-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI DATA TABLE: MNI China Interbank Liquidity Index (Jul) - 1

MNI DATA TABLE: MNI China Interbank Liquidity Index (Jul) - 2

MNI US Open: Social Media Under Scrutiny

EXECUTIVE SUMMARY:

- EQUITIES WEAKER AS Q1 U.S. EARNINGS SEASON BEGINS

- SOCIAL MEDIA APP PARLER NOW OFFLINE; TWITTER SHARES DROP AFTER PERMANENT TRUMP BAN

- UK CHANCELLOR TO UPDATE MPs ON ECONOMY LATER TODAY

- BITCOIN SEES SHARPEST 2-DAY DROP SINCE MARCH

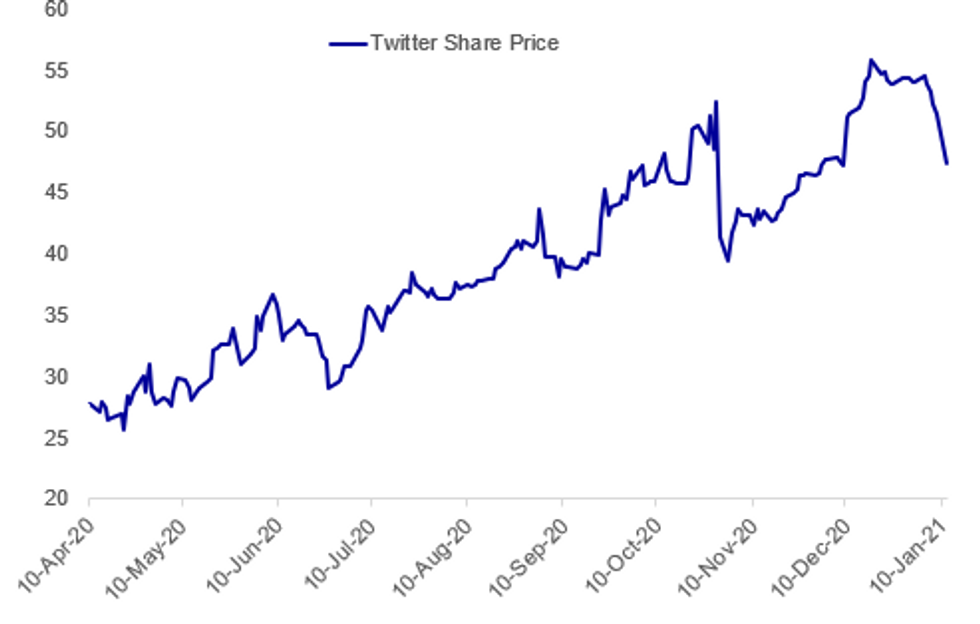

Fig. 1: Social Media Under Scrutiny

BBG, MNI

BBG, MNI

NEWS:

US / EQUITIES: The Q1 earnings cycle begins this week, with big banks and finance firms the initial focus. 3% of the S&P500 by market cap are due to report, in what's expected to be another strong quarter for banks. Financials have outperformed solidly throughout the first weeks of 2021. A more solid outlook for fiscal stimulus, a steeper US yield curve and hopes for a calmer year in politics and Coronavirus in 2021 have all helped. For our full US Earnings Calendar, please contact sales@marketnews.com

US / SOCIAL MEDIA (BI): Parler, the social media app popular with supporters of President Donald Trump, is now offline after Amazon booted the platform off its web-hosting service. Amazon announced its intention to sever ties with Parler on Sunday, saying it "cannot provide services to a customer that is unable to effectively identify and remove content that encourages or incites violence against others." "Because Parler cannot comply with our terms of service and poses a very real risk to public safety, we plan to suspend Parler's account effective Sunday, January 10th, at 11:59PM PST," a spokesperson said in an emailed statement to Insider. Parler CEO John Matze told Fox News on Sunday that the platform would "get back online as quickly as possible," and that the site could be down for up to a week.

