-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Europe PMIs Show Strong Start To Spring

EXECUTIVE SUMMARY:

- EUROZONE, U.K. APRIL FLASH PMIS BEAT EXPECTATIONS

- LEADING CENTRAL BANKS TO WITHDRAW 84-DAY USD LIQUIDITY OPS

- E.C.B. KEPT BOND PLAN STEADY AFTER RATES STABILIZED: MULLER

- PROFESSIONAL FORECASTERS REVISE UP 2021 EUROZONE INFLATION EXPECTATIONS: E.C.B. SURVEY

- U.K. ANNOUNCES BIGGER-THAN-EXPECTED REDUCTION IN GILT ISSUANCE

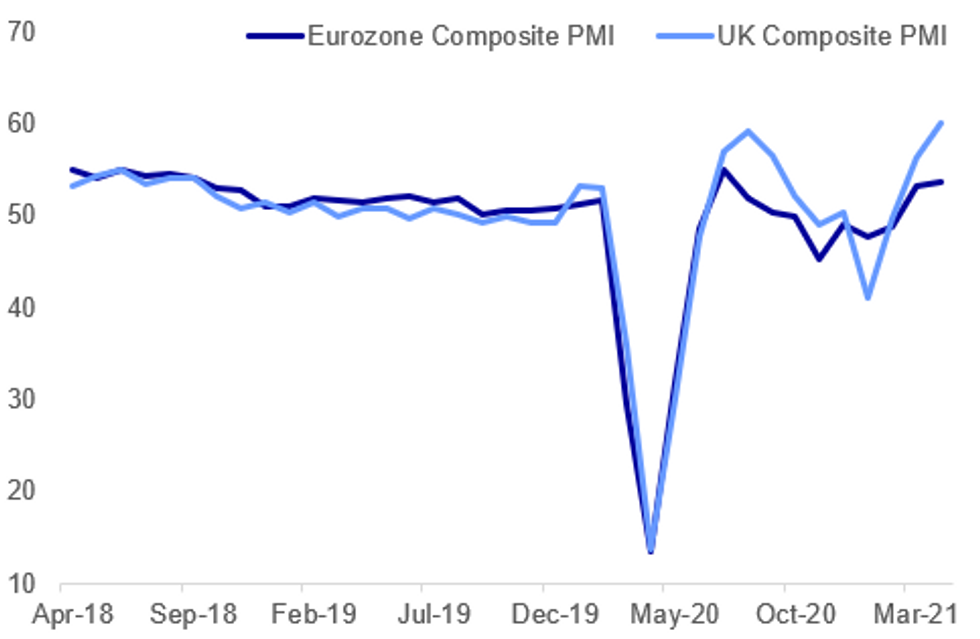

Fig. 1:

IHS MARKIT, MNI

IHS MARKIT, MNI

NEWS:

USD/CENTRAL BANKS: The Bank of England, the European Central Bank, the Swiss National Bank and the Bank of Japan, all in consultation with the Federal Reserve, will discontinue 84-day dollar liquidity operations from July 2021. However, all the leading banks have said the stand ready to readjust provisions as warranted by future market conditions.

ECB (BBG): The European Central Bank kept its bond buying plan unchanged after halt to earlier rise in interest rates, Governing Council member Madis Muller says on Estonian central bank website. "Since the rise in interest rates also stopped, there was no need to change the current plans and previous policy decisions at this week's meeting."

ECB: The latest ECB Survey of Professional Forecasters (SPF) sees inflation expectations revised higher by 0.7pp for 2021 compared to the previous quarterly survey, data published Friday by the European Central Bank showed. Expectations for 2022 and 2023 were unchanged in the Q2 report. They now see HICP inflation expectations at 1.6%, 1.3% and 1.5% for 2021, 2022 and 2023, respectively. Respondents consider the factors causing the upward revision as temporary, with long-term inflation expectations still at 1.7%, unchanged from the Q1 SPF.

U.K. GILTS (BBG): The U.K. Debt Management Office's reduces planned gilt sales for the fiscal year to GBP252.6 billion, a reduction of 43.3 billion, it says in statement.

U.K. GILTS: Average auction sizes have changed a little in light of today's remit revision. The most notable change will be for medium-dated gilts, with average auctions sizes to be GBP0.20bln smaller than originally anticipated. Short-dated auctions will increase a little while long-dated auction sizes will decrease a little. The average size of linker auctions will fall, but this is to be largely expected as auction that replaces the syndication is likely to be for a higher duration than the average linker auction.

FLOWS (RTRS): Investors pumped nearly $15 billion into equity funds and $13.7 billion into bond funds in the week to Wednesday, BofA's weekly fund flow data showed on Friday. Though the overall money hosed into stocks this year is still at a record, inflows slowed down in recent weeks as major stock indexes are trading at sky-high valuations. Under the hood, investors pulled back $1.3 billion from emerging market equities and added $1.4 billion in European stocks, according to BofA's crunching of EPFR data.

