-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Europe Reassesses Reopenings

EXECUTIVE SUMMARY:

- U.K.'S JOHNSON TO URGE CAUTION AS COVID RESTRICTIONS ARE LIFTED

- SUSTAINED WAGE GAINS THREAT TO U.K. PRICE OUTLOOK (MNI INTERVIEW)

- E.C.B.'S LAGARDE FLAGS FORWARD GUIDANCE CHANGE IN JULY, DEEPER CHANGES DOWN THE ROAD

- FRANCE'S MACRON TRIES TO SLOW DELTA VARIANT, BOOST VACCINES

- SWEDISH RIKSBANK MINUTES SHOW END-FORECAST HIKE DEBATED

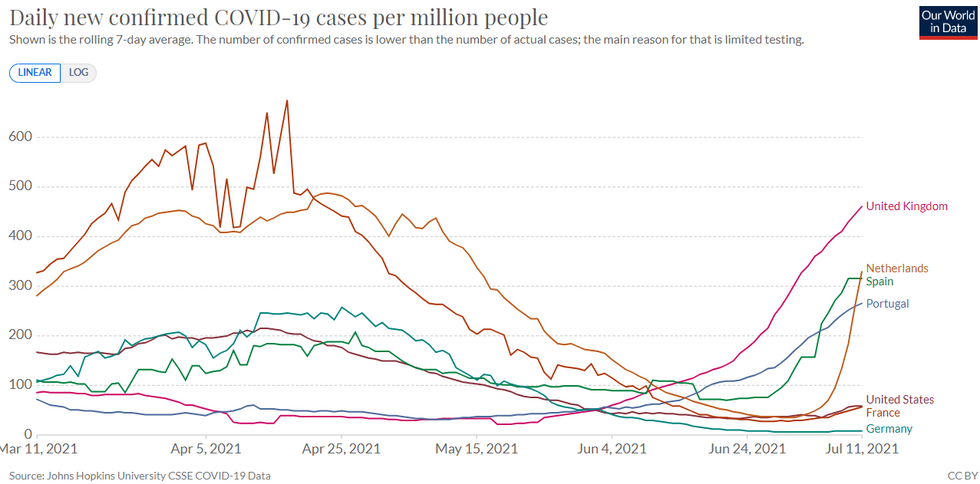

Fig. 1: Europe COVID Restrictions In Focus

NEWS:

U.K. (BBG): Prime Minister Boris Johnson will warn people to remain vigilant as he prepares to lift virtually all remaining coronavirus restrictions in England.In a news conference on Monday, Johnson is widely expected to confirm that mandatory curbs will end as planned on July 19, including the legal requirement to wear masks in indoor settings. But he'll also warn that the unlocking will drive a new surge in cases and that people must "all take responsibility" in the coming weeks to help keep infections at a manageable level, his office said in an emailed statement.

U.K. (MNI INTERVIEW): UK prices pressures could mount in coming months, but the economy has yet to flash any 'red lights' warning of a prolonged period of above-target inflation, although any sustained increase in wages could become problematic, the chief economist at the Office for National Statistics told MNI in an interview. For full article contact sales@marketnews.com

ECB: Below are some key snippets from the latest BBG interview with ECB President Lagarde overnight:

- Lagarde signalled that the upcoming July meeting will now have "some interesting variations and changes."

- "It's going to be an important meeting. Given the persistence that we need to demonstrate to deliver on our commitment, forward guidance will certainly be revisited."

- Lagarde stressed that she expects the ECB's current bond-buying plan to run "at least" until March 2022. That could then be followed by a "transition into a new format."

- "We need to be very flexible and not start creating the anticipation that the exit is in the next few weeks, months."

- "We're going to look at the circumstances, we're going to look at what forward guidance we need to revisit, we're going to look at the calibration of all the tools we are using to make sure it is aligned with our new strategy."

- Lagarde agreed that the Banks new inflation target may "take a little longer" to achieve.

- She stressed that the ECB has to "use the tools, and we have a big toolbox, to actually deliver that 2%."

E.C.B. (BBG): The European Central Bank doesn't have any "concrete" ideas about how much and how long inflation might overshoot the institution's new target in the future, according to Vice President Luis de Guindos. Any inflation overshoot will be a "matter of judgment".

