-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Treasuries Attempt Another Flattening Rally

EXECUTIVE SUMMARY:

- E.C.B.'S VILLEROY SAYS E.U. NEEDS "CREDIBLE BUT FLEXIBLE" FISCAL RULES

- CHINA RESISTANT TO U.S. GLOBAL TAX PLAN: ADVISORS (MNI EXCLUSIVE)

- CHINESE REGULATORS ASKS BANKS NOT TO WITHHOLD LOANS TO ASSET MANAGER HUARONG (RTRS SRCS)

- EUROZONE INFLATION CONFIRMED AT 14-MONTH HIGH IN MARCH

- E.U. WILL "MOST PROBABLY" DROP ASTRAZENECA, J&J AS FUTURE VACCINE OPTIONS

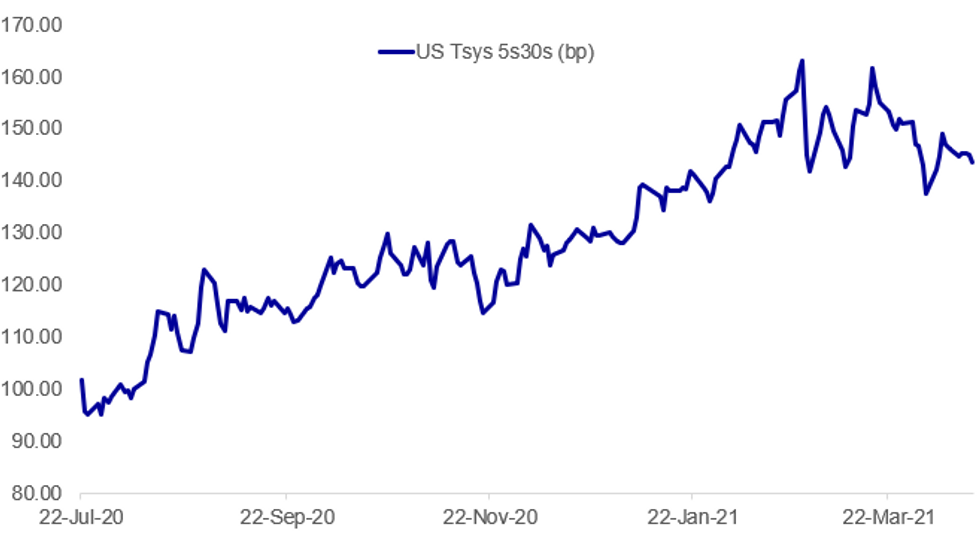

Fig. 1: Curve Tentatively Flattening Again Friday

BBG, MNI

BBG, MNI

NEWS:

ECB/EU: Europe needs "credible but flexible" fiscal rules, the governor of the Central Bank of France said in a speech Friday, as he advocated keeping the 3% deficit rule and 60% of GDP debt ceiling, while jettisoning the 1/20 rule of yearly adjustment towards it in favour of country-specific targets. "The revised rules, without changing the Treaty, should be based on a long-term debt trajectory and on a single operational target, namely a ceiling on the growth rate of public expenditure," François Villeroy de Galhau said, highlighting too the risk outside France of bank-sovereign loop. MNI has reported that France would like to see Covid-related debts to be excluded from any reordered fiscal rules.

CHINA (MNI EXCLUSIVE): China is little inclined to go along with the U.S. plan for a global minimum corporate tax as Beijing wants to protect small and medium companies and free trade zones and remain attractive for foreign businesses, policy advisors said. For full article contact sales@marketnews.com

CHINA/HUARONG (RTRS): Chinese regulators have asked some banks not to withhold loans to embattled asset management giant China Huarong Asset Management Co, as part of the supportive measures to stabilize its cash flow position, sources told Reuters. Huarong is one of China's four biggest distressed asset management companies (AMCs) which counts the Ministry of Finance as its biggest shareholder. It has been hit by an offshore bond selloff and a suspension in its shares since March 31, after it announced a delay in its earnings report due to a "relevant transaction" yet to be finalised. That is the latest in the troubles for the distressed-debt manager whose failed investments and expanded businesses have forced it into restructuring talks since 2018 and whose Chairman Lai Xiaomin was executed in January after a graft probe. Huarong and its subsidiaries currently have outstanding offshore bonds worth $22.39 billion, according to Refinitiv data, with some $3.57 billion of them are maturing in 2021.

