-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: CPI Expected To Re-Accelerate

EXECUTIVE SUMMARY:

- US CPI SET TO SHOW FURTHER RISE IN OCTOBER

- MERKEL ADVISERS URGE ECB EXIT STRATEGY AS PRICE PRESSURES RISE

- EUROPEAN GAS PRICES SLUMP AS RUSSIA FINALLY INCREASES SUPPLIES

- BOJ SEES RISK OF VOLATILITY IF FED HIKES FAST (MNI INSIGHT)

- EU'S SEFCOVIC TO BRIEF AMBASSADORS AS HARDLINE OPTION AGAINST UK GAINS GROUND

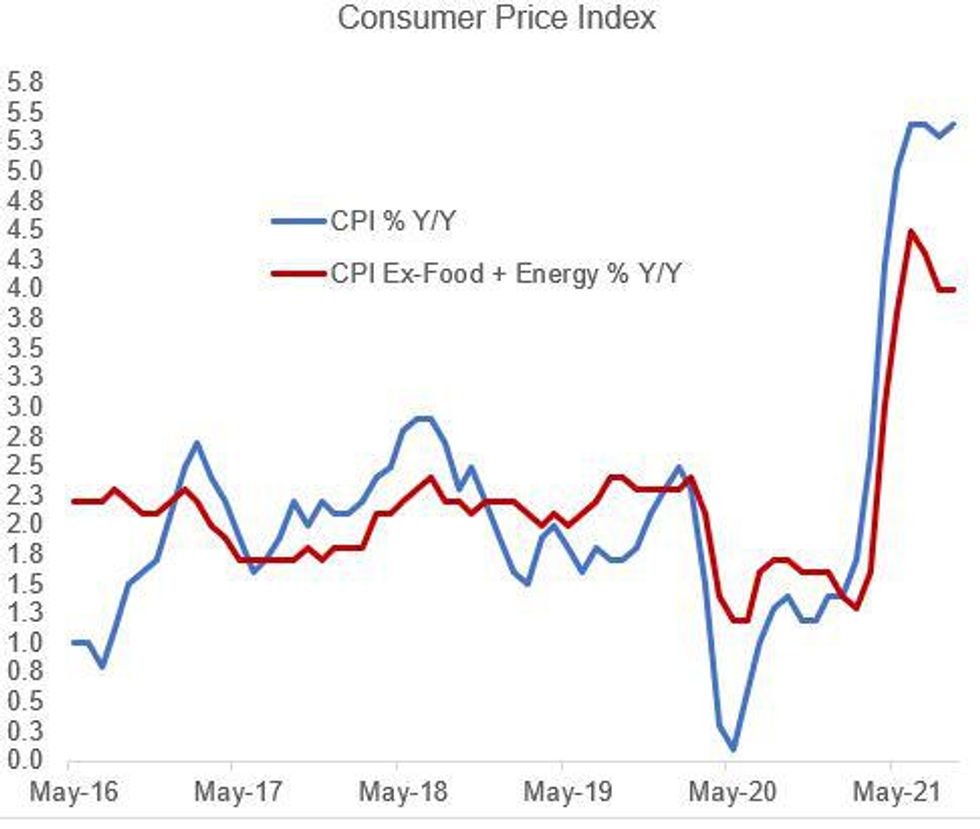

Fig. 1: Re-Acceleration In US CPI Expected In October

Source: BLS, MNI

Source: BLS, MNI

NEWS:

