-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Key Data Week Begins With Caution

EXECUTIVE SUMMARY:

- ECB'S PANETTA: MUST NOT FEAR MONETARY, FISCAL WORKING TOGETHER

- NEW UK HEALTH SEC JAVID TO GIVE UPDATE ON LIFTING MEASURES IN ENGLAND

- SWEDISH PM LOFVEN RESIGNS IN WAKE OF NO-CONFIDENCE VOTE

- FITCH AFFIRMS CHINA AT 'A+'; OUTLOOK STABLE

Fig. 1: Travel Stocks Weaken On Continued Uncertainty

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB (BBG): "A return of macroeconomic policy to the pre-pandemic status quo would be an immense wasted opportunity. NGEU, flexible monetary policy, monetary-fiscal interactions – all of these innovations are helping our monetary union to function better," ECB Executive Board member Fabio Panetta said. "We should not be afraid of monetary and fiscal policies working together when interest rates are near the lower bound"/ "We do not seem to be on track to 'run the economy hot'". "There needs to be the confidence that combined policy support will not be withdrawn prematurely"

UK/COVID (BBC): New Health Secretary Sajid Javid will update MPs later on when the Covid measures will be lifted in England. His address will come less than 48 hours after he took over following Matt Hancock's resignation. Prime Minister Boris Johnson has said the remaining restrictions will ease on 19 July, but has also promised a data review to see if this can happen two weeks earlier on 5 July. The Commons is expected to be given the details of this review. The ministerial statement about coronavirus restrictions is expected in the House of Commons at about 15:30 BST.

SWEDEN (RTRS): Swedish Prime Minister Stefan Lofven said on Monday he had handed in his notice of resignation, giving parliament's speaker the job of finding a new premier after the Social Democrat leader lost a vote of no-confidence last week. Lofven lost the confidence vote in parliament on June 21 after the Left Party withdrew its support, triggering frenzied talks as both the centre-left and centre-right tried to line up enough support to form a government. He had until midnight tonight to find fresh backing in parliament, enabling him hand over the job of finding a new government to the speaker with the expectation of being reappointed, or to call a snap election.

CHINA/RATINGS: Fitch Ratings has affirmed China's Long-Term Foreign-Currency Issuer Default Rating (IDR) at 'A+' with a Stable Outlook. China's ratings are supported by the country's robust external finances, a record of strong and resilient macro performance, and size as the world's second-largest economy. The ratings are constrained by fiscal and macro-financial stability risks associated with China's highly indebted non-government sector, and per capita income and governance scores that fall below 'A' peers.

RUSSIA (RTRS): Russia's central bank will consider raising interest rates by between 25 and 100 basis points at its next rate-setting meeting on July 23, amid high inflation, Governor Elvira Nabiullina said on Monday. Speaking on Bloomberg TV, Nabiullina said monetary policy was the main tool to curb inflation, which has accelerated sharply above the bank's 4% target this year.

RUSSIA (RTRS): Russia has successfully test launched a new intercontinental ballistic missile from the Plesetsk cosmodrome in the country's northwest, the TASS news agency reported on Monday, citing a source in the defense industry.The launch took place in mid-June, the source said.

