-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI US Open: Europe Services Recovery Is On; U.S. ISM Next

EXECUTIVE SUMMARY:

- SERVICES PMIS: ITALY AND SPAIN BEAT EXPECTATIONS UK FINAL REVISED UP

- U.K. RECOVERY ONGOING AS RE-OPENINGS PICK UP

- AMC EXTENDS SURGE AS REDDIT'S RETAIL FRENZY REACHES NEW HEIGHTS

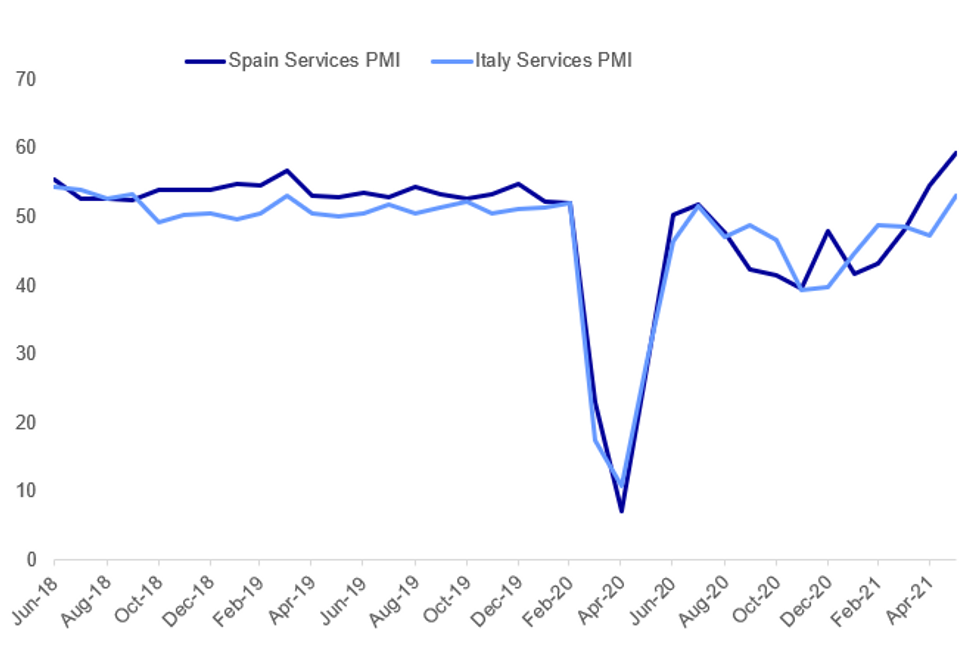

Fig. 1: Spanish And Italian Service Sectors On The Road To Recovery

Source: IHS Markit, MNI

Source: IHS Markit, MNI

NEWS:

UK (BBG): Prime Minister Boris Johnson's government is likely to keep tight limits on international travel for the weeks ahead, denting hopes of a major summer revival for aviation and tourism businesses which have been hammered by the pandemic. Officials are set to announce a revised "green list" of countries deemed safe for leisure travel Thursday, but the government is likely to stay cautious in the face of a growing threat of another wave of infections, a person familiar with the matter said.

UK: The percentage of businesses currently trading in the UK increased to 87% in the Office for National Statistic's latest survey period, the highest proportion since comparable estimates began in June 2020. A further 3% of businesses expect to restart trading in the next two weeks, the survey found. The percentage of businesses currently operational in the accommodation and food service sector rose from 61% to 83% during May, helped by a further relaxation of coronavirus regulations and the re-opening of indoor dining.

EUROZONE: Resurgent service sector growth in May on top of an already recovering manufacturing sector saw the eurozone economy growing at its fastest pace since February 2018, the latest PMI survey from IHS Markit showed. The headline Composite index rose to 57.1 in May from 53.8 in April, with the Services index rising to 55.2 from 50.5. Overall growth across the economy should lead to a strong Q2 GDP reading for the euro area according to Chris Williamson, IHS Markit's chief business economist. "With a survey record build-up of work-in-hand to be followed by the further loosening of covid-19 restrictions in the coming months, growth is likely to be even more impressive in the third quarter," he added.

