-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI US Open: Safe Havens Up As Regulators Mull Vaccine Safety

EXECUTIVE SUMMARY:

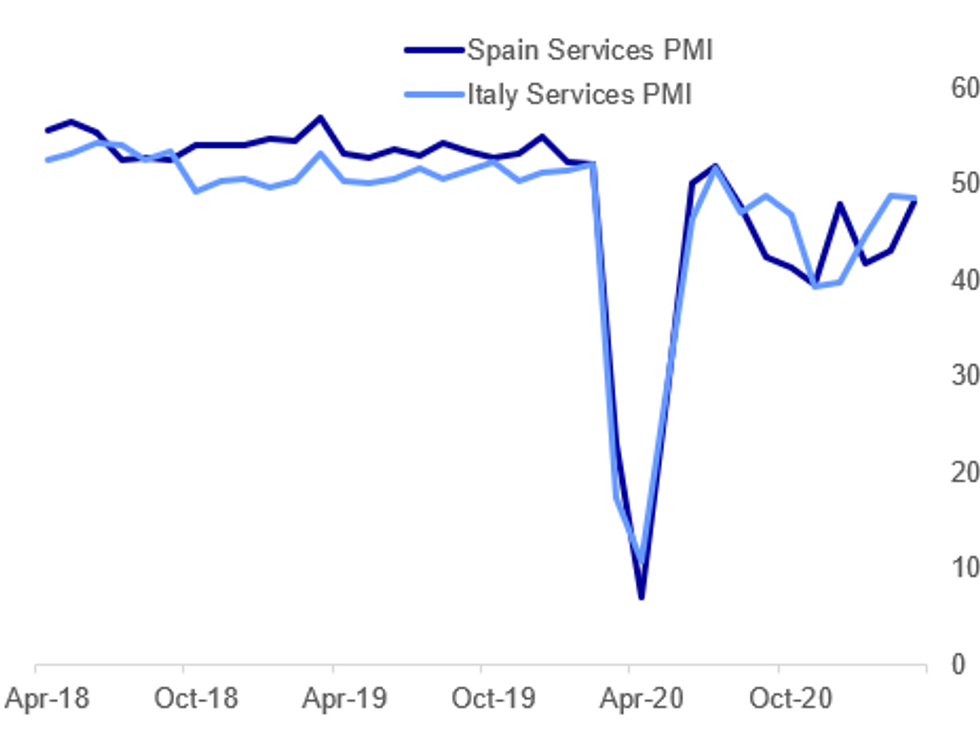

- MARCH SERVICES PMIS: SPAIN BEATS EXPECTATIONS, ITALY MISSES, BOTH SUB-50

- E.C.B. COULD START WINDING DOWN PEPP FROM Q3: KNOT (RTRS INTERVIEW)

- EUROPEAN MEDICINES AGENCY TO BRIEF ON ASTRAZENECA BLOOT CLOT CONCLUSIONS AT 1600CET...

- ...AMID SPECULATION OVER WHETHER U.K. VACCINE REGULATOR WILL RECOMMEND ROLLOUT PAUSE (POLITICO)

Fig. 1: Italian And Spanish Services Sectors Continue To Contract

IHS Markit, BBG, MNI

IHS Markit, BBG, MNI

NEWS:

SPAIN PMI DATA: The Spanish services sector contracted for the 8th consecutive month in March, but it was the smallest contraction in that sequence and beat expectations, coming in at 48.1 (vs 43.1 in Feb and the 45.8 BBG Survey).

- IHS Markit's report notes that "activity continued to be negatively impacted by COVID-19 restrictions during March, albeit perhaps not to the same degree as recent months with some firms reporting an improvement in underlying demand". That said, an overall decline in services sales was led by a drop in foreign orders, especially in tourism/hospitality.

- Services firms are being pressured on prices at both ends: "Margins also remained under pressure, with firms reporting another noticeable increase in operating expenses, but a slight drop in output charges."

- Jobs growth was negative, "extending the current period of job shedding to over a year – although the pace of contraction was comfortably the weakest in the current sequence. Job losses were again linked by firms to a reduction in new work, plus continued efforts to keep on top of operating expenses."

- As with services sectors elsewhere in Europe, Spanish firms reported strong confidence in the outlook on the back of the COVID vaccine rollout (though sentiment was little changed from Feb).

ITALY PMI DATA: Italian Services PMI missed expectations in March, remaining in contractionary territory at 48.6, vs 48.8 in Feb and and 49.0 expected by the Bloomberg consensus.

- This was the 8th consecutive monthly sub-50.0 reading. The IHS Markit report explains the worsening contraction came "amid a renewed dip in new work. As a result, firms continued to trim their workforce numbers during March, with the rate of job shedding quickening on the month."

