-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Stocks (And Yields) Continue To Regain Ground

EXECUTIVE SUMMARY:

- UK GOV'T BORROWING UP ON RECORD INTEREST PAYMENTS

- DEADLY FLOODS SWEEP CHINA'S HUB FOR IPHONES, CARS AND HOGS

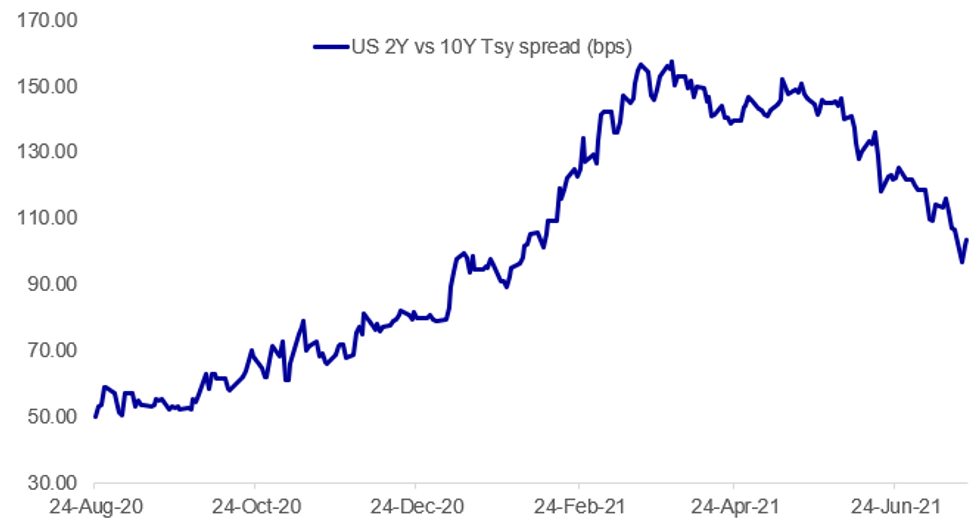

Fig. 1: Treasury Curve Re-Steepening A Little

Source: BBG, MNI

Source: BBG, MNI

NEWS:

CHINA (BBG): Around 100,000 people have been evacuated from the central Chinese city of Zhengzhou, as record rainfall caused widespread flooding and economic disruptions to Henan province, home to the world's biggest production base for iPhones and a major hub for food production and heavy industry.Pictures published by state media showed large sections of roads submerged in Zhengzhou, a city of 10 million, while videos posted on social media showed passengers stuck inside flooded subway cars with water levels up to their shoulders and residents pulled to safety with ropes from fast moving floodwaters. State news agency Xinhua reported that 12 deaths had been confirmed so far. The deluge has brought the equivalent of more than eight months' worth of the city's average rainfall since Tuesday.

CHINA (BBG): China, the world's top commodities consumer, said it will increase the amount of base metals it sells from its state reserves in its latest effort to rein in surging raw material costs.China will sell 30,000 tons of copper, 90,000 tons of aluminum, and 50,000 tons of zinc from stockpiles on July 29, the National Food and Strategic Reserves Administration said in a statement on its website Wednesday.That's up from 20,000 tons of copper, 50,000 tons of aluminum and 30,000 tons of zinc it last auctioned earlier this month.

U.K. (BBG): Boris Johnson's government will set out its preferred approach to post-Brexit trade in Northern Ireland, with the fallout from the U.K.'s split from the European Union still causing tensions in the province. With the U.K. and EU at odds over the so-called Northern Ireland protocol -- the part of the Brexit divorce treaty which sought to avoid a hard border on the island of Ireland -- the British government will lay out how it thinks the agreement should be implemented to Parliament on Wednesday.

GERMANY (BBG): Chancellor Angela Merkel's cabinet approved a flood-relief package to help devastated regions in western Germany as a poll showed her designated successor's support slipping after his fumbled response to the disaster. Cabinet members will brief on the scale of the relief aid and reconstruction plan later on Wednesday. Finance Minister Olaf Scholz had pledged at least 300 million euros ($353 million) in relief for hard-hit areas in the states of North Rhine-Westphalia and Rhineland-Palatinate.

BOJ / JAPAN: The Bank of Japan and the government must jointly take action when the economy is hit by a large shock, Deputy Governor Masayoshi Amamiya said Wednesday, although adding it is unlikely any such action will be directly coordinated. "We can lower both short- and long-term interest rates, if necessary. But (the BOJ) isn't considering concrete plans now," Amamiya said. The government is expected to compile a supplementary budget before Lower House elections, which could prompt the central bank into considering taking further action. "We need to activate economic activity through easy policy and hope wages and prices rise, which in turn will cause a rise in interest rates," he said.

OLYMPICS (BBG): The Australian city of Brisbane will host the Olympics in 2032, the country's third time hosting the games, according to a statement.

DATA:

UK DATA: Gov't Borrowing 2nd Highest June on Record

JUN PSNB-X GBP 22,754BN VS GBP 28,224BN IN JUN 2020

JUN CGNCR GBP 19,168BN VS GBP 25,229BN JUN 2020

JUN PSNCR GBP 11,254BN VS GBP 16,335BN JUN 2020

JUN DEBT/GDP RATIO EX-BOE 89.5% VS 83.4% JUN 2020

JUN YTD BORROWING GBP 69.5BN VS GBP 119.3BN JUN 2020

- Public sector net borrowing was GBP 22.8bn in Jun, the second highest Jun borrowing on record and GBP 5.5bn less than a year ago.

- YTD borrowing registered at GBP 69.5bn which is GBP 49.8bn less than in a year ago.

- UK year-to-date borrowing for the financial year 2020/21 was revised down by GBP1.5bn to GBP 297.7bn, but remains the highest borrowing on record.

