-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Monday, December 9

MNI US Open: European Energy Price Surge Continues

EXECUTIVE SUMMARY:

- EUROPEAN ENERGY PRICES SURGE TO RECORDS AS SUPPLY CRISIS SPREADS

- VILLEROY: INFLATION FORECAST JUSTIFIES KEEPING LOOSE ECB POLICY

- ECB'S KAZIMIR: FINANCING CONDITIONS CURRENLY VERY FAVORABLE

- ATHENS TO BUY FRENCH FRIGATES IN DEAL TO BOOST EU "STRATEGIC AUTONOMY"

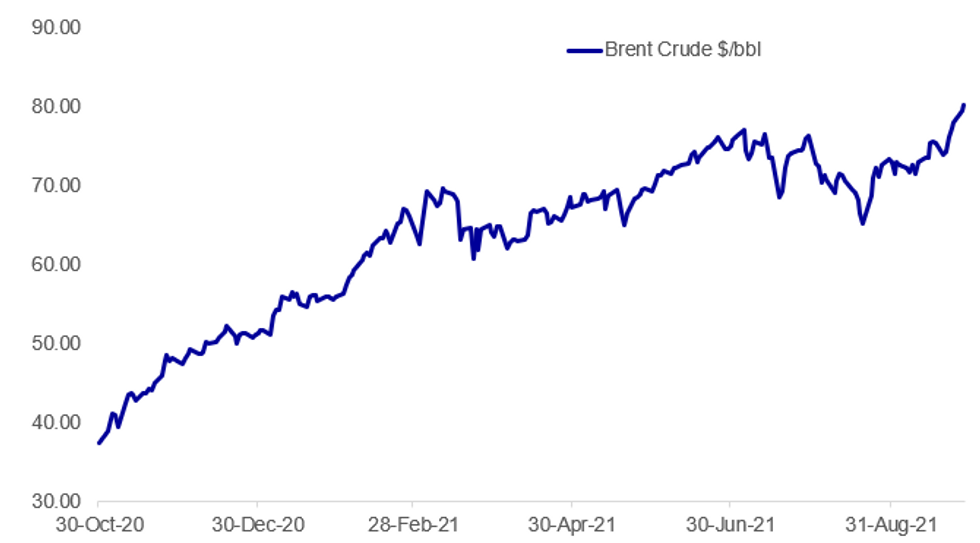

Fig.1: Brent Oil Hits 3-Yr High

Source: BBG, MNI

Source: BBG, MNI

NEWS:

EUROPE / ENERGY (BBG): European energy markets from natural gas to carbon permits jumped to records, signaling the supply shortage will get worse just as the winter season starts. Stockpiles of everything from natural gas to coal and Norwegian water for electricity production are dwindling and there are few signs the situation will improve anytime soon as demand continues to roar back from a pandemic-driven lull. Many of the U.K.'s smaller energy suppliers have collapsed, while some French electricity retailers are struggling to supply clients and are also at risk of folding. Meanwhile, Europe's miners have warned that the unprecedented prices could disrupt their shift away from fossil fuels. Dutch front-month natural gas futures surged as much as 12%, while carbon futures carbon futures jumped 2.2%. German electricity for next year and U.K. gas also climbed to new highs. Brent crude, the international benchmark, is trading above $80 a barrel for the first time since October 2018 and northwest European coal prices are at their highest since the financial crisis.

ECB (BBG): European Central Bank policy maker Francois Villeroy de Galhau says there is "no doubt" that inflation will be below 2% in 2023 and this "justifies therefore keeping accommodative monetary policy." Says there are undeniably tensions on supply and energy prices, but they will be "temporary" and are associated with the strong economic recovery in Europe.

ECB (BBG): The European Central Bank will take its next decision on bond-buying volumes under the pandemic purchase program in December, based on financing conditions, Governing Council member Peter Kazimir says. Financing conditions are "currently very favorable," Kazimir says.

U.K. / ENERGY (BBG): The U.K. officially put the military on standby to help deliver supplies to gasoline stations in an effort to stem a crisis that's engulfed Prime Minister Boris Johnson's government. A "limited number" of army tanker drivers will be trained up in case they're needed, the Department for Business, Energy and Industrial Strategy said late on Monday. Non-military holders of specialized licenses that allow them to drive hazardous substances will also have their permits extended.

