-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Safe Havens Retreat On Vaccine Optimism

EXECUTIVE SUMMARY:

- VACCINE, BREXIT HOPES BOOST RISK APPETITE WITH EQUITIES GAINING

- AZN/OXFORD VACCINE 90% EFFECTIVE; PLANS 700MN DOSES BY END-Q1 2021

- EUROZONE, U.K. PMIS SHOW LOCKDOWN IMPACT

- BREXIT NEGOTIATIONS TO CONTINUE VIA VIDEOLINK (RTRS)

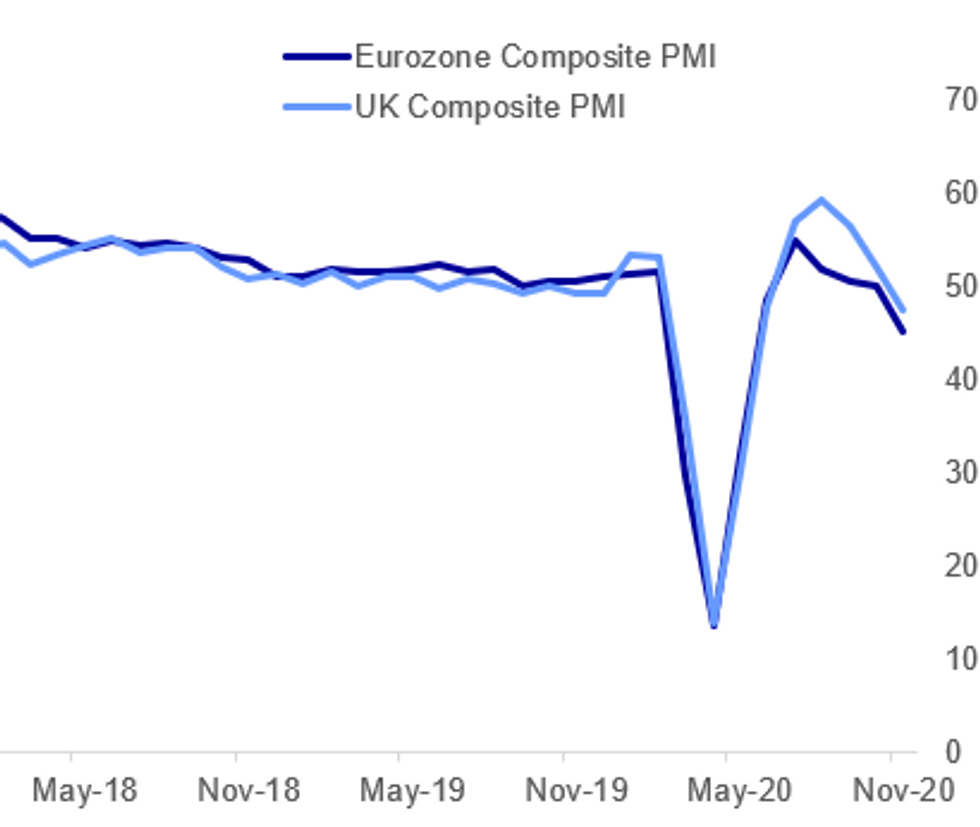

Fig.1: November PMIs Signal Lockdown Slowdown

IHS, BBG, MNI

IHS, BBG, MNI

NEWS:

COVID VACCINE (RTRS): AstraZeneca said on Monday its vaccine for the novel coronavirus could be around 90% effective without any serious side effects, giving the world another important tool to halt the COVID-19 pandemic. Phase III trial results of the vaccine developed by Oxford University found it was 90% effective if administered at a half dose and then at a full dose, or 62% effective if administered in two full doses. But scientists cautioned against seeing this as evidence that it would be less useful than rival vaccines from Pfizer and Moderna, which each prevented about 95% of cases according to data this month. AstraZeneca will have 200 million doses by the end of 2020, with 700 million doses ready globally by the end of the first quarter of 2021, operations executive Pam Cheng said on Monday.

U.K. PMI (MNI/IHS MARKIT): A good beat in November flash PMIs, but there seem to be some concerns that manufacturing may not be sustainable as it has been boosted by pre-orders ahead of the end of the Brexit transition: "Manufacturing growth was mainly linked to a sustained recovery in production volumes after stoppages at the start of the pandemic. Survey respondents also commented on rising demand from export markets, especially in China and the EU. The latter was often linked to pre-purchasing due to Brexit uncertainty as European customers sought delivery of orders before the end of the transition period. "Employment also not looking great:"November data indicated that job shedding accelerated across the UK private sector, with the rate of decline in staffing numbers the steepest for three months. Lower employment was mainly attributed to redundancy measures, although some service providers also commented on the renewed use of the government furlough scheme during the latest survey period.

