-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: S&P 500 Takes Another Run At 4,000

EXECUTIVE SUMMARY:

- STRONGER EUROZONE MANUFACTURING PMIS SHOW INCREASING PRICE PRESSURES

- RICHMOND FED'S BARKIN SEES "POWERFUL" DISINFLATION FORCES (MNI INTERVIEW)

- E.U. MAY NOT START ISSUING RECOVERY BONDS UNTIL YEAR-END, S&P SAYS

- E.C.B. TO LOOK THROUGH TEMPORARY INFLATION RISE: LANE

- MIZUHO MAY HAVE 10B YEN ($90MN) EXPOSURE TO ARCHEGOS, NIKKEI SAYS

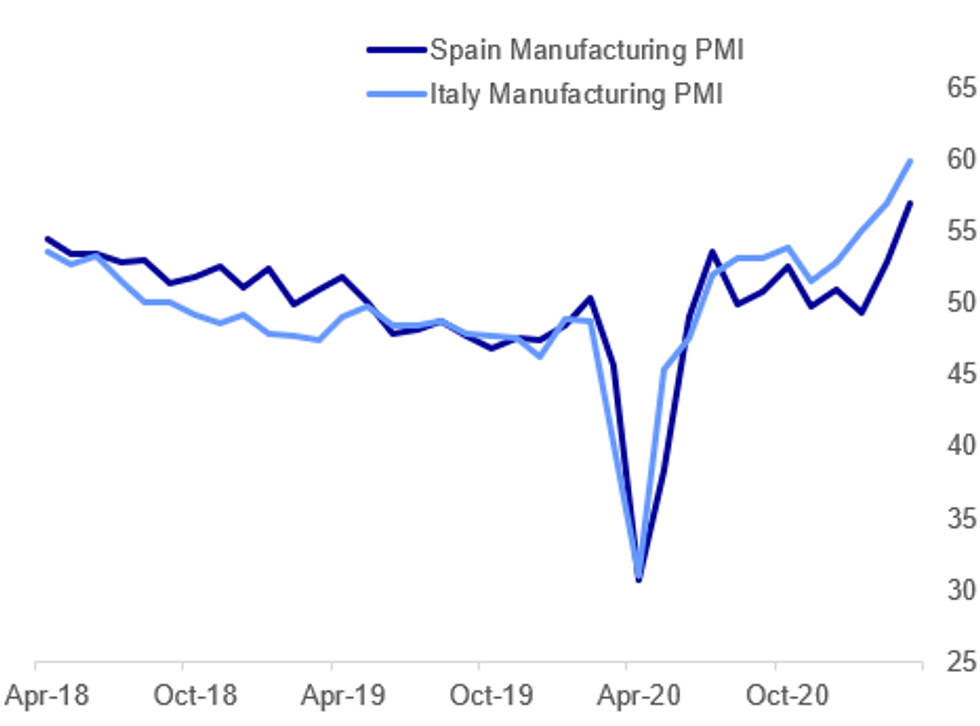

Fig. 1: Stronger In March Amid Supply Bottlenecks

IHS Markit, MNI

IHS Markit, MNI

NEWS:

FED (MNI INTERVIEW):Richmond Fed President Tom Barkin said in an interview Wednesday that long-term inflation expectations have remained stable through the start of an economic boom triggered by Covid-19 vaccines, and there's still lots of slack in the economy to hold down prices overall. For full interview contact sales@marketnews.com

ARCHAGOS (BBG): Mizuho Financial Group Inc. may have exposure to about 10 billion yen ($90 million) in potential losses tied to Bill Hwang's Archegos Capital Management, the Nikkei newspaper reported, without attribution.

E.U. (BBG): The EU is likely to delay bond issuance under its landmark recovery fund to the fourth quarter of this year, compared with previous expectations that it would sell debt in June, according to S&P Global Ratings. "The delay would be very negative news, especially if it's an indefinite delay," says Frank Gill, head of EMEA sovereigns.

E.C.B.: Recent rises in inflation are the result of unwinding of disinflationary forces following the outbreak of the Covid-19 pandemic and not a sustained change in inflation dynamics, European Central Bank chief economist Philip Lane wrote in a blog Thursday. Even with the expected 0.3% cumulative boost to euro area GDP provided by US president Joe Biden's rescue plan (not included in the March Eurosystem staff macroeconomic projections), the medium-term outlook for inflation remains subdued, Lane added.

OIL (BBG): Oil advanced toward $60 a barrel ahead of a high-stakes OPEC+ policy meeting, with producers set to debate whether to extend deep, pandemic-driven supply curbs to drain stockpiles and safeguard a rally. Prices fell on Wednesday after an OPEC+ panel meeting ended without a policy recommendation, and France announced that it will start a month-long lockdown. Still, positive signs from the U.S. as well as parts of Asia highlight the complexity of the decision facing OPEC+ ministers later Thursday.