- Demand relapsed from the previous month: "Following a slight upturn in February, new business declined marginally amid reports of weak demand conditions due to COVID-19 restrictions. New orders from abroad also decreased in March, extending the current sequence of contraction to 21 months, although the rate of decline was the slowest since August 2019."

- That said, there was some positive news on the confidence front, with service sector sentiment the strongest since September 2010 on COVID vaccine rollout and anticipated economic recovery.

- Also notable is input price pressures, which eased in the month but remained "solid". That said, "service providers continued to offer discounts as part of efforts to attract sales during March. Average charges fell for the twentieth month in a row and moderately overall."

ASTRAZENECA VACCINE / UK (POLITICO PLAYBOOK): All eyes are on the U.K.'s vaccines regulator today amid rising speculation that it may recommend the rollout of the Oxford/AstraZeneca jab to younger people should be paused. Last night a trial of the vaccine on children was halted by the team at Oxford University, who stressed there were "no safety concerns" but that they were waiting for the regulator to announce the results of its review on whether there is a link between the AZ jab and blood clots in adults. Playbook understands the Medicines and Healthcare products Regulatory Agency (MHRA) was locked in talks with the Joint Committee on Vaccination and Immunisation (JCVI) last night over what to do — with Downing Street anxiously awaiting their decision. Stay tuned: It is possible we may get the MHRA's decision today and that it could hold a briefing for journalists to explain its findings, Playbook is told, but this is still up in the air...a consultation on mandatory jabs for care workers was also meant to launch this week but seems to have been put on hold until the MHRA review concludes.

FRANCE/E.U. (BBG): French Finance Minister Bruno Le Maire said he's "deeply concerned" by the slow rollout of the European Union's joint recovery fund, saying governments are putting the rebound from the pandemic at risk.The 750 billion-euro ($890 billion) plan is "not on the right track," Le Maire said in a Bloomberg Television interview. "If we want a strong economy, we need to invest, and invest right now. The key point is to have a quick EU recovery and have the plan implemented as soon as possible."

DATA:

MNI: SPAIN MAR SERVICES PMI 48.1; FEB 43.1

MNI: SPAIN FINAL MAR COMPOSITE PMI 50.1; FEB 45.1

MNI: ITALY MAR SERVICES PMI 48.6; FEB 48.8

MNI: ITALY FINAL MAR COMPOSITE PMI 51.9; FEB 51.4

MNI: FRANCE FINAL MAR SERVICES PMI 48.2; FLASH 47.8; FEB 45.6

MNI: FRANCE FINAL MAR COMPOSITE PMI 50.0; FLASH 49.5; FEB 47.0

MNI: GERMANY FINAL MAR SERVICES PMI 51.5; FLASH 50.8; FEB 45.7

MNI: GERMANY FINAL MAR COMPOSITE PMI 57.3; FLASH 56.8; FEB 51.1

MNI: EZ FINAL MAR SERVICES PMI 49.6; FLASH 48.8; FEB 45.7

MNI: EZ FINAL MAR COMPOSITE PMI 53.2; FLASH 52.5; FEB 48.8

MNI: UK FINAL MAR SERVICES PMI 56.3; FLASH 56.8; FEB 49.5

MNI: UK FINAL MAR COMPOSITE PMI 56.4; FLASH 56.6; FEB 49.6

FIXED INCOME: Risk events closely watched

Core Govies have started the European session better bid today, with safe haven assets favoured, Bonds and USD for FX.

- Early focus is on supplies, but these have very little impact.

- Bund are up on the session, as investors awaits for the EMA presser at 15.00GMT, regarding Astra vaccine safety.

- German curve has bull flatten, as the long end outperform, ahead of potential risk event.

- Similar price action in Gilts, with the contract underpinned, but upside here has been limited, likely on delta hedging, on heavy UK supplies, equating combined 53k Gilts.

- ALL EYES on the UK and what the regulators might decide on Astra and younger people. (no set time or day for that event so far)

- US treasuries have traded inline with EGBs, as the US gears up for Fed speakers, including Fed Evans, Barkin, Daly, all discussing the Economy, while Fed Kaplan is in a Panel hosted by UBS

- Most desk don't expect too much from the FOMC minutes, but they event will be watched nonetheless

FOREX: EUR Recovery Continues, Hitting April High

- CHF, EUR are among the session's strongest performers Wednesday, indicating a modest risk-off feel - although equity futures are holding the bulk of the week's gains ahead of the NY crossover. The USD index holds just below the 200-dma at 92.427.

- Caution and concern over vaccine rollouts across Europe remain a market focus, with both UK and EU medicines regulators due to give their judgements on the AstraZeneca vaccine as soon as today. A negative judgement would be a considerable hurdle to re-opening plans across the UK and the continent, so remains a key market risk.

- PMI revisions for March across the Eurozone generally fared a little better than expected, helping nudge the Eurozone composite PMI to its best level since July last year.

