-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: The Long Road Out Of Lockdown

EXECUTIVE SUMMARY

- U.K. GOV'T TO ANNOUNCE ROADMAP OUT OF LOCKDOWN

- MERKEL SEEKS 4-STAGE PLAN TO LOOSEN LOCKDOWN RESTRICTIONS: BILD

- GERMAN BUSINESS CONFIDENCE JUMPS ON POST-PANDEMIC ECONOMIC HOPES

- MNI INTERVIEW: U.S. TREASURY TO RAMP UP BILLS, AVOID 50-YR: CLARK

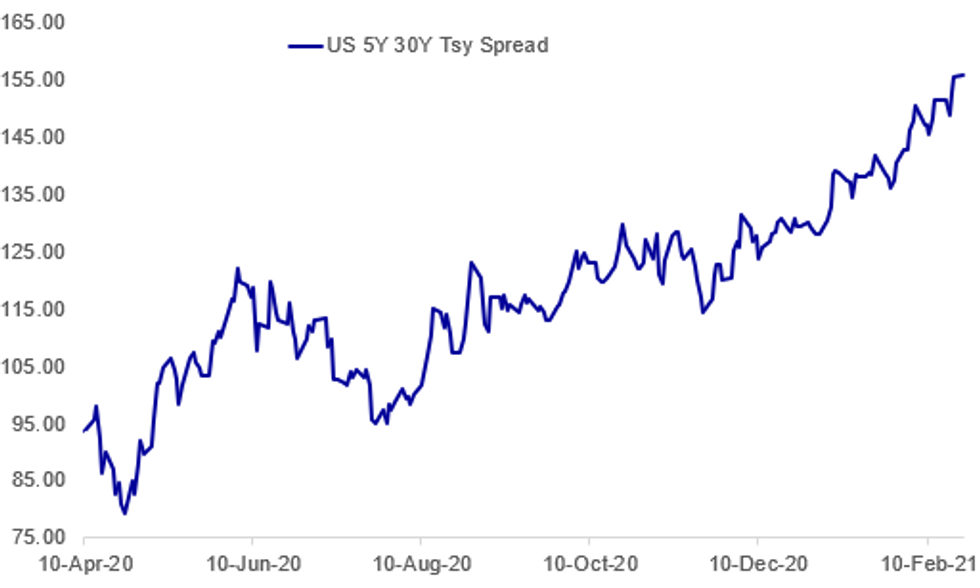

Fig.1 : Hitting Post-2014 Highs

BBG, MNI

BBG, MNI

NEWS:

UK: The biggest event for the UK this week will undoubtedly be the government's announcement regarding the roadmap out of lockdown.

- Cabinet are expected to sign off the decisions this morning with the Prime Minister expected to give a statement to parliament at 15:30GMT (timing approximate) before a press conference is given to the nation at 19:00GMT.

- According to media reports, this is likely to be accompanied by a "60-page document" emphasising "data not dates".

- It is looking likely that all school children will return on 8 March. The Telegraph is reporting that from 29 March people will be able to meet outside again if they stick to either a two household rule (with no limits on the size of a household) or the "rule of six" for people from multiple households. This is also seen as the date people will be allowed to leave their local area.

- According to multiple media reports, pubs and restaurants will be allowed to open for outside service in the next stage (likely April) with non-essential retailers also opening.

- Then the next steps would be to allow indoor pub/restaurant service and hairdressers to open before staycations are allowed.

UK/COVID: Scott Beasley at Sky News tweets: "New study from Scotland shows vaccines massively reduce the risk of hospitalisation. By the 4th week after first dose- the risk of hospitalisation is reduced by: Pfizer 85%, AstraZeneca 94%. This is real world data in a study by scientists from the University of Edinburgh, University of Strathclyde and Public Health Scotland. Dataset is entire Scotland population of 5.4m people"

- The good news on vaccine effectiveness in reducing the risk of hospitalisation comes as UK PM Boris Johnson is due to announce a roadmap to ending lockdown restrictions in England this afternoon in the House of Commons.