FRANCE PMI: Nothing too surprising in the French PMI release with perhaps the most noteworthy statement: "Amid reduced output requirements, private sector firms continued to cut their staff numbers in November. This extended the current run of workforce contraction that began in March. However, the latest decline in employment was the softest in that sequence and modest overall. Manufacturers reduced payroll numbers at a slightly quicker pace than service providers."

GERMAN PMI: In contrast to France, employment actually picked up in Germany - this is encouraging. From the press release: "Stronger business confidence in turn acted to support the labour market in November. Flash data showed payroll numbers rising - albeit marginally - for the first time since February. The increase was driven by a modest round of hiring in the service sector, where some firms reported gearing up for potentially higher activity in the coming months. The drag from manufacturing job losses meanwhile continued to ease, with November seeing the slowest reduction in factory workforce numbers since June 2019."

EUROZONE PMI: Employment is again the most noteworthy mention in the pan-Eurozone PMI: "Job cuts deepened in the rest of the region as a whole [outside of Germany and France], however, to the steepest since June"

BREXIT: Social media reporting Reuters as stating that EU-UK FTA talks will continue via videolink and only return to in-person talks when safe to do so. Comes after a member of EU chief negotiator Michel Barnier's team returned apositive COVID-19 test last week. News circulating yesterday that a deal was '95% done', but with issuesremaining on fisheries, LPF, and governance. The mantra of 'nothing is agreed until everything is agreed' looms over the talks, which are entering the final stages of when it would be possible to reach a deal and have it ratified by year-end.

FRANCE FLASH NOV MFG PMI 49.1; OCT 51.3

GERMANY FLASH NOV MFG PMI 57.9; OCT 58.2

EZ FLASH NOV MFG PMI 53.6; OCT 54.8

UK FLASH NOV MFG PMI 55.2; OCT 53.7

FIXED INCOME: Positive start to the week triggered by Covid and Brexit news

Risk has been on the front foot in the European morning session with core fixed income all moving lower while Treasuries have moved through Friday's lows already.

- There has been more positive vaccine news this morning with the AstraZeneca / Oxford vaccine showing efficacy at 70%. This is someway off the circa 95% efficacy achieved by the mRNA vaccines of Pfizer and Moderna but the AZ/ Oxford vaccine is based on a more conventional technology of a mutated chimpanzee virus. This means it is easy to transport at refrigerated temperatures and a number of vaccines have already been promised to the less developed world at cost pricing - so this is still a positive for the world as a whole. And with vaccine production limited globally, another effective vaccine is still a good thing.

- We have also had some positive Brexit murmurings in the press over the weekend, so hope for a deal is a bit higher today than it was Friday. This has helped to see gilts underperform Treasuries.

- PMI data this morning beat expectations in the UK but has been more mixed across Europe with concerns about the labour market.

- There are a number of speakers later today with four MPC members including Bailey testifying before the Treasury Select Committee and also speeches from the ECB's Schnabel and Fed's Barkin, Daly and Evans.

- TY1 futures are down -0-5 today at 138-11 with 10y UST yields up 2.5bp at 0.850% and 2y yields up 0.3bp at 0.162%.

- Bund futures are down -0.04 today at 175.49 with 10y Bund yields up 0.1bp at -0.583% and Schatz yields down -0.2bp at -0.762%.

- Gilt futures are down -0.18 today at 135.02 with 10y yields up 1.5bp at 0.315% and 2y yields up 0.4bp at -0.43%.

FOREX: Markets Buoyant as Another Vaccine Candidate Reports Strong Results

Following promising updates from Moderna and Pfizer/BioNTech in recent weeks, equity markets are trading well, with core European indices higher across the board. Futures in the US are similarly higher, indicating a firmer open on Wall Street later today, with the e-mini S&P higher by over 20 points at pixel time.

GBP is the strongest performer in FX space, with reports over the weekend adding to hopes surrounding a potential Brexit deal being struck as soon as this week. GBP/USD sits at a multi-month high in response and just shy of the 1.34 handle. This narrows the gap with the September highs of 1.3482 which remain the medium-term target.

The greenback is the weakest currency in G10, with CHF and JPY also soft. AUD and NZD rise alongside global equity markets.

Focus turns to prelim November US PMI data and speeches from BoE's Bailey, Haldane & Tenreyro as well as Fed's Barkin, Daly & Evans. UK PM Johnson is expected to provide an update on post-lockdown life in the UK, with an announcement seen on a relaxation of restrictions over Christmas.

EQUITIES: Week Begins On Optimistic Note

Positive vaccine news (AZN/Oxford this morning adding to other promising candidates) helping buoy risk assets across the board, with equities/futures gaining to start the week.

- In Asia, markets closed higher (Japan closed for holidays): China's SHANGHAI closed up 36.763 pts or +1.09% at 3414.49 and the HANG SENG ended 34.66 pts higher or +0.13% at 26486.2.