RIKSBANK: The Riksbank did discuss the case for showing the repo rate rising at the end of its three-year forecast, before deciding to stick with its flat zero per cent projection, the minutes of its June 30 meeting show. Martin Floden explicitly said that a "a rate rise during the second half of 2024 may be justified." The minutes, however, highlighted how the Riksbank is conducting something close to average inflation targeting, with members arguing that the prolonged undershoots of the inflation target meant it was not a bad thing if there were periods where inflation overshot now and that it was too early to predict tightening.

FRANCE (AP): With the delta variant now driving resurgent infections, potential new restrictions loom. President Emmanuel Macron is hosting a top-level virus security meeting Monday morning and then giving a televised speech in the evening, the kind of solemn speech he's given at each turning point in France's virus epidemic. This time, he's expected to announce plans for a law requiring health care workers to get vaccinated, and may require special COVID-19 passes for restaurants or other day-to-day activities. Other possibilities: A return to limits on the number of people allowed in public venues that just reawakened in May after one of the world's longest shutdowns. Or an announcement that France could start charging money for some virus tests, which up to now have been free for everyone on French territory.

CHINA / TECH (WSJ): ByteDance Ltd., the Chinese owner of popular short-video app TikTok, put on hold indefinitely its intentions to list offshore earlier this year after government officials told the company to focus on addressing data-security risks, people familiar with the matter said.The Beijing-based social-media giant, last valued at $180 billion in a funding round in December, had been mulling an initial public offering of all or some of its businesses in the U.S. or Hong Kong, according to people familiar with the company's plans.

