MNI US OPEN - Trudeau Resignation Odds Surge to 95%

EXECUTIVE SUMMARY

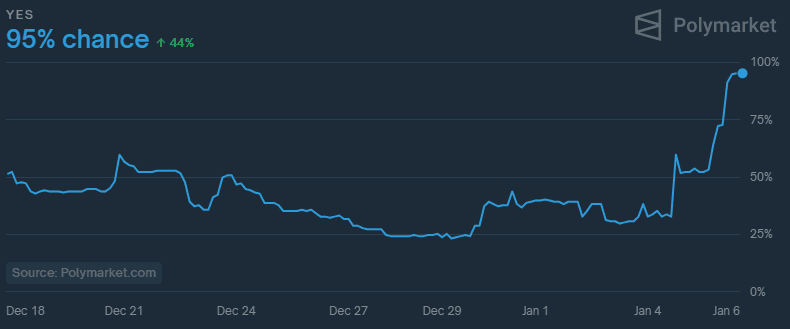

- BETTING MARKETS SHIFT TO 95% PROBABILITY OF IMMINENT TRUDEAU RESIGNATION

- ISRAEL AND HEZBOLLAH TRADE THREATS OVER FUTURE OF CEASEFIRE AS DEADLINE LOOMS

- BOJ TO RAISE RATE IF ECONOMY, PRICES IMPROVE, UEDA SAYS

- EUROZONE COMPOSITE PMI STILL LACKLUSTRE BUT PRICE PRESSURES FIRM

Figure 1: Betting market implied probability PM Trudeau announces resignation before February, %

Source: Polymarket.com

NEWS

CANADA (MNI): Betting Markets Shift to 95% Probability of Imminent PM Resignation

Following earlier headlines in the domestic press claiming that PM Justin Trudeau could resign/announce his resignation as soon as 7 Jan, betting markets have shifted significantly. Data from Polymarket shows political bettors assigning a 95% implied probability that Trudeau will announce his resignation before February, while data from Kalshi shows bettors assigning the same 95% implied probability that Trudeau will resign before April. Prior to the publication of the speculation on 5 Jan, the implied probability of an immediate resignation stood around 50%.

MIDEAST (WaPo): Israel And Hezbollah Trade Threats Over Future of Ceasefire as Deadline Looms

Israel accused Hezbollah on Sunday of failing to meet the terms of their fragile 60-day ceasefire agreement, due to expire on Jan. 26, threatening that it would be "forced to act" if the militant group's violations continue. The warning comes days after Lebanon reported to the U.N. Security Council that Israel had launched more than 800 "ground and air attacks" after the ceasefire came into effect. Israeli Defense Minister Israel Katz said during a visit to troops Sunday that Hezbollah militants and weaponry had not yet moved north of the Litani River in southern Lebanon, as stipulated in the deal.

US (BBG): Biden Bars Offshore Oil Drilling in US Atlantic and Pacific

President Joe Biden is indefinitely blocking offshore oil and gas development in more than 625 million acres of US coastal waters, warning that drilling there is simply “not worth the risks” and “unnecessary” to meet the nation’s energy needs. Biden’s move is enshrined in a pair of presidential memoranda being issued Monday, burnishing his legacy on conservation and fighting climate change just two weeks before President-elect Donald Trump takes office.

UK (FT): UK Businesses Plan Price Increases as Budget Drives Up Costs

The number of businesses planning to raise prices in the coming months has jumped sharply as increases in the UK Budget in tax and wage costs caused confidence to “slump”, the British Chambers of Commerce has warned. About 55 per cent of companies said they were planning to increase prices in the coming three months, up from 39 per cent in the third quarter, the lobby group’s survey of almost 5,000 businesses found.

FRANCE (BBG): French Government Tempers Budget Goal to Shelter Economy

France’s new Finance Minister Eric Lombard set out a slower pace of deficit reduction as he seeks to preserve economic growth and shore up political support after the previous government was toppled over its budget plan. Lombard was appointed last month to piece together a 2025 finance bill that can significantly rein in the deficit from around 6.1% of economic output this year, while also garnering support in a divided National Assembly.