- European equities are stronger, with the German Dax up 129.11 pts or +0.98% at 13274.55, FTSE 100 up 19.88 pts or +0.31% at 6387.31, CAC 40 up 39.32 pts or +0.72% at 5549.01 and Euro Stoxx 50 up 26.67 pts or +0.77% at 3495.81.

- U.S. futures are higher, with the Dow Jones mini up 206 pts or +0.71% at 29418, S&P 500 mini up 22.25 pts or +0.63% at 3576.5, NASDAQ mini up 50.25 pts or +0.42% at 11956.

COMMODITIES: Precious Dips On Safe Haven Retreat

Precious metals are weaker despite a weaker dollar, reflecting a move away from safe havens. Oil outperforming on stronger risk appetite.

- WTI Crude up $0.63 or +1.49% at $43.19

- Natural Gas up $0.07 or +2.6% at $2.707

- Gold spot down $3.39 or -0.18% at $1872.09

- Copper down $1.55 or -0.47% at $330

- Silver down $0.1 or -0.43% at $24.1251

- Platinum down $1.5 or -0.16% at $948.92

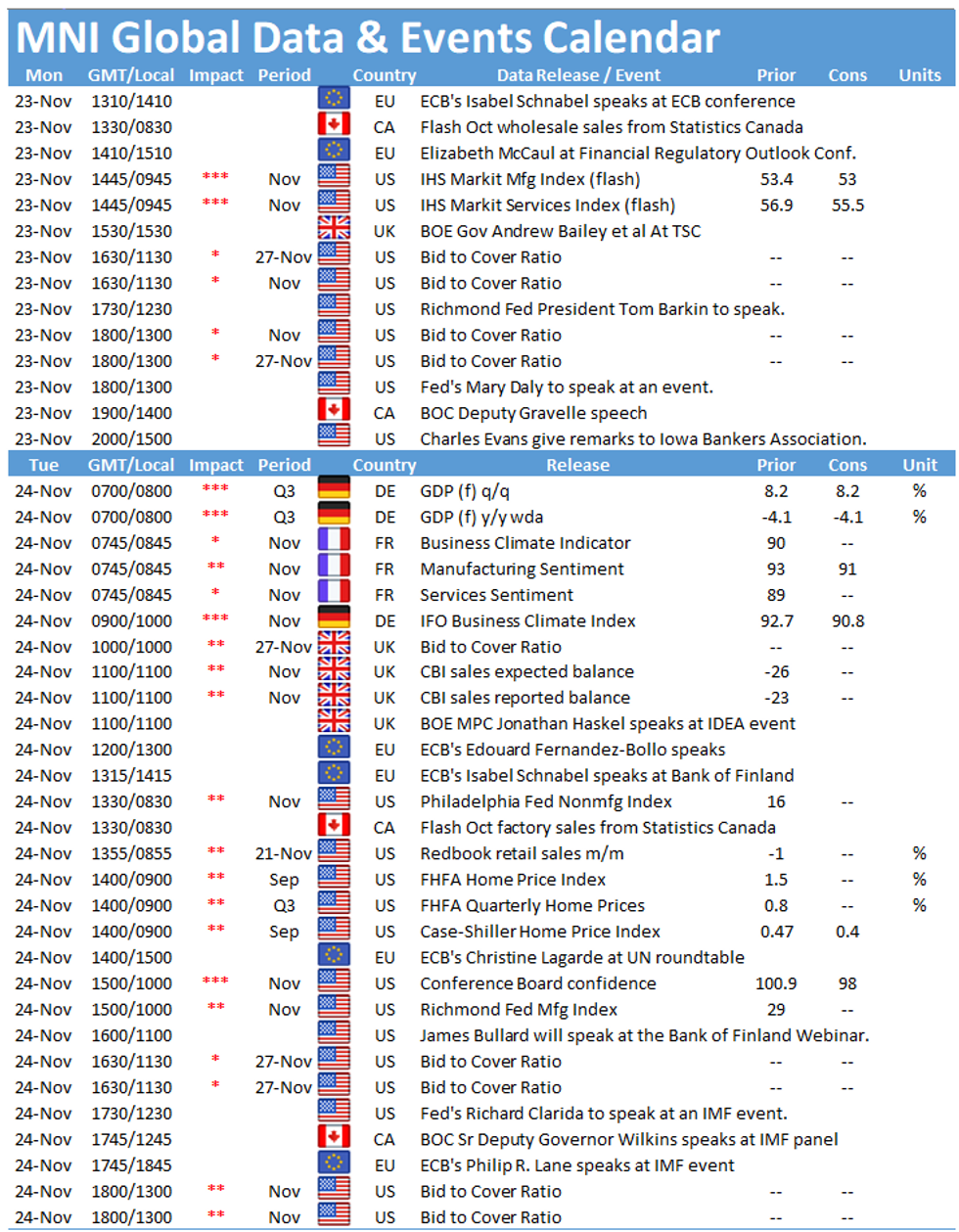

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.