-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US Open: Equities & FI Under Pressure

MNI US Open: Equities & FI Under Pressure

EXECUTIVE SUMMARY

- European sovereign bonds and equities have both sold off this morning.

- Evergrande bondholders are still waiting to see if a key interest payment is made

- The UK government is facing increasing pressure over the mounting fuel supply issues

NEWS

EVERGRANDE (FT): Investors in an Evergrande offshore bond say they have yet to receive a closely watched interest payment that was due on Thursday, adding to uncertainty over an unfolding liquidity crisis at the world's most indebted property developer. The $83.5m payment had a deadline of midnight in New York on Thursday, or noon on Friday in Hong Kong. Two people with direct knowledge of the matter said that no payment had been received on Friday in Hong Kong. The property group, which has not made a statement on the repayment, has a 30-day grace period before any failure to pay officially results in a default. Evergrande, which had been widely expected to default for weeks, is at the centre of an unfolding storm over the health of China's vast property sector as the government seeks to crack down on excessive debt. Its woes shook global stock and commodity markets this week ahead of the impending payment deadline, as traders weighed the implications of a slowdown across a real estate industry that has anchored China's economic growth for decades.

EUROZONE (BLOOMBERG): European banks are underestimating the risks they face from borrowers hit hard by the pandemic, potentially laying the ground for an increase in bad loans, according to their top regulator. Two-thirds of the models banks use to calculate loan risk are factoring in a lower probability of default for companies in the hotel and accommodation industry than before the pandemic, said Edouard Fernandez-Bollo, a member of the European Central Bank's supervisory board. "Who can believe that? This is completely counter-intuitive," he said at a conference on Friday. "The backward-looking risk metrics that the banks are using are no longer fit for purpose today because they are underrating the risk, because they are projecting in fact implicitly the continuation of the credit support given by the state and this is not the case."

UK (GUARDIAN): The UK transport secretary, Grant Shapps, said he would "move heaven and earth" to solve the nationwide shortage of truck drivers that threatens fuel supplies at some petrol stations, adding that motorists should not panic as the problem would be "smoothed out relatively quickly". Shapps said he would consider all options, including the possibility of issuing short-term skilled worker visas to tap mainland Europe's pool of potential HGV drivers. "I'll look at everything," he told Sky News. "I wouldn't rule anything out. We will move heaven and earth to do whatever it takes to make sure shortages are alleviated with HGV drivers."

ITALY DATA: Consumer Confidence at More Than Two-Decade High

Sep SA consumer confidence 119.6 vs Aug 116.2

-Sep cons. conf index highest recorded since Jan'98-Istat says

-Consumer's sentiment on the economy rose to 143.6 vs 132.4

-Confidence in future outlook rose to 124.7 from Aug 122.5

-Sentiment on their personal climate up to 111.5 vs Aug 110.8

-Sentiment on the current climate rose to 116.1 from Aug 112.0

ITALY DATA: Manufacturing Sentiment Slips

Sep SA manufacturing morale 113.0 vs Aug 113.2

-Sep composite business sentiment indicator 113.8 vs Aug 114.0

-Business sent. indicator drops for 2nd consec. month--Istat says

-Sep m/m intermed., consumer gds rose; capital gds fell--Istat says

-Manufacturing current orders +6.2 in Sep vs +6.4 in Aug

-3-month manuf. output outlook +15.1 vs +15.6 in Aug

-Current manufacturing inventory levels -1.1 vs. Aug -0.8

FIXED INCOME: Another busy session in terms of volumes

Another big session in terms of volumes for Bonds.

- Bund and EGBs have extended lower this morning after the Hawkish BoE stunned the markets yesterday.

- Bund is off the low, after testing initial support noted at 170.20 (did print 170.17 low).

- A clear break below 170.00,would open to next yield level seen at -0.178%, which today, reference 170.26, would equate to 169.50.

- Gilts were initially wider against Germany but are back to flat at the time of typing.

- The spread traded at 117.5bps in early trading, to the widest levels since 2019.

- Next resistance is at that 2019 peak 121.0123, which is also the widest level since June 2016.

- The spread is now at 116.3

- US treasuries are also down but are better bid on the margin, bringing the Tnote/Bund spread 3.5bps tighter on he session.

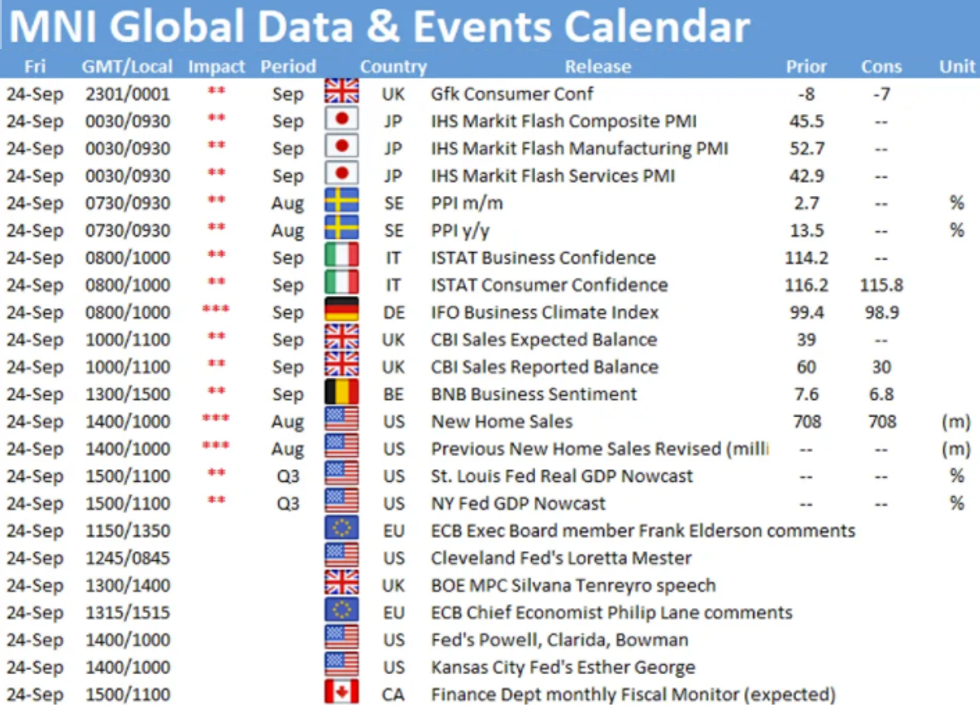

- Looking ahead, we have no real market moving data, and focus turns on speakers, including ECB Elderson, Lane, Fed Mester, Powell, Clarida, Bowman, George, Bostic, BoE Tenreyro

- After markets we get ratings from Fitch on Belgium, S&P on Germany, DBRS on Finland

FOREX: Markets Consolidate After Busy Week

- Markets are largely consolidating early Friday, with equities reversing a small portion of the solid gains posted over the past few days, working in favour of haven currencies and against high beta growth FX. As a result, the USD trades firmer alongside the JPY, while the AUD and NZD are the poorest performers on the day.

- German IFO data for September came in mixed, with expectations beating forecast while the current assessment and business climate components came in just below. EUR/USD was little changed and holds close to the week's best levels but still below key resistance at the 1.1786 50-dma.

- The data calendar thins out headed into the weekend, with just August New Home Sales left on the docket.

- There are a number of ECB and Fed speakers on the docket, with ECB's Elderson, Lane, Fed's Powell, Clarida Mester, Bowman, Bostic and George on the schedule.

EQUITIES: Generally lower outside Japan

- Japan's NIKKEI up 609.41 pts or +2.06% at 30248.81 and the TOPIX up 47.2 pts or +2.31% at 2090.75

- China's SHANGHAI closed down 29.153 pts or -0.8% at 3613.067 and the HANG SENG ended 318.82 pts lower or -1.3% at 24192.16

- German Dax down 88.96 pts or -0.57% at 15555.78, FTSE 100 down 14.25 pts or -0.2% at 7063.75, CAC 40 down 51.08 pts or -0.76% at 6650.48 and Euro Stoxx 50 down 26.16 pts or -0.62% at 4168.58.

- Dow Jones mini down 82 pts or -0.24% at 34565, S&P 500 mini down 13 pts or -0.29% at 4425, NASDAQ mini down 63.75 pts or -0.42% at 15240.25.

COMMODITIES: Smaller moves today but natgas still up 2.25% today

- WTI Crude up $0.14 or +0.19% at $73.43

- Natural Gas up $0.11 or +2.25% at $5.086

- Gold spot up $12.19 or +0.7% at $1754.93

- Copper down $0.5 or -0.12% at $422.65

- Silver up $0.17 or +0.77% at $22.6857

- Platinum down $7.32 or -0.74% at $984.9

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.