U.S. EQUITIES (BBG): AMC Entertainment Holdings Inc. extended Wednesday's surge in premarket trading as the Reddit retail-trading army continued to gorge on the stock, sending it to heights that has left Wall Street pros perplexed. After rising 95% to a record high in the last regular session, AMC gained 13% to $71.01 as of 4:02 a.m. in New York. The money-losing movie-theater chain has a market value of more than $30 billion, making it more valuable than at least half of the companies in the S&P 500 Index.

HONG KONG (BBG): Hong Kong will deploy 7,000 police to prevent protests on the anniversary of the Tiananmen Square crackdown, local media said, as human rights groups urged authorities to let residents express their views peacefully. The operation included dispatching some 3,000 officers near Victoria Park on Friday, Radio Television Hong Kong reported, referring to the site of an annual vigil commemorating the 1989 incident. The deployment was expanded due to calls for gatherings in various locations after police banned the usual event citing coronavirus measures, RTHK said, citing people familiar with the matter.

SPAIN / US / GLOBAL TAX (RTRS): Spain is negotiating with the United States and other countries to find a fairer system for taxing tech companies' profits at a global level, Economy Minister Nadia Calvino said on Thursday.Calvino spoke a day after Washington slapped a 25% tariff on over $2 billion worth of imports from Spain and five other countries over their digital services taxes.

DATA:

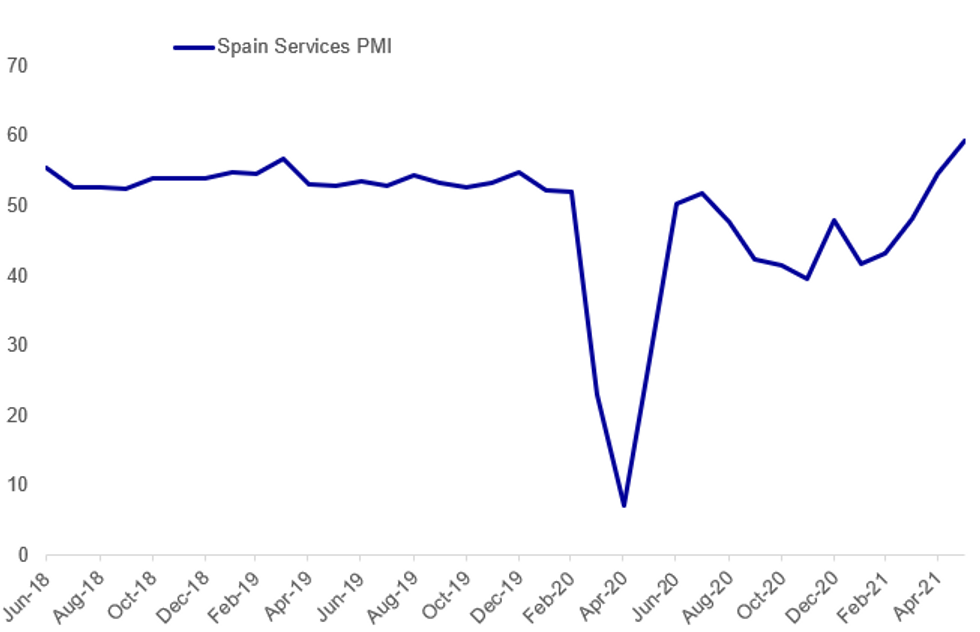

MNI: SPAIN MAY SERVICES PMI 59.4; APR 54.6

Spain Services PMI: 6-Year High (And Higher Cost Pressures)

Spanish May Services PMI beat expectations at 59.4 (vs 57.9 survey, 54.6 prior), with the composite reading coming in at 59.2 (55.2 prior). The Services figure was the highest since August 2015 and comes amid a lifting of COVID restrictions, per the IHS Markit release:

- On new orders: New business volumes were the strongest since early 2018, with domestic orders strong (foreign demand less so). Baclkogs of work rose at the fastest since Jul 2015.

