-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI US Open: Tech Stocks, USD, Tsys Sink On Georgia Results

EXECUTIVE SUMMARY:

- DEMOCRATS POISED TO CONTROL SENATE AFTER GEORGIA RUNOFF ELECTIONS

- U.K. BOOKMAKERS IMPLY 99+% PROBABILITY OF DEMS WINNING BOTH GEORGIA SEATS

- EUROZONE PMIS MISS EXPECTATIONS (WITH EXCEPTION OF SPAIN)

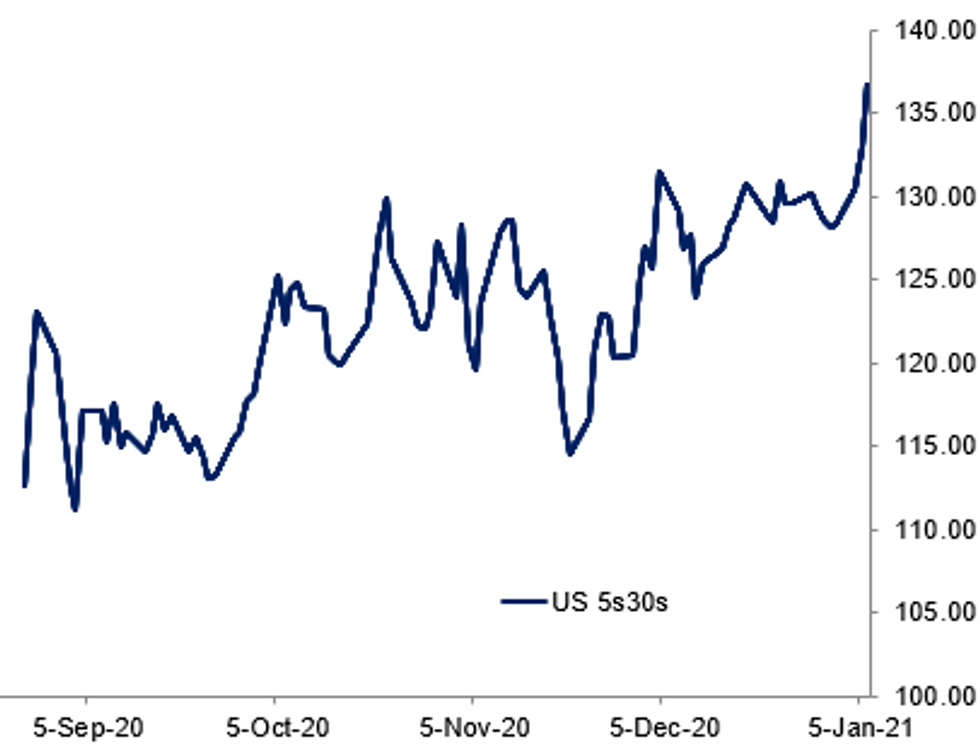

Fig. 1: Tsy Curve Steepens Post-GA Runoffs

BBG, MNI

BBG, MNI

NEWS:

GEORGIA ELECTIONS: Democrats are on the verge of taking effective control of the Senate following a pair of run-off elections in the southern state of Georgia. Democrat Raphael Warnock has been projected by a number of outlets as winning the special election, defeating incumbent Republican interim Senator Kelly Loeffler.

GEORGIA ELECTIONS (BBG): Loeffler said she isn't conceding. David Perdue, the other Republican candidate in the runoff, was narrowly trailing Democrat Jon Ossoff. There were still absentee ballots to be counted in some counties, and as many as 17,000 military and overseas ballots can be counted if they are postmarked by Tuesday and received by 5 p.m. Friday. Votes still to be counted were "scattered" throughout the state, with outstanding ballots in some counties that will help Democrats and others that will boost Republicans, Georgia Secretary of State Brad Raffensperger said late Tuesday night on CNN."I know one thing, there will be a lot of people looking for that mail coming in on Friday," Raffensperger said.

