-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Safe Havens Regain Some Ground

EXECUTIVE SUMMARY:

- PFIZER, BIONTECH TO SUPPLY E.U. WITH 200M EXTRA DOSES OF COVID VACCINE

- ITALY'S DRAGHI: EURO IS IRREVERSIBLE, "NO SOVEREIGNTY IN SOLITUDE"

- U.K. JAN CPI A LITTLE HIGHER THAN EXPECTED, BUT FEW SIGNS OF BORDER FRICTION IMPACT

- U.S. RETAIL SALES LIKELY REBOUNDED IN JAN (MNI REALITY CHECK)

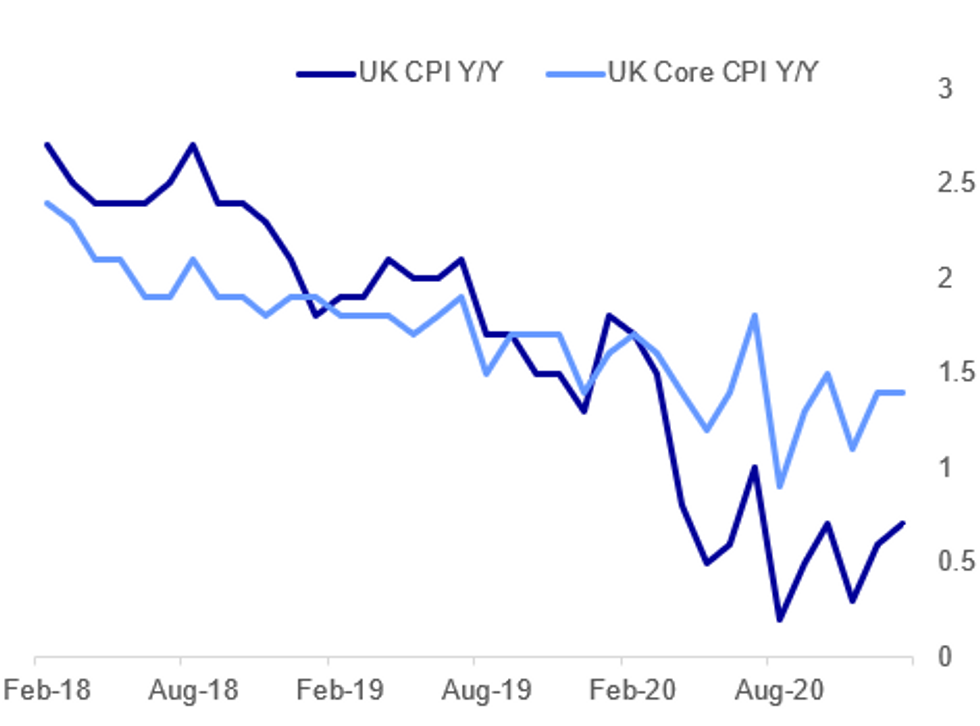

Fig. 1: UK Jan Inflation A Little Higher Than Expected

NEWS:

E.U./COVID (BBG): Pfizer and BioNTech have announced an agreement with the European Commission to supply an additional 200 million doses of Comirnaty, the companies' COVID-19 vaccine, according to statement. New agreement is in addition to the 300 million doses that have already been committed to the EU through 2021 under the first supply agreement signed last year. The additional 200 million doses are expected to be delivered in 2021, with an estimated 75 million to be supplied in the second quarter.

ITALY: New PM Mario Draghi delivering a speech to the Italian Senate presently (link in Italian). Selected comments below.

- Pushes back at claims from right-wing FdI that the gov't is illegitimate: "We're all here as citizens. That's the spirit of the Republic. Those who say this government is a failure of the political system, allow me to disagree."

- "The government will make reforms and deal with the emergency. Our duty is to fight the pandemic by all means and safeguard the lives of our citizens: a trench where we all fight together, the virus is the enemy of all."

- Makes it clear that his gov't will not be in place for the long term: "Important decisions can be made in a short time, the time in power can also be wasted in an attempt to preserve it."

- ""A government born as a founding member of the EU and respectful of the Atlantic Alliance. Supporting this government means sharing the increasingly integrated European Union. Shared membership"

- "Supporting this government means sharing the irreversibility of the choice of the euro, it means sharing the prospect of an increasingly integrated European Union. There is no sovereignty in solitude."

- Following the speech Draghi and his gov't will face a confidence vote, which is expected to gain one of the largest majorities in post-war Italian history.