E.U.: The governments of France and Greece have signed a deal in Athens for French firms to provide the Greek armed forces with at least three frigates. The deal comes in the wake of the cancellation of the Franco-Australian submarine deal and the creation of the AUKUS alliance that cause significant opprobrium in Paris. French President Emmanuel Macron has stated his desire for the EU to be able to act with more 'strategic autonomy', separate from the foreign policy aims and intentions of the United States. Greece is one of the few EU and NATO members that spends more than 2% of its GDP on defence, and as such is likely to provide a reliable partner to the French in the region.

EVERGRANDE (BBG): Hong Kong's central bank asked lenders to report their exposure to debt-laden China Evergrande Group on concern over potential systemic risks to the region's financial system, according to people familiar with the matter.The Hong Kong Monetary Authority queried lenders in the city last week, giving them 24 hours to respond on their financial commitments to China's most indebted developer, both in terms of lending and derivatives, one of the people said, asking not to be named because of confidentiality.

CRYPTO (BBG): A mistaken $24 million in crypto transaction fees is being returned, according to an exchange involved in the issue.Decentralized exchange DeversiFi, which had earlier called the price tag "erroneously high," expressed gratitude that the recipient was willing to cooperate. While fat-finger errors can spark sharp swings in traditional markets, they are uniquely problematic in the crypto world, since blockchain transactions are supposedly irreversible.

DATA:

No key data released in the European morning session.

FIXED INCOME: Lurch lower but some retracement

Despite some partial retracement, core fixed income remains lower across the board.

- TY1 hit a low of 131-09 but has since recovered to 131-16 at the time of writing. still well below yesterday's close of 131-25+. If we close lower today, TY1 will have fallen for six consecutive sessions for the first time since October.

- 10-year gilt yields breached 1% for the first time since May 2019 (with the exception of the intraday liquidity squeeze ahead of the announcement of QE in March 2020 at the beginning of the pandemic).

- Against this backdrop curves have steepened while peripheral spreads are mixed (Italy wider while Portugal, Spain, Greece are tighter).