GEORGIA ELECTIONS: Democratic challenger Jon Ossoff's lead over incumbent Republican Senator David Perdue in the race for Georgia's Class II US Senate seat continues to grow, with the latest overnight figures showing Ossoff 16,370 votes ahead, compared to a lead of just over 12k votes earlier. In DeKalb County (a major focus of analysts in the 2020 presidential election) around 96% of the vote has been counted with the majority of thec.19k votes left to count being absentee ballots that are likely to lean strongly towards Ossoff. This is the case in nearly all large counties that still have votes left toc ount. There are c.11k votes left to count in Fulton County, c.5k in Chatham County, c.10k in Henry County, and c.4k in both Cobb and Gwinett counties. As in DeKalb County, these are mostly absentee ballots, and therefore are likely to also swing towards Ossoff.

GEORGIA ELECTIONS: While official results and potential challenges are still pending, latest Betfair odds show that the Democrats are certain to win the Georgia Special election (Warnock defeating Loeffler), with odds on the Democrat no longer on offer. In the Regular Senate race (Ossoff vs Purdue), the Democrats are priced on Betfair with 99% odds of victory.

FRANCE DATA: Consumer confidence snapped back sharply in France in December, as survey respondents looked through the current lockdowns to a brighter 12 months ahead, data released Wednesday by the French stats agency INSEE showed. The December Consumer Confidence Index rose to 95 from 89 in the previous month, which was a two-year low. A consumer fear of unemployment eased in Dec by 9pt, but remains well above pre-crisis levels.

UK DATA: The UK service sector saw a modest recovery in December although remaining in contractionary territory, data published Wednesday showed, as the brightest outlook in 6 years for 'the coming twelve months' underpinned IHS Market/CIPS Services index. The index rose to 49.4 in December, helped by almost 60% of respondents pointing to an increase in activity over the coming year, helping push past weaker current conditions.

EUROZONE: Euro area structural unemployment could increase due to mismatches between existing employment skills and those required to fulfill post-Covid crisis job needs, an article published by the European Central Bank in its economic bulletin has argued. Furloughs and short-time work temporarily cushioned the pandemic's effects on the labour market , according to the article, whose authors included Robert Anderton and Vasco Botelho. Yet it remains "unclear" what proportion of workers still taking advantage of such schemes will return to normal working hours, and how many will lose their jobs.

DATA:

MNI: UK FINAL DEC COMPOSITE PMI 50.4; FLASH 50.7; NOV 49.0

MNI: UK FINAL DEC SERVICES PMI 49.4; FLASH 49.9; NOV 47.6

MNI: EZ FINAL DEC COMPOSITE PMI 49.1; FLASH 49.8; NOV 45.3

MNI: EZ FINAL DEC SERVICES PMI 46.4; FLASH 47.3; NOV 41.3

MNI: GERMANY FINAL DEC COMPOSITE PMI 52.0; FLASH 52.5; NOV 51.7

MNI: GERMANY FINAL DEC SERVICES PMI 47.0; FLASH 47.7; NOV 46.0

MNI: FRANCE FINAL DEC COMPOSITE PMI 49.5; FLASH 49.6; NOV 40.6

MNI: FRANCE FINAL DEC SERVICES PMI 49.1; FLASH 49.2; NOV 38.8

MNI: ITALY FINAL DEC COMPOSITE PMI 43.0; NOV 42.7

MNI: ITALY DEC SERVICES PMI 39.7; NOV 39.4

MNI: SPAIN FINAL DEC COMPOSITE PMI 48.7; NOV 41.7

MNI: SPAIN DEC SERVICES PMI 48.0; NOV 39.5

MNI: FRANCE DEC CONSUMER CONF IND 95; NOV 89

MNI: FRANCE DEC FLASH HICP +0.2% M/M, 0.0% Y/Y; NOV +0.2% Y/Y

MNI: SAXONY DEC CPI +0.5% M/M, 0.0% Y/Y; NOV +0.1% Y/Y

HESSE DEC CPI +0.6% M/M, -0.5% Y/Y; NOV -0.6% Y/Y

MNI: BRANDENBURG DEC CPI +0.7% Y/Y, -0.1% M/M; NOV -0.1% Y/Y

FIXED INCOME: Core FI lower as more fiscal spending expected; Georgia turns blue

- Bonds have been under pressure this morning with curves bear steepening as betting markets are now pricing in a 99% chance of both Democratic candidates winning Senate seats in Georgia and hence the Democrats taking a clean sweep of the Presidency, House and Senate. This has led to expectations of larger fiscal stimulus alongside some policies which may potentially harm the profitability of certain sectors, such as tech.

