-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Supply Disruptions Weigh On German Factories

EXECUTIVE SUMMARY:

- SUPPLY DISRUPTIONS CAUSE DIP IN GERMAN INDUSTRIAL ORDERS

- COMMODITIES AND TECH STOCKS WEAKER

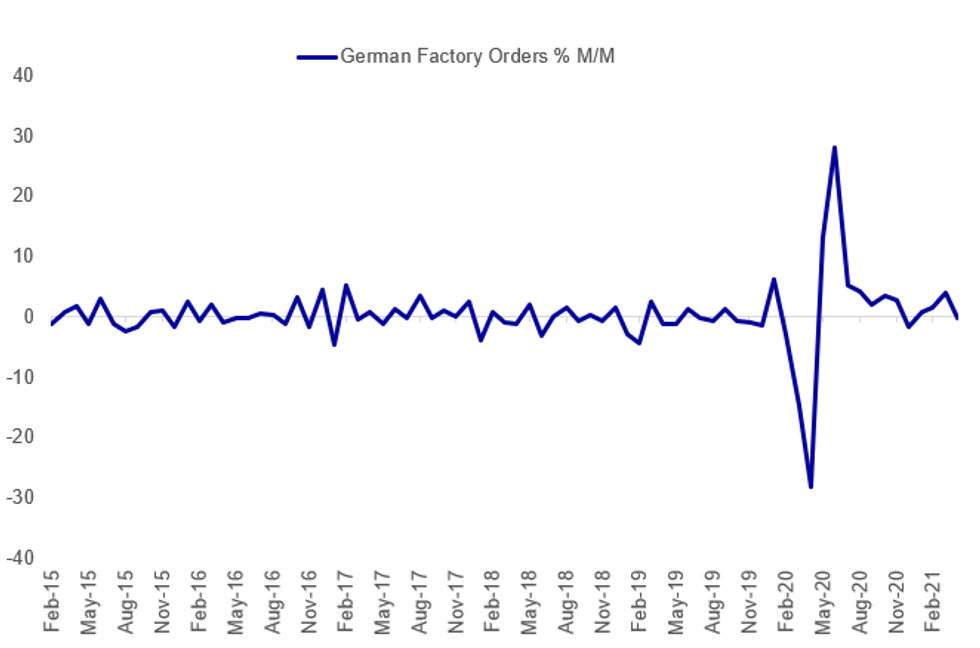

Fig. 1: German Factory Orders Fall Back In April

Source: Destatis, MNI

Source: Destatis, MNI

NEWS:

GERMAN DATA (RTRS): German industrial orders dropped unexpectedly in April on falling domestic demand, data showed on Monday, as supply chain disruptions held back manufacturers in Europe's largest economy. The Federal Statistics Offices said orders for industrial goods fell by 0.2% in seasonally adjusted terms, the first drop this year after three successive increases. The reading confounded a Reuters forecast of a 1.0% rise and came after an upwardly revised increase of 3.9% in March. A breakdown of the data showed that domestic demand fell by 4.3% while foreign demand rose by 2.7%.Both consumer and capital goods posted an increase while intermediate goods contracted by 1%, the data showed.

OIL (BBG): Oil declined after hitting $70 a barrel for the first time since October 2018 as a rally driven by signs of a tightening market stalled.Futures dropped 0.7% in New York after posting a second straight weekly gain. Despite oil falling on Monday, the long-term demand outlook remains bullish as vaccination rates climb worldwide, driving greater mobility. OPEC+ appears in control of crude prices, with U.S. production lagging pre-pandemic levels, according to Mike Muller, Vitol Group's head of Asia.

U.S. (BBG): In case you missed over the weekend... Treasury Secretary Janet Yellen said President Joe Biden should push forward with his $4 trillion spending plans even if they trigger inflation that persists into next year and higher interest rates. "If we ended up with a slightly higher interest rate environment it would actually be a plus for society's point of view and the Fed's point of view," Yellen said Sunday in an interview with Bloomberg News during her return from the Group of Seven finance ministers' meeting in London.

UK DATA (BBG): U.K. house prices grew at their strongest pace in almost seven years as consumers unleashed pent-up savings to gain more space after coronavirus lockdowns, Halifax Building Society said.Prices grew 1.3% in May, driving the annual pace of growth to 9.5%, the mortgage lender said in a statement on Monday. That put the average cost of a home at 261,743 pounds ($369,895).