- Central gov. receipts rose by GBP 9.5bn compared to the previous year to GBP 62.2bn in Jun, which includes GBP 45.5bn of tax receipts.

- Central gov. bodies spent GBP 2.5bn more in Jun 2021 than in Jun 2020 at GBP 84.1bn

- CGNCR was GBP 19.2bn in Jun, which is GBP 28.0bn less than in Jun 2020.

- Interest payments on central gov. debt reached a record high of GBP 8.7bn, which is GBP 6.0bn more than a year ago. This was mainly driven by movements in the RPI to which index linked gilts are pegged, the ONS noted.

- The first payments of GBP 0.8bn to the EU was made under the withdrawal agreement in Jun and the ONS expects similar payments in the coming months.

FIXED INCOME: Comes off the highs

It's been a busy morning again for fixed income, with core fixed income continuing to come off of its highs here with risk recovering as equities continue and oil also push higher.

- It's a very light calendar for the rest of the day with the only data coming earlier this morning in the form of UK public finance data (which came in a bit better than expected by the OBR). Italian industrial sales were a little lower on the month.

- Ahead of tomorrow's ECB meeting, the market is likely to stay focused on developments with the delta variant globally and how much risk to the economic recovery that poses.

- TY1 futures are down -0-7+ today at 134-14 with 10y UST yields up 2.7bp at 1.251% and 2y yields up 0.3bp at 0.205%.

- Bund futures are down -0.32 today at 175.53 with 10y Bund yields up 1.6bp at -0.396% and Schatz yields up 0.3bp at -0.715%.

- Gilt futures are down -0.33 today at 129.57 with 10y yields up 1.9bp at 0.582% and 2y yields down -0.3bp at 0.084%.

FOREX: JPY Hampered by Continued Bounce in Stocks

- Reflecting the continued bounce in equities, JPY is Wednesday's poorest performer so far, with USD/JPY edging comfortably back above the Y110.00 ahead of the NY crossover.

- The surge in the e-mini S&P puts the index through the week's best levels, with the contract now inside 50 points of the alltime highs posted on July 14th. The energy and financials sectors (the poorest performers at the beginning of the week) are driving the recovery in Europe, with US indices likely to follow suit.

- This has put a temporary end to the recent USD strength, with the USD Index in minor negative territory at pixel time. A negative close for the index today would be the first in five sessions. EUR/USD's rejection of any test on key support at 1.1704 is largely responsible, but the pair needs to make progress through the Tuesday high of 1.1803 before the outlook begins to look more positive.

- Once again, there's relatively little data or central bank speak to digest across G10, keeping focus on the ECB rate decision due tomorrow and the continued roll out of US earnings. Highlights today include Johnson & Johnson, Coca-Cola and Verizon Communications.

EQUITIES: Bounce Continues, Led By UK FTSE

- Asian markets closed mostly higher, with Japan's NIKKEI up 159.84 pts or +0.58% at 27548 and the TOPIX up 15.52 pts or +0.82% at 1904.41. China's SHANGHAI closed up 25.87 pts or +0.73% at 3562.661 and the HANG SENG ended 34.67 pts lower or -0.13% at 27224.58.

- European equities are higher, with the German Dax up 104.07 pts or +0.68% at 15260.68, FTSE 100 up 105.38 pts or +1.53% at 6943.14, CAC 40 up 90.15 pts or +1.42% at 6393.85 and Euro Stoxx 50 up 49.02 pts or +1.24% at 3995.27.

- U.S. futures continue to bounce, with the Dow Jones mini up 197 pts or +0.57% at 34597, S&P 500 mini up 18.25 pts or +0.42% at 4333.75, NASDAQ mini up 12.75 pts or +0.09% at 14735.5.

COMMODITIES: Energy Complex Rebounding

- WTI Crude up $0.94 or +1.4% at $67.22

- Natural Gas up $0.07 or +1.73% at $3.942

- Gold spot down $2.01 or -0.11% at $1808.12

- Copper up $2.15 or +0.5% at $424.55

- Silver up $0.27 or +1.08% at $25.0729

- Platinum up $10.25 or +0.96% at $1072.4

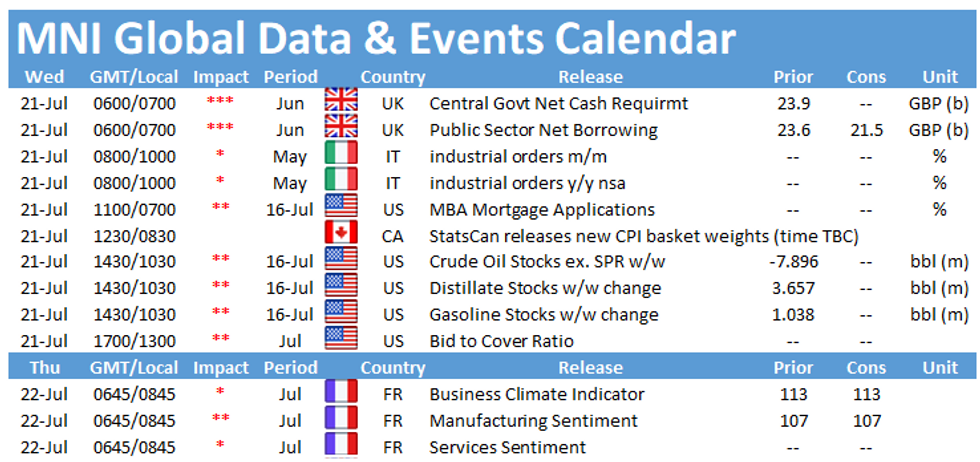

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.