US / SOCIAL MEDIA (BBG): Twitter shares fell as much as 8.3% in U.S. premarket trading before paring drop to 6.4%. The social media platform on Friday permanently banned U.S. President Donald Trump's personal account for repeated rules violations. Twitter announced the ban two days after Trump's account was initially suspended after a series of tweets that misled users about the presidential election results and appeared to encourage violent rioters who had mobbed the U.S. Capitol.

UK: Leader of the Commons confirms that Chancellor of the Exchequer Rishi Sunak will deliver an update to MPs on the state of the economy at around 1530GMT (1030ET, 1630CET).

- This could be purely an update on the state of the economy, but it could also involve the announcement of the extension of some COVID-19 support schemes or the introduction of new ones in light of the COVID-19 lockdowns in place across the UK.

- Following Sunak, Vaccinations Minister Nadhim Zahawi is set to give an update on the Gov'ts vaccinations programme.

ITALY: Italian media reporting comments from President Serio Mattarella, pleading that the Cabinet and parliament approve the EU's COVID-19 recovery package before any attempt is made to bring the gov't down.

- Mattarella's comments are in line with the MNI Exclusive published on 8 January 'Italy Reshuffle Nears As PM Conte Hangs On'.

- The president's pleas may fall on deaf ears, given that it is the distribution of funds from the COVID-19 recovery package that has exacerbated the schisms between the gov't of PM Giuseppe Conte and the centrist Italia Viva party of former PM Matteo Renzi.

- Nevertheless, should Renzi hold off from seeking to bring down the gov't, it seems likely that it will only prolong the inevitable (either a gov't collapse or a major Cabinet reshuffle) rather than allow for significant dialogue to take place.

- The 'white semester' begins on July 1. This is the last 6 months of Mattarella's term in office, and during this period he cannot call an election. As such, Renzi or others seeking a change in gov't will have to act in the first half of the year or risk waiting until 2022 for their chance to force a vote.

BITCOIN (BBG): The white-knuckle Bitcoin ride took another twist Monday as the worst two-day tumble in the digital currency since March stoked concern that the polarizing cryptocurrency boom may run out of steam. Bitcoin, the largest cryptocurrency, slid as much as 21% over Sunday and Monday to as low as $32,389. That's the biggest two-day slide since global markets were first roiled by the pandemic last year and follows a record high of almost $42,000 on Jan. 8.