- Widely expected that the unwinding will be very gradual, with several weeks between each of the four stages of removing restrictions. Johnson came in for significant criticism in 2020 for the perception he had removed restrictions too early and too quickly to the detriment of public health. As such he is taking the opposite approach this time and ignoring the more lockdown-sceptic members of his own Conservative party, instead siding with more cautious scientific advice.

GERMANY (BBG/Bild); German Chancellor Angela Merkel told a CDU party meeting on Monday that she wants a plan for a four-stage loosening of restrictions, Bild reports, without saying where it got the information. Merkel didn't provide details on the plan. A working-level group is expected to work out the details on Tuesday.

GERMAN DATA (DPA): German business confidence rose sharply in February on hopes of a rebound in Europe's biggest economy and an end to tough restrictions aimed at containing the coronavirus. The Munich-based Ifo institute said its closely watched business climate index jumped more than forecast to 92.4 points this month from a revised January reading of 90.3.Analysts had forecast a more modest gain in February to 90.5 from a previously estimated 90.1 in January.

US (MNI EXCLUSIVE): The U.S. Treasury Department will likely ramp up bills auctions to fund President Joe Biden's USD1.9 trillion relief package and infrastructure plan later in the year while maintaining coupon auctions and continuing to avoid ultra-long bonds, former Treasury deputy assistant secretary for federal finance James Clark said in an interview. On MNI Policy MainWire now, for more details please contact sales@marketnews.com