CHINA/HUARONG (BBG): China Huarong Asset Management's operations are normal and liquidity is ample, China's banking regulator says in a statement sent via WeChat. Huarong will publish delayed annual report at appropriate time based on rules.

E.U./COVID (BBG): The European Union "most probably" won't renew contracts for Covid-19 vaccines with AstraZeneca Plc and Johnson & Johnson as it prioritizes other types of shots, according to a French government minister.The comments follow the European Commission's announcement this week that it's in talks with Pfizer Inc. and BioNTech for as many as 1.8 billion additional vaccine doses through 2023.

IRAN NUCLEAR (RTRS): The speaker of Iran's parliament said on Friday that Tehran had successfully enriched 60% uranium."I am proud to announce that at 00:40 … Iranian scientists were able to produce 60% enriched uranium," Mohammad Qalibaf said on Twitter.

GERMANY / EU (RTRS): Germany is optimistic that it will be able to soon ratify the European Union's own resources decision which is essential for launching the bloc's 750 billion euro recovery spending to mitigate the consequences of the COVID-19 pandemic. "The experience with similar cases makes me very optimistic that the ratification of the own resources decision can be completed promptly," German Finance Minister Olaf Scholz said on Friday ahead of a virtual meeting with his EU counterparts.

CHINA: China's banks may dispose of more bad loans than last year, Liu Zhiqing, the deputy head of the statistics department of the China Banking and Insurance Regulatory Commission (CBIRC), said Friday. Banks disposed of CNY3.02 trillion bad loans in 2020, the highest level in recent years, but there were still CNY3.6 trillion non-performing loans outstanding at the end of Q1, up CNY118.3 billion from the beginning of this year, despite the bad loan ratio edging down 2 bps to 1.89%.

DATA:

EZ Inflation Confirmed At 14-Month High in Mar

MAR FINAL HICP +0.9% M/M, +1.3% Y/Y; FEB +0.9% Y/Y

MAR FINAL CORE HICP +1.0% M/M; +0.9% Y/Y; FEB +1.1% Y/Y

Headline EZ inflation ticked up in Mar by 0.4pp to 1.3%, confirming the flash estimate and coming in line with market expectations.

This marks the highest level since Jan 2020 where inflation registered at 1.4%.

Core inflation eased to 0.9% in Mar, down from 1.1% seen in Feb and showing the lowest level since Dec 2020.

Price growth for food, alcohol and tobacco slowed to 1.1% in Mar, while non-energy industrial goods prices decelerated to 0.3%.

Service inflation edged higher to 1.3% in Mar, while energy prices rebounded sharply, rising by 4.3% after falling by 1.7% in Feb.

Among the member states, the highest annual rates have been recorded in Luxembourg (2.5%), Germany and Austria (both at 2.0%), while Greece (-2.0%), Portugal, Malta, Ireland and Slovenia (all at 0.1%) saw the lowest inflation rates.

MNI: EZ FEB SA TRADE BALANCE +EUR18.4 BN; JAN +EUR28.7 BN

FIXED INCOME: Waiting for the US: Retrace or continue yesterday's UST moves?

- Core fixed income has again been partially reversed yesterday's moves. This has marked a range-bound week for Bunds with gilts and Treasuries a little higher on the week so far.

- It's a pretty light day on the calendar with Michigan confidence, housing data and a speech from Kaplan the highlights. Markets will be watching closely to see the reaction in the Treasury market as the US starts to get in after yesterday's rally and the partial retracement overnight.

- TY1 futures are down -0-10 today at 132-11 with 10y UST yields up 0.1bp at 1.579% and 2y yields up 0.1bp at 0.162%.

- Bund futures are down -0.38 today at 170.95 with 10y Bund yields up 2.2bp at -0.270% and Schatz yields up 0.5bp at -0.699%.