U.K. DATA: UK retail sales surged in March boosted by Easter and gardenware spending, far exceeding market expectations but in line with the latest MNI Reality Check, data released on Friday by the Office for National Statistics showed. Retail sales jumped by 5.4% between February and March, well ahead of the expected 1.5% forecast by City analysts. Sales surged by 7.2% on an annual basis and stand 1.6% above February of 2020, before the pandemic ravaged the UK economy. Despite the strong performance in March, overall sales declined by 5.8% in the first quarter, which could shave 0.3 percentage points from gross domestic produce over the opening three months of the year.

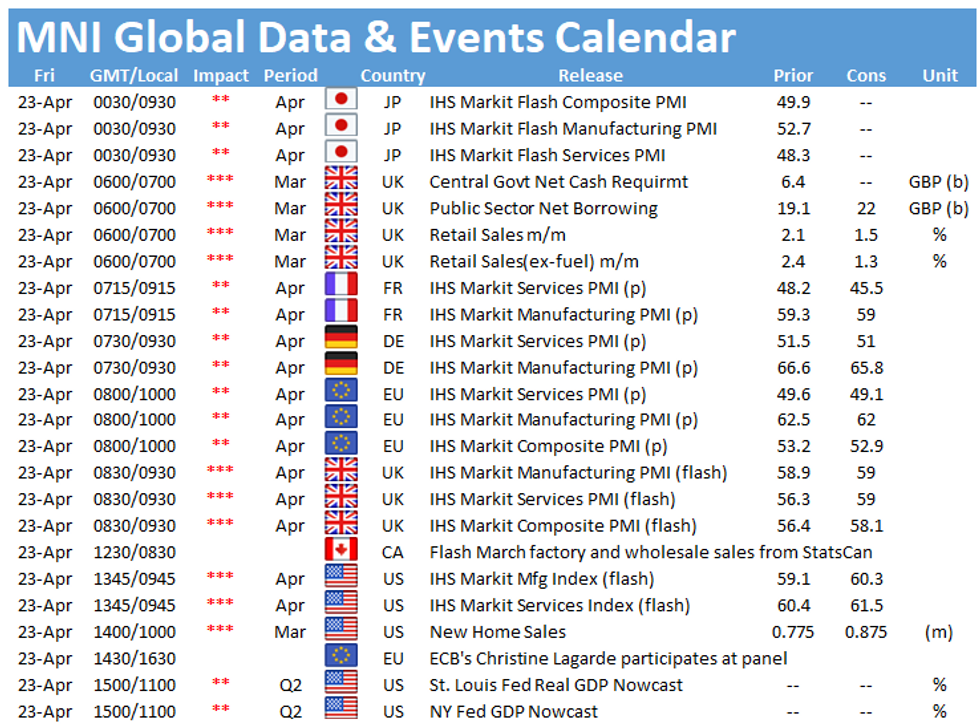

DATA:

French PMI: Big Services Surprise

The April flash PMI reading for France beat expectations, with manufacturing at 59.2 (59.0 exp., 59.3 prior) and services at 50.4 (46.7 exp., 48.2 prior). Obviously the services component was the bigger surprise, coming in at an 8-month high whereas manufacturing posted a 2-month low.

- The services rebound meant overall private sector activity rose for the first time since Aug 2020.

- Per IHS Markit's report, new business increased across the private sector for the 2nd consecutive month, with the rate of growth the quickest since July 2020. Manufacturers enjoyed strong new export orders, whereas services saw a 14th consecutive month of foreign demand contraction.

- Private sector hiring remained positive, though manufacturing jobs "continued to post a much stronger rate of growth". Both services and manufacturing firms saw bigger backlogs despite hiring.

- Input price inflation accelerated the most since Jan 2018, as "input costs continued to rise sharply in April amid further panellist reports of severe global raw material shortages" - manufacturing input costs rose the fastest "in a decade".

- However, there was only a "modest" level of pass-through inflation to consumers, with service firms actually reducing prices "fractionally".

- Businesses were more optimistic: the one-year ahead outlook was the strongest since Feb 2018.

German PMI: Manufacturing "Held Back By Supply Shortages"

German April flash PMI came in mixed but overall weaker than expected, with services at 50.1 (51.0 exp., 51.5 prior) and manufacturing at 66.4 (65.8 exp., 66.6 prior). This put the composite figure at 56.0, a bigger deceleration than expected (57.0 exp., 57.3 prior).

- All of those readings represented 2-month lows, and came on the back of "services activity stalling and the upturn in manufacturing production partly held back by supply shortages" per IHS Markit.

- Services in particular stalled due to "the impact of the pandemic and stricter lockdown measures".

- New business rose for the 10th straight month, but slightly more slowly than in March, while backlogs increased by the most since Feb 2011 as goods producers "struggled to keep pace with demand" and services businesses saw their first rise in backlogs for 21 months.

- Job creation was the quickest for 2.5 years. Services jobs rose at the most since the pandemic.

- Input costs rose at the fastest pace for over a decade "amid widespread reports of an imbalance of supply and demand for inputs as well as higher fuel and energy prices". Businesses responded by passing through some of those costs to buyers (mostly on the manuf side).