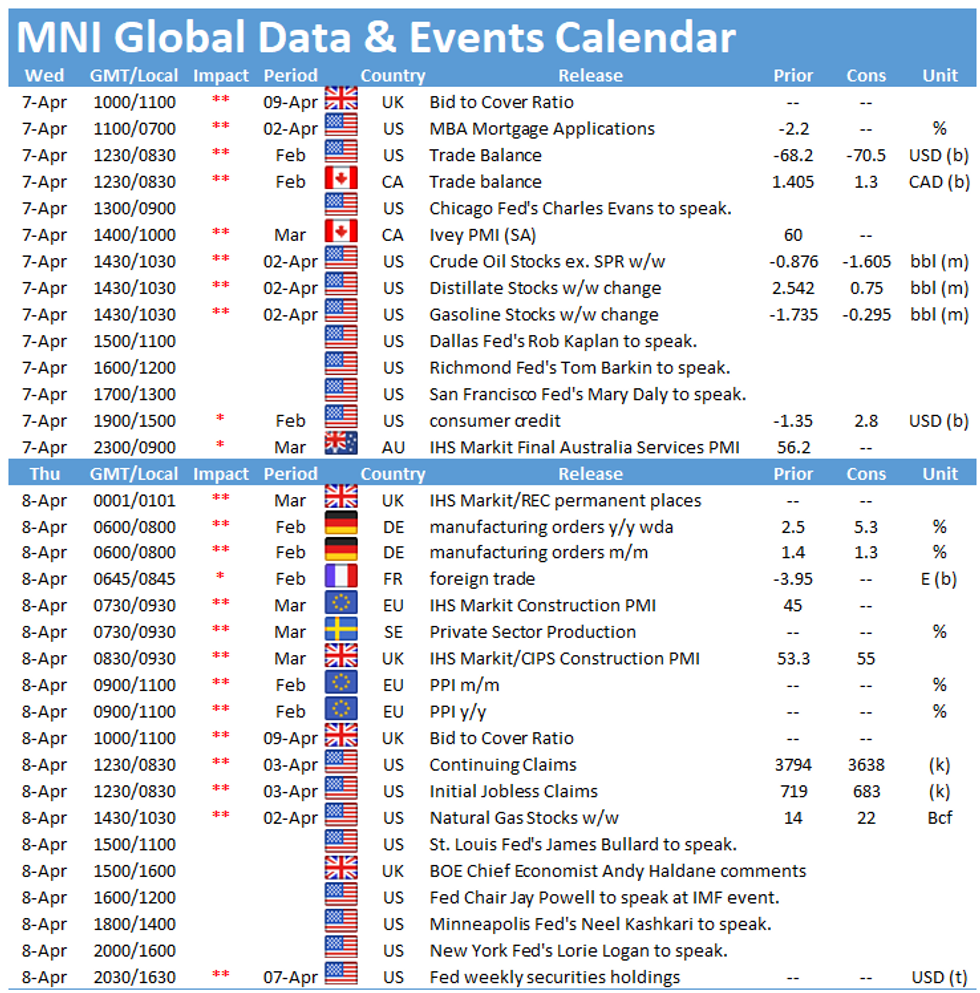

- US & Canadian trade balance, Canada's Ivey PMI and the FOMC minutes are highlights Wednesday, as well as speeches from Fed's Evans, Kaplan, Barkin & Daly. G20 FinMins also hold a press conference.

EQUITIES: FTSE Leads Gains

- Asian stocks closed mixed, with Japan's NIKKEI up 34.16 pts or +0.12% at 29730.79 and the TOPIX up 13.09 pts or +0.67% at 1967.43. China's SHANGHAI closed down 3.342 pts or -0.1% at 3479.625 and the HANG SENG ended 263.94 pts lower or -0.91% at 28674.8.

- European stocks are mostly higher, with the German Dax up 6.04 pts or +0.04% at 15233.08, FTSE 100 up 56.67 pts or +0.83% at 6853.47, CAC 40 up 14.06 pts or +0.23% at 6133.28 and Euro Stoxx 50 down 1.63 pts or -0.04% at 3968.85.

- U.S. futures are a little higher, with the Dow Jones mini up 31 pts or +0.09% at 33346, S&P 500 mini up 4 pts or +0.1% at 4068, NASDAQ mini up 16.75 pts or +0.12% at 13586.75.

COMMODITIES: Broad Weakness

- WTI Crude down $0.27 or -0.46% at $59.5

- Natural Gas up $0.02 or +0.73% at $2.48

- Gold spot down $6.12 or -0.35% at $1740.81

- Copper down $3.55 or -0.86% at $407.85

- Silver down $0.14 or -0.55% at $25.0838

- Platinum down $1.9 or -0.15% at $1238.22

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.