- Gilt futures are down -0.41 today at 128.41 with 10y yields up 3.0bp at 0.766% and 2y yields up 1.0bp at 0.043%.

FOREX: GBP Softens, Erasing Week's Stronger Start

- Having outperformed during the first half of the week, GBP slipped to the bottom of the G10 pile early Friday, with decent volumes going through on the fall from ~1.3760 to ~1.3735 and from ~1.3740 to the day's lows of 1.3717.

- There was no key headline driver for the move, but does coincide with EUR/GBP convincingly taking out 0.87 on the way higher to touch the best levels since late February.

- Elsewhere, USD underwent a spell of weakness, with the turnaround being felt most materially in EUR/USD. The pair narrowed in on yesterday's highs at 1.1993 to play catch-up with the earlier strength in EURGBP.

- Next resistance in EURUSD crosses at 1.2037, the 61.8% retracement of the Feb 25 - Mar 31 sell-off and a break through here would signal scope for an extension of recent gains. There was a decent uptick in EUR futures volumes on the move, with over 3,500 contracts changing hands inside 5 minutes (cash equivalent approx. E450mln).

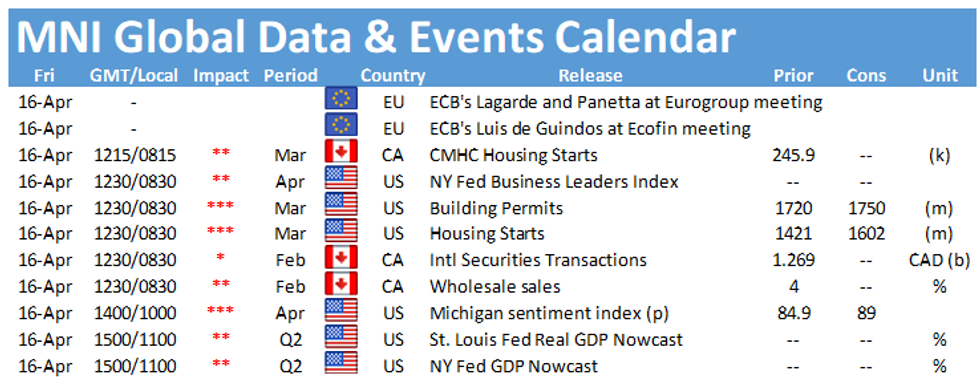

- Focus turns to US Housing Starts/Building Permits data as well as prelim Uni. of Michigan Sentiment data for April. Fed's Kaplan has the final word ahead of the FOMC media blackout period, which begins this weekend ahead of the Apr 28 rate decision.

EQUITIES: European Stocks Higher; U.S. Flat

- Asian markets closed higher, with Japan's NIKKEI up 40.68 pts or +0.14% at 29683.37 and the TOPIX up 1.74 pts or +0.09% at 1960.87. China's SHANGHAI closed up 27.63 pts or +0.81% at 3426.618 and the HANG SENG ended 176.57 pts higher or +0.61% at 28969.71.

- European equities are gaining, with the German Dax up 98.33 pts or +0.64% at 15331.36, FTSE 100 up 30.55 pts or +0.44% at 7013.9, CAC 40 up 17.27 pts or +0.28% at 6247.15 and Euro Stoxx 50 up 11.6 pts or +0.29% at 4005.54.

- U.S. futures are flat, with the Dow Jones mini up 12 pts or +0.04% at 33935, S&P 500 mini down 2.75 pts or -0.07% at 4159.75, NASDAQ mini down 41.5 pts or -0.3% at 13972.5.

FOREX: Copper Underperforms On Underwhelming China Econ Data

- WTI Crude up $0.16 or +0.25% at $63.62

- Natural Gas up $0.03 or +1.2% at $2.69

- Gold spot up $2.7 or +0.15% at $1762.05

- Copper down $1.85 or -0.44% at $420

- Silver up $0.08 or +0.32% at $25.93

- Platinum up $1.49 or +0.12% at $1199.3

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.