- Optimism remained strong but dipped slightly from March's record high.

UK PMI: Lockdown Easing Boosts Services

The April flash PMI reading for the UK came in higher than expected, with 60.1 for services (58.9 exp., 56.3 prior) and 60.7 for manufacturing (59.0 exp., 58.9 prior) equating to a 60.0 composite figure (58.1 exp., 56.4 prior). Composite was highest since Nov 2013, services highest since Aug 2014.

- The upside surprise for services and outperformance vs manufacturing "was largely due to a boost from easing government stringency measures regarding some consumer services and non-essential retail" in England and Wales, per the IHS Markit report.

- The employment reading was the strongest since Aug 2017, and "survey respondents mostly noted additional staff hiring as opposed to the impact of recalls from furlough".

- New business volumes accelerated the most in nearly 7 years, despite "subdued export sales, especially in the service economy due to tight restrictions on international travel".

- Input cost pressures persist, " led by higher fuel bills, staff wages, commodity prices and freight surcharges" - this and stronger demand led to prices charged rising at one of the fastest rates over the past 3.5 years.

- Optimism remained close to record highs.

FIXED INCOME: Gilts recede from supply-led highs

- The main move in core fixed income came on the gilt open, with the futures contract briefly breaching 129.00 (129.09 high). This was the highest level since 11 March with the move triggered by a bigger than expected revision lower for the gilt remit. Around GBP20bln less issuance had been expected due to stronger than expected outturn data for central government net cash requirements (CGNCR) for FY20/21, but the gilt remit was actually revised GBP43.3bln lower. UK retail sales data for March was also stronger than expected.

- However, within around 15 minutes of the open, these moves were reversed and gilts have traded largely in line with other core fixed income since (which is generally flat on the day). Peripheral spreads are marginally wider on the day.

- In terms of other data, PMI data has generally been better than expected today with the French services PMI the highlight, coming in at 50.4 against expectations of 46.7. Looking ahead there is not much other than the US PMI and some speeches on climate change at COP26 with Yellen and Lagarde the most relevant for the market.

- TY1 futures are down -0-0+ today at 132-17 with 10y UST yields up 1.9bp at 1.559% and 2y yields up 0.1bp at 0.150%.

- Bund futures are up 0.03 today at 170.97 with 10y Bund yields down -1.4bp at -0.268% and Schatz yields down -0.4bp at -0.699%.

- Gilt futures are up 0.04 today at 128.84 with 10y yields down -1.2bp at 0.727% and 2y yields down -1.1bp at 0.027%.

FOREX: USD Sees Continuation Selling

USD saw some continuation selling during our early morning European session.

- The Dollar under performing against all G10s, and most EMs, beside the TRY.

- The EURUSD regained most of the drop from yesterday after Lagarde's comment on negative rates.

- The EUR was boosted by the broader USD selling and following this morning's PMIs data beat, which supported constructive recovery views in the street. EURUSD is just short of initial resistance at 1.2080, with the cross printing a 1.2062 high so far today.

- The EUR leads against the USD in G10, up 0.36%, and the currency trades in the green versus all majors

- AUD still leads against the Greenback in G10 following the upbeat unemployment forecast by Westpac, but has faded somewhat, now just up 0.38% after being up 0.43% earlier.

- Next resistance in the AUDUSD comes at yesterday's high 0.7765.

- Looking ahead, market participants awaits the Russian Rate decision, when Economists survey expect a 25bps hike to 4.75%.

- On the data front, US PMIs are the notable release.

- Mr Draghi is also set to reveal a draft of his recovery plan (EU220bn) to his cabinet sometime today.

- Lagarde and Yellen are on a Bloomberg climate panel

EQUITIES: U.S. Futures Stabilize After Cap Gains Tax Concerns

- Asian markets closed mixed, with Japan's NIKKEI down 167.54 pts or -0.57% at 29020.63 and the TOPIX down 7.52 pts or -0.39% at 1914.98. China's SHANGHAI closed up 9.052 pts or +0.26% at 3474.166 and the HANG SENG ended 323.41 pts higher or +1.12% at 29078.75.

- European equities are slightly lower, with the German Dax down 55.44 pts or -0.36% at 15279.64, FTSE 100 down 12.54 pts or -0.18% at 6911.81, CAC 40 down 0.41 pts or -0.01% at 6265.44 and Euro Stoxx 50 down 8.62 pts or -0.21% at 4008.67.

- U.S. futures are edging higher, with the Dow Jones mini up 57 pts or +0.17% at 33766, S&P 500 mini up 8.75 pts or +0.21% at 4136.5, NASDAQ mini up 19.25 pts or +0.14% at 13769.5.

COMMODITIES: Base Metals Gaining

- WTI Crude up $0.32 or +0.52% at $61.99

- Natural Gas up $0.01 or +0.36% at $2.762

- Gold spot up $1.79 or +0.1% at $1784.31

- Copper up $3.35 or +0.78% at $431.2

- Silver down $0.04 or -0.15% at $26.1213

- Platinum up $9 or +0.75% at $1214.55

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.