CHINA DATA: China's exports rose 27.9% y/y in May driven by growing demand from European countries and the U.S. and greater shipments of labour intensive as well as mechanical and electrical products although the pace slowed from the 32.3% rise recorded in April, data from the General Administration of Customs showed on Monday.

JAPAN DATA: The Bank of Japan's Consumption Activity Index fell 0.7% m/m in April, falling after the revised 1.7% rise in March (up from +1.2%), data released Monday showed. The April index rose 0.4% q/q from Q1.

DATA:

FIXED INCOME: Looking ahead to Thursday

Core fixed income has been under a little pressure this morning, but markets are already starting to focus on events later this week with US CPI and the ECB monetary policy decision on Thursday both key events for the market.

- Today's calendar is a little light with the main releases having been German factory orders which was a bit softer than expected and Spanish industrial production which was a bit stronger.

- The only notable issuance is from EFSF which is selling a 3-year bond via syndication with a size of E2.5bln (upsized from E2.0bln). The US, Germany, the Netherlands and France all look to issue bills today.

- TY1 futures are down -0-5 today at 132-01+ with 10y UST yields up 2.5bp at 1.580% and 2y yields up 0.4bp at 0.152%.

- Bund futures are down -0.21 today at 171.73 with 10y Bund yields up 1.4bp at -0.200% and Schatz yields up 0.3bp at -0.673%.

- Gilt futures are down -0.21 today at 127.08 with 10y yields up 2.2bp at 0.811% and 2y yields up 1.2bp at 0.076%.

FX SUMMARY- USD pares some gains

A calmer start for FX as we start the week and attention turning squarely towards ECB meeting and US CPI, both released on Thursday.

- The Dollar was mostly better bid overnight, with risk tilted to the downside, following G7 ministers agreeing on a minimum 15% corporate tax.

- USD has given back of of its gains, as Equities edge back to flat during our morning European session.

- NOK, SEK, AUD and JPY are trading in the Green at the time of typing.

- AUDUSD hovers near session high at 0.7750, buoyed by S&P's rating, revising the long term outlook for the country to stable from negative.

- NOK leads against the greenback in G10, albeit just up 0.28%, despite lower Oil.

- WTI is seeing a corrective pullback towards %69, after hitting highest levels since 2018 at $70 overnight.

- The British Pound is struggling somewhat, down versus all majors,

- Focus for the UK going forward will be on the re-opening date of the 21st June, with some news report that the government is considering pushing back the next set of lifting of restrictions to July 5,

- A date by when over 40s are expected to have had their 2nd vaccinations.

- Looking ahead, no tier 1 data are scheduled

- Speakers sees BoE's Breeden speaking on Greening the Financial System, while Fed speakers are now on blackout period.

- ALL EYES are on Thursday's event/Data.

EQUITIES: U.S. Tech Underperforming Early

- Asian markets closed mixed, with Japan's NIKKEI up 77.72 pts or +0.27% at 29019.24 and the TOPIX up 1.66 pts or +0.08% at 1960.85. China's SHANGHAI closed up 7.696 pts or +0.21% at 3599.541 and the HANG SENG ended 130.82 pts lower or -0.45% at 28787.28.

- European markets are fairly flat, with the German Dax down 0.53 pts or 0% at 15651.38, FTSE 100 up 17.38 pts or +0.25% at 7069.04, CAC 40 down 2.63 pts or -0.04% at 6515.66 and Euro Stoxx 50 up 1.37 pts or +0.03% at 4079.6.

- U.S. futures are flat/weaker, with tech underperforming, with the Dow Jones mini up 6 pts or +0.02% at 34748, S&P 500 mini down 4.75 pts or -0.11% at 4223.5, NASDAQ mini down 35.25 pts or -0.26% at 13731.5.

COMMODITIES: Oil Slips, Silver Weaker

- WTI Crude down $0.49 or -0.7% at $69.23

- Natural Gas down $0.01 or -0.42% at $3.096

- Gold spot down $6.1 or -0.32% at $1884.13

- Copper down $2.65 or -0.59% at $450.55

- Silver down $0.19 or -0.69% at $27.574

- Platinum down $3.3 or -0.28% at $1166.78

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.