-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Risk Appetite Wavers Ahead Of The Powell Show

EXECUTIVE SUMMARY:

- B.O.J. MAY DROP LONG-END JGB OPS FREQUENCY SCHEDULE (MNI INSIGHT)

- U.K. TO NORMALISE BOND AUCTION CALENDAR: DMO CHIEF (MNI INTERVIEW)

- ECB'S KNOT SAYS RISING YIELDS REFLECT OPTIMISM ABOUT OUTLOOK

- SENATE FINAL VOTE ON STIMULUS LIKELY PUSHED INTO WEEKEND

- EUROPEAN MEDICINES AGENCY TO START REVIEW PROCESS FOR RUSSIA'S SPUTNIK VACCINE

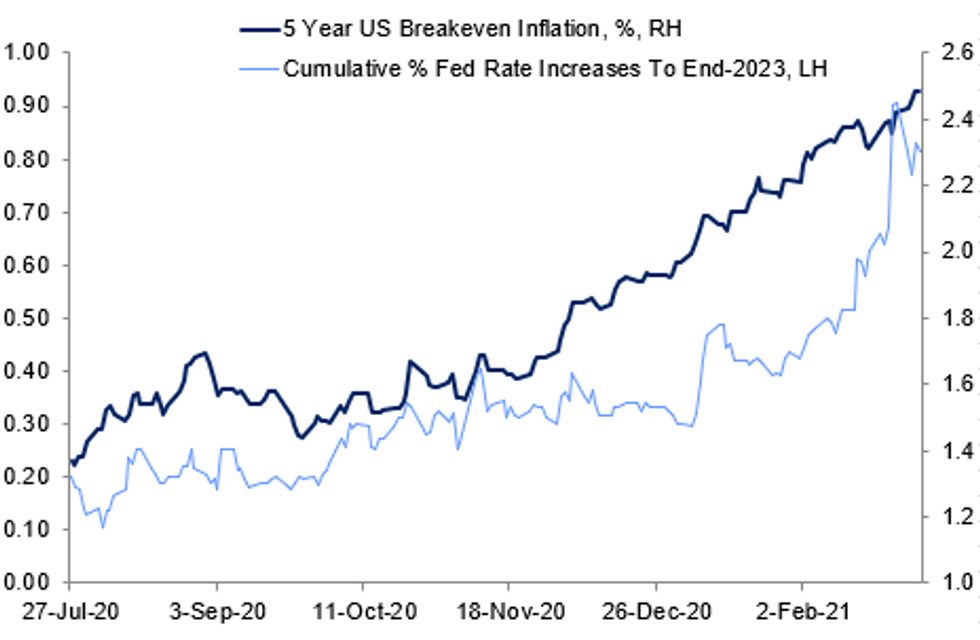

Fig. 1: Rate Hike And Inflation Expectations Rising

Fed Rate Increases implied by ED futures. BBG, MNI

Fed Rate Increases implied by ED futures. BBG, MNI

NEWS:

B.O.J. (MNI INSIGHT): The Bank of Japan may step back from publishing the frequency of its longer-dated bond buying operations, leaving the operational timing to the Financial Markets department as it seeks to meet the Board's intention of slightly steepening the longer-end of the curve, MNI understands. For full article contact sales@marketnews.com

U.K. GILTS (MNI INTERVIEW): The UK is aiming to normalise its bond auction calendar, stepping back from the short-term remits used over the past 12 months, despite greater-than expected bond issuance in the coming fiscal year, Debt Management Office head Robert Stheeman told MNI. For full article contact sales@marketnews.com

ECB (BBG): Rising government bond yields are a "positive story" because they reflect expectations for an improving economy, European Central Bank Governing Council member Klaas Knot said."There is reason to be optimistic about the second half of the year when the lockdowns will be lifted," despite uncertainties about the current vaccination drive and businesses' health, Knot said in a webcast panel discussion on Thursday. "What the market is actually doing is pricing that optimism."

U.S. (BBG): The Senate enters the final stages of debating President Joe Biden's $1.9 trillion pandemic relief bill on Thursday, with passage in the chamber likely pushed off until the weekend. Senate Majority Leader Chuck Schumer had planned to kick off the process Wednesday night but lacked an official cost estimate on the latest version of the bill, which has been trimmed down from the House-passed measure. In addition to stripping out a minimum-wage increase to comply with Senate rules, Biden agreed to moderate Democrats' demands for tightening eligibility for $1,400 stimulus checks, which will also affect the Congressional Budget Office's calculation of the overall price tag.

