-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Dollar Under Pressure

EXECUTIVE SUMMARY:

- FED'S BULLARD UPBEAT, BUT PUSHES BACK ON TIGHTENING (MNI INTERVIEW)

- BIDEN PROPOSES BILLIONS FOR CYBERSECURITY AFTER WAVE OF ATTACKS

- GERMAN TOP COURT REJECTS BIDS TO ENFORCE E.C.B. P.S.P.P. RULING

- U.K. CONSIDERS FORCE MAJEURE OVER BREXIT DEAL N.I. PROTOCOL (RTE)

- HUARONG BONDHOLDERS FACE SIGNIFICANT LOSSES (NYT)

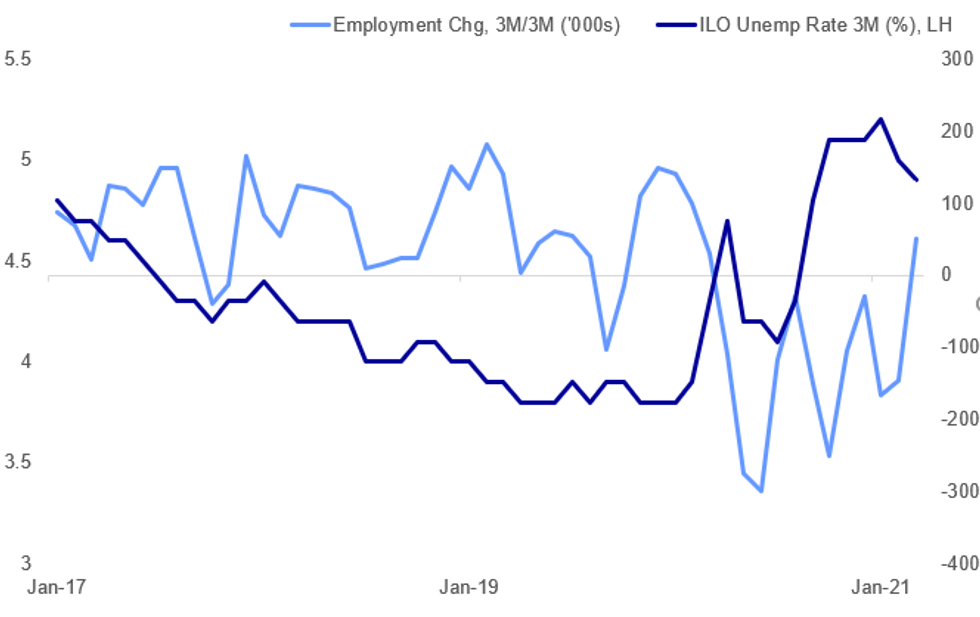

Fig. 1: U.K. Unemployment Rate Unexpectedly Declined In March

Source: ONS, MNI

Source: ONS, MNI

NEWS:

FED (MNI INTERVIEW): Despite expectations of GDP growth exceeding 6.5% y/y and CPI inflation registering at 2.5% in 2021, St. Louis Fed President James Bullard used an interview with MNI published late Monday to push back against talk from investors and former policymakers about a near-term tightening of monetary policy, saying he was looking for a "more definitive end to the pandemic" before discussing a policy shift. For full article contact sales@marketnews.com

U.S. (BBG): President Joe Biden's infrastructure proposal includes billions of dollars tied to improving cybersecurity, an area of intensified interest after the ransomware attack on the Colonial Pipeline Co. sent U.S. gasoline prices soaring last week.But the exact amount that will be spent on improving cyber defenses remains to be seen.The $2 trillion American Jobs Plan, as the infrastructure proposal is known, includes $20 billion for state, local and tribal governments to modernize their energy systems contingent upon meeting cybersecurity standards, as well as $2 billion for grid resilience in high-risk areas that will be contingent on meeting cybersecurity targets, the White House said in a fact sheet obtained by Bloomberg News ahead of its release Tuesday.