BOJ (MNI): To Raise Rate if Economy, Prices Improve - BOJ's Ueda

The BOJ will raise its benchmark interest rate to adjust the degree of easy policy if the improvement in the economy and prices continues, Governor Kazuo Ueda said on Monday, the Nikkei reported. Ueda, speaking at the new year party of Japanese Bankers Association, said that the timing of policy adjustments will depend on future economic, price and financial conditions and the BOJ must pay attention to various risk factors. He also said the uncertainties over policy under the new U.S. president are high and he also cited the momentum toward the spring wage negotiations as a point.

CHINA (RTRS): Chinese Exchanges Ask Big Fund Managers to Restrict Stock Selling

China's main stock exchanges asked some large mutual funds to restrict stock selling at the start of the year, three sources familiar with the matter said, as authorities sought to calm markets heading into a tricky period for the world's second-largest economy. At least four large mutual funds received calls from the Shanghai and Shenzhen stock exchanges on Dec. 31 and Jan. 2 and 3, asking them to buy more stocks than they sold each day.

CHINA (BBG): China Pushes Back Against Yuan Weakness After Last Week’s Slide

China reaffirmed its support for the yuan after the currency’s slide last week fanned speculation policymakers would allow it to depreciate faster. The People’s Bank of China set its daily reference rate stronger than the line of 7.2 per dollar, defying speculation it would weaken the so-called fixing. In addition, a PBOC-backed newspaper said central bank communication had showed a clearer resolve to stabilize the currency. Beijing is planning to sell more bills in Hong Kong, local media Yicai said, a move that may mop up liquidity and boost the yuan.

S. KOREA (BBG): South Korea Investigators to Seek Extension of Warrant for Yoon

South Korea’s corruption watchdog plans to ask a Seoul court to extend a warrant to arrest President Yoon Suk Yeol after their first attempt last week ended in failure following an hours-long standoff with his security team. The Corruption Investigation Office for High-ranking Officials asked the police to handle the arrest on their behalf following the failure. But police effectively rejected the request, saying there could be legal controversy for them to execute the warrant issued for CIO.

N. KOREA (MNI): N. Korea Tests Suspected Hypersonic Missile During Sensitive Period

North Korea test-fired a suspected hypersonic missile into the East Sea overnight, Yonhap News Agency reported citing the South Korean military. The launch took place days before the inauguration of US President-elect Donald Trump and during outgoing Secretary of State Anthony Blinken's visit to Seoul. A projectile resembling an intermediate-range ballistic missile (IRBM) was fired from the Pyongyang area and flew for around 1,100km before crashing into the sea. This comes amid the ongoing political crisis in South Korea, with analysts warning that the North could seek to exploit the opportunity and ratchet up geopolitical tensions to further destabilise its neighbour.

DATA

EUROZONE DATA (MNI): EZ Composite PMI Still Lacklustre But Price Pressures Firm

- EUROZONE FINAL DEC COMPOSITE PMI 49.6 (FLASH 49.5)

- EUROZONE FINAL DEC SRVCS PMI 51.6 (FLASH 51.4); NOV 49.5

- GERMANY FINAL DEC SRVCS PMI 51.2 (FLASH 51.0); NOV 49.3

- FRANCE FINAL DEC SRVCS PMI 49.3 (FLASH 48.2); NOV 46.9

- SPAIN DEC SRVCS PMI 57.3 (FCAST 54.1); NOV 53.1

- ITALY DEC SRVCS PMI 50.7 (FCAST 50.0); NOV 49.2

The Eurozone services PMI was revised higher in December from a preliminary 51.4 to 51.6, leaving it with a complete reversal of the slide to 49.5 in Nov. France drove the upward revision (from 48.2 to 49.3 to also more firmly bounce from the 46.9 in Nov) although Germany was also revised higher from 47.8 to 48.0. Whilst already implied, new data showed peripherals continued to outperform in Dec with the Spain jumping from 53.1 to 57.3 (highest since Apr'23) and Italy rising from 49.2 to 50.7 (albeit only highest since Oct).

UK DATA (MNI): Final Dec PMI Confirms Deeper Job Cuts But Accelerating Inflation

- UK FINAL DEC SRVICES PMI 51.1 (FLASH 51.4); NOV 50.4

The UK services PMI was revised three tenths lower to 51.1 in the final December release (51.4 prelim), leaving a very mild bounce from the 50.8 in Nov. The tepid recovery is in contrast to the stronger relative rebound in the Eurozone PMIs this morning. The flash release had indicated as such but this final release notes three consecutive monthly declines in staffing numbers for service providers, with December seeing its sharpest drop since Jan 2021. 23% of respondents reported a decline vs 12% signalling a rise.