- It has been a busy morning for data. The Spanish services PMI beat expectations and the Italian services PMI was worse than expected with some small revisions lower to other Eurozone PMI data. French inflation data has come in softer than expected, while some of the German regional data is pointing to downside risks to the German national print due out later today. The Italian and pan-Eurozone inflation prints are both due out at 11:00GMT/6:00ET.

- Across the pond, ADP employment, factory orders and the final print of durable goods will be watched, along with the FOMC Minutes from the December meeting.

- TY1 futures are down -0-19+ today at 137-07+ with 10y UST yields up 7.1bp at 1.028% and 2y yields up 1.3bp at 0.136%.

- Bund futures are down -0.67 today at 177.23 with 10y Bund yields up 3.4bp at -0.545% and Schatz yields up 1.3bp at -0.708%.

- Gilt futures are down -0.56 today at 134.77 with 10y yields up 4.9bp at 0.257% and 2y yields up 2.9bp at -0.122%.

FOREX SUMMARY

A busy early morning session for FX and across assets.

- USD came under renewed pressure throughout the EU morning session.

- Price action was led by some of the US run=offs results, with Warnock announced as the first winner.

- It also looks more than likely that the Dems will win the 2nd seat, as Ossoff moves ahead.

- Stimulus hope keeps the USD under renewed pressure.

- Despite some European National PMI misses this morning, EUR has taken its cue from the USD selling.

- EUR leads against JPY, but another small round of USD selling goes through.

- Still worth keeping a close eye on EUR appreciation and the ECB going forward.

- Couple of close resistance for the currency are nearing.

- EURJPY comes at 127.08 (dec 18 high)

- EURUSD 1.2353 High Apr 20, 2018

- A more limited impact for Cable, with the pair up 0.21% at 1.3652.

- Next resistance here is still at 1.3704 High Jan 4 where decent selling interest has been noted of late.

- Looking ahead, US ADP, Service PMI, Durable goods are the highlight, as well as the FOMC minutes

EQUITIES: Tech Stocks Underperforming On Apparent Democrat Senate Win

- Asian stocks closed mixed, with Japan's NIKKEI down 102.69 pts or -0.38% at 27055.94 and the TOPIX up 4.96 pts or +0.28% at 1796.18. China's SHANGHAI closed up 22.2 pts or +0.63% at 3550.877 and the HANG SENG ended 42.44 pts higher or +0.15% at 27692.3.

- European equities are higher, with the German Dax up 97.61 pts or +0.72% at 13666.42, FTSE 100 up 74.1 pts or +1.12% at 6651.92, CAC 40 up 27.42 pts or +0.49% at 5564.73 and Euro Stoxx 50 up 28.15 pts or +0.79% at 3555.24.

- U.S. futures are mixed-to-lower, with the Dow Jones mini up 49 pts or +0.16% at 30333, S&P 500 mini down 9.75 pts or -0.26% at 3708.5, NASDAQ mini down 213 pts or -1.66% at 12580.5.

COMMODITIES: Mixed Trade

Commodities are trading mixed early Wednesday, with gains led by Copper.

