-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Retail Sales Seen Slowing

EXECUTIVE SUMMARY:

- U.S. RETAIL SALES SEEN SLOWING IN SEPTEMBER (MNI REALITY CHECK)

- SEFCOVIC, FROST TO MEET AS N IRELAND PROTOCOL TALKS LOOK SET TO START

- WUNSCH HINTS ECB POLICY MAY BE FLEXIBLE TO FIGHT SHOCKS

- OIL HITS 3-YR HIGH, LME COPPER INVENTORIES HIT 37-YR LOW

- EUROZONE TRADE SURPLUS FALLS TO 17-MONTH LOW

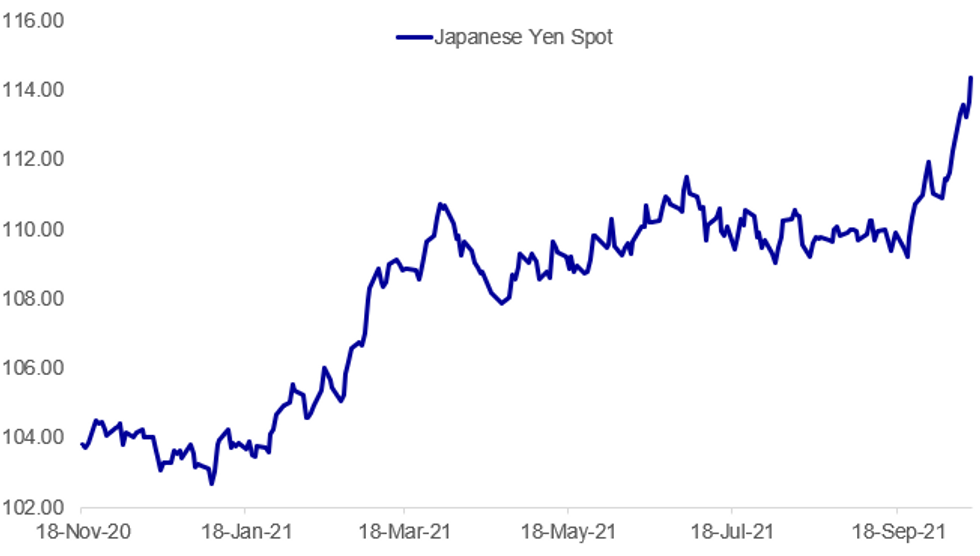

Fig. 1: Yen Weakness Continues

Source: BBG, MNI

Source: BBG, MNI

NEWS:

US RETAIL SALES (MNI REALITY CHECK): The pace of retail sales likely slowed in September after a much stronger-than-expected August as consumer confidence stumbled and prices continued to skyrocket, industry experts told MNI, though new Covid-19 infections through the month likely benefited the goods sector as consumers again shied away from services. For full article contact sales@marketnews.com

CHINA RETAIL SALES (MNI REALITY CHECK): China's September retail sales likely saw a moderate recovery from August's more than one-year low as services spending rebounded after the sporadic outbreaks of Covid-19 cases eased, but any uptick would still be tamed by weaker spending on big-ticket items including cars and home-related products, industry insiders and analysts told MNI. For full article contact sales@marketnews.com

UK/EU: European Commission VP Maros Sefcovic and UK Cabinet Office minister Lord Frost are set to meet over lunch in Brussels around midday to launch talks between the two sides on potential alterations to the Northern Ireland protocol in an effort to improve EU-UK relations. In an interview with Politico published this morning, Lord Frost stated that the continued jurisdiction of the ECJ in Northern Ireland under the recent EU proposals on the protocol remain a major sticking point. Frost stated that "There needs to be significant change if we are to get an agreed solution," although referring to the proposals as a whole he stated that "We do recognize that the EU has made an effort here."

ECB (BBG): The European Central Bank has a good track record when it comes to flexibly deploying its monetary instruments and will continue that approach even after the pandemic crisis, according to policy maker Pierre Wunsch."We've shown a lot of flexibility in the past -- whether we need here and there to change our instruments, we're going to have a discussion. Basically we have a good track record," the Governing Council member told Bloomberg Television.

BOJ (MNI INSIGHT): Lingering shortages of imported parts and semiconductors for Japanese automobile makers could lead the Bank of Japan to review its long-running language that the economy will pick up "as a trend," MNI understands. For full article contact sales@marketnews.com

GERMAN POLITICS (BBG): Germany's Olaf Scholz is stepping up his push to succeed Angela Merkel as chancellor, as his Social Democrats meet with two junior partners again on Friday to determine whether they can bridge significant differences to form a government. If the SPD, Greens and the pro-business Free Democrats agree to advance from a week of exploratory talks to comprehensive negotiations, a Scholz-led government will be more likely to take shape before the end of the year.

COMMODITIES (BBG): Copper inventories available on the London Metal Exchange hit the lowest level since 1974, in a dramatic escalation of a squeeze on global supplies that's sent spreads spiking and helped drive prices back above $10,000 a ton.Copper tracked by LME warehouses that's not already earmarked for withdrawal has plunged 89% this month after a surge in orders for metal from warehouses in Europe. Stockpiles have also been falling fast on rival bourses and in private storage, and LME spreads have entered historic levels of backwardation, with near-term contracts trading at huge premiums.