FOREX: Euro Strengthens Following Stronger Data, Dollar on Back Foot

- Markets are continuing to pare ECB easing bets following the stronger-than-expected data releases across the Eurozone PMIs and the German inflation print for Hesse. As such, the Euro is rising and is among the best performers in G10.

- EURUSD has gained momentum back above the prior breakout level of 1.0335, briefly taking the pair to an intra-day high of 1.0369. Overall, the trend needle continues to point south, and initial firm resistance is at 1.0414, the 20-day EMA.

- EURJPY is standing out, rising 0.75% at typing amid the notable weakness for the Japanese Yen overnight. We have traded above the Jan 02 high while the focus will be on 165.04, the Nov 15 high and a key short-term resistance.

- The dollar has started the week on the back foot, with higher beta currencies such as GBP, AUD, NZD and CAD all benefitting. This brings the USD index pullback to ~0.9%, following the new two-year high made last week of 109.53.

- There will be particular focus on the Canadian dollar as betting markets shift to 95% probability of imminent PM Trudeau resignation. USDCAD is down 0.5% on the session with pullback seen as technically corrective at this juncture. Initial firm support to watch lies at 1.4320, the 20-day EMA.

- German national-level HICP & CPI inflation is scheduled to be released later today 13:00 GMT. US Final Services PMI and Factory Orders are due for release, and FOMC Member Cook will speak.

BONDS: Core Global FI Pressured by Data & Supply, EGBs Tighten to Bunds

Core global FI markets have sold off this morning.

- Firmer-than-expected Hesse CPI data out of Germany (based on comparisons with the national CPI expectations) drove further hawkish repricing on the ECB-dated OIS strip and some weakness in bonds.

- ~100bp of ECB cuts now priced through ’25 vs. 115-120bp seen just before the Christmas break.

- Issuance-related pressure also noted ahead of the data, with EUR & GBP supply swelling, expectations for a brisk start for $IG ’25 issuance noted and Tsy coupon supply due over the next three days (as well as the risk of EGB syndication announcements).

- Bund futures -31 at 132.33, lows of 132.22 printed.

- Initial support at 132.00 untested.

- German yields 1-4bp higher, curve flattens. 2s10s 24.6bp, just over 5bp off December highs.

- EGB spreads to Bunds tighter given the Hesse CPI, equity rally and stronger-than-expected peripheral & French services PMIs.

- BTPs and OATs the outperformers, narrowing by ~2bp vs. Bunds.

- 10-Year gilts little changed vs. Bunds, spread ~216bp after trading either side of 220bp over the holiday period.

- Benchmark UK yields 1-2bp higher, cross-market inputs continue to dominate.

- Gilt futures -26 at 91.97, off lows of 91.78. Initial support at the Dec 19 low/bear trigger (91.64) untested.

- SONIA futures +0.5 to -2.0. BoE-dated OIS pricing 56bp of cuts through ’25, 1.5bp less dovish on the day.

- German national CPI data due this afternoon.

- Final U.S. services PMI and durable goods data also due later today, as is factory orders.

- Elsewhere, Fed Governor Cook will speak.

EQUITIES: Bear Threat in E-Mini S&P Remains Present, Attention on $5866.00

A bull cycle in the Eurostoxx 50 futures contract remains intact. However, the recent move down continues to highlight a corrective phase and despite the latest bounce, a short-term bear threat remains present - for now. Key short-term support has been defined at 4829.00, the Dec 20 low. A break of it would confirm a resumption of the bear cycle and open 4800.87, a Fibonacci retracement. Initial firm resistance to watch is at 4942.00, the Jan 2 high. A bear threat in the S&P E-Minis contract remains present. The reversal lower from the Dec 26 high, highlights the end of the recent Dec 20 - 26 corrective bounce. Attention is on 5866.00, the Dec 20 low and a key short-term support. Clearance of this level would strengthen a bearish theme. Initial firm resistance to monitor is 6107.50, the Dec 26 high. Clearance of this level is required to open key resistance at 6178.75, the Dec 6 high.

- Japan's NIKKEI closed lower by 587.49 pts or -1.47% at 39307.05 and the TOPIX ended 28.54 pts lower or -1.02% at 2756.38.

- Elsewhere, in China the SHANGHAI closed lower by 4.507 pts or -0.14% at 3206.923 and the HANG SENG ended 71.98 pts lower or -0.36% at 19688.29.