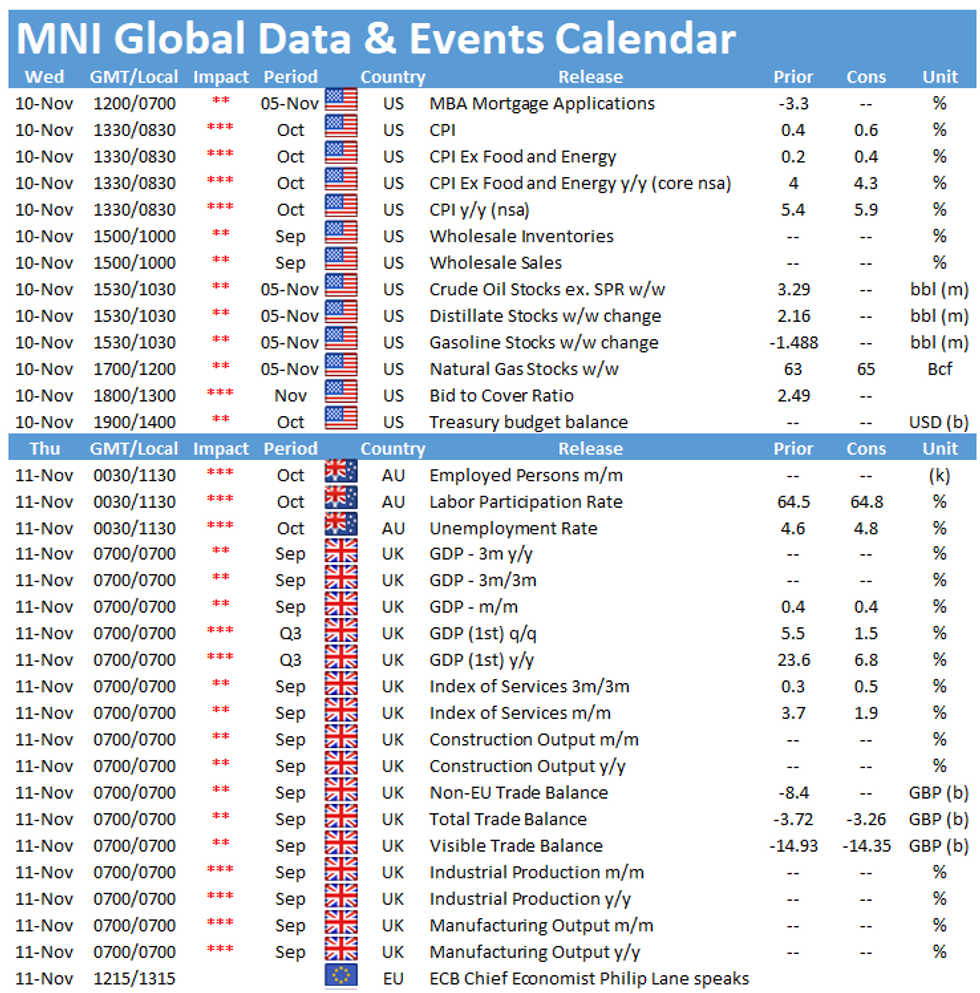

US CPI (MNI): Forecasters see further upward pressure on US consumer inflation in October and highlight the potential market threat of accelerated tapering by the Fed and even an eventual move to pull forward rate hikes. With energy prices continuing to accelerate, headline CPI inflation is geared towards an increase on all fronts, with the monthly CPI expected to rise from 0.4% in September to 0.6% for October. Similarly, core CPI is set to accelerate from 0.2% to 0.4% previously, particularly influenced by the expansion of COVID-19-sensitive key demand products including automobiles and apparel, according to some analysts. As such, market forecasts point to another solid rise in the annual CPI, reaching 5.9% in October up from 5.4%. It the headline rate comes in at that level, it will be the highest level since inflation peaked just above 6% in the early 1990's. Following suit, the core annual CPI is set to increase to 4.3% compared to 4.0% y/y in September.

ECB / GERMANY (BBG): Germany's council of economic advisers urged the European Central Bank to come up with a strategy for normalizing its ultra-expansive monetary policy in light of building inflation risks. The group sees inflation in the euro-area's largest economy averaging 3.1% in 2021 and 2.6% in 2022, and warned that persistent supply-chain logjams and rising fuel prices could turn temporary factors into lasting higher rates of inflation. "There are risks to the upside for the inflation outlook for the coming years," the advisers said in a report published on Wednesday. The ECB "should communicate a normalization strategy soon," with quantitative metrics for the unwinding of its ultra-loose policy.