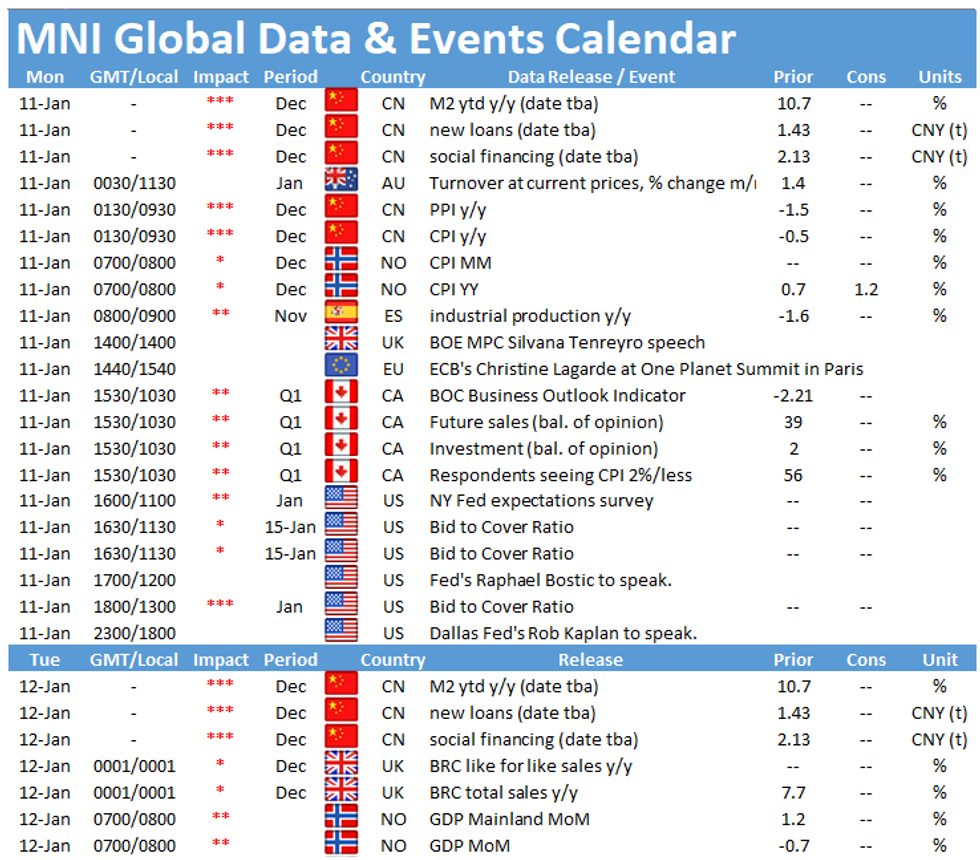

DATA:

FIXED INCOME: Strong start to the week with speakers the highlight

There is a slight risk-off undertone to markets today, potentially triggered by concerns that the UK lockdown restrictions could be tightened. Moves on the whole have been fairly limited, however.

- It's a fairly light calendar to start the week with, but there are a number of notable speakers. BOE's Tenreyro is due to discuss negative rates at 14:00GMT/9:00ET the same time that ECB's Lagarde is due to moderate a panel discussion. Fed's Bostic is due to discuss the 2021 economic outlook at 17:00GMT/12:00ET with Kaplan due to discuss monetary policy at 23:00GMT/18:00ET. Also today we have UK Chancellor Sunak giving an update on economic measures at 15:30GMT/10:30ET to the House.

- TY1 futures are unch today at 136-21 with 10y UST yields down -1.1bp at 1.106% and 2y yields down -0.4bp at 0.132%.

- Bund futures are up 0.10 today at 177.40 with 10y Bund yields down -0.5bp at -0.527% and Schatz yields down -0.4bp at -0.711%.

- Gilt futures are up 0.11 today at 134.48 with 10y yields down -0.5bp at 0.282% and 2y yields down -0.8bp at -0.143%.

FOREX: USD Bouncing as Stocks, Risk Appetite Moderate

After an impressive rally into the Friday close, stock futures have moderated in the US in likely profit-taking after a strong start to 2021. With equities still the driver, currencies are taking the risk-off queue, boosting the USD and other haven currencies throughout Asia-Pac and European hours.

USD strength has pressured EUR/USD through Friday's lows of 1.2193 to hit the lowest level since mid-December. 1.2130 marks next support, the Dec 21 low.

Commodities are moderately softer, leading NOK and other oil-tied FX lower. Nonetheless, USD/NOK remains well within range of the multi-year lows posted Friday at 8.3626.

Data is few and far between Monday, keeping focus on the central bank speakers slate. Speeches from BoE's Tenreyro, ECB's Lagarde and Fed's Bostic & Kaplan will take particular focus.

EQUITIES: Weaker As US Earnings Cycle Begins

- Asian stocks closed mixed (Japanese markets are closed for a holiday); China's SHANGHAI closed down 38.61 pts or -1.08% at 3531.498 and the HANG SENG ended 30 pts higher or +0.11% at 27908.22

- European stock futures are weaker, with the German Dax down 97.48 pts or -0.69% at 13929.91, FTSE 100 down 38.47 pts or -0.56% at 6868.21, CAC 40 down 30.61 pts or -0.54% at 5695.94 and Euro Stoxx 50 down 20.57 pts or -0.56% at 3624.63.

- U.S. futures are lower, with the Dow Jones mini down 204 pts or -0.66% at 30789, S&P 500 mini down 24.25 pts or -0.64% at 3793.25, NASDAQ mini down 64.75 pts or -0.49% at 13032.75.

COMMODITIES: Weaker Led By Industrials

- WTI Crude down $0.52 or -1% at $51.93

- Natural Gas down $0.09 or -3.37% at $2.611

- Gold spot down $0.26 or -0.01% at $1853.21

- Copper down $6 or -1.63% at $362.75

- Silver down $0.36 or -1.41% at $25.0918

- Platinum down $23.53 or -2.2% at $1051.68

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.