-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Inflation Pressures Continue To Build

MNI US Open: Inflation Pressures Continue To Build

EXECUTIVE SUMMARY:

- UK Inflation Surged Further In November

- US Congress Votes to Lift Debt Ceiling

- Near-Term Focus Shifts To US Retail Sales, Ahead of the FOMC Later Today

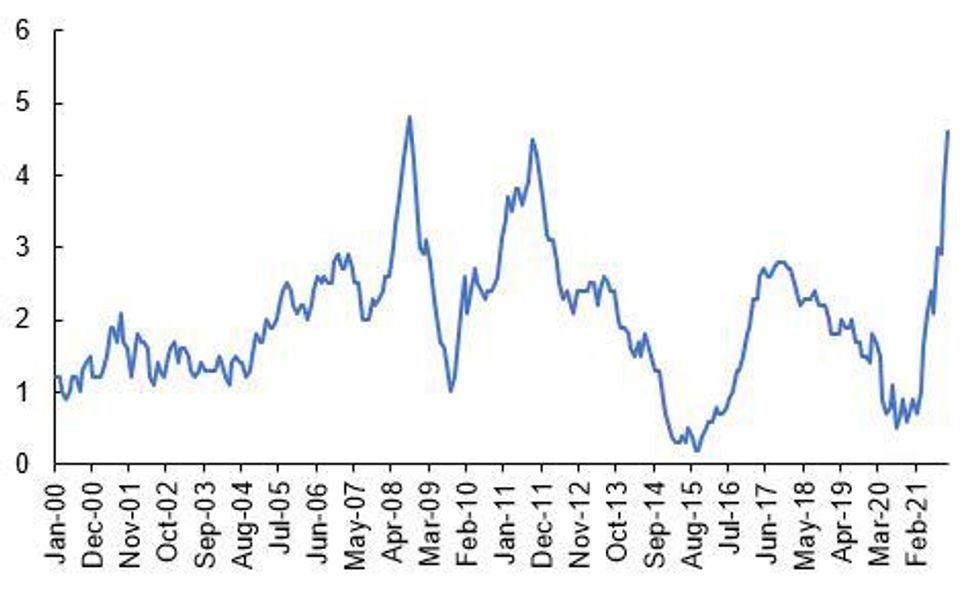

Fig 1. UK CPI, % Y/Y

Source: MNI/Bloomberg

NEWS

US (FT): US lawmakers have voted to raise the government borrowing limit by $2.5tn, in an eleventh-hour effort to avert default before the end of the year. The Senate voted on Tuesday evening to lift the debt ceiling to $31.4tn in a party-line vote. The House of Representatives later passed the same measure shortly after midnight. The votes came just before a December 15 deadline set by Janet Yellen, US Treasury secretary, who has for weeks warned about the risks of a government default. Republicans and Democrats have been at odds over the debt ceiling, with the GOP insisting that President Joe Biden’s party “go it alone” in lifting the borrowing limit while blaming Democrats for reckless spending.

US-CHINA (FT): The US Treasury will put DJI and the other firms on its “Chinese military-industrial complex companies” blacklist on Thursday, according to two people briefed on the move. US investors are barred from taking financial stakes in the 60 Chinese groups already on the blacklist. The measure marks the latest effort by US president Joe Biden to punish China for its repression of Uyghurs and other Muslim ethnic minorities in the north-western Xinjiang region. Last week, SenseTime, the facial recognition software company, postponed its planned initial public offering in Hong Kong after the Financial Times reported that the US was set to place the company on the blacklist. The other Chinese companies that will be sanctioned on Thursday include Megvii, SenseTime’s main rival that last year halted plans to list in Hong Kong after it was put on a separate US blacklist, and Dawning Information Industry, a supercomputer manufacturer that operates cloud computing services in Xinjiang.

COVID (REUTERS): All three U.S.-authorized COVID-19 vaccines appear to be significantly less protective against the newly-detected Omicron variant of the coronavirus in laboratory testing, but a booster dose likely restores most of the protection, according to a study released on Tuesday. The study from researchers at Massachusetts General Hospital (MGH), Harvard and MIT that has not yet been peer reviewed tested blood from people who received the Moderna, Johnson & Johnson and Pfizer/BioNTech vaccines against a pseudovirus engineered to resemble the Omicron variant.

UK (GUARDIAN): Any further measures to limit the spread of the Omicron variant of coronavirus would lead to a recall of the House of Commons for a vote, the cabinet minister Grant Shapps has said. After disquiet among backbenchers over plans for vaccine certificates led to a rebellion by 99 Conservative MPs on Tuesday, Shapps told BBC Radio 4’s Today programme that he believed the precautions now in pace would be enough to keep Omicron under control. But he said: “If more measures were required … then of course the house would be recalled and those measures would be put to the house. But I don’t think that’s going to need to happen this year.”