- On employment: With strong orders/backlogs, May saw the sharpest rate of growth for over two years, and a 2nd successive monthly increase in overall employment.

- On prices: Cost pressures "intensified to the greatest degree since the summer of 2008" as manufacturers passed on inflationary pressures in supply chains. But "although companies were able to raise their own charges in response to the strongest degree for over two years, inflation was relatively modest as pricing power amongst service providers remained limited."

- On the outlook: Overall confidence dipped only slightly vs April's 17-year high.

Source: IHS Markit, MNI

Source: IHS Markit, MNI

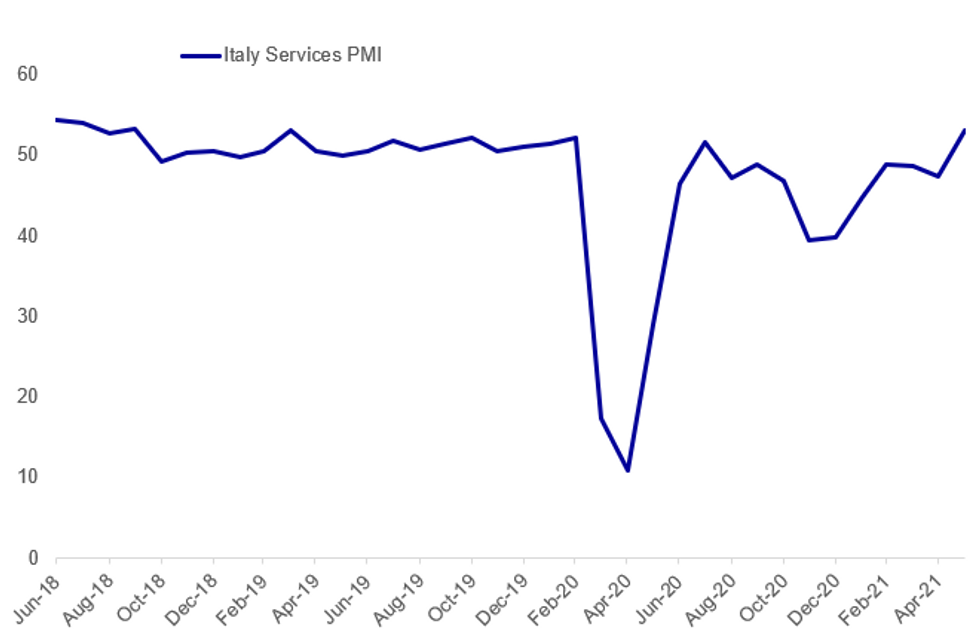

MNI: ITALY MAY SERVICES PMI 53.1; APR 47.3

Italy Services PMI: Back To Growth, And Passing Along Price Rises

Italian Services PMI rebounded into expansionary territory in May with an above-expected 53.1 reading (vs 52.3 survey, 47.3 prior). Highlights from the IHS Markit report:

- On new orders: Italy's service sector saw the first rise in new business for 3 months, with the rate of growth in new work the highest in over 3 years - but this was wholly domestically driven, with new export orders continuing to decline. Backlogs rose for the 2nd month in a row, to the fastest rate since June 2018.

- On employment: Employment stabilized (in part with firms taking on staff to "alleviate capacity pressures", a key shift compared with 14 consecutive months of contraction.

- On prices: Input costs rose to the highest since April 2012, and services firms responded by increasing average charges for the first time in nearly two years (at the quickest pace since January 2008).

- On the outlook: The sector saw the strongest positive sentiment for over 11 years.

MNI: GERMANY FINAL MAY SERVICES PMI 52.8; FLASH 52.8; APR 49.9

MNI: FRANCE FINAL MAY SERVICES PMI 56.6; FLASH 56.6; APR 50.3

MNI: EZ FINAL APR SERVICES PMI 55.2; FLASH 55.1; APR 50.5

MNI: UK FINAL MAY SERVICES PMI 62.9; FLASH 61.8; APR 61.0

FIXED INCOME: Reversing yesterday's gains ahead of ISM services

Core fixed income has been under some pressure this morning, reversing yesterday's gains. Treasury, Bund and gilt futures are now close to levels seen around Tuesday's close.

