-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Stocks Holding Their Ground

EXECUTIVE SUMMARY:

- GERMAN FEDERAL COURT DISMISSES LEGAL CHALLENGE TO E.U. RECOVERY FUND

- U.K. SEES HIGHER INFLATION IN MARCH

- CHINA IS SAID TO MULL SUPPORTING HUARONG WITH CENTRAL BANK FUNDS

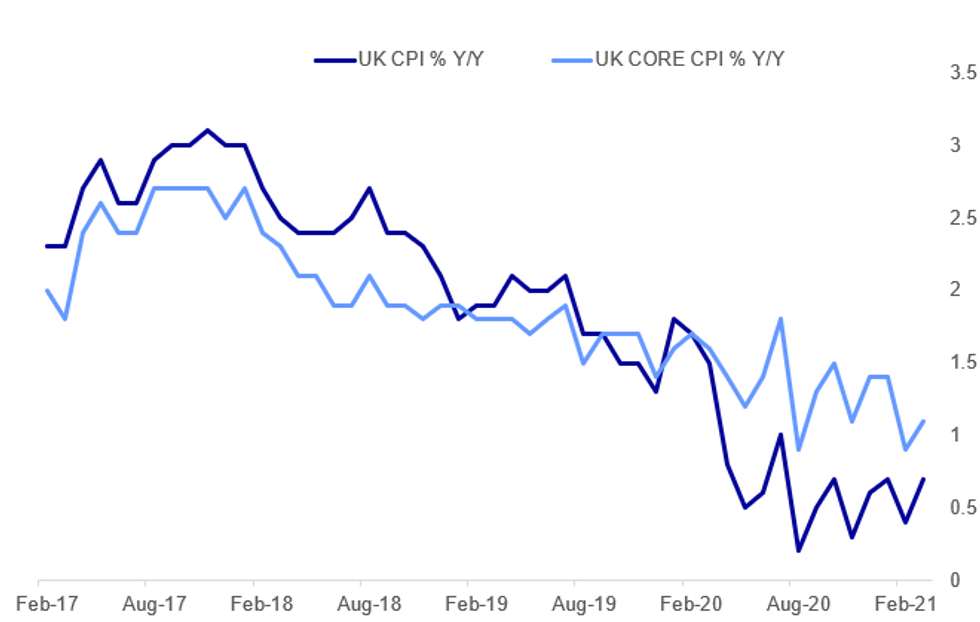

Fig. 1: Sideways UK Inflation

ONS, MNI

ONS, MNI

NEWS:

GERMANY/E.U.: The German Federal Constitutional Court issued a ruling today, rejecting an injunction that sought to stop the ratification of the EU's long-term budget and COVID-19 recovery package in the German parliament.

- Full judgement (in English):https://www.bundesverfassungsgericht.de/SharedDocs...

- The German Constitutional Court has long been a tool of eurosceptic Germans to bring cases against integration efforts, but this ruling goes against that grain in enabling the German parliament's ratification process of the long-term budget ('Next Generation EU') and its associated COVID-19 recovery fund to go ahead.

- One of the major complaints about the recovery fund has been the increased 'own resources' for the Commission to be raised by the institution borrowing up to EUR750bn on capital markets, something never permitted before.

DATA:

UK Inflation Ticked Up In Mar

MAR CPI +0.3% M/M, +0.7% Y/Y VS +0.4% Y/Y FEB

MAR CORE CPI +0.4% M/M, +1.1% Y/Y VS +0.9% Y/Y FEB

MAR OUTPUT PPI +0.5% M/M; +x1.9% Y/Y VS +0.9% Y/Y FEB

MAR INPUT PPI +1.3% M/M; +5.9% Y/Y VS +3.3% Y/Y FEB

- Y/Y CPI edged up in Mar to 0.7%, coming in below market expectations (BBG: 0.8%) and showing the highest level since Jan. Nevertheless, this marks the 20th straight reading below the BOE's 2.0% target.

- Core inflation gained 0.2pp to 1.1% in Mar, after dropping to 0.9% in Feb, confirming of market forecasts.

- The largest upward contribution came from transport and clothing and footwear, adding 18pp and 0.14pp, respectively, to CPI growth. The ONS noted that petrol prices rose in Mar 2021 compared to a fall in 2020 and clothes recovered from the falls seen in Feb.

- On the other hand, food inflation declined by 1.4% in Mar, showing the biggest downward contribution and shaving off 0.9pp from price growth.

- Output inflation rose by 1.9%, marking the third consecutive months of growth and was largely driven by transport equipment.

- Input inflation surged by 5.9% in Mar, its highest level since Oct 2018 and the fourth positive reading in a row after 10 consecutive months of decline. Metals and non-metallic minerals led the increase, while crude oil was the second largest driver, also due to a change in the weights.

- The service producer price index rose by 1.7% in Q1 2021, up from 0.4% in Q4 2020.

FIXED INCOME: German court ruling helps peripheral spreads tighten

- After a fairly flat overnight session, we have seen core fixed income move lower so far through the European morning session.

- The main headlines this morning have surrounded the German Constitutional Court ruling against an injunction that sought to stop the ratification of the EU's long-term budget and COVID-19 recovery package in the German parliament. This has helped the general risk tone with equities higher and notably, peripheral spreads tightening (BTP-Bund 10y spread 2.3bp tighter on the day at typing).