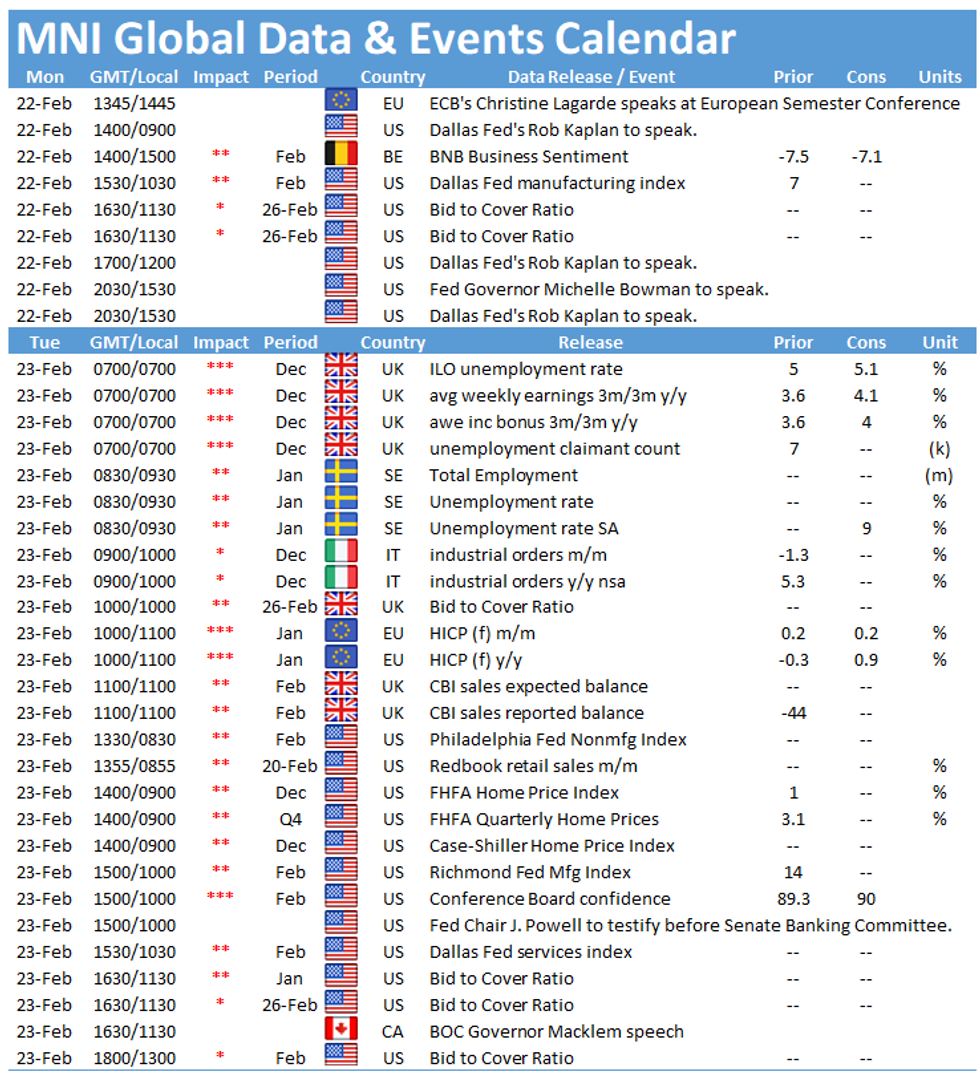

DATA:

FIXED INCOME: Profit taking, consolidation and front-running month-end

After a weak start, through both the Asian session and the European open, core fixed income has reversed its losses with Bunds and gilts largely flat compared to last week's close but Treasuries still a little lower. Curves have also seen reversals from the early steepening.

- Profit taking, consolidation and front-running of month-end portfolio rebalancing are all being cited as the reasons for the moves off the lows.

- The highlight of the day ahead will be Prime Minister Johnson's announcement on the roadmap out of lockdown in the UK. See our 7:17GMT bullet for more.

- TY1 futures are down -0-4+ today at 135-10 with 10y UST yields up 2.0bp at 1.359% and 2y yields unch at 0.108%.

- Bund futures are up 0.15 today at 174.33 with 10y Bund yields down -1.4bp at -0.321% and Schatz yields down -0.4bp at -0.692%.

- Gilt futures are up 0.01 today at 130.09 with 10y yields down -1.0bp at 0.687% and 2y yields down -1.9bp at 0.032%.

FOREX: Currencies Shrug Off Weaker Treasury, Equity Prices

Markets are holding steady so far Monday, with recent ranges being largely respected. The somewhat quieter currency markets contrast with some more interesting moves in others assets, with US Treasury yields edging further higher to hit the highest levels since February 2020. This coincides with weakness in global equities, with European and US futures all lower.

Commodity-tied currencies trade poorly, with NOK and CAD among the weakest so far Monday as markets reflect on the recent ebb off the cycle highs in both WTI and Brent crude futures.

The data calendar is typically thin for a Monday, with Chicago and Dallas Fed metrics the only highlights. The speaker slate should be more interesting, with ECB's Lagarde giving a keynote speech in front of the European Parliament just ahead of the NY opening bell. Fed's Kaplan & Bowman and BoE's Vlieghe are also on the docket.

EQUITIES: Turning Lower To Start The Week

- Asian stocks closed mixed, with Japan's NIKKEI up 138.11 pts or +0.46% at 30156.03 and the TOPIX up 9.4 pts or +0.49% at 1938.35. China's SHANGHAI closed down 53.723 pts or -1.45% at 3642.445 and the HANG SENG ended 324.9 pts lower or -1.06% at 30319.83

- European stocks are weaker, with the German Dax down 89.51 pts or -0.64% at 13829.65, FTSE 100 down 51.71 pts or -0.78% at 6600.48, CAC 40 down 34.94 pts or -0.61% at 5740.74 and Euro Stoxx 50 down 28.58 pts or -0.77% at 3667.46.

- U.S. futures are lower, with the Dow Jones mini down 183 pts or -0.58% at 31250, S&P 500 mini down 28 pts or -0.72% at 3875, NASDAQ mini down 150.25 pts or -1.11% at 13425.75.

FIXED INCOME: Metals Lead Broad Gains

- WTI Crude up $0.33 or +0.56% at $59.53

- Natural Gas down $0.09 or -3.06% at $2.979

- Gold spot up $13.5 or +0.76% at $1790.77

- Copper up $3.65 or +0.9% at $409.65

- Silver up $0.23 or +0.82% at $27.4039

- Platinum down $0.68 or -0.05% at $1268.86

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.