COMMODITIES (BBG): Oil jumped to $85 a barrel for the first time since late 2018 as a global energy crunch tightens the crude market.Brent futures in London rose as high as $85.10 a barrel, a gain of 1.3%. A shortage of gas and coal is triggering extra demand for oil products from the power market, especially in Asia, the International Energy Agency said. The energy squeeze has also led to an unusually large draw of crude stockpiles for the time of year at the U.S. storage hub of Cushing, government data show.

EUROPE / AUTOS (BBG): Automakers logged their worst September sales in Europe in more than a quarter century, putting the industry on course to come up short of last year's disastrous showing.New-car registrations plummeted 25% to 972,723, the lowest for the month since 1995, the European Automobile Manufacturers' Association said Friday. The lobby group largely attributes the drop to the semiconductor shortage, which worsened when Covid-19 outbreaks idled chip packaging and testing facilities in Southeast Asia.

DATA:

MNI: EZ AUG SA TRADE BALANCE +EUR11.1 BN; JUL +EUR13.5r BN

MNI BRIEF: EZ August Trade Surplus Falls To 17-Month Low

The eurozone trade deficit declined to EUR11.1 billion in August, the lowest level since April of 2020, from EUR13.5 billion in July. Imports rose by 1.6% in August, far outpacing a 0.3% increase in exports. Over the year to date, total exports rose by 15.2% to EUR1.6 trillion on a non-seasonally-adjusted basis, while imports rose by 16.8% to EUR1.4 trillion, leaving the surplus at EUR126.9 billion, little changed from the same period of 2020.

However, that obscures a sharp drop in imports from the UK, which fell by 16.7% y/y on a non-seasonally-adjust basis over the first eight months of the year to EUR88.7 billion. The bilateral surplus ballooned to EUR110.0 billion from EUR92.6 billion in 2020.

Exports to China rose by a non-seasonally-adjusted 15.3% between January and August (over the same period of 2020), while imports rose by 15.2%, expanding the bilateral deficit with China to EUR138.7 billion to EUR120.4 billion in 2020.

FIXED INCOME: Looking ahead to US retail sales

- Core FI has drifted lower and there has been a busy morning of trading, but the moves in FI have been less noteworthy than the moves in USDJPY.

- The moves lower in bonds correspond to moves lower for the Eurodollar and short sterling strips, but the Euribor strip has remained fairly steady on the day.

- US retail sales and Michigan confidence will be in focus later.

- TY1 futures are down -0-6 today at 131-10 with 10y UST yields up 3.8bp at 1.550% and 2y yields down -0.1bp at 0.360%.

- Bund futures are down -0.34 today at 169.31 with 10y Bund yields up 3.2bp at -0.160% and Schatz yields up 0.9bp at -0.705%.

- Gilt futures are down -0.39 today at 124.68 with 10y yields up 5.0bp at 1.091% and 2y yields up 4.1bp at 0.548%.

FOREX: USD/JPY Climb Accelerates, Narrows In On 2018 Highs

- The upside in USD/JPY accelerated early Friday, with the pair taking out further resistance to print up at 114.38 - just shy of the 114.55 high last printed in 2018. The pair's rally comes alongside further strength in equity markets and as markets continue to assess the policy divergence evident between the BoJ and Fed - with the former having few policy options to shore up domestic currency weakness.

- As a result, JPY is comfortably the poorest performer in G10 ahead of the NY crossover. GBP is at the other end of the table, rallying against all others as markets respond to the rise in front-end UK yields across the week, as a number of BoE speakers over the past few days flagging the raised likelihood of a rate hike in the coming months.

- Markets see out the week with a slew of tier one US data, with retail sales, import/export price indices and the prelim October University of Michigan sentiment figures. BoE's Pill, Fed's Bullard & Williams are the key central bank speakers.

EQUITIES: Energy, Financials Lead European Gains

- Asian equities rose sharply Friday, with Japan's NIKKEI up 517.7 pts or +1.81% at 29068.63 and the TOPIX up 36.96 pts or +1.86% at 2023.93. China's SHANGHAI closed up 14.086 pts or +0.4% at 3572.366 and the HANG SENG ended 368.37 pts higher or +1.48% at 25330.96.

- European stocks are stronger, with the German Dax up 28.8 pts or +0.19% at 15491.07, FTSE 100 up 14.75 pts or +0.2% at 7222.78, CAC 40 up 26.86 pts or +0.4% at 6711.63 and Euro Stoxx 50 up 16.88 pts or +0.41% at 4166.96.

- U.S. futures continue to gain, with the Dow Jones mini up 118 pts or +0.34% at 34902, S&P 500 mini up 12.25 pts or +0.28% at 4441.25, NASDAQ mini up 36.75 pts or +0.24% at 15074.

COMMODITIES: Crude Touches Fresh Cycle Highs

- WTI Crude up $0.75 or +0.92% at $82.07

- Natural Gas up $0.08 or +1.41% at $5.767

- Gold spot down $9.22 or -0.51% at $1786.71

- Copper up $1.4 or +0.3% at $464.55

- Silver down $0.17 or -0.72% at $23.3517

- Platinum down $4.37 or -0.41% at $1055.21

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.