UK DATA: CPI in January showed little sign that reports of border friction following the UK's withdraw from its transition trading arrangement with the European Union affected pricing. Consumer price inflation rose to 0.7% from 0.6% in December. Despite the lift, inflation remained below the bank of England's 2.0% target for the 18th-straight month.

U.S. (MNI REALITY CHECK): U.S. retail sales likely rebounded in January after a particularly weak holiday season as improvements in the U.S. Covid vaccine rollout and government relief have boosted spending, industry experts told MNI. For full article contact sales@marketnews.com

FED (MNI EXCLUSIVE): In case you missed our article yesterday: The Federal Reserve will likely hike the interest rates it pays on both overnight reverse repos and excess bank reserves in the next few months, former Fed officials told MNI, as policymakers look to keep the Fed Funds rate above zero. For full article contact sales@marketnews.com

U.K./COVID (RTRS): Britain on Wednesday became the first country in the world to allow volunteers to be exposed to the COVID-19 virus to advance medical research into the pandemic.The trial, which will begin within a month, will see up to 90 healthy volunteers aged 18-30 exposed to COVID-19 in a safe and controlled environment to increase understanding of how the virus affects people, the government said.

DATA:

FIXED INCOME: Sell-off takes a breather

Core fixed income hit lows yesterday as the reflation theme and medium-term optimism surrounding Covid continued while the downside risks of Italian politics continued to be priced out of broader EGBs. However, we have been partially retracing these moves throughout the European session today, although gilts and Bunds remain at similar levels to those seen on the US open yesterday.

- Looking ahead the FOMC Minutes and US retail sales will be the highlights, along with a speech from BOE's Ramsden on QE as a policy tool (particularly topical given the debate about the exit strategy).

- TY1 futures are up 0-3 today at 135-28 with 10y UST yields down -3.5bp at 1.281% and 2y yields down -0.5bp at 0.116%.

- Bund futures are up 0.16 today at 174.96 with 10y Bund yields down -1.4bp at -0.363% and Schatz yields down -0.2bp at -0.697%.

- Gilt futures are up 0.24 today at 131.08 with 10y yields down -2.6bp at 0.594% and 2y yields down -0.2bp at -0.46%.

FOREX: First Down Day in Six For EUR/JPY

The pullback from Tuesday's EUR/USD high has extended early Wednesday, with prices slipping comfortably through the 1.21 handle to set sights on the Feb 9 low at 1.2047. A break below here would be a bearish development, and increase focus on Tuesday's candle pattern which resembles a bearish shooting star.

The greenback is among the strongest in G10 so far today, with equities circling the week's lows and consolidating yesterday's (slightly) negative close for the S&P 500. This has buoyed JPY so far Wednesday, which is clawing back recent losses against a number of currencies, most notably EUR.

The front-end of the DM implied vol curve has seen some support, with the equity pullback helping arrest recent declines. 1m AUD/USD implied vols look to have bottomed after printing post-COVID lows earlier this week of just 8.97 points.

Focus for the rest of the sessions switches to data, with US retail sales, PPI and industrial production due. CPI numbers for January from Canada also cross. Central bank speakers include Fed's Barkin & Rosengren, BoE's Ramsden and the FOMC minutes.

EQUITIES: Weak Start, With Tech And Consumer Stocks Lagging

- Asian stocks closed mixed, with Japan's NIKKEI down 175.56 pts or -0.58% at 30292.19 and the TOPIX down 3.59 pts or -0.18% at 1961.49. The HANG SENG ended 338.28 pts higher or +1.1% at 31084.94.

- European equities are weaker, with the German Dax down 97.7 pts or -0.69% at 14064.6, FTSE 100 down 22 pts or -0.33% at 6748.86, CAC 40 down 12.81 pts or -0.22% at 5786.53 and Euro Stoxx 50 down 11.27 pts or -0.3% at 3726.4.

- U.S. futures are a bit lower, with the Dow Jones mini down 31 pts or -0.1% at 31427, S&P 500 mini down 4.75 pts or -0.12% at 3923, NASDAQ mini down 22.5 pts or -0.16% at 13745.25.

COMMODITIES: Dollar Strength Hits Metals

- WTI Crude up $0.21 or +0.35% at $60.41

- Natural Gas down $0.06 or -1.79% at $3.087

- Gold spot down $9.4 or -0.52% at $1790.11

- Copper down $2.55 or -0.67% at $382.3

- Silver down $0.23 or -0.84% at $27.1971

- Platinum down $35.5 or -2.81% at $1241.48

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.