-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI US OPEN - Oil Eases as Israel Back Out of Khan Younis

EXECUTIVE SUMMARY:

- ISRAEL BACKS OUT OF KHAN YOUNIS, GAZA

- UK GROWTH AT A "TURNING POINT" - BDO

- CHINA MAINTAINS YUAN DEFENSE WITH MIDPOINT FIX

- US TO WARN CHINA OVER SOUTH CHINA SEA MILITARY OUTPOST

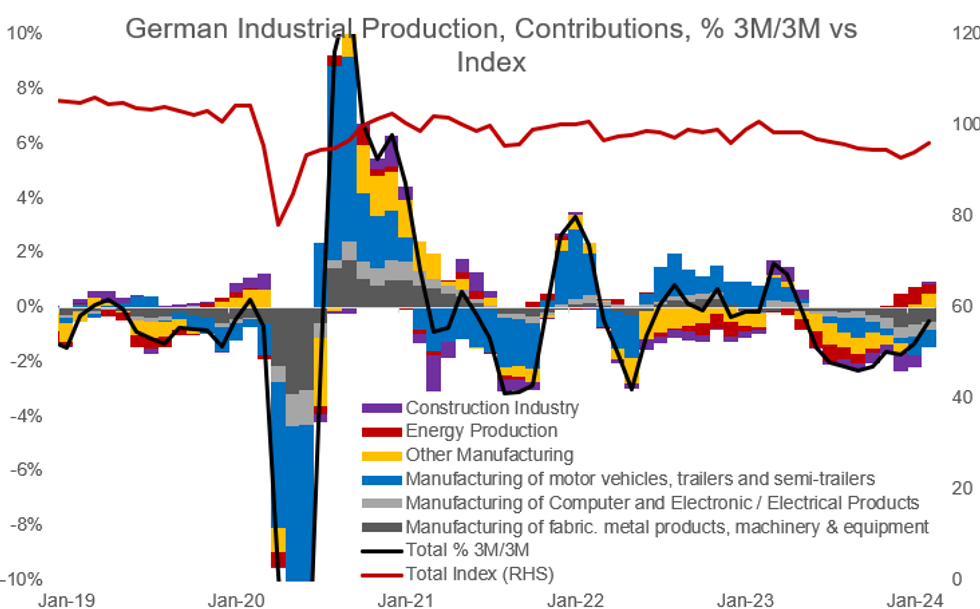

Figure 1: German Industrial Production ticks higher, but outlook remains clouded

NEWS:

JAPAN (MNI): Japan Mar Sentiment, Outlook Indexes Drop

The Japanese government has left its economic assessment unchanged despite both its sentiment and outlook indices falling, the Economy Watchers report released by the Cabinet Office showed Monday. The sentiment index stood at a seasonally adjusted 49.8 in March, down from 51.3 in February, its first fall in two months, while the outlook index for two-to-three months ahead fell 1.8 points to 51.2 -- its first drop in five months. The indexes linked to the households and businesses fell but those of labour market rose.

ISRAEL (BBG): Israel Backs Out of Khan Younis to Prepare ‘Future Operations’

Military officials said on Sunday that Israel is pulling some troops out of the city of Khan Younis in Gaza, saying it had ended its mission there as the war against Hamas reached the six-month mark. Israel said its 98th Commando Division had moved out of Khan Younis and the Gaza Strip “to recuperate and prepare for future operations.”

ECB (BBG): Former Senior Banker Patsalides to Head Cyprus’s Central Bank

Former banking executive Christodoulos Patsalides will replace Constantinos Herodotou as governor of Cyprus’s central bank, according to a statement from the Cyprus President’s office. Patsalides, who’s been a special adviser on economic affairs to President Nikos Christodoulides since March 2023, will take over on April 11 when Herodotou’s term ends.