DATA

UK NOV CORE CPI +0.5% M/M, +4.0% Y/Y

MNI: UK NOV CPI +0.7% M/M, +5.1.% Y/Y

MNI: UK Nov OUTPUT PPI +0.9% M/M, +9.1% Y/Y

FIXED INCOME: Gilt curve bear flattens on CPI print; FOMC the highlight later

There is some divergence in core fixed income markets this morning.

- The biggest moves have been seen in gilt markets with the curve bear flattening after this morning's higher than expected CPI data (headline and core both 3 tenths higher than expected at 5.1%Y/Y and 4.0%Y/Y respectively). Markets are now looking for just under a 50% probability of a BOE hike tomorrow, up from around 35% probability yesterday.

- The event of the day of course will be the FOMC meeting. Ahead of this the Treasury curve has bear flattened. A faster pace of tapering is fully priced into the curve. What would be more market moving would be the FOMC more than 2 hikes in 2022, or a hiking pace faster than 3 hikes per year. This would be a hawkish development.

- And of course we have the ECB tomorrow, but today the Bund curve is only seeing small moves with peripheral spreads mixed (Spain wider, Italy and Greece tighter).

- TY1 futures are up 0-2+ today at 130-23 with 10y UST yields down -1.0bp at 1.433% and 2y yields up 0.2bp at 0.660%.

- Bund futures are unch today at 174.46 with 10y Bund yields down -0.3bp at -0.374% and Schatz yields unch at -0.695%.

- Gilt futures are down -0.27 today at 127.09 with 10y yields up 2.2bp at 0.744% and 2y yields up 5.0bp at 0.484%.

FOREX: Most of the early action is in the Pound

- Most of the early action has been in the Pound in G10, during the early trading European session.

- The UK CPI beat provided some buying interest in the currency, which is up versus all G10, besides the AUD.

- The Pound has nonetheless faded from its best levels, with the attention from most market participants turning to the FOMC later today.

- Turnovers and volumes have been on the very low side, ahead of the Central Bank meeting, today and tomorrow.

- There's some focus this week on Option expiry, with USDJPY 1.46bn at 113.75 for today.

- Looking at Friday, and these may act as a magnet, although direction will be led by the CB's outcome before that day.

- EURUSD has 2.38bn at 1.1300 for Friday's expiry, GBPUSD 1.43bn at 1.3250, and USDJPY 1.61bn at 113.75.

- Focus on the data front front this afternoon will be on the US retail sales.

- But all attention is on the Fed, and as mentioned in our MNI preview,:

- The FOMC is expected to shift in a hawkish direction as it weighs rising inflation risks.

- This shift will include a doubling of the pace of the asset purchase taper, a more aggressive rate “dot plot”, and an adjustment in the Statement language (including eliminating the word “transitory” to describe inflation).

FX OPTION EXPIRY

FX OPTION EXPIRY: (Closest ones)

Of note:

USDJPY 1.46bn at 113.75 (for today)

EURUSD 2.38bn at 1.1300 (Friday expiry)

GBPUSD 1.43bn at 1.3250 (Friday expiry)

USDJPY 1.61bn at 113.75 (Friday expiry)- EURUSD: 1.1200 (700mln), 1.1250 (278mln), 1.1275 (266mln), 1.1300 (760mln), 1.1350 (529mln)

- GBPUSD: 1.3225 (469mln), 1.3240 (391mln), 1.3250 (343mln)

- USDJPY: 113.50 (490mln), 113.75 (1.46bn) 113.95 (460mln), 114 (375mln)114.20 (1.08bn)

- AUDUSD: 0.7100 (366mln)

EQUITIES: Mixed moves in European markets this morning

- Japan's NIKKEI up 27.08 pts or +0.1% at 28459.72 and the TOPIX up 10.29 pts or +0.52% at 1984.1

- China's SHANGHAI closed down 13.895 pts or -0.38% at 3647.63 and the HANG SENG ended 215.19 pts lower or -0.91% at 23420.76

- German Dax up 49.97 pts or +0.32% at 15501.91, FTSE 100 down 33.17 pts or -0.46% at 7184.12, CAC 40 up 36.16 pts or +0.52% at 6928.79 and Euro Stoxx 50 up 20.06 pts or +0.48% at 4164.7.

- Dow Jones mini up 27 pts or +0.08% at 35575, S&P 500 mini down 2.25 pts or -0.05% at 4635.75, NASDAQ mini down 45.5 pts or -0.29% at 15884.75.

COMMODITIES: Natgas bucking the theme of lower commodity prices today

- WTI Crude down $0.65 or -0.92% at $70.14

- Natural Gas up $0.05 or +1.44% at $3.801

- Gold spot down $1.43 or -0.08% at $1770.12

- Copper down $6.95 or -1.63% at $418.85

- Silver down $0.09 or -0.41% at $21.8647

- Platinum down $13.39 or -1.45% at $911.55

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.