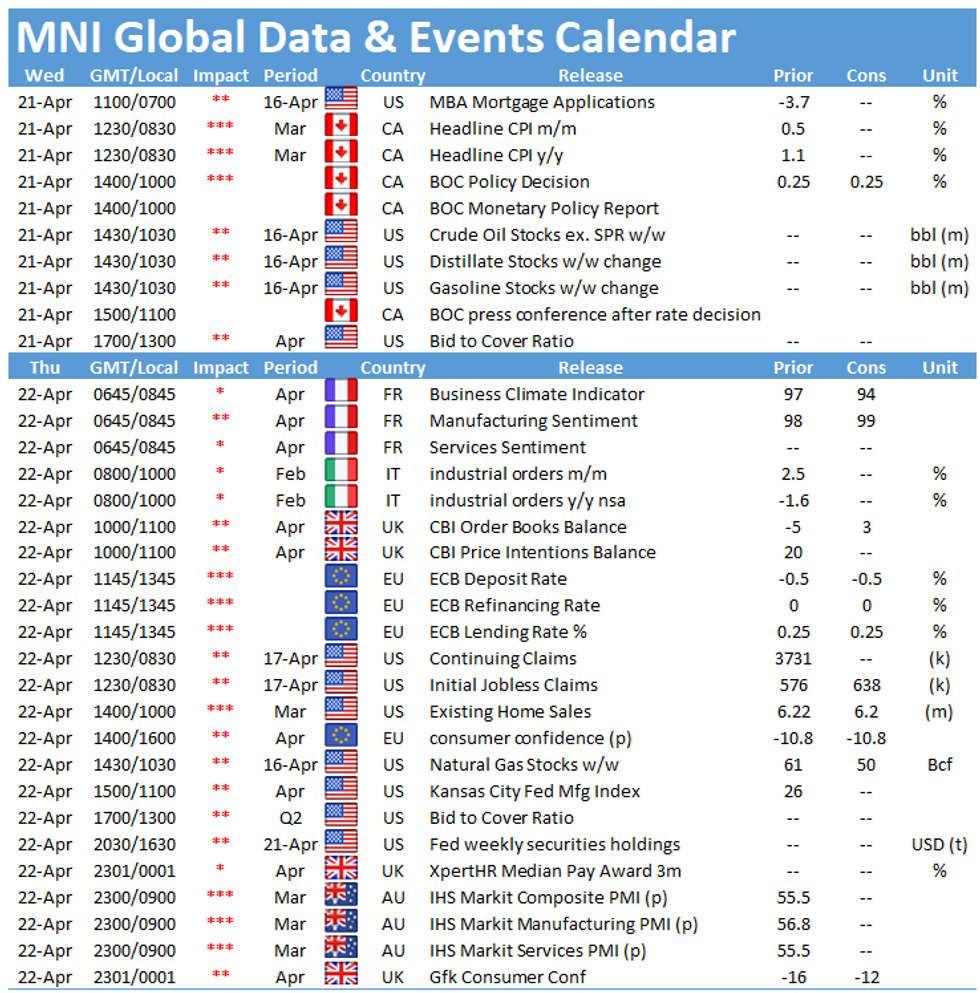

- In terms of data, we saw UK CPI a tenth lower than expected this morning but very little market reaction and the focus later today will switch to the BoC policy decision ahead of the ECB meeting tomorrow. BOE Governor Bailey is due to speak at 11:30BST at a diversity event but he is unlikely to talk much (if at all) on monetary policy.

- TY1 futures are down -0-4 today at 132-14 with 10y UST yields up 1.8bp at 1.579% and 2y yields up 0.2bp at 0.152%.

- Bund futures are down -0.07 today at 170.67 with 10y Bund yields up 1.5bp at -0.248% and Schatz yields up 0.2bp at -0.695%.

- Gilt futures are down -0.18 today at 128.58 with 10y yields up 2.1bp at 0.751% and 2y yields up 1.0bp at 0.043%.

FOREX: Markets Watch for BoC Taper Clues

- Treasury yields appear to have found a near-term bottom, with the 10y yield bouncing back above 1.58%, which has underpinned some further support for the greenback at present levels.

- The USD Index remains between the 50- and 100-dma directional parameters for now, which may dictate price action in a session devoid of data or central bank speakers.

- The single currency is among the weakest performers Wednesday as markets continue to book profits on the late EUR/USD rally last week. The pair remains above the 1.20 mark which continues to act as decent psychological support for now.

- CAD and NZD are among Wednesday's best performers, but both currencies trade very much inside recent ranges.

- Focus turns to Canada later today, with the Bank of Canada rate decision due as well as March CPI. The BoC are expected to keep policy unchanged, with rates at 0.25%. Markets watch for any clues on the BoC's approach to tapering their government bond purchase programme.

EQUITIES: Europe Sees Modest Bounce After Weak Asia Session

- Asian stocks closed lower, with Japan's NIKKEI down 591.83 pts or -2.03% at 28508.55 and the TOPIX down 38.07 pts or -1.98% at 1888.18. China's SHANGHAI closed down 0.013 pts or 0% at 3472.93 and the HANG SENG ended 513.81 pts lower or -1.76% at 28621.92.

- European equities are bouncing a little, with the German Dax up 31.4 pts or +0.21% at 15182.88, FTSE 100 up 22.95 pts or +0.33% at 6899.29, CAC 40 up 25.15 pts or +0.41% at 6197.57 and Euro Stoxx 50 up 24.7 pts or +0.63% at 3971.1.

- U.S. futures are flat/lower, with the Dow Jones mini up 8 pts or +0.02% at 33711, S&P 500 mini down 0.25 pts or -0.01% at 4126.25, NASDAQ mini down 30.75 pts or -0.22% at 13763.5.

COMMODITIES: Oil Lagging

- WTI Crude down $0.57 or -0.91% at $62.49

- Natural Gas down $0.01 or -0.4% at $2.714

- Gold spot up $0.11 or +0.01% at $1782.15

- Copper up $1.7 or +0.4% at $424.2

- Silver up $0.06 or +0.25% at $25.999

- Platinum up $1.72 or +0.14% at $1198.3

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.