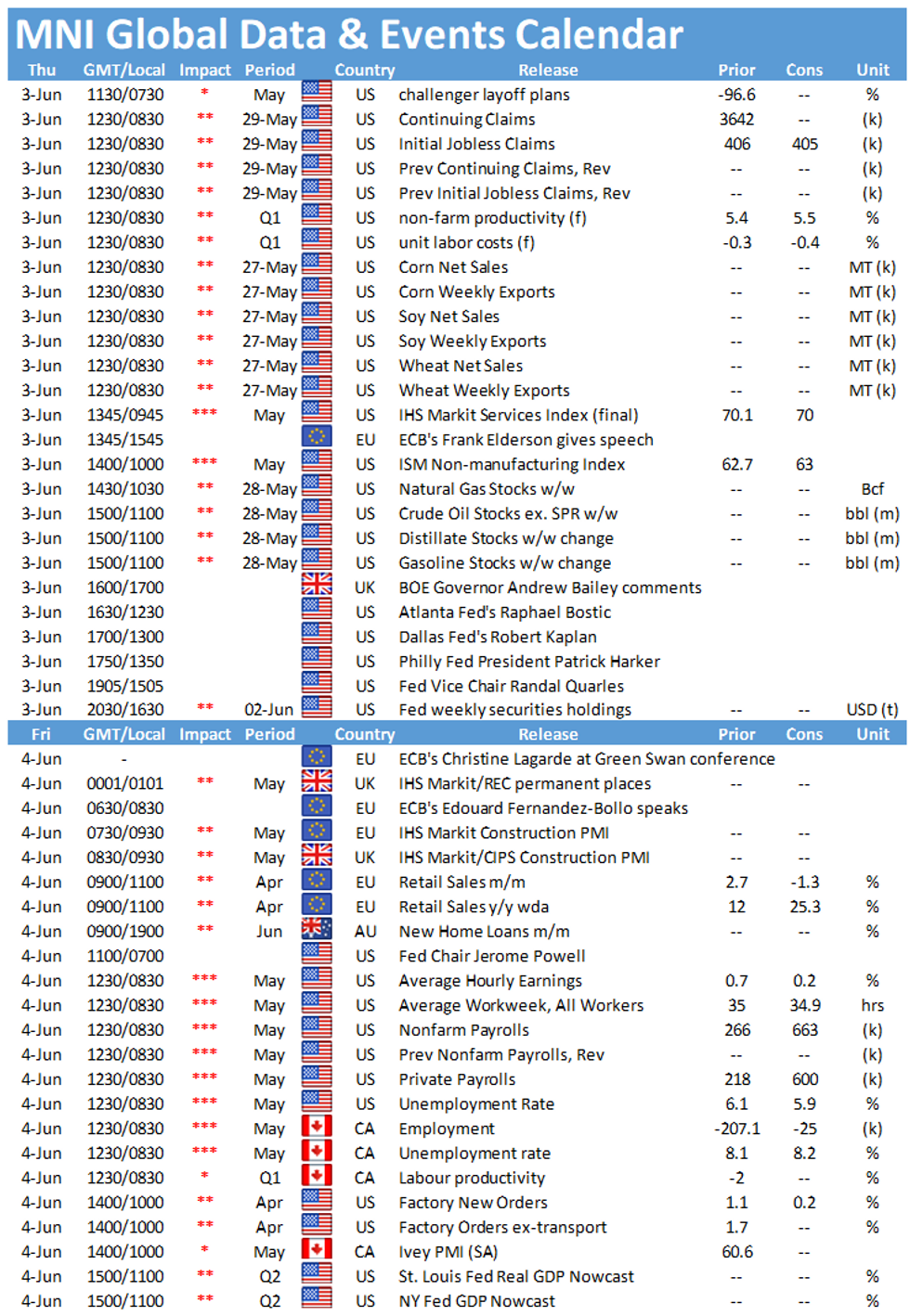

- This morning saw Spanish and Italian services PMIs come in a bit better than expected while final PMI prints from Germany, France, the Eurozone and UK were generally in line or marginally higher.

