNINGS: Tech in focus with Microsoft, Amazon, Alphabet, Apple and Facebookall due. 46% of the S&P500 by market cap report between now and Friday.

* CORONAVIRUS: Restrictions rolling in across Europe, with Spanish national curfews, restrictions across Italian leisure and even a voluntary lockdown in the city of Uppsala, Sweden

GERMAN DATA (RTRS): German business morale fell in October, weighed down by companies' concerns about rising coronavirus infection rates that are making them more sceptical about the coming months, a survey showed on Monday. The Ifo institute said its business climate index fell to 92.7 from a downwardly revised 93.2 in September. The fall followed five months of rises. "Companies are considerably more skeptical regarding developments over the coming months," Ifo President Clemens Fuest said in a statement. "In view of rising infection numbers, German business is becoming increasingly worried."

COVID/U.K. (BBG): U.K. Health Secretary Matt Hancock says it's his "central expectation" there will be a Covid-19 vaccine to roll out in the first half of next year

- Asked whether some vaccines will be available this year, Hancock tells BBC Radio 4: "I don't rule that out, but that is not my central expectation"

- Hancock: "We're not there yet. The vaccine program is progressing well"

- "I would expect the bulk of the roll out in the first half of next year": Hancock

COVID/ASTRAZENECA (RTRS): The COVID-19 vaccine being developed by the University of Oxford produces a similar immune response in both older and younger adults, and adverse responses were lower among the elderly, British drug maker AstraZeneca Plc said on Monday. A vaccine that works is seen as a game-changer in the battle against the novel coronavirus, which has killed more than 1.15 million people, hammered the global economy and shuttered normal life across the world. "It is encouraging to see immunogenicity responses were similar between older and younger adults and that reactogenicity was lower in older adults, where the COVID-19 disease severity is higher," an AstraZeneca spokesman told Reuters. "The results further build the body of evidence for the safety and immunogenicity of AZD1222," the spokesman said, referring to the technical name of the vaccine.

EUROPEAN EQUITIES (BBG): SAP SE shares dropped as much as 21%, the biggest intra-day fall since 1999, after the Walldorf, Germany-based company cut its revenue forecast for the full year and said it expects a fresh wave of lockdowns to hurt demand through the first half of 2021. Europe's Stoxx Tech Index falls as much as 6.3%, its biggest one-day loss since March, as SAP's outlook cut weighs on software peers and IT services stocks. Note SAP accounts for more than 20% of the index, according to Bloomberg data. European software peers Micro Focus -0.3%, Sage -1.3%, Computacenter -1.4%, Amadeus -1.8%; IT services firms Capgemini -3.4%, Atos -2.2%, SoftwareONE Holding -3%, Bechtle -1%.

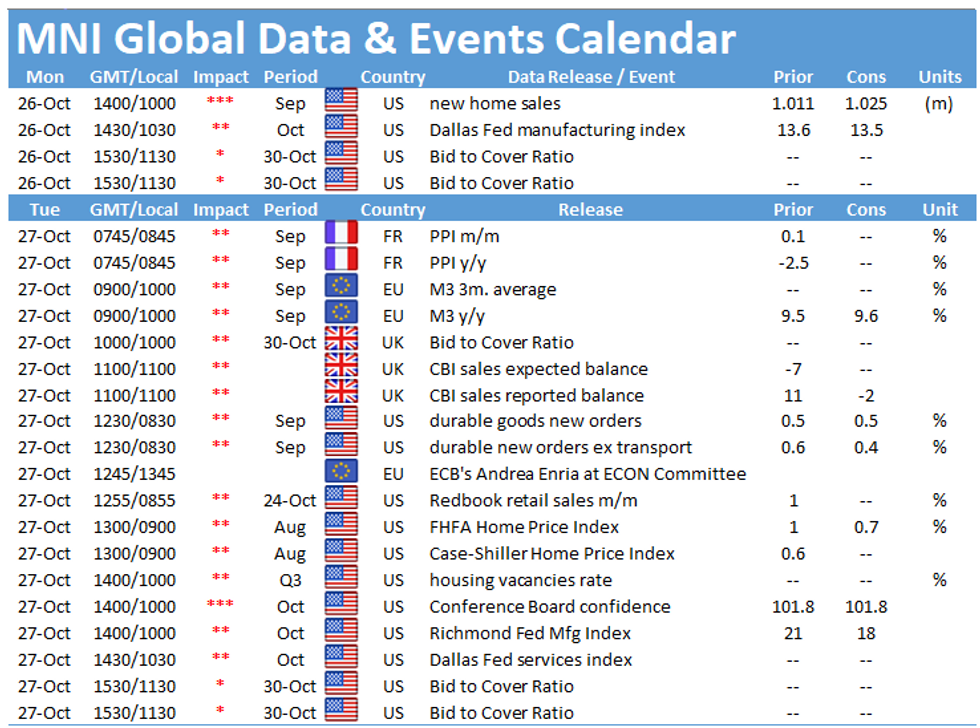

DATA:

FIXED INCOME: Core FI reacts to risk off, but EGB peripheral spreads tighten

Covid concerns have been the driving factor for core fixed income markets this morning with Treasuries, Bunds and gilts all higher on the day. There has been some pullback off the highs, particularly for Bunds despite the worse than expected German IFO print.

- In contrast to the risk off moves seen in core FI, Eurozone peripheral spreads are all tighter on the day, generally by around 2bp but with the notable exception of Italy. BTPs saw a strong rally on the open after the decision by S&P to maintain the BBB rating of Italy and upgrade the outlook from negative to stable. 10-year BTP spreads are around 6.3bp tighter on the day at the time of writing.

- The calendar is pretty light today but we have a busy week ahead. Barnier has stayed in London for further Brexit talks - he had been due to leave yesterday but will now stay until Wednesday in what is seen as a positive development. The ECB meets this week and will announce its latest decision and hold its press conference on Thursday. Furthermore, a number of European countries will publish their first estimate of Q3 GDP on Friday. Of course, the US election is next week, too, so polling data will be closely watched too.

- TY1 futures are up 0-5 today at 138-16+ with 10y UST yields down -3.2bp at 0.812% and 2y yields down -0.6bp at 0.150%.

- Bund futures are up 0.20 today at 175.46 with 10y Bund yields down -0.5bp at -0.582% and Schatz yields down -0.3bp at -0.766%.

- Gilt futures are up 0.22 today at 135.59 with 10y yields down -1.5bp at 0.264% and 2y yields down -0.4bp at -0.43%.

FOREX: EUR Sluggish on Slipping European Equities

The EUR trades poorly despite initially holding up well in Asia-Pac hours. The single currency came under some selling pressure alongside the poor cash equity open in Europe, with German stocks coming under particular pressure as software giant SAP fell as much as 20% on a downward revision to their outlook.

EUR/USD is still well away from Friday's lows at 1.1787 which provide initial support, but persistent USD pressure could see the pair test the mark ahead of Monday's close.

Petrocurrencies are soft to start the week, with NOK and CAD falling against all others in G10 on a further pullback in crude. WTI and Brent futures trade lower by as much as 2.5%, with increased Libyan output responsible.

TRY hit another alltime low on worsening diplomatic relations with France, while USD/CNH extended its bounce after sanctioning US defense firms on Taiwanese weapons deals.

US new home sales and Dallas Fed manufacturing activity data are the calendar highlights. ECB's de Cos is due to speak, but the Fed speaker schedule is empty as the bank enters the media blackout period ahead of next week's policy decision.

EQUITIES: European Stocks Hit By SAP Results

A lower start to the week for stocks as COVID lockdown concerns weigh and the US presidential election looms. The German DAX is underperforming as SAP dropped as much as 20% on a downgraded 2020 outlook (an announcement seen weighing on tech more broadly).

- Asian stocks closed lower, with Japan's NIKKEI down 22.25 pts or -0.09% at 23494.34 and the TOPIX down 6.34 pts or -0.39% at 1618.98. China's SHANGHAI closed down 26.878 pts or -0.82% at 3251.119.

- European equities are lower, with the German Dax down 247.87 pts or -1.96% at 12397.62, FTSE 100 down 2.28 pts or -0.04% at 5858.68, CAC 40 down 25.41 pts or -0.52% at 4881.86 and Euro Stoxx 50 down 42.39 pts or -1.33% at 3156.02.

- U.S. futures are weaker, with the Dow Jones mini down 237 pts or -0.84% at 27952, S&P 500 mini down 29.5 pts or -0.85% at 3422.25, NASDAQ mini down 93.75 pts or -0.8% at 11569.75.

COMMODITIES: Oil Slips Further

Oil is off sharply, with Libyan supply restarting and COVID lockdown fears seen weighing; metals prices are also down, with precious suffering from the stronger USD.

- WTI Crude down $0.96 or -2.41% at $38.84

- Natural Gas up $0.02 or +0.64% at $2.988

- Gold spot down $1.56 or -0.08% at $1899.46

- Copper down $1.85 or -0.59% at $311

- Silver down $0.39 or -1.6% at $24.1828

- Platinum down $12.53 or -1.38% at $892.35

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.