US/CHINA (BBG): Biden to Say South China Sea Outpost Part of Defense Deal: FT

President Joe Biden will warn China that a US defense treaty with the Philippines covers a maritime outpost that’s become a focus of Beijing’s aggression, the Financial Times reported, effectively drawing a red line amid rising tensions in the South China Sea. The US president will use a visit this week by Japanese Prime Minister Fumio Kishida and Philippines President Ferdinand Marcos Jr. to express serious concerns regarding ongoing tensions around Second Thomas Shoal, where Chinese vessels regularly collide with and use water cannons on Philippine ships, the FT reported, citing two senior US officials it didn’t identify.

UK (The Times): Growth at a ‘turning point’ as UK economy gains momentum

Output reached its highest level since May 2022 last month and inflation slid to its lowest point in more than three years, according to research by BDO. The UK looks to have emerged from recession and the economy is generating momentum, with two closely watched surveys revealing that growth has reached a “turning point”. Research by BDO, the consultancy, found that output reached its highest level since May 2022 last month and inflation slid to its lowest point in more than three years.

NORWAY (BBG): Labor Unions Reach Wage Deal to Avert Large Strike

Norway’s employers and two industrial trade unions clinched an agreement on wages with the help of the state mediator, averting a wide-ranging strike. The Federation of Norwegian Industries reached a deal in overtime with the Fellesforbundet union for a wage increase of 5.2%, the union said in a statement, with Parat, a smaller union, agreeing on a similar increase late on Sunday. The central bank forecast annual wage growth of 4.9% this year in its March monetary policy report.

CHINA (BBG): Chinese State Bank Asks Court to Liquidate Developer Shimao

Defaulted Chinese developer Shimao Group Holdings Ltd. is facing a demand to liquidate from creditor China Construction Bank (Asia) Corp., one of the most prominent examples yet of a state-backed bank trying to claw back money from a distressed developer.

CHINA (BBG): China Maintains Yuan Defense After Currency Nears Red Line

China stuck to a pattern of keeping yuan weakness contained as pressure from a resilient dollar and poor investor sentiment pushes it toward a policy red line. The People’s Bank of China kept its daily reference rate for the managed currency broadly unchanged, implying to traders that yuan stability is key. China sets the so-called fixing at 9:15 a.m. local time, around which the currency is then permitted to trade in a 2% range.

MEXICO (BBG): Mexico Candidates Squabble in First Debate Light on Proposals

Mexico’s presidential candidates traded attacks and attempted to discredit each other in the first debate of the 2024 race, while going light on details of proposals to address corruption, education and health. The debate, the first of three ahead of June 2 elections, pit ruling party candidate Claudia Sheinbaum against main competitor Xochitl Galvez and third-party candidate Jorge Alvarez Maynez, all of whom spent much of the time pulling out placards to illustrate one another’s alleged corruption or mismanagement scandals.

METALS (BBG): UBS Jacks Up Year-End Gold Forecast to $2,500 as Rally Builds

UBS Group AG boosted its year-end gold outlook by 11% to $2,500/oz, with a revival in demand for bullion-backed exchange traded funds set to support another leg up when the Federal Reserve cuts rates around mid-year.

EQUITIES (BBG): Goldman Strategists Expect Europe to Beat US Over Next 12 Months

Goldman’s strategists say European equities are likely to outperform the US over the next 12 months as the region is now trading at a deeper discount than history, especially in sectors like financials, energy and consumer discretionary.

DATA:

MNI: SWISS MAR UNEMPLOYMENT -2.9% M/M, +17.1% Y/Y

SWISS MAR UNEMPLOYMENT RATE +2.3%

JAPAN (MNI): Japan Feb Negative Real Wage Widens to -1.3%

The year-on-year drop of inflation-adjusted real wages, a barometer of households' purchasing power, widened to 1.3% in February from a 1.1% fall in January, preliminary data released by the Ministry of Health, Labour and Welfare on Monday showed. February’s result represents the 23rd straight month wages have remained in negative territory, which will impede household spending. The degree of negative real wages is expected to narrow as the y/y rise of consumer price index will likely slow.

GERMAN DATA: Industrial Production Ticking Higher, But Outlook Remains Clouded

German industrial production exceeded expectations in February with a second consecutive monthly uptick of 2.1% M/M (highest since January 2023; vs +0.5% cons/+1.3% prior revised from +1.0%) but is still clearly in negative territory on a yearly comparison at -4.9% Y/Y (vs -6.8% cons/-5.3% prior revised from -5.5%).

- Overall this is a strong report, especially when considering the upward revision of last month, and was driven by strong developments in the construction and automotive industries. The less volatile 3M/3M measure also improved to -0.5% (vs -1.4% prior), which while still negative was the highest value since May 2023.

- Looking at individual components of production ex-energy and construction, the uptick was broad-based, with intermediate goods +2.5% M/M (vs +4.3% prior), investment goods +1.5% M/M (vs -1.5% prior), durable goods +3.0% M/M (vs +1.1% prior), non-durable goods +1.6% M/M (vs +4.0% prior) and consumption goods +1.9% (vs +3.4% prior).

- A split across industries shows strength especially in construction with its highest monthly increase since March 2021 (+7.9% M/M, vs +2.9% prior) as well as in automotive (+5.7% M/M, vs -4.0% prior, highest increase since August 2023) and pharmaceutical production (+6.4% M/M, vs -0.8% prior). There were some weaker sectors, also, however: energy production for instance came in at -6.5% M/M (vs -2.7% prior).

- Despite the strong IP figures, the outlook for German industrial activity remains clouded.

- Other hard data and surveys suggest no rebound is imminent, with February's factory orders surprising to the downside, manufacturing PMI falling to a 5-month low in March, and the March EC manufacturing confidence survey plumbing the lowest levels since the pandemic. Even the construction production growth appears at odds with very weak construction PMI.

- MNI's median of sellside analysts' estimates of Y/Y industrial production hasn't changed in the past month after downward revisions earlier in the year and sees continued falls through Q3 2024 (-5.5% Y/Y Q1, -3.6% Q2, -0.3% Q3, +1.9% Q4).

MNI, Destatis

MNI, Destatis

FOREX: US Yields Continue March Higher, But USD Unphased

- The dollar takes up the midpoint of the G10 table so far Monday, shrugging off a continued rise in the US 10y yield, which rose to another recovery high at 4.4520% today as markets continue to gravitate toward fewer Fed rate cuts this year than initially envisaged. Just over 2 x 25bps rate cuts are now priced for this calendar year, down from over seven rate cuts priced at the beginning of 2024.

- CHF is the poorest performer so far, a move that's keeping the uptrend in EUR/CHF underpinned. Cycle highs at 0.9849 remain the bull trigger, a break above which puts the cross at the best levels since April last year.

- Scandi currencies are among the session's best performers, with NOK shrugging off the pullback in oil prices. EUR/NOK trades close to last week's lows, with the striking of a sizeable wage deal with labour unions adding to domestic inflationary pressure and possibly restricting the Norges Bank's space with which to ease policy this year.

- The schedule for Monday is typically muted, with few datapoints for markets to digest ahead of the US CPI report on Wednesday. Central banks are similarly quiet, however BoE's Breeden and Fed's Goolsbee set to make appearances.

EGBS: Strong German IP and Hawkish Fed Repricing Weighs On EGBs

Core/semi-core EGBs remain under pressure to begin the week, with hawkish Fed cut repricing and a strong German IP reading the main drivers this morning.

- German industrial production exceeded expectations in February with a second consecutive monthly uptick of 2.1% M/M (highest since January 2023; vs +0.5% cons/+1.3% prior revised from +1.0%).

- This added to the negative bias that was seen through the Asia-Pac session, largely a continuation of hawkish Fed repricing following Friday’s US strong jobs report.

- Bunds are -48 ticks at 131.74, having breached the April 2 low at 131.87. A continuation lower would refocus attention on key support and the bear trigger at 131.23, the Feb 29 low.

- German cash yields are 4 to 5bps higher today, while the French curve has bear flattened.

- 10-year periphery spreads to Bunds are tighter, with European equities edging higher to start the week.

- The remainder of today’s calendar is quiet, with market focus on Wednesday’s US CPI report before Thursday’s ECB decision.

GILTS: Macro Matters Weigh, Futures Pierce Key Support

Pressure in wider core global FI markets continues to weigh on gilts as the post-NFP re-assessment of the Fed outlook extends.

- Elsewhere, the lack of meaningful escalation in Middle East geopolitical tension will be factoring in.

- Gilt futures -46 at 98.00, after piercing key short-term support to trade as low as 97.96. The bearish threat is deepening.

- Fresh downside impetus would expose the 76.4% retracement of the Feb 29-Mar 12 rally (97.67).

- Cash gilt yields 3-6bp higher, 7- to 10-Year sector leading the move.

- 10s threaten a clean break above their mid-March high.

- SONIA futures are flat to -5.5.

- BoE-dated OIS shows ~69bp of ’24 cuts, with June & August MPC pricing in familiar territory.

- The aforementioned global matters dominate, with the latest signs of loosening in the UK labour market (REC/KPMG report) having little lasting impact.

- Comments from BoE’s Breeden and short bucket BoE APF sales are due later today.

EQUITIES: Eurostoxx Pullback Deemed Corrective

The trend condition in S&P E-Minis remains bullish, however, the recent move lower highlights a corrective cycle and last week's sell-off reinforces this condition. The contract has breached bull channel support drawn from the Jan 17 low, and cleared the 20-day EMA. The uptrend in Eurostoxx 50 futures remains intact and last week’s pullback is considered corrective. The break of support around the 20-day EMA - at 4965.40 - suggests potential for a deeper retracement near-term.

- Japan's NIKKEI closed higher by 354.96 pts or +0.91% at 39347.04 and the TOPIX ended 25.7 pts higher or +0.95% at 2728.32.

- Elsewhere, in China the SHANGHAI closed lower by 22.244 pts or -0.72% at 3047.052 and the HANG SENG ended 8.93 pts higher or +0.05% at 16732.85.

- Across Europe, Germany's DAX trades higher by 84.19 pts or +0.46% at 18262.25, FTSE 100 lower by 0.43 pts or -0.01% at 7912.07, CAC 40 up 33.92 pts or +0.42% at 8096.31 and Euro Stoxx 50 up 13.38 pts or +0.27% at 5028.91.

- Dow Jones mini down 54 pts or -0.14% at 39170, S&P 500 mini down 9.75 pts or -0.19% at 5244.5, NASDAQ mini down 27.5 pts or -0.15% at 18277.75.

COMMODITIES: Gold Trend Condition Remains Bullish

The trend condition in Gold remains bullish and the yellow metal is again trading higher and starts the week on a bullish note. This maintains the price sequence of higher highs and higher lows and note that moving average studies are in a bull-mode condition. A bull theme in WTI futures remains intact and last week’s rally reinforces current condition, confirming a resumption of the uptrend. The contract has traded through $84.87, the Sep 15 ‘23 high, paving the way for a climb towards the $90.00 handle further out.

- WTI Crude down $0.72 or -0.83% at $86.26

- Natural Gas down $0.02 or -0.95% at $1.768

- Gold spot up $7.25 or +0.31% at $2336.53

- Copper up $4.3 or +1.02% at $427.6

- Silver up $0.35 or +1.27% at $27.82

- Platinum up $9.09 or +0.98% at $939.56

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/04/2024 | 1530/1630 |  | UK | BOE's Breeden Panellist at 'Towards the future of the monetary system' | |

| 08/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 08/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 09/04/2024 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 09/04/2024 | 0645/0845 | * |  | FR | Foreign Trade |

| 09/04/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 09/04/2024 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/04/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 09/04/2024 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.