E.U./RUSSIA/COVID (BBG): The European Medicines Agency said it has started a rolling review of Russia's Sputnik V Covid-19 vaccine to test compliance with safety and quality standards, the first major step in gaining approval for use in the European Union. "The rolling review will continue until enough evidence is available for formal marketing authorization application," the agency said in a statement Thursday. "While EMA cannot predict the overall timelines, it should take less time than normal to evaluate an eventual application because of the work done during the rolling review."

E.U./GERMANY/COVID (RTRS): Germany told the European Union it would uphold its latest border restrictions imposed to curb the spread of new coronavirus variants, snubbing calls from the bloc's executive European Commission, Austria and the Czech Republic. The Brussels-based executive last week asked Germany and five other countries to ease unilateral restrictions on movement of goods and people, saying they have "gone too far" and were putting a strain on the bloc's cherished single market. But Germany's EU ambassador replied in a March 1 letter, which was seen by Reuters: "We have to uphold the measures taken at the internal borders at the moment in the interest of health protection."

FRANCE (BBG): France will unveil a long-awaited plan on Thursday to prevent a wave of bankruptcies in the nation after the pandemic, combining private and public money to provide as much as 20 billion euros ($24 billion) to strengthen the finances of small companies. The so-called participative loans -- which combine some of the advantages of equity and debt -- are a central plank of President Emmanuel Macron's stimulus plan. They are also a test case for other European governments looking for ways to keep businesses afloat when they start withdrawing their extraordinary fiscal aid.

U.K. (BBG): "The percentage of businesses that viewed overall economic uncertainty as high or very high fell from 67% to 57% in February, but it remained higher than the 41% at the start of 2020," according to BOE's Decision Maker survey conducted between Feb. 5-19."Covid-19 remained the largest source of uncertainty for 47% of businesses, and in the top three sources for around 82%, similar to previous months"

UK-EU-IRELAND (RTRS): Britain's decision to make unilateral changes to Northern Irish Brexit arrangements is "not the appropriate behaviour of a respectable country" and will erode trust with the European Union, senior Irish ministers said on Thursday. The EU promised legal action on Wednesday after the British government unilaterally extended a grace period for checks on food imports to Northern Ireland, a move Brussels said violated terms of Britain's divorce deal. "For the second time in the course of a few months, the British government has threatened to breach international law," Deputy Prime Minister Leo Varadkar told Virgin Media television, referring to a similar unilateral move last year that London eventually dropped. "This is not the appropriate behaviour of a respectable country, quite frankly."

DATA:

EZ Jan Retail Sales Fall to 9-Month Low

EZ JAN RET SALES -5.9% M/M, -6.4% Y/Y; DEC +1.8% M/M

- M/M retail sales plunged by 5.9% in Dec, coming in weaker than markets expected (BBG: -1.5%), while y/y sales dropped to -6.4% after ticking up by 0.9% in the previous month.

- Monthly sales declined to the lowest level since April as many European countries tightened their restrictions after Christmas.

- Jan's decrease was mainly driven by non-food product sales which plummeted by 12.0% following a 1.0% uptick in Dec.

- Food, drinks and tobacco sales slowed to 1.1% on a monthly basis after rising by 2.3% in the previous month.

- Automotive fuel sales dropped to -1.1% in Jan, following a strong rise of 4.7% in Dec.

- Among the member states, the largest m/m drops were observed in Austria (-16.6%), Ireland (-15.7%) and Slovakia (-11.1%), while the biggest increases were registered in Estonia (+1.7%), Slovenia (+1.3%) and Luxembourg and Hungary (both at +0.6%).

BOND SUMMARY: Awaiting Fed Powell

EGBs hold onto gains in early trading.

- Bund started the session better bid, pushing the curve bull flatter, but we faded going into Auction pricing, with heavy early supplies this morning from France and Spain.

- Volumes are dominated by rolling positions into June ahead of expiry on Monday.

- Gilt have traded in line with EGBs, with Gilt/Bund spread trading close to flat on the session.

- Upside was also limited for the contract going into DMO selling £2.75bn of 10yr.

- US Treasuries have traded within overnight ranges, with ALL EYES on Fed Powell at 17.00GMT/12.00ET.

- Some institutions are speculating that we could have comments on Yield, which will be revealed.

- Looking ahead, US IJC, Durable goods and Factory Orders.

- OPEC meeting, and of course US Fed Powell.

- Bund futures are up 0.15 at 174.10

- BTP futures are up 0.12 at 150.10

- OAT futures are up 0.06 at 164.11

- Gilt futures are up 0.10 at 129.33

- TY1 futures are up 0-1+ at 134-06

FOREX: Greenback Slightly Firmer Pre-Powell

Growth and commodity-tied FX is holding water so far Thursday, with AUD and NZD outperforming all others in G10. There are few signs of a bullish breakout just yet, however, with both pairs still well below the week's best levels and recent cycle highs. Australian trade balance data out overnight helped the AUD cause, with exports rising faster than forecast.

- Equities market are soft so far Thursday, with mainland indices lower by 0.2-0.7%. Nonetheless, the JPY remains soft to keep the recent bullish sequence of higher highs in tact for USD/JPY.

- Scandi currencies are among the worst performers of the day, with NOK and SEK both lower.

- Focus turns to a speech from the Fed Chair Powell, speaking later today at 1705GMT/1205ET. This marks the penultimate Fed speech ahead of the pre-March meeting media blackout period, so markets will be carefully watching for any policy signals - with speculation the Chair could lean dovish given recent volatility in yields. Data due today also includes weekly US jobless claims and Factory Orders.

EQUITIES: Tech Dragging Global Stocks In Risk-Off Session

- Asian equities closed sharply lower, with Japan's NIKKEI down 628.99 pts or -2.13% at 28930.11 and the TOPIX down 19.8 pts or -1.04% at 1884.74. China's SHANGHAI closed down 73.413 pts or -2.05% at 3503.492 and the HANG SENG ended 643.63 pts lower or -2.15% at 29236.79

- European stocks are weaker, with the German Dax down 51.65 pts or -0.37% at 14080.03, FTSE 100 down 72.14 pts or -1.08% at 6675.47, CAC 40 down 14.67 pts or -0.25% at 5830.06 and Euro Stoxx 50 down 14.99 pts or -0.4% at 3712.78.

- U.S. futures are lower too, with the Dow Jones mini down 76 pts or -0.24% at 31160, S&P 500 mini down 14.25 pts or -0.37% at 3802.5, NASDAQ mini down 52 pts or -0.41% at 12628.25.

COMMODITIES: Copper Tumbles; Oil Weaker Ahead Of OPEC Decision

- WTI Crude down $0.51 or -0.83% at $61.68

- Natural Gas down $0.01 or -0.46% at $2.816

- Gold spot up $4.58 or +0.27% at $1719.57

- Copper down $19.65 or -4.74% at $405.4

- Silver down $0.11 or -0.44% at $26.097

- Platinum down $6.24 or -0.53% at $1165.39

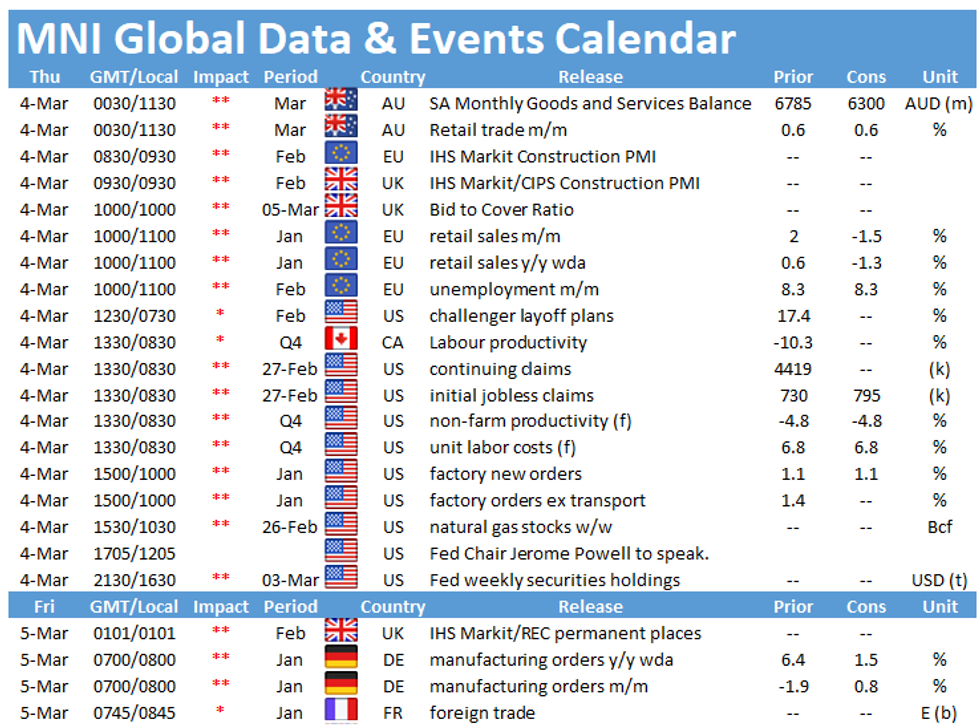

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.