-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Post-Pandemic Trades Tested Once Again

EXECUTIVE SUMMARY:

- USD STRONGER, STOCKS WEAKER, SAFE HAVEN BONDS HIGHER

- OXFORD'S COVID-19 VACCINE TRIAL RESULTS "DEFINITELY" BEFORE CHRISTMAS

- ECB'S LAGARDE: PEPP, TLTRO LIKELY REMAIN TOOLS OF CHOICE

- E.U. BUDGET AGREEMENT IN FOCUS AT EUROPEAN COUNCIL

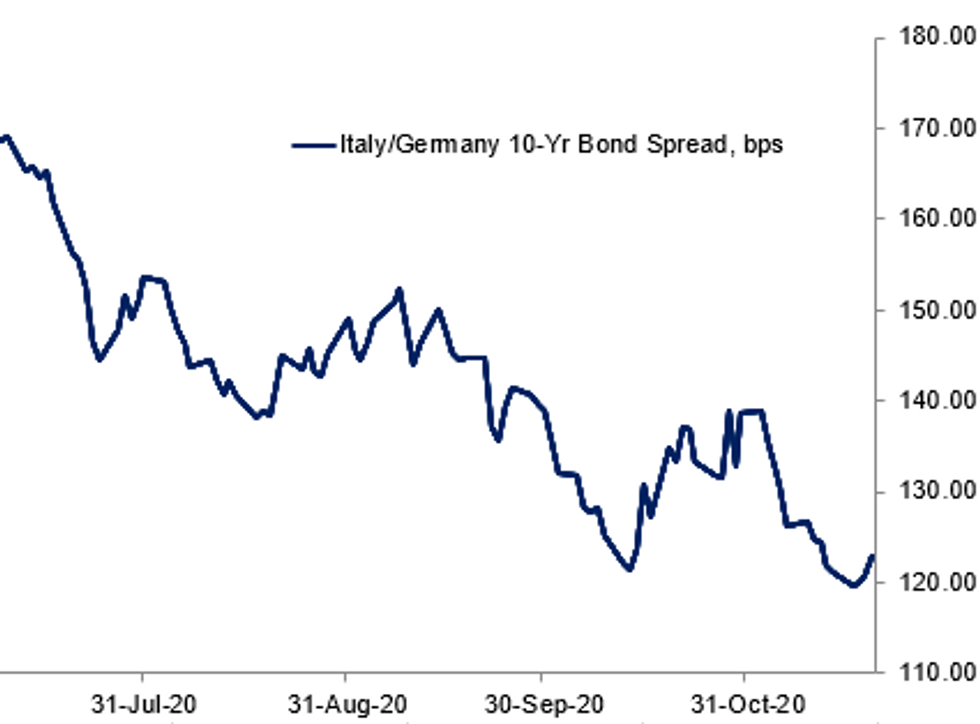

Fig. 1: Periphery Eurozone Spreads Widening With Questions Raised Over E.U. Funds

BBG, MNI

BBG, MNI

COVID (RTRS): Results of late-stage trials of University of Oxford's COVID-19 vaccine candidate should definitely be known by Christmas, the chief investigator on the study said on Thursday, adding it was too early to know its efficacy yet. Asked if it was too early to say whether the vaccine, which is licensed to AstraZeneca, stops disease developing, Andrew Pollard, director of the Oxford Vaccine Group, said: "We haven't quite got to that point yet. We're obviously not going to rush that." "We're getting close, and it's definitely going to be before Christmas, based on the progress," he told BBC Radio when asked when the trial investigators would be unblinded to efficacy data and results released.

COVID (BBG): The University of Oxford confirmed that the Covid-19 vaccine it's developing with AstraZeneca Plc produced strong immune responses in older adults in an early study, with pivotal findings from the final phase of trials expected in the coming weeks. The results, published Thursday in The Lancet medical journal, shed more light on preliminary data released in recent months showing the experimental shot generated an immune response in older people, who are at highest risk of severe illness. Researchers are still eagerly awaiting late-stage trial results that will show whether the Astra-Oxford vaccine can meet the high bar set by front-runners Pfizer Inc. and Moderna Inc.

ECB: Europe still sees challenges on both economic and health issues in coming months, European Central Bank President Christine Lagarde said Thursday, again underlining that there are still downside risks and a key challenge for policymakers will be 'bridging the gap' until a vaccine is in place. As for the policies to help achieve aims, Lagarde said the recalibration of policy would likely see the Pandemic Emergency Purchase Program (PEPP0 and TLTROs would remain the main tools to use she told the European Parliament's ECON Committee.

E.U. (BBG): EU leaders are due to have a tense and inconclusive video summit this afternoon. As the resurgence of Covid-19 pushes the continent back into recession, the effective veto by Poland and Hungary on the jointly-financed stimulus package agreed to in July threatens to delay the flow of funds into the region's battered economies. Officials in Brussels say they'd be surprised if a solution is found tonight — or anytime soon. The crucial question that still needs to be answered: is this just posturing from Warsaw and Budapest, designed only to show their domestic audiences that they put up a fight? In this case, the spat will eventually be resolved after some symbolic concessions and unwelcome delays. The other possibility is that what we see now is the start of an inevitable systemic crisis, triggered by the determination of eastern European governments to push ahead with an illiberal transformation that the rest of the EU can't possibly put up with.

E.U. (RTRS): Billionaire financier George Soros said the European Union must stand up to Hungary and Poland and cannot afford to compromise on the rule-of-law provisions it applies to the funds it allocates to member states. Hungary and Poland on Monday blocked the adoption of the 2021-2027 budget and recovery fund by European Union governments because the budget law included a clause which makes access to money conditional on respecting the rule of law. This delay the launch of the 1.8 trillion euro package that combines the EU's long-term budget and the bloc's economic recovery plan. In a Project Syndicate article published on Thursday, Soros said Hungary and Poland's veto of the EU budget and coronavirus recovery plan could be circumvented. If there is no agreement on a new EU budget, the old budget could be extended on a yearly basis. If this is the case, Poland and Hungary would risk not receiving any payments under new rule of law conditions, the financier and philanthropist argued.

CHINA/EU: China and the EU are accelerating negotiations to their planned Investment Agreement through continuous and intensive talks, aiming to complete negotiations within the year, Gao Feng, spokesman of the Ministry of Commerce said Thursday, adding that Beijing was also willing to push on with talks towards to a free trade agreement.

DATA:

FIXED INCOME: Grinding higher

We have seen both gilts and Bunds moving higher this morning as Treasuries stay largely flat but Eurozone peripheral spreads widen.

- The main headline of the morning concerns an update on the AZ/Oxford vaccine. There is no disclosure of the efficacy but it has been announced that it works as well in older people as it does in younger age groups. This is further promising news on the vaccine development but with the Pfizer/Moderna/Sputnik vaccines all at more advanced stages there was little market reaction to the news.

- An FT report this morning focused on Weidmann's view that market neutrality should be more important for the ECB than buying green bonds. This is being considered in the ECB's strategic review but Lagarde is thought to be leaning towards compensating for the market's failures (see our bullets at 6:57GMT).

- Looking ahead we have claims data as well as several ECB/Fed speakers.

- TY1 futures are up 0-5+ today at 138-11+ with 10y UST yields down -1.8bp at 0.853% and 2y yields down -0.3bp at 0.172%.

- Bund futures are up 0.17 today at 175.29 with 10y Bund yields down -1.6bp at -0.571% and Schatz yields unch at -0.735%.

- Gilt futures are up 0.13 today at 134.96 with 10y yields down -1.5bp at 0.320% and 2y yields down -0.1bp at -0.31%.

FOREX

USD trades on the front foot this morning a continuation of the overnight session.

- Equity future are better offered, providing some USD lifts

- The Greenback tested high of the session across the board on Safe Haven, as Covid spikes, Lockdown and the lack of stimulus dominates.

- Early European session saw two surprise rate cuts from Asia.

- Indonesia cut rate by 25bps to 3.75% vs unchanged expected at 4%

- The BSP, also cut 25bps to 2% versus unchanged expectation at 2.25%

- GBP is down 0.47% against the Dollar, more a function of the broader USD buying, but also heavy as the window for a Brexit deal continues to narrow.

- Brexit update are expected on Friday, but worth keeping an eye on any potential headline today.

- ALL EYES today on EM FX and especially the CBRT, following Erdogan's comments on "high rates rendering production and export impossible".

- Turkish Lira outperforms across the board, ahead of the awaited CBRT rate decision, when Economists surveyed by Bloomberg expects a 475bps hike to 15%

EQUITIES: Post-Vaccine Trade Fades Once Again

Equities continue to suffer from risk aversion early Thursday, with the post-vaccine trade fading once again (energy and financials underperforming in Europe, Nasdaq slightly outperforming in the US).

- Asian stocks closed mixed, with Japan's NIKKEI down 93.8 pts or -0.36% at 25634.34 and the TOPIX up 5.76 pts or +0.33% at 1726.41. China's SHANGHAI closed up 15.785 pts or +0.47% at 3363.088 and the HANG SENG ended 187.32 pts lower or -0.71% at 26356.97.

- European stocks are lower, with the German Dax down 162.46 pts or -1.23% at 13109.4, FTSE 100 down 55.67 pts or -0.87% at 6340.07, CAC 40 down 45.14 pts or -0.82% at 5485.14 and Euro Stoxx 50 down 41.06 pts or -1.18% at 3456.41.

- U.S. futures are weaker, with the Dow Jones mini down 194 pts or -0.66% at 29197, S&P 500 mini down 22 pts or -0.62% at 3543.25, NASDAQ mini down 70.75 pts or -0.59% at 11826.25.

COMMODITIES: Broad Weakness On Risk-Off, Dollar Strength

There is weakness across the commodity complex early Thursday as risk-off sentiment combines with a rising USD.

- WTI Crude down $0.5 or -1.2% at $41.5

- Natural Gas down $0.05 or -1.77% at $2.668

- Gold spot down $10.95 or -0.58% at $1859.49

- Copper down $1.2 or -0.37% at $320

- Silver down $0.43 or -1.75% at $23.7809

- Platinum down $6.39 or -0.68% at $936.42

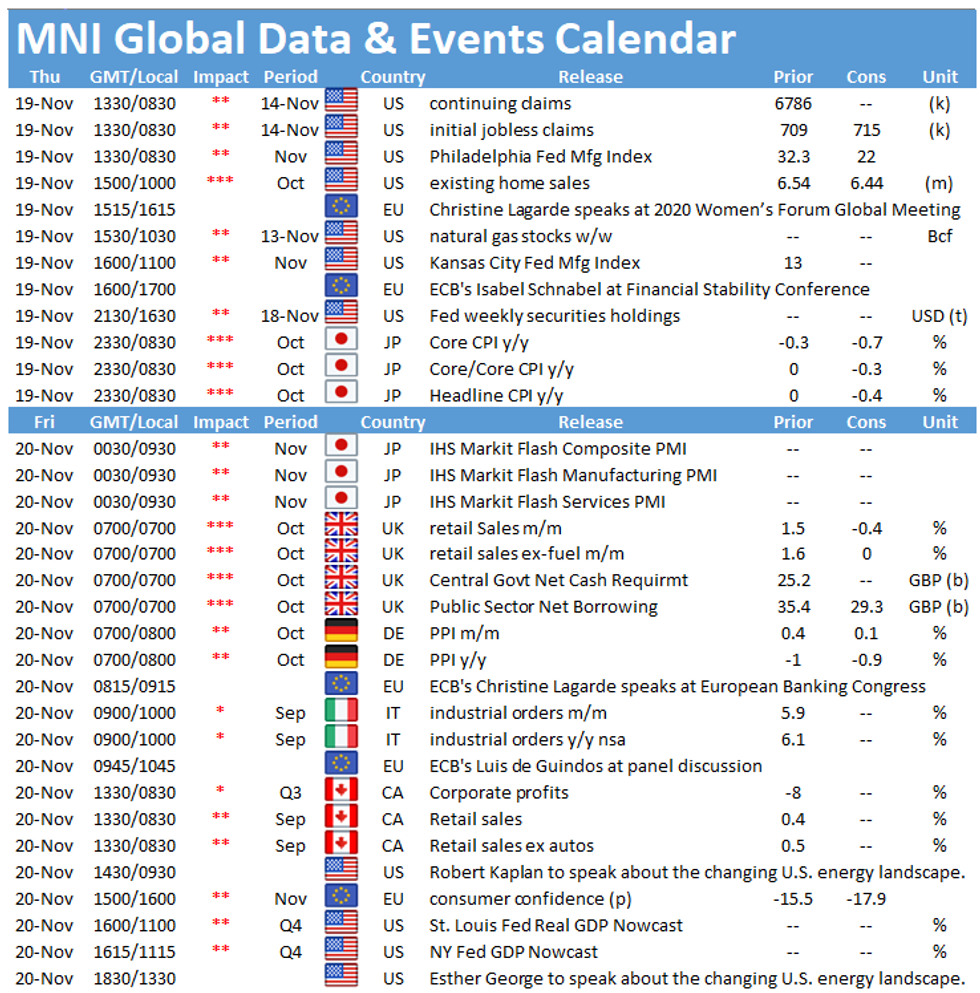

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.