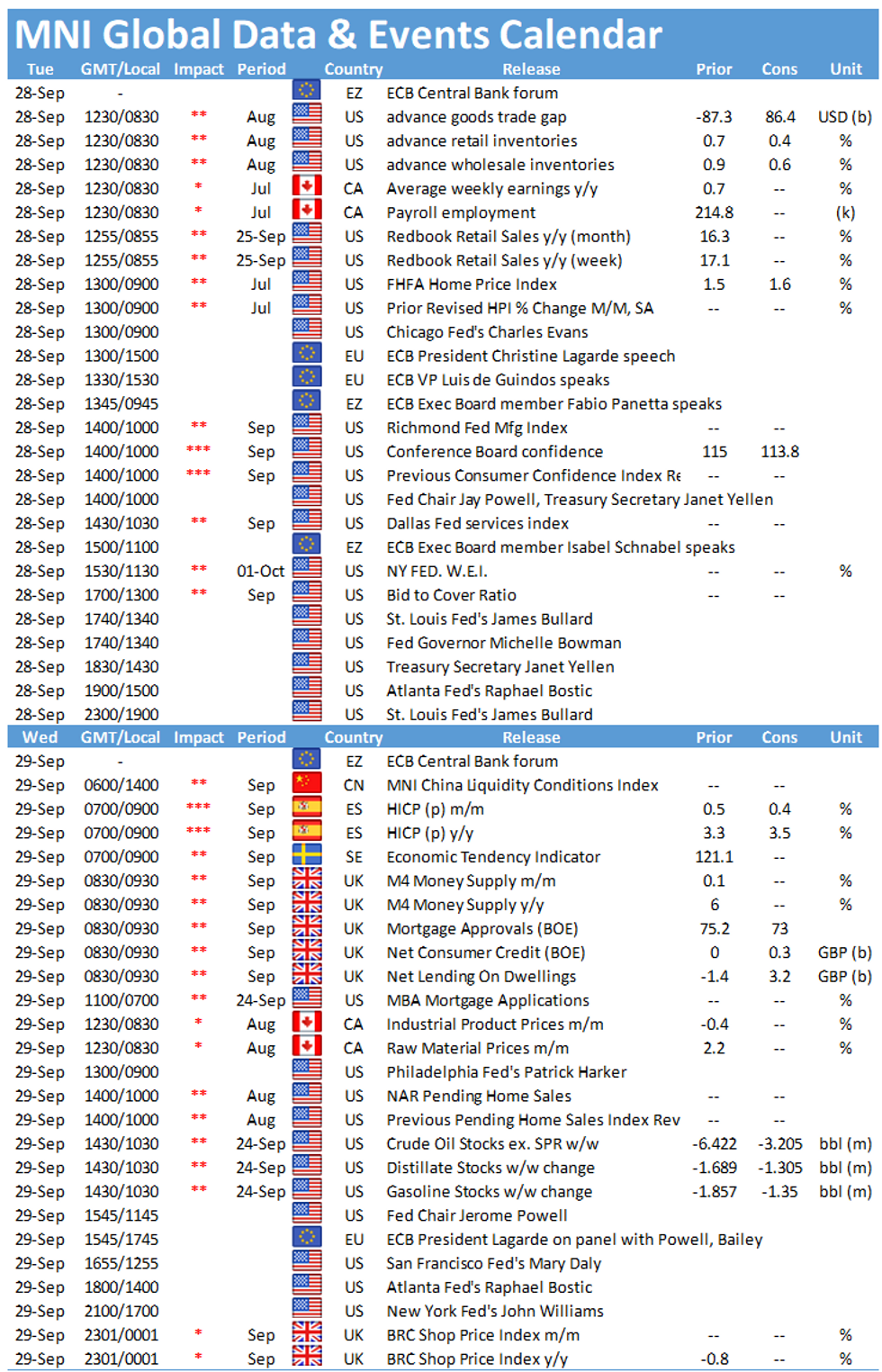

- There are a number of ECB speakers due today (due to the ECB Forum) while the BOE's Mann makes her first post-meeting appearance.

- Powell and Yellen are due to appear ahead of the Senate Banking Panel while we are also due to hear from Evans, Bostic and Bowman. US trade headlines the data releases.

- TY1 futures are down -0-9+ today at 131-16 with 10y UST yields up 3.6bp at 1.524% and 2y yields up 0.9bp at 0.312%.

- Bund futures are down -0.35 today at 169.82 with 10y Bund yields up 2.6bp at -0.198% and Schatz yields up 0.4bp at -0.692%.

- Gilt futures are down -0.48 today at 125.46 with 10y yields up 5.1bp at 1.002% and 2y yields up 3.6bp at 0.417%.

FOREX: Solid Yields Lead USD Index Toward Bull Trigger

- The greenback trades well headed into the Tuesday session, with the USD Index showing above last week's highs and narrowing the gap with the bull trigger at August 20th's 93.729. The greenback is following yields higher - as has been the case since the beginning of the week - with the 10y yield today already showing above 1.54% and the highest level since mid-June.

- Bond strength comes alongside equity weakness, with core markets off around 1% or so. The risk-off theme has filtered into growth proxies and high beta FX, leading NZD to trade at the bottom of the pile alongside NOK (which trades off despite firm oil prices).

- JPY is failing to benefit from the stock market weakness, keeping the USD/JPY uptrend intact as it targets the July highs of 111.66.

- US trade balance data and the September consumer confidence release are the data highlights Tuesday, with appearances from ECB's Lagarde, Schnabel and Panetta due as well as Fed's Evans, Powell, Bowman and Bostic.

EQUITIES: Retracing

- Asian equities closed mixed, with Japan's NIKKEI down 56.1 pts or -0.19% at 30183.96 and the TOPIX down 5.97 pts or -0.29% at 2081.77. China's SHANGHAI closed up 19.388 pts or +0.54% at 3602.219 and the HANG SENG ended 291.61 pts higher or +1.2% at 24500.39

- European stocks are weaker, with the German Dax down 115.97 pts or -0.74% at 15535.33, FTSE 100 down 29.77 pts or -0.42% at 7063.4, CAC 40 down 88.21 pts or -1.33% at 6650.91 and Euro Stoxx 50 down 52.07 pts or -1.25% at 4151.34.

- U.S. futures are also lower, with the Dow Jones mini down 108 pts or -0.31% at 34633, S&P 500 mini down 28 pts or -0.63% at 4404.75, NASDAQ mini down 179.75 pts or -1.18% at 15014.5.

COMMODITIES: Gas Still Soaring, WTI Nears 3-Yr Highs

- WTI Crude up $0.88 or +1.17% at $76.4

- Natural Gas up $0.39 or +6.8% at $6.176

- Gold spot down $7.19 or -0.41% at $1738.29

- Copper down $3.15 or -0.73% at $428.05

- Silver down $0.27 or -1.17% at $22.336

- Platinum down $5.56 or -0.57% at $979.82

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.