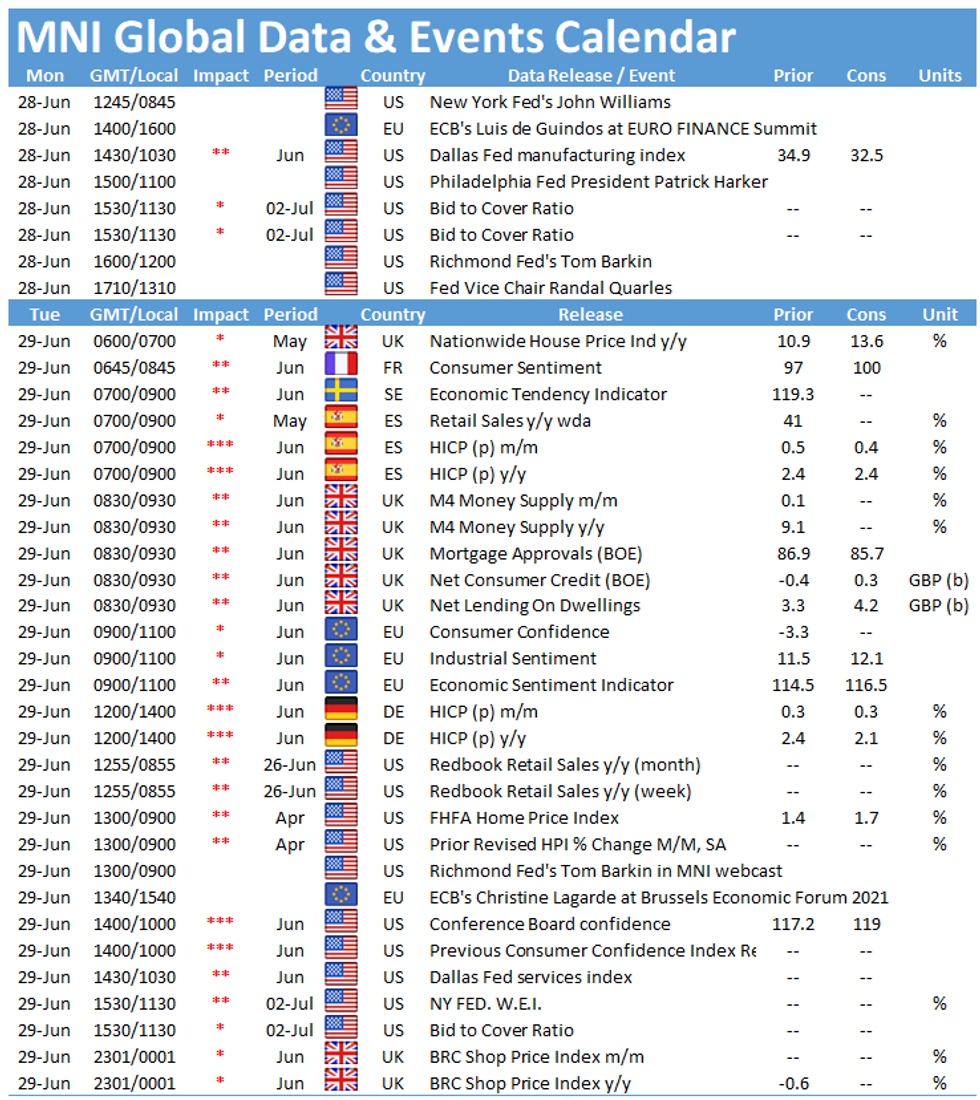

DATA:

*GERMANY MAY EXPORT PRICES +0.7% M/M, +4.2% Y/Y

FIXED INCOME: Bull flattening

Bull flattening has been the theme for core FI to begin the week. The biggest moves have been seen in gilts.

- Despite today's data calendar being rather light, the week as a whole has a number of key data points. In Europe, flash HICP prints will be the main talking point kicking off with Spanish and German prints tomorrow ahead of Wednesday's French, Italian and Eurozone aggregate flash readings. Across the pond in the US, the focus will be skewed more towards the labour market with ADP on Wednesday, ahead of payrolls on Friday.

- This week is also likely to see a fair amount of supply in Europe with a second NGEU syndicated transaction expected alongside over E25bln of EGBs sold via auctions.

- TY1 futures are up 0-4+ today at 132-00 with 10y UST yields down -0.7bp at 1.518% and 2y yields down -0.4bp at 0.263%.

- Bund futures are up 0.15 today at 171.92 with 10y Bund yields down -0.9bp at -0.165% and Schatz yields down -0.2bp at -0.654%.

- Gilt futures are up 0.09 today at 127.64 with 10y yields down -1.4bp at 0.764% and 2y yields down -0.4bp at 0.074%.

FOREX: Deluge of CB Speakers Props Up Headline Risk

- GBP is among the better performers in G10, with early gains in GBP/USD coming ahead of the first appearance of Sajid Javid in parliament as the new Secretary of State for Health, and is expected to reaffirm his commitment to a normalization of COVID restrictions as quickly as possible. Early strength in GBP/USD saw the pair touch 1.3940 before retracing, although near-term gains continue to appear corrective.

- Scandi currencies have diverged, with NOK among the weakest in G10 while SEK rises to the top of the pile. As expected, the Swedish PM has announced his resignation, prompting the speaker to seek a new government in lieu of another election.

- There are no tier one data releases due Monday, keeping focus on the speakers slate. There are no fewer than 10 separate ECB speeches - the most important of which being ECB's Weidmann - one of the ECB members speculated to have voted against the PEPP programme at the most recent rate decision. BoE's Haldane and Fed's Williams, Barkin & Quarles are also due.

EQUITIES: Soft Start To The Week, Though NASDAQ Higher

- Asian stocks closed mixed, with Japan's NIKKEI down 18.16 pts or -0.06% at 29048.02 and the TOPIX up 3.02 pts or +0.15% at 1965.67. China's SHANGHAI closed down 1.19 pts or -0.03% at 3606.372 and the HANG SENG ended 19.92 pts lower or -0.07% at 29268.3.

- European equities are weaker, with the German Dax down 27.67 pts or -0.18% at 15632.99, FTSE 100 down 33.54 pts or -0.47% at 7136.07, CAC 40 down 27.68 pts or -0.42% at 6622.87 and Euro Stoxx 50 down 18.31 pts or -0.44% at 4119.82.

- U.S. futures are mixed, with the Dow Jones mini down 40 pts or -0.12% at 34293, S&P 500 mini down 0.25 pts or -0.01% at 4271, NASDAQ mini up 27.25 pts or +0.19% at 14366.25.

COMMODITIES: Modest Weakness Across The Board

- WTI Crude down $0.2 or -0.27% at $74.06

- Natural Gas up $0.03 or +0.92% at $3.54

- Gold spot down $3.34 or -0.19% at $1783.27

- Copper down $1.7 or -0.4% at $429.65

- Silver down $0.03 or -0.13% at $26.1964

- Platinum down $2.95 or -0.27% at $1115.05

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.