EUROPE ENERGY / RUSSIA (BBG): European natural gas prices slumped to the lowest in more than a week as Russia gradually delivers the boost in supplies that President Vladimir Putin promised. Benchmark Dutch futures fell more than 10% after flows to Europe via Ukraine and Poland edged higher Wednesday. Gazprom PJSC booked some pipeline capacity on the Ukrainian-Slovakian border for the day, bringing supplies through the route in line with Russia's long-term transit agreement with its neighbor.

BOJ (MNI INSIGHT): Bank of Japan officials are concerned that financial markets could be destabilised if the Federal Reserve is forced to carry out a series of rapid rate hikes to tame inflation, MNI understands. For full article contact sales@marketnews.com

EU-UK: This afternoon, European Commission Vice President Maros Sefcovic is set to brief EU ambassadors on the situation regarding the Northern Ireland protocol. The briefing comes around a month after the EU published its response to the UK's summer command paper regarding the protocol. Sefcovic is set to hold talks with the UK gov'ts point-man on EU-UK relations, Cabinet Office minister Lord Frost, on Friday.

UK POLITICS (BBG): The U.K. opposition called for a parliamentary investigation into former Conservative cabinet minister Geoffrey Cox, as the scandal over sleaze and lobbying engulfing Boris Johnson's ruling party gains momentum. Labour accused Cox, who had been a leading government figure in the political wrangling over Brexit, of violating the code of conduct for members of Parliament after the Times newspaper posted footage of him allegedly using his Parliament office to do outside legal work. Cox didn't immediately respond to Bloomberg requests for comment made by phone and by email.

GERMAN POLITICS: Tom Nuttall at the Economist tweets: "Acc to The Pioneer the Belarus migrant drama has spilled into Germany's coalition talks: the Greens reject border pushbacks; the FDP wants to turn Frontex into a "robust police force". This eve the 22 working groups pass their work to party leaders to write a coalition deal."

- Coalition talks are ongoing between the centre-left Social Democrats (SPD), environmentalist Greens, and pro-business liberal Free Democrats (FDP). As part of the talks the parties established 22 working groups to focus on specific policy areas and find landing zones of agreement.

- The current situation on the Polish-Belarusian border is exposing some fairly clear divisions between the two smaller parties in the tripartite 'traffic light' coalition. As such, the effort to write a full coalition deal could prove difficult in the short term if the Greens and FDP cannot find some common ground on what should be done to remedy the situation to the east.

COP26 (BBG): The U.K. presidency of COP26 has released a first draft of the summit's conclusions, urging nations to strengthen their climate targets by the end of 2022 and calling on the UN to report each year on the impact of those plans on global warming. The draft goes some way to step up action this decade, yet some of the world's worst polluters haven't submitted an official blueprint since 2016, and it remains to be seen if this will spur efforts. NGOs criticized the lack of detail on help for vulnerable nations to adapt to climate change. The text will now go to consultations with national capitals as the meeting in Glasgow enters its decisive phase.

GREECE/IMF: From an interview in Naftemporiki with Greek FinMin Staikouras (via Google Translate): "Our intention is to proceed with the early repayment of the balance of loans to the IMF, amounting to about 1.8 billion euros, as well as a significant amount, amounting to about 5.3 billion euros, maturing in 2022 and 2023, of existing bilateral loans to Eurozone countries, concluded in 2010, under the first fiscal adjustment program."* "Our efforts for these early repayments have started, at a technical level, about three months ago."

BOT (MNI STATE OF PLAY): Thailand's central bank is relying on its new foreign exchange "eco-system" to address what it says is a volatile baht impacted by monetary policy in developed economies and uncertainty in the Thai recovery outlook. For full article contact sales@marketnews.com

DATA:

CHINA DATA (From Overnight): PPI Hits 26-Year High, CPI Above Forecast

China's producer price index measuring factory gate prices jumped13.5% y/y in October amid tighter supply of domestic energy and raw materials, accelerating from September's 10.7% gain, hitting the highest level since June 1995 and outshining a forecast of 12.4%, according to the National Bureau of Statistics on Wednesday.