HUARONG (NYT): Foreign investors had good reason to trust Huarong, the sprawling Chinese financial conglomerate. Even as its executives showed a perilous appetite for risky borrowing and lending, the investors believed they could depend on Beijing to bail out the state-owned company if things ever got too dicey. That's what China had always done.Now some of those same foreign investors may need to think twice. Huarong is more than $40 billion in debt to foreign and domestic investors and shows signs of stumbling. The Chinese government, which has stayed quiet about a rescue, is in the early stages of planning a reorganization that will require foreign and Chinese bondholders alike to accept significant losses on their investments, according to two people familiar with the government's plans.

FRANCE/ECB (BBG): Bank of France Governor Francois Villeroy de Galhau says the French economy will recover more strongly than the central bank's latest forecasts. Speaking at online conference, Villeroy say the central bank will update its forecasts in June after saying in March that the French economy would expand 5.5% in 2021 and 4% in 2022: "I can say with good degree of confidence today that we should be at least at these levels".

NOMURA (BBG): Nomura Holdings says it will book a loss of $600m in 1Q as it closed all positions related to a "U.S. client."

JAPAN: Japan's economy has the potential for a forceful recovery as exports continue to be strong and capital investment remains solid, Economy Minister Yasutoshi Nishimura said on Tuesday. Nishimura, however, said that the government must carefully pay attention to the impact of the state of emergency until the end of May on economic activity and sentiment.

DATA:

MNI DATA BRIEF: UK Employment Growth At Post-Pandemic High

The UK unemployment rate fell unexpectedly in the first quarter, to 4.8%, as LFS employment rose by 84,000, the biggest gain since the three months to February of 2020, before the pandemic ravaged the economy, the Office for National Statistics said Tuesday. RTI employment, as measured by payroll data submitted to HMRC, increased by 97,000 in April, the largest rise since the onset of the pandemic.

More than three-quarters of those news roles were in administration and support or finance and insurance. The employment rate inched up to 75.2% from 75.1% in the three months to February, while the number of redundancies fell sharply to 5.5 per thousand from 7.3 per thousand in the three months to February. Vacancies rose by 48,4000 over the three months to January to 657,000, the highest since the first quarter of last year.

MNI DATA BRIEF: UK Regular Earnings At Multi Year Highs

UK regular earnings rose by an annual rate of 4.6% in the first quarter, the fastest pace since the three months to February 2008, from a downwardly-revised 4.4% gain in the previous period, the Office for National Statistics said Tuesday. Adjusting for inflation, real regular wages rose by a record high 3.6% in the first quarter.

Bonuses declined by 0.7% in the first quarter (dragged lower by a 3.9% decline in the month of February), pushing total earnings growth down to 4.0% from 4.5% in the three months to February. Given the loss of a large number of lower-paid jobs during the pandemic, national statisticians estimate the underlying rate of total nominal earnings growth at approximately 2.5%, and nominal regular earnings at roughly 3%.

Average hours worked fell to 29.4 in the first quarter, with much of the economy in lockdown from 30.2 in the closing months of 2020. The jobless rate fell to 4.6% in March, according to experimental statistics, the lowest since July 2020.

EZ Flash GDP At Prelim. Estimate; EZ Trade Surplus Down

EZ Q1 FLASH GDP -0.6% Q/Q SA, -1.8% Y/Y WDA

EZ Q1 EMPLOYMENT -0.3% Q/Q SA; -2.1% Y/Y NSA

EZ MAR SA TRADE BALANCE +EUR13.0 BN; FEB +EUR23.1 BN

- The flash estimate of GDP confirmed the preliminary results, showing a 0.6% decline of EZ GDP in Q1, while the annual rate fell at 1.8%.

- Among the member states for which data is available, Portugal (-3.3%), Latvia (-2.6%) and Germany (-1.7%) saw the largest quarterly declines, while Cyprus (+2.0%), Lithuania (+1.8%) and Belgium (+0.6%) recorded the biggest gains.

- While the quarterly EZ employment rate fell by 0.3% in Q1 following two consecutive quarters of growth, the yearly employment rate deteriorated to -2.1% in Q1, after improving to -1.9% in Q4 2020.

- Meanwhile, monthly trade data showed a contraction of the EZ trade surplus to EUR13.0bn in Mar, its lowest level since Mar 2020.

- While monthly exports dropped by 0.3%, imports rose by 5.6%, leading to a decline in the trade surplus.

FIXED INCOME: Surprisingly stable against USD and equity moves

Core fixed income is showing a mixed performance this morning with Bunds and Treasuries showing little in the way of direction and trading largely inside yesterday's ranges while gilts have moved through yesterday's lows (but remain above Friday's lows).

- The lack of significant movement in core fixed income stands in curious contrast to the moves higher seen in equity markets and the USD selloff.

- Issuance has been heavy in the European session with a E14.137bln dual-tranche EU SURE transaction being the highlight (likely the last sizeable SURE transaction). 3/20-year gilts and Schatz make up the rest of the European government issuance for the morning.

- Looking ahead there is focus on the three MPC members (Bailey, Broadbent and Ramsden) appearing ahead of the Lord Economic Affairs Committee. The topic is QE and given the focus on how the unwind of QE will be managed in the future is under investigation by BOE staff at present, the market will watch for any new nuggets of information.

- In terms of data so far this morning, UK labour market data was encouraging (but still showed we were a long way from pre-pandemic levels). Eurozone GDP was in line with expectations. Housing starts and building permits are the highlights of the US data calendar.

- TY1 futures are down -0-2 today at 132-09 with 10y UST yields down -0.3bp at 1.648% and 2y yields down -0.1bp at 0.154%.

- Bund futures are up 0.03 today at 168.89 with 10y Bund yields unch at -0.116% and Schatz yields up 0.1bp at -0.659%.

- Gilt futures are down -0.10 today at 127.32 with 10y yields up 1.5bp at 0.879% and 2y yields up 0.8bp at 0.087%.

FOREX: USD Under Pressure

USD under pressure throughout our European morning session.

- A continuation from the overnight Asian risk on session.

- Commodity bid helps the Kiwi and Aussie at the top of the pile in G10.

- A little perplexed by the risk on bid, which looked to have been driven by a tech bounce, although surprising given supply chain issues.

- The Dollar is struggling across the board with the EURUSD testing initial resistance at 1.2218 at the time of typing.

- Similar story for the British Pound also supported as the UK enter the next step in re-openings.

- Cable is testing trendline resistance circa 1.4216 (printed a 1.4220 high so far)

- The Greenback tested new session low against EUR, GBP, CHF, AUD, SEK, NOK, PHP, INR,, TWD, MYR, and IDR.

- Looking ahead, very little on the data front, but still plenty of speakers are scheduled, including BoE Bailey, Broadbent and Ramsden.

- ECB Lagarde at a prize ceremony, and Fed Kaplan in a panel discussion.

EQUITIES: Tech Leads Early Gains

- Asian markets closed higher, with Japan's NIKKEI up 582.01 pts or +2.09% at 28406.84 and the TOPIX up 28.88 pts or +1.54% at 1907.74. China's SHANGHAI closed up 11.398 pts or +0.32% at 3529.014 and the HANG SENG ended 399.72 pts higher or +1.42% at 28593.81.

- European equities are higher, with the German Dax up 60.6 pts or +0.39% at 15533.38, FTSE 100 up 22.6 pts or +0.32% at 7032.85, CAC 40 up 14.62 pts or +0.23% at 6367.35 and Euro Stoxx 50 up 17.81 pts or +0.44% at 4039.71.

- U.S. futures are gaining, with the Dow Jones mini up 98 pts or +0.29% at 34354, S&P 500 mini up 15.25 pts or +0.37% at 4173, NASDAQ mini up 108.25 pts or +0.81% at 13412.

COMMODITIES: WTI, Silver At Multi-Month Highs

- WTI Crude up $0.44 or +0.66% at $66.86

- Natural Gas up $0.01 or +0.35% at $3.12

- Gold spot up $2.61 or +0.14% at $1870.21

- Copper up $4.7 or +1% at $475

- Silver up $0.35 or +1.23% at $28.5095

- Platinum down $10.42 or -0.84% at $1241.03

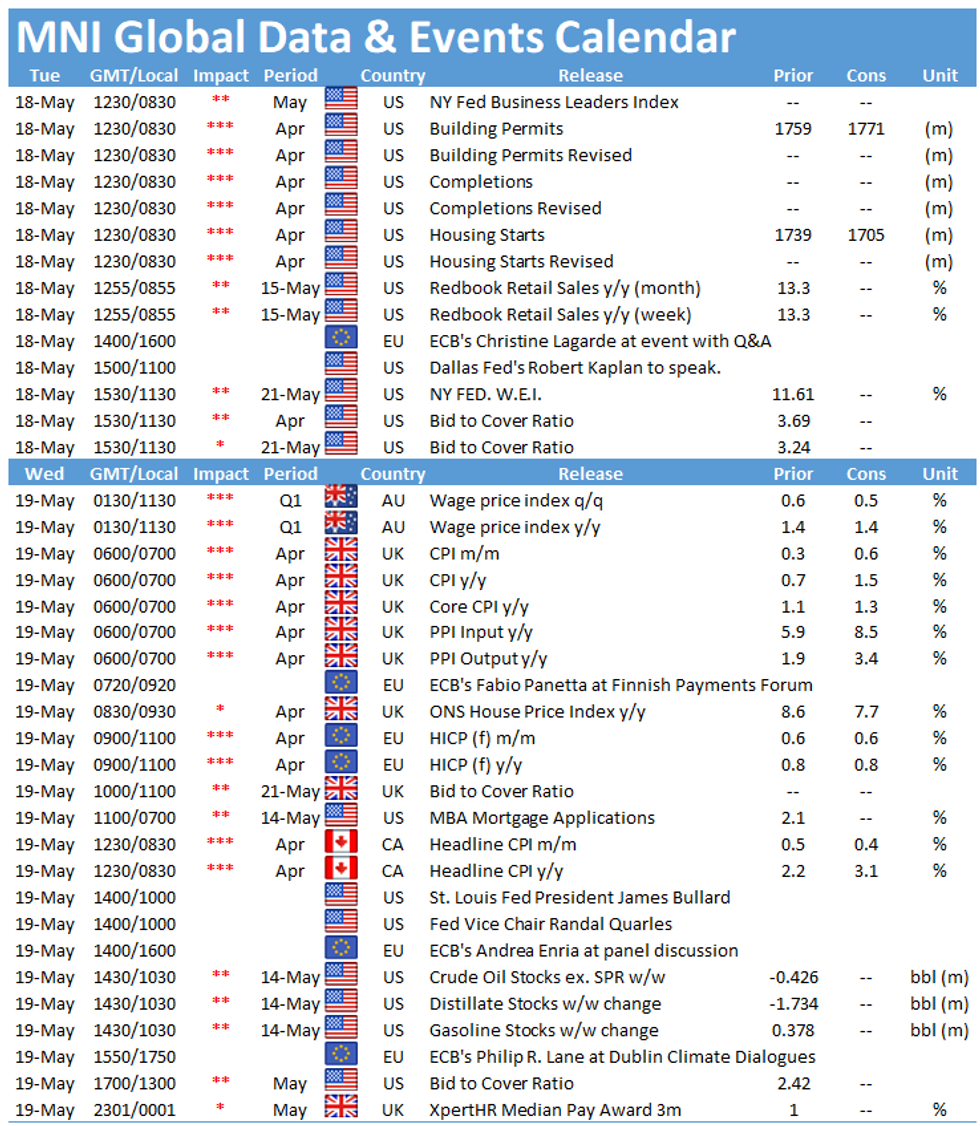

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.