-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Vaccine Tensions Weigh On Stocks

EXECUTIVE SUMMARY:

- U.K.-E.U. RELATIONS UNDER STRAIN AS BRUSSELS POTENTIALLY BLOCKS VACCINE EXPORTS

- U.S. VACCINE TRIAL DATA LIKELY TO SEE ASTRAZENECA/OXFORD FILE FOR EMERGENCY USE APPROVAL

- EUROPE AIRLINES, TRAVEL STOCKS FALL AMID EU-UK VACCINE TENSION

- FED'S BARKIN SEES STRONG ECONOMY WITH SOME PRICE PRESSURES

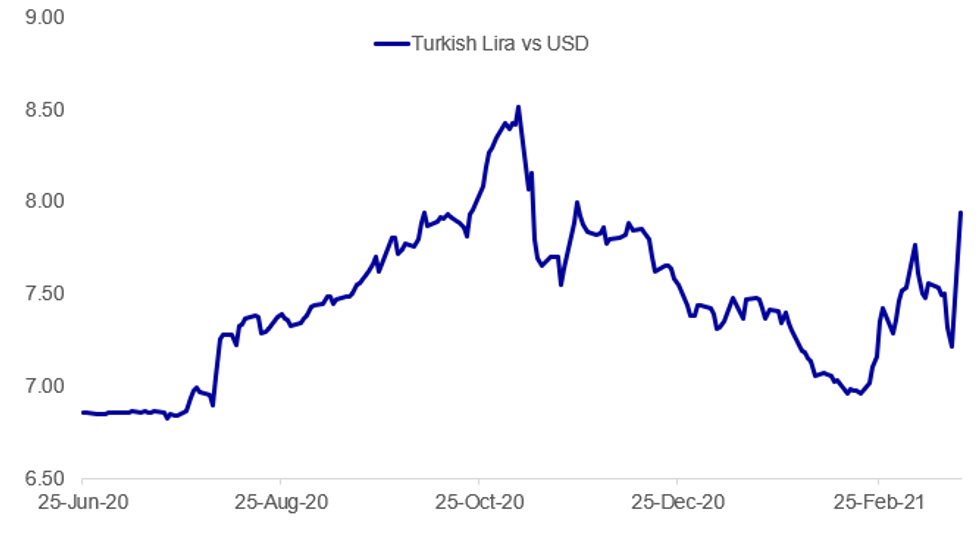

Fig. 1: Turkish Lira Off Weakest Intraday Levels Vs USD But Still Down Sharply

BBG, MNI

BBG, MNI

NEWS:

UK/EU/COVID VACCINE: U.K. political developments will be closely watched this week, particularly regarding vaccine supply (which has now seen more than 50% of adults receive a first dose). Supply is already expected to slow in April as 5 million doses of the AZ/Oxford vaccine that were due to be imported from India have been delayed (after reported export bans) while a batch of 1.7 million doses which has already been delivered is undergoing additional checks and it is uncertain whether this batch will be able to be used. This has led to guidance for the NHS not to book in any vaccine appointments for anyone outside of the top 9 priority groups during April, and instead to focus on second doses and anyone in the priority groups who has yet to receive a first dose (note that the priority groups include all over 50s, all clinically vulnerable, all carers and NHS workers).

UK/EU/COVID VACCINE: Weekend reports suggest that the EU will block any exports to the UK of the AZ/Oxford vaccine or its ingredients to the UK, but that Prime Minister Boris Johnson is attempting to drum up enough support from Eurozone leaders to veto this before a final decision is reached on Thursday. A ban on exports to the UK of the AZ/Oxford would have huge political ramifications, particularly with the EU and UK already at odds regarding the implementation of the post-Brexit trade deal in Northern Ireland. However, most of the vaccines imported into the UK from the EU have been in the form of the Pfizer vaccine. A block on exports of the Pfizer vaccine from the EU (which is manufactured in Belgium and reports