- The focus on the data front now switches to the ISM services, although it is the subcomponents that will probably be more market moving than the headline. The employment component was closely watched in the manufacturing print earlier this week, and if that shows similar weakness it will set the tone for a weaker payrolls number tomorrow.

- In terms of speakers, the Fed's Bostic, Kaplan, Harker and Quarles all make apparances post-ISM while BOE's Bailey is due to speak at the Green Swan conference on "How in practice can the financial sector take immediate action against climate change-related risks".

- On the supply front, France sold E4.96bln of nominals and E511mln of linkers while France sold E11bln of LT OATs (including 1.8bln of the Jun-44 Green OAT).

- TY1 futures are down -0-2+ today at 131-27+ with 10y UST yields up 1.1bp at 1.599% and 2y yields up 0.2bp at 0.148%.

- Bund futures are down -0.18 today at 169.97 with 10y Bund yields up 1.3bp at -0.186% and Schatz yields unch at -0.670%.

- Gilt futures are down -0.23 today at 126.95 with 10y yields up 2.4bp at 0.822% and 2y yields up 1.6bp at 0.071%.

FOREX: GBP Higher as Composite PMI Hits Series Record

- Having rolled off the week's highs of 1.4248 over the past few sessions, GBP is the strongest performer in G10 so far Thursday, with a decent final revision to May services PMI adding a tailwind. This bumped the composite PMI for May to 62.9, the highest such reading since the series began in 1998. GBP/USD eyes first resistance at 1.4248, which marks fresh 2021 highs, ahead of 1.4315, April 18 2018 high.

- USD also trades well, although markets will be wary of a repeat performance from Wednesday, where the USD gained throughout European hours before reversing course through the NY open. The USD Index sits just above the 90.00 handle at pixel time.

- Markets watch the release of ADP employment change today, weekly jobless claims and ISM services data. The manufacturing ISM earlier this week showed a sharp slowdown in the employment subcomponent, raising focus for Friday's nonfarm payrolls release, in which markets see net gains of around 650k jobs. The whisper number for Friday's headline is currently at a lofty 780k.

- Speeches are due from BoE's Bailey, Fed's Bostic, Kaplan, Harker and Quarles.

EQUITIES: US Futures Off Overnight Highs

- Asian markets closed mixed, with Japan's NIKKEI up 111.97 pts or +0.39% at 29058.11 and the TOPIX up 16.37 pts or +0.84% at 1958.7. China's SHANGHAI closed down 12.926 pts or -0.36% at 3584.212 and the HANG SENG ended 331.59 pts lower or -1.13% at 28966.03

- European equities are slightly weaker, with the German Dax down 20.27 pts or -0.13% at 15571.08, FTSE 100 down 41.12 pts or -0.58% at 7108, CAC 40 down 4.12 pts or -0.06% at 6521.52 and Euro Stoxx 50 down 5.08 pts or -0.12% at 4081.29.

- U.S. futures are a bit lower, with the Dow Jones mini down 44 pts or -0.13% at 34546, S&P 500 mini down 4.75 pts or -0.11% at 4201.5, NASDAQ mini down 11.25 pts or -0.08% at 13662.5.

COMMODITIES: Precious Metals Underperforming As Dollar Strengthens

- WTI Crude up $0.13 or +0.19% at $69.09

- Natural Gas down $0 or -0.13% at $3.086

- Gold spot down $14.18 or -0.74% at $1897.21

- Copper up $0.45 or +0.1% at $460.7

- Silver down $0.33 or -1.16% at $27.8715

- Platinum down $7.04 or -0.59% at $1187.41

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.