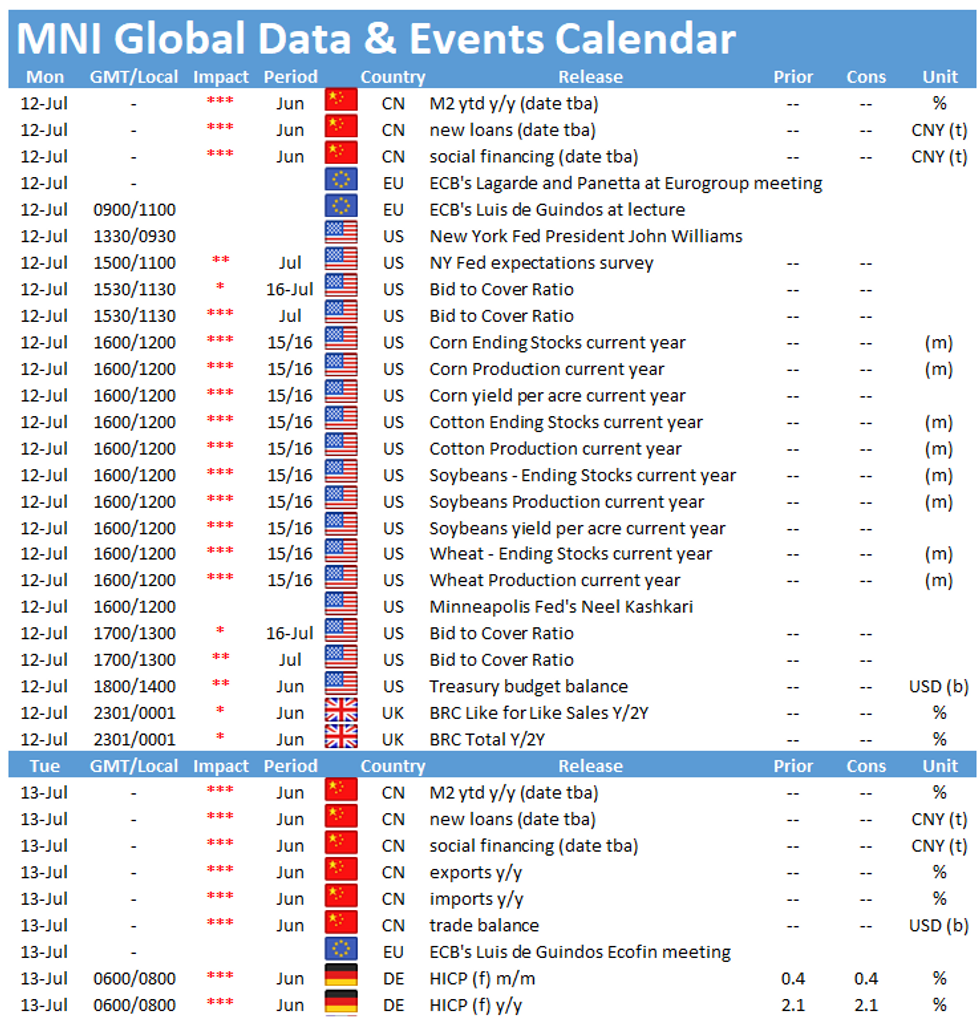

DATA:

No key data in the European morning.

FIXED INCOME: Oil lower, fixed income higher

Core fixed income has seen a decent start to the morning, with Treasuries, Bunds and gilts close to (but not yet surpassing) their highs of Friday's session.

- The moves higher for fixed income coincide with crude oil falling around $1/bbl, but equity markets are more mixed this morning. Eurozone peripheral spreads are generally tighter, with the exception of Greece.

- In a day light on data, there will be a focus on UST supply later with 3-year and 10-year notes being auctioned alongside 6-month and 3-month bills.

- Looking ahead to later in the week, US CPI tomorrow is the highlight while the US will also see releases of PPI and the Beige Book (Wed), Philly Fed, weekly claims and IP (Thurs) with retail sales Friday. The UK also sees inflation data Wednesday and labour market data Thursday.

- TY1 futures are up 0-5 today at 133-18+ with 10y UST yields down -2.9bp at 1.332% and 2y yields down -0.7bp at 0.208%.

- Bund futures are up 0.31 today at 174.21 with 10y Bund yields down -1.6bp at -0.310% and Schatz yields down -0.2bp at -0.683%.

- Gilt futures are up 0.31 today at 129.08 with 10y yields down -2.6bp at 0.629% and 2y yields down -1.2bp at 0.070%.

FOREX: Mixed Outlook for Stocks Helps Buoy Haven FX

- Equity markets are mixed early Monday, with mainland European indices failing to carry on the stronger stocks theme from the Asia-Pac session. As a result, JPY is firmer so far this morning, higher than all others in G10 ahead of the NY crossover.

- USD/JPY's weakness has been modest, however, with the pair still above first support at the Y109.82 50-dma.

- Growth proxies including AUD, NZD and NOK are among the weakest, although AUD/USD is still well clear of last week's lowest levels. $0.7410 acts as the first key level.

- There's little in the way of tier one data Monday, with focus on the beginning of US earnings season (a number of bulge bracket banks report from Tuesday onwards) with Fed's Kashkari also speaking at 1700BST/1200ET.

EQUITIES: Nasdaq Gains Defy Broader Weakness

- Asian stocks closed higher, with Japan's NIKKEI up 628.6 pts or +2.25% at 28569.02 and the TOPIX up 40.95 pts or +2.14% at 1953.33. China's SHANGHAI closed up 23.748 pts or +0.67% at 3547.836 and the HANG SENG ended 170.7 pts higher or +0.62% at 27515.24

- European equities have slipped, with the German Dax down 5.06 pts or -0.03% at 15648.87, FTSE 100 down 36.76 pts or -0.52% at 7082.61, CAC 40 down 23 pts or -0.35% at 6496.3 and Euro Stoxx 50 down 6 pts or -0.15% at 4050.01.

- U.S. futures are mixed, with the Dow Jones mini down 113 pts or -0.33% at 34637, S&P 500 mini down 7 pts or -0.16% at 4353, NASDAQ mini up 33 pts or +0.22% at 14843.5.

COMMODITIES: Copper, Oil Lead Losses

- WTI Crude down $0.59 or -0.79% at $74.02

- Natural Gas down $0.03 or -0.79% at $3.636

- Gold spot down $5.46 or -0.3% at $1803.8

- Copper down $4.1 or -0.94% at $430.35

- Silver down $0.13 or -0.48% at $26.0466

- Platinum down $7.56 or -0.68% at $1095.57

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.