- WTI Crude up $0.19 or +0.38% at $49.77

- Natural Gas down $0.07 or -2.7% at $2.628

- Gold spot up $7.87 or +0.4% at $1953.23

- Copper up $5.45 or +1.5% at $368.6

- Silver up $0.17 or +0.62% at $27.6144

- Platinum down $5.35 or -0.48% at $1107.15

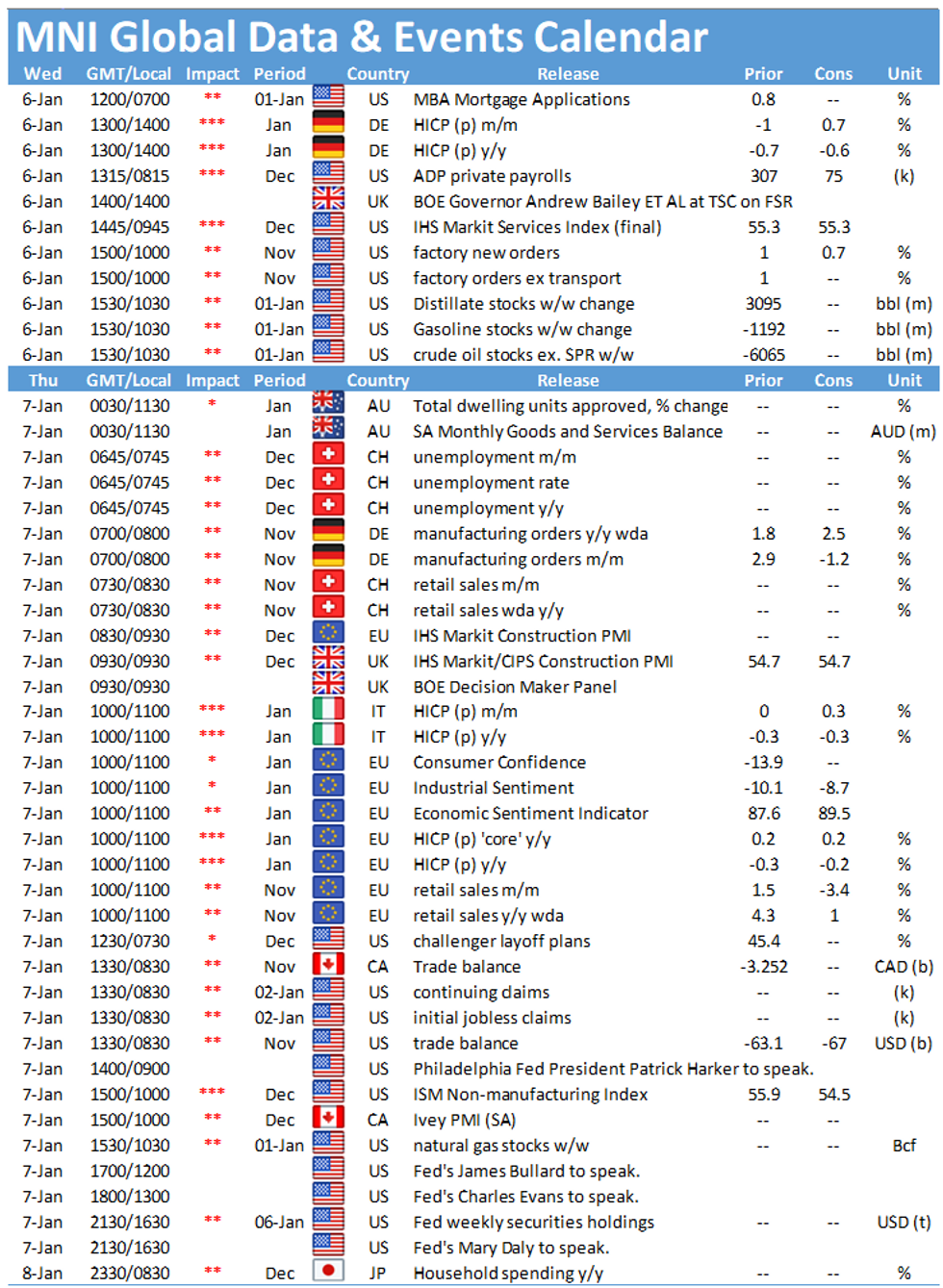

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.