- Across Europe, Germany's DAX trades higher by 81.84 pts or +0.41% at 19989.21, FTSE 100 lower by 11.2 pts or -0.14% at 8212.75, CAC 40 up 47.39 pts or +0.65% at 7329.61 and Euro Stoxx 50 up 40.2 pts or +0.83% at 4911.65.

- Dow Jones mini up 44 pts or +0.1% at 43067, S&P 500 mini up 21.5 pts or +0.36% at 6011, NASDAQ mini up 119.5 pts or +0.56% at 21636.

Time: 09:50 GMT

COMMODITIES: Gains for WTI Futures Expose Key Short-Term Resistance at $76.41

WTI futures traded higher last week as the contract extended recent gains. A stronger reversal to the upside has exposed key short-term resistance at $76.41, the Oct 8 high. A firm resistance at $71.97, the Nov 7 high, has been breached, strengthening a bullish theme. On the downside, a reversal lower would expose support at the 20-day EMA, at $70.49. This average is seen as a key short-term support. A bear threat in Gold remains present despite the latest recovery, The yellow metal traded sharply lower on Dec 18 and the move undermines a recent bull theme. A resumption of weakness would open key support at $2536.9, the Nov 14 low. The first firm support to watch is $2583.6, the Dec 19 low. On the upside, a resumption of gains would instead signal scope for a climb towards resistance at $2726.2, the Dec 12 high.

- WTI Crude down $0.14 or -0.19% at $73.83

- Natural Gas up $0.29 or +8.5% at $3.637

- Gold spot down $8.18 or -0.31% at $2631.91

- Copper up $1.45 or +0.36% at $409.1

- Silver up $0.13 or +0.44% at $29.7411

- Platinum up $9.26 or +0.99% at $948.25

Time: 09:50 GMT

| Date | GMT/Local | Impact | Country | Event |

| 06/01/2025 | 1300/1400 | *** | HICP (p) | |

| 06/01/2025 | 1445/0945 | *** | S&P Global Services Index (final) | |

| 06/01/2025 | 1445/0945 | *** | S&P Global US Final Composite PMI | |

| 06/01/2025 | 1500/1000 | ** | Factory New Orders | |

| 06/01/2025 | 1630/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 06/01/2025 | 1630/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 06/01/2025 | 1800/1300 | *** | US Note 03 Year Treasury Auction Result | |

| 07/01/2025 | 0001/0001 | * | BRC-KPMG Shop Sales Monitor | |

| 07/01/2025 | 0030/1130 | * | Building Approvals | |

| 07/01/2025 | 0730/0830 | *** | CPI | |

| 07/01/2025 | 0745/0845 | *** | HICP (p) | |

| 07/01/2025 | 0830/0930 | ** | S&P Global Final Eurozone Construction PMI | |

| 07/01/2025 | 0900/1000 | ** | ECB Consumer Expectations Survey | |

| 07/01/2025 | 0900/1000 | *** | Bavaria CPI | |

| 07/01/2025 | 0930/0930 | ** | S&P Global/CIPS Construction PMI | |

| 07/01/2025 | 1000/1000 | ** | Gilt Outright Auction Result | |

| 07/01/2025 | 1000/1000 | ** | Gilt Outright Auction Result | |

| 07/01/2025 | 1000/1100 | *** | HICP (p) | |

| 07/01/2025 | 1000/1100 | ** | Unemployment | |

| 07/01/2025 | 1000/1100 | *** | HICP (p) | |

| 07/01/2025 | 1330/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 07/01/2025 | 1330/0830 | ** | Trade Balance | |

| 07/01/2025 | 1330/0830 | ** | International Merchandise Trade (Trade Balance) | |

| 07/01/2025 | 1355/0855 | ** | Redbook Retail Sales Index | |

| 07/01/2025 | 1500/1000 | * | Ivey PMI | |

| 07/01/2025 | 1500/1000 | *** | ISM Non-Manufacturing Index | |

| 07/01/2025 | 1500/1000 | *** | JOLTS jobs opening level | |

| 07/01/2025 | 1500/1000 | *** | JOLTS quits Rate | |

| 07/01/2025 | 1630/1130 | * | US Treasury Auction Result for Cash Management Bill | |

| 07/01/2025 | 1800/1300 | ** | US Note 10 Year Treasury Auction Result |