The PPI surge was mainly driven by price increases in coal mining and washing which rose by 103.7% y/y, widening 28.8 percentage points. Price hikes in eight industries related to coal, oil, natural gas, ferrous metal, chemical raw material, and non-ferrous metal dragged up the PPI by about 11.38 pp, contributing over 80% of the surge, the NBS said. PPI rose 2.5% m/m, also quickening from 1.2% reported last month, see: MNI REALITY CHECK: China Oct CPI Seen Up On Food, Fuel Costs.

China's October consumer price index quickened to 1.5% y/y from 0.7% in September, the highest since September 2020, above the forecast 1.4%. The acceleration was mainly due to rising food and energy prices led by higher vegetable prices amid rainy weather and rising costs, the NBS said. Core CPI, excluding food and energy prices, was up 1.3% y/y, up 0.1 pp from the previous month.

FIXED INCOME: Chinese inflation --> US inflation

- Inflation is the buzzword of the day (again) with core fixed income under pressure on the back of a higher than expected Chinese inflation print overnight. Inflation will also be in focus later today with the release of US CPI the highlight of the session ahead for markets.

- STIR is under pressure this morning, particularly the Eurodollar and short sterling strips. Euribor moves have been a bit more muted.

- Despite the downward pressure in STIR, Schatz yields have continued their downward descent so move to their lowest levels since August.

- Peripheral spreads have all widened too, on the back of the more hawkish data.

- Elsewhere curves have flattened in both the US and UK.

- TY1 futures are down -0-11+ today at 131-15+ with 10y UST yields up 2.2bp at 1.477% and 2y yields up 2.9bp at 0.452%.

- Bund futures are down -0.02 today at 171.23 with 10y Bund yields up 0.9bp at -0.291% and Schatz yields down -0.6bp at -0.793%.

- Gilt futures are down -0.27 today at 126.92 with 10y yields up 3.2bp at 0.855% and 2y yields up 5.5bp at 0.498%.

FOREX: Greenback Makes Modest Advance Pre-CPI

- Markets are mixed early Wednesday as traders await the US inflation data later today as well as the day-advanced initial jobless claims numbers, shifted due to Thursday's market holiday.

- USD/JPY has bounced off the Tuesday lows of 112.73 snapping the four session losing streak as the pair recovers back above the 113.00 handle.

- CAD is stronger for a second session, pressing USD/CAD to its lowest levels of the week and further off the 1.2476 200-dma, which remains a key resistance. The solid rally in oil prices late Tuesday remains the key driver, with Brent futures just below the $85.50/bbl weekly high printed overnight.

- JPY, SEK and NZD are among the weakest in G10, while CAD, USD and EUR are slightly firmer.

- US inflation data takes focus going forward, with M/M CPI expected to ratchet higher to +0.6% from +0.4% previously, taking the Y/Y rate to 5.9% - the highest rate since 1990.

EQUITIES: Energy Stocks Leading In Europe

- Asian markets closed mostly weaker, with Japan's NIKKEI down 178.68 pts or -0.61% at 29106.78 and the TOPIX down 10.81 pts or -0.54% at 2007.96. China's SHANGHAI closed down 14.54 pts or -0.41% at 3492.462 and the HANG SENG ended 183.01 pts higher or +0.74% at 24996.14.

- European equities are trading mixed, with the German Dax up 0.32 pts or +0% at 16040.97, FTSE 100 up 34 pts or +0.47% at 7308.12, CAC 40 down 14.06 pts or -0.2% at 7029.21 and Euro Stoxx 50 up 1.58 pts or +0.04% at 4346.21.

- U.S. futures are a little weaker, with the Dow Jones mini down 48 pts or -0.13% at 36161, S&P 500 mini down 6 pts or -0.13% at 4672.25, NASDAQ mini down 22 pts or -0.14% at 16191.

COMMODITIES: Oil Retraces Some Of Tuesday's Gains

- WTI Crude down $0.49 or -0.58% at $83.65

- Natural Gas down $0.11 or -2.25% at $4.867

- Gold spot down $6.7 or -0.37% at $1825.19

- Copper up $1.2 or +0.27% at $438.5

- Silver down $0.08 or -0.34% at $24.2233

- Platinum down $6.09 or -0.57% at $1056.78

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.