GERMANY (RTRS): Germany needs to secure more output capacity with leading COVID-19 vaccine makers because repeat shots will likely be needed from next year, and Germany would go it alone if other European Union members fail to see the urgency, its health minister said. "For now we don't know how long protection will last," Jens Spahn said in an online press briefing. "Nobody can rule out the need for repeat shots for immune reinforcement. Therefore we should secure capacity within the European Union framework, if not done urgently, then nationally," he added.

SUEZ CANAL (BBG): Egypt said it may seek around $1 billion in compensation after a giant container vessel blocked the Suez Canal for almost a week and roiled shipping markets. The figure is a rough estimate of losses linked to transit fees, damages incurred during the dredging and salvage efforts, the cost of the equipment, and labor, Suez Canal Authority chief executive Osama Rabie said late Wednesday to local television channel Sada Elbalad. He did not specify who the Canal Authority would seek compensation from. "This is the right of the country," Rabie said, adding that the incident hurt Egypt's reputation. "This country should get its due."

CHINA-U.S.: China and the U.S. should resolve concerns through dialogues and negotiations on the basis of mutual respect as equals, Ministry of Commerce spokesman Gao Feng said Thursday, when asked to comment on U.S. official's saying China-U.S. talks were possible.

IRELAND ISSUANCE: Ireland has announced its Q2 auction/syndication schedule with bill auctions each month and bond auctions in May and June. Given the absence of an April bond auction, we expect a syndication, possibly as soon as next week. Ireland held three syndications last year but so far this year has only held a 10-year syndication. Our policy team interviewed the head of the NTMA last month but he gave little away in terms of what maturity to expect in the next syndication. See the full interview here.

- Bond Auctions

- Thursday 13 May

- Thursday 10 June

- Treasury Bill Auctions

- Thursday 15 April

- Thursday 20 May

- Thursday 17 June

PORTUGAL ISSUANCE: Portugal has also announced its Q2 issuance schedule, although for bonds has just said that it can hold auctions on the 2nd or 4th Wednesday of the month and has given no updates on planned syndications.

- The MNI Markets team continues to expect that we could have seen the last auction for the current 10-year OT, and think that there is a good chance we see a new 10-year OT launched via syndication this month.

- Bills scheduled for the quarter:

- 21 April: 3/11-month for E1.00-1.25bln

- 19 May: 6/12-month for E1.50-1.75bln

- 16 June: 3/11-month for E1.00-1.25bln

DATA:

Italian Manuf PMI Shows Surge In Demand And Rising Price Pressures

Italian Manufacturing PMI came in exactly in line with expectations at 59.8 (59.8 survey, 56.9 prior). The IHS Markit report identifies the drivers of the improvement as output and new orders, each of which rose at the quickest rates for more than three years "amid reports of a further surge in client demand".

- The report identifies positive trends for employment and confidence: "firms took on additional staff at a sharper pace, while the year-ahead outlook for output remained robust".

- But as part of a broader theme in European manufacturing, supply bottlenecks are putting upside pressure on prices: "average cost burdens facing Italian goods producers rose again, with the latest uptick the steepest for nearly ten years. Greater raw material costs, price hikes at suppliers and rising transportation fees drove the latest round of cost inflation, according to anecdotal evidence. In response, firms again upped their average charges in March. The rate of inflation was the most marked for a decade"

Spain Manuf PMI Improvement Driven By Output And New Orders

Spanish manufacturing PMI beat expectations in March (56.9 vs 56.0 survey and 52.9 in Feb), rising to the highest level since Dec 2006 and driven by increases in output and new orders.

- According to IHS Markit, the sector enjoyed a "noticeable upturn in demand during March, with output being pushed up to its strongest degree since the end of 2017 and confidence also improving to its highest in over three years."

- Job growth was positive, but supply chain issues are leading to higher price pressures: "Employment rose for the first time in five months, as firms struggled to keep on top of workloads. However, there were some noticeable challenges for firms to overcome, with delays in the delivery of inputs becoming increasingly acute and prices paid for inputs surging at the strongest rate in the past 10 years."

German Retail Sales Rebound In Feb

FEB RET SALES +1.2% M/M, -9.0% Y/Y; JAN -6.5% M/M

- German retail sales rebounded to 1.2% in Feb, following a downward revised reading for Jan (-2.0pp), but still fell short of market expectations.

- This marks the first increase after two consecutive months of decline, however retail sales remain 9.0% below their pre-pandemic level.

- Destatis noted that retail sales differed significantly across sectors, depending on the impact of the restrictions.

- While food, beverages and tobacco sales fell by 1.6% y/y, non-food product sales dropped by 13.8% y/y.

- Among non-food products, clothing and footwear saw the largest annual decline of 73.7%, while online sales surged by 34.1% compared to Feb 2020.

MNI: GERMANY FINAL MAR MFG PMI 66.6; FLASH 66.6; FEB 60.7

MNI: EZ FINAL MAR MFG PMI 62.5; FLASH 62.4; FEB 57.9

MNI: SWISS MAR CPI +0.3% M/M, -0.2% Y/Y;

FIXED INCOME: Core fixed income moves higher

Core fixed income has been on the front foot this morning but Bund, gilt and TY1 futures remain below the highs of yesterday.

- This morning's European PMI data has been generally a little better than the flash would have suggested but saw no kneejerk moves in fixed income.

- Later today the ISM and claims data will be closely watched.

- TY1 futures are up 0-6+ today at 131-04+ with 10y UST yields down -2.9bp at 1.713% and 2y yields down -0.1bp at 0.161%.

- Bund futures are up 0.20 today at 171.48 with 10y Bund yields down -1.5bp at -0.308% and Schatz yields down -1.0bp at -0.705%.

- Gilt futures are up 0.24 today at 127.83 with 10y yields down -2.8bp at 0.816% and 2y yields down -1.5bp at 0.082%.

FOREX: AUD Contrasts With Firmer Stocks, Hits 2021 Lows

- The greenback is holding recent gains, with the USD index in a holding pattern just below this week's 93.437 multi-month high. Having underperformed earlier this week, EUR is moderately stronger early Thursday, with EUR/GBP bouncing very slightly off the 2021 low of 0.8503.

- Today's weaker AUD contrasts with continued strength in equity markets as the e-mini S&P continues to probe recent highs. The index looks on track to test the record highs printed mid-March, a move above which would open the 4,000 level. AUD/USD retreated to touch 0.7532 in early Europe, a new 2021 low. Technical pressure and the further trimming of AUD longs by fund-type accounts have been cited for today's weakness.

- NOK is firmer as WTI and Brent crude futures resume their uptrend, with USD/NOK oscillating either side of the 8.5195 50-dma.

- Focus turns to March Manufacturing ISM data as well as US weekly jobless claims. Fed's Harker is also due to speak.

EQUITIES: S&P Set For Another Run At 4,000

- Asian stocks closed higher, with Japan's NIKKEI up 210.07 pts or +0.72% at 29388.87 and the TOPIX up 3.64 pts or +0.19% at 1957.64. China's SHANGHAI closed up 24.42 pts or +0.71% at 3466.332 and the HANG SENG ended 560.39 pts higher or +1.97% at 28938.74.

- European stocks are stronger, with the German Dax up 78.85 pts or +0.53% at 15049.74, FTSE 100 up 41.7 pts or +0.62% at 6741.42, CAC 40 up 23.88 pts or +0.39% at 6077.31 and Euro Stoxx 50 up 19.34 pts or +0.49% at 3930.66.

- U.S. futures are rising, with the Dow Jones mini up 54 pts or +0.16% at 32952, S&P 500 mini up 15.25 pts or +0.38% at 3982.75, NASDAQ mini up 121 pts or +0.92% at 13211.

COMMODITIES: Oil Rising Ahead Of OPEC Meeting Thurs

- WTI Crude up $0.99 or +1.67% at $59.68

- Natural Gas down $0 or 0% at $2.6

- Gold spot up $7.42 or +0.43% at $1717.83

- Copper down $3.1 or -0.78% at $395.05

- Silver down $0.01 or -0.05% at $24.4499

- Platinum down $0.02 or 0% at $1194.6

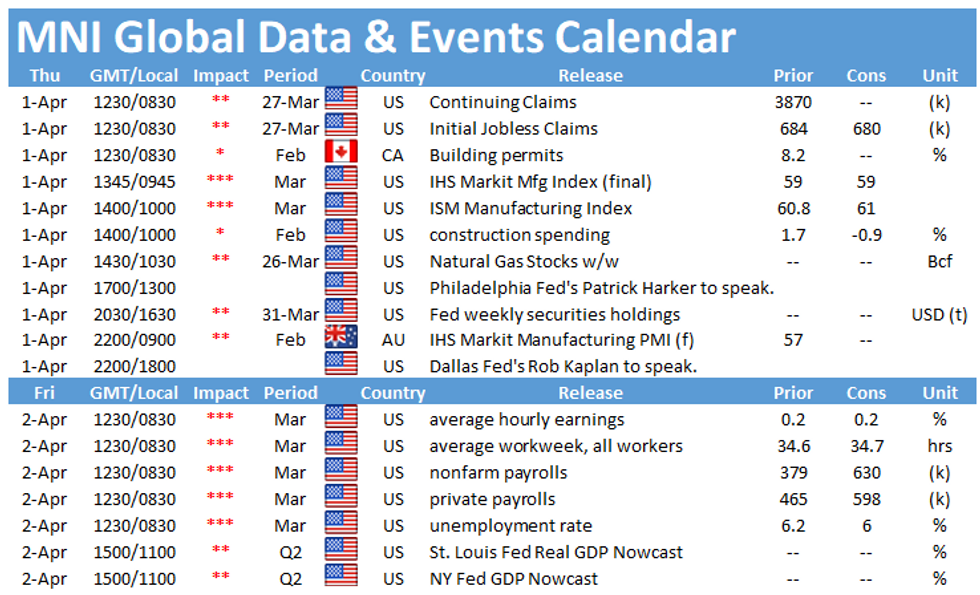

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.