-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Europe Lockdown Speculation

EXECUTIVE SUMMARY:

- ITALY READIES CURBS ON UNVACCINATED; GERMAN LOCKDOWN RUMORS SWIRL

- MNI CHINA LIQUIDITY INDEX: CONDITIONS LITTLE CHANGED IN NOV

- ECB'S HOLZMANN, PANETTA, VASLE ON INFLATION OUTLOOK

- SPD, GREENS, FDP REACH COALITION DEAL IN GERMANY (POLITICO)

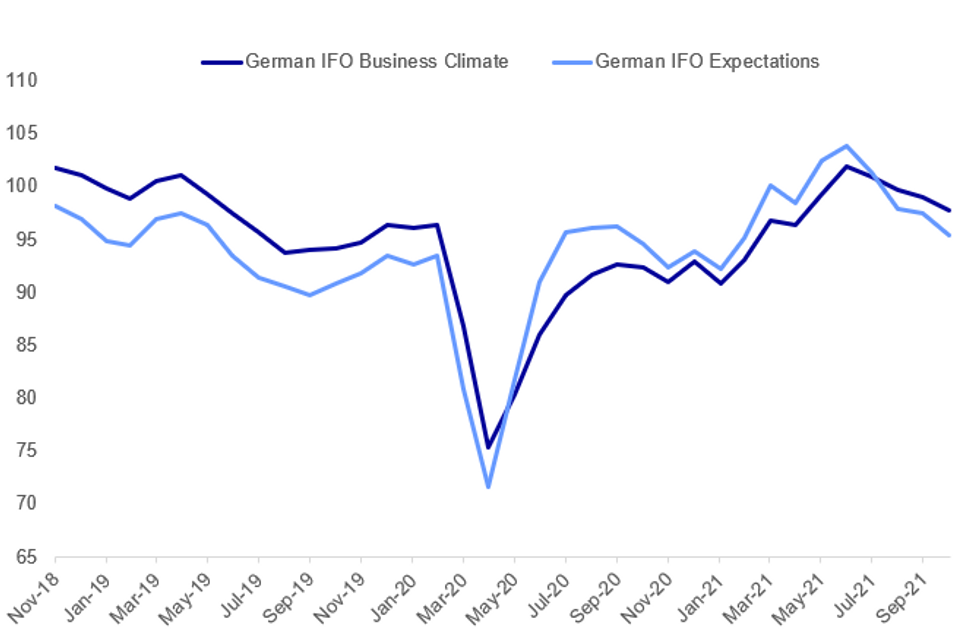

- GERMAN IFO SURVEY SIGNALS RAPID LOSS OF MOMENTUM

Fig. 1: IFO Suggests Waning German Business Confidence

Source: IFO, MNI

Source: IFO, MNI

NEWS:

GERMANY / COVID LOCKDOWNS: CNBC: "Germany is set to decide on tougher Covid restrictions on Wednesday. Officials have been considering more Covid rules and even a full or partial lockdown." MNI: Not clear that there's any new reporting in that CNBC piece vs what has been reported previously - published at 0946am UK / 1046am CET time, coinciding with a risk-off move in Bunds and equities.

ITALY / COVID LOCKDOWNS (BBG): Italy's government is debating tough new measures to stem an increase in coronavirus cases, which could include restrictions on unvaccinated people and could be approved as soon as Wednesday.The measures would only allow those with proof of inoculation to access venues such as cinemas and theaters, according to people familiar with the talks. The rules would still allow the unvaccinated to enter their workplace after testing negative for the virus.

MNI CHINA LIQUIDITY INDEX: Liquidity conditions across China's interbank market were little changed through November, as efforts by the People's Bank of China to 'stabilize' the markets soothed any concerns for traders, the latest MNI Liquidity Conditions Index shows. For full analysis contact sales@marketnews.com

ECB (BBG): The ECB's pandemic purchasing program may enter a "waiting room" rather than be abolished completely once net purchases are set to end in March, Governing Council member Robert Holzmann says at briefing in Vienna. ECB may assess whether the benefits of flexibility provided by the program will be needed in case of economic shocks later on. Says inflation increase largely transitory, price growth may slow from next year.

ECB (BBG): The European Central Bank must not tighten monetary policy too early in response to an inflation spike driven by "purely temporary factors," according to Executive Board member Fabio Panetta.A premature withdrawal of stimulus would risk damaging the euro-area economy and curbing domestic demand, he said Wednesday. If current high inflation rates turn out to be more persistent, that could in fact lead to a situation where monetary policy needs to be eased further, he said.

ECB (BBG): Financial market and company expectations as well as transfer of higher prices into wage demands are two key factors which could lead to inflation staying above 2% for a longer period of time, European Central Bank. Governing Council member Bostjan Vasle says at a virtual press conference in Ljubljana.Acceleration of inflation is not unexpected, Vasle says, but it's "more pronounced and longer-lasting than expected".

GERMAN POLITICS: Politico Europe tweets: "The three parties set to form Germany's new government have sealed a coalition deal, almost two months after the election. They're set to present the deal later today." Politico: "The deal will then be put to the wider parties for consideration, with the Greens planning to consult all their members, while the SPD has already scheduled an extraordinary party conference for December 4, where it will decide whether to accept the coalition agreement. The FDP plans to do the same at its own party conference on December 5. If all parties approve, they will be done in time to have Scholz elected as chancellor in the week starting December 6, sticking to the parties' intended timeline."

GERMAN DATA (BBG): Business surveys point to Germany's recovery losing momentum as the year end approaches. The composite PMI stood at 52.8 in November down from a peak of 62.4 this year reached in July. Output expanding at a slower pace in both the services and manufacturing sectors. The expectation index of the Ifo survey, usually one of the best indicators of growth in Germany, fell to 94.2 in November, below its long-term average of 97.6.

RUSSIA / UKRAINE (RTRS): Russian fighter planes and ships practiced repelling air attacks on naval bases and responding with air strikes during military drills in the Black Sea, Interfax reported on Wednesday, as neighbouring Ukraine also held combat exercises. The drills come at a time of high tension over Ukraine, with Ukrainian and U.S. officials voicing concerns about a possible Russian attack on its southern neighbour, a suggestion the Kremlin has dismissed as false. "About 10 aircraft crews and ships of the Black Sea fleet's Novorossiysk naval base... took part in this combat training event," Interfax cited Russia's Black Sea fleet as saying.

HONG KONG / MORGAN STANLEY (BBG): Morgan Stanley is offering to reimburse its Hong Kong employees as much as HK$40,000 ($5,100) to compensate for quarantine costs brought on by the financial hub's zero-Covid strategy. The one-time reimbursement will be available to all Hong Kong permanent employees when they return from a personal trip to visit immediate family members, including spouses, domestic partners, children, parents and grandparents, the U.S. bank said in a memo. A spokesman confirmed its contents.

DATA:

GERMANY NOV IFO BUSINESS CLIMATE +96.5

MNI: GERMANY NOV IFO CURRENT CONDITIONS 99.0; OCT 100.1

FIXED INCOME: Lockdown talk spooks markets

Core fixed income has moved largely in lockstep today with a bull steepening of 2s10s curves across Germany, the US and UK.

- This morning's data has consisted of slightly better than expected French confidence data and an in line ZEW while we have heard from a number of ECB speakers (who have largely not moved markets).

- The main news has instead been the Twitter rumour mill discussing whether or not there will be a lockdown in Germany following a CNBC story that discussed the options to the German government who are due to discuss today any new Covid-19 restrictions in the country.

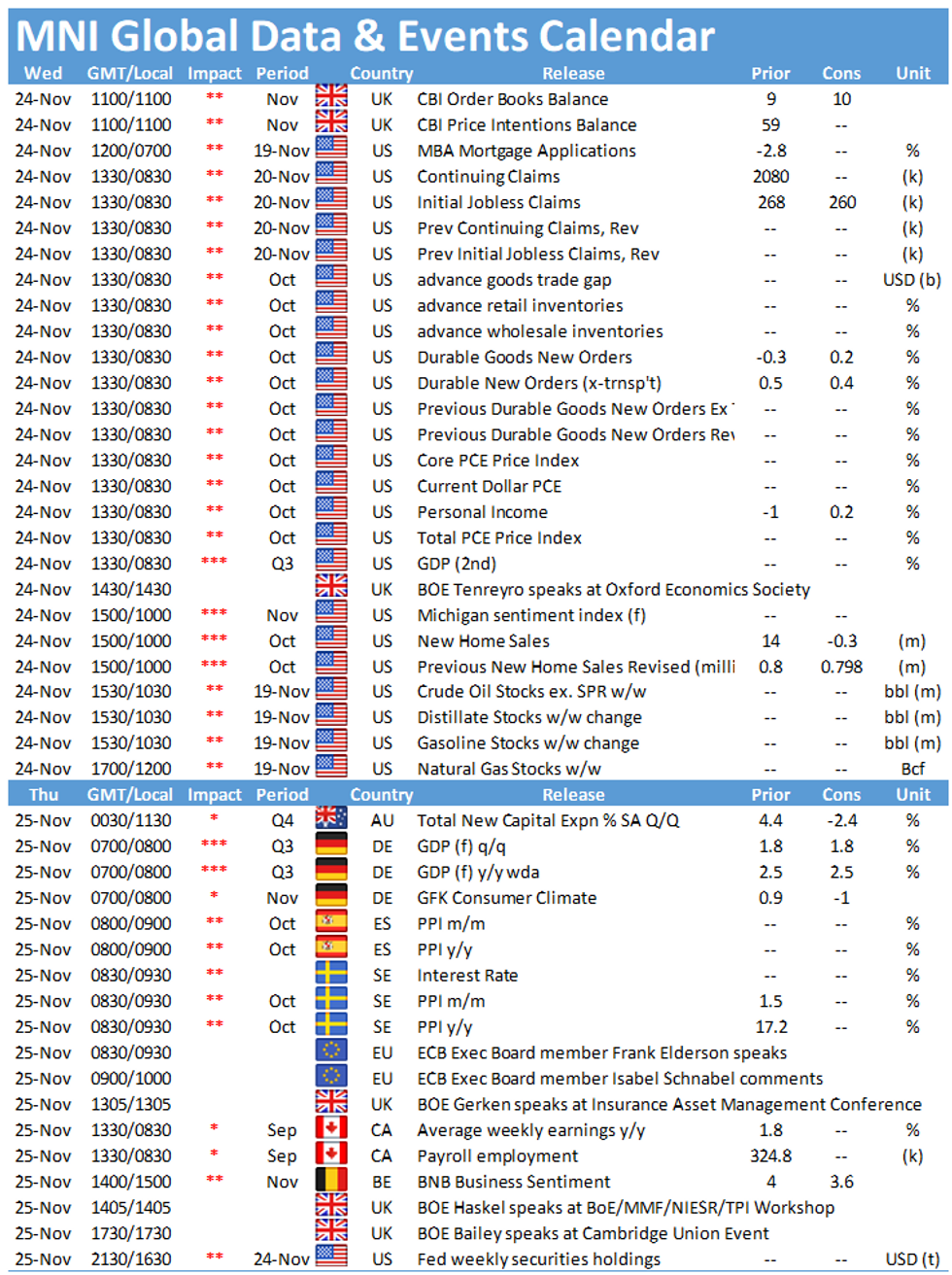

- There are a number of US events later with the second print of Q3 GDP, preliminary durable goods orders for October, personal income/spending, PCE, weekly claims and the FOMC Minutes all due ahead of the Thanksgiving holiday tomorrow. The Minutes are likely be analysed for any discussion of what the triggers are to adjust the pace of tapering, but with a number of FOMC members having spoken since the meeting may not be as closely watched as usual.

- TY1 futures are up 0-6+ today at 129-31+ with 10y UST yields down -2.4bp at 1.644% and 2y yields down -2.8bp at 0.589%.

- Bund futures are up 0.06 today at 170.87 with 10y Bund yields down -1.7bp at -0.239% and Schatz yields down -1.6bp at -0.856%.

- Gilt futures are down -0.06 today at 125.78 with 10y yields down -1.3bp at 0.982% and 2y yields down -1.9bp at 0.565%.

FOREX: Dollar is up against G10s

- EUR has been under pressure this morning, also helped by a stronger USD.

- EUR test session low, against AUD, CNH, CAD, USD,

- EURUSD broke below t 1.1222 1.618 proj of the Jan 6 - Mar 31 - May 25 price swing.

- And the break of that levels opens s to 1.1185 Low Jul 1, 2020.

- Cable has also traded lower this morning, more a function of the USD, with DXY at session high.

- USD test best levels against the SEK, CHF, GBP, SGD, ILS.

- Initial support for Cable is still at 1.3343 Low Nov 23.

- Looking ahead, we have a session packed with data, ahead of the US holiday.

- This will include some second reading for the US.

- Most notable one, will be US PCE core deflator for October.

- This will be followed by the FOMC minutes,

- Speakers include, ECB Panetta, Schnabel BoE Tenreyro,

EQUITIES: Futures Retreat As German Lockdown Rumors Swirl

- Asian markets closed mixed, with Japan's NIKKEI down 471.45 pts or at 29302.66 and the TOPIX down 23.7 pts or at 2019.12. China's SHANGHAI closed up 3.613 pts or +0.1% at 3592.702 and the HANG SENG ended 33.92 pts higher or +0.14% at 24685.5

- European equities retreated just before 1000BST on a (as yet unsubstantiated) headline that Germany was set to impose a full COVID lockdown, with the German Dax down 52.1 pts or -0.33% at 15959.08, FTSE 100 up 6.81 pts or +0.09% at 7301.67, CAC 40 down 8.08 pts or -0.11% at 7080.01 and Euro Stoxx 50 down 9.05 pts or -0.21% at 4301.61.

- U.S. futures are also weaker, with the Dow Jones mini down 122 pts or -0.34% at 35644, S&P 500 mini down 13 pts or -0.28% at 4675.5, NASDAQ mini down 37 pts or -0.23% at 16275.

COMMODITIES: Oil Slips On Europe Lockdown Concerns

- WTI Crude down $0.18 or -0.23% at $78.9

- Natural Gas down $0.04 or -0.83% at $4.96

- Gold spot up $1.63 or +0.09% at $1793.23

- Copper up $3.55 or +0.8% at $445.05

- Silver down $0.06 or -0.26% at $23.6348

- Platinum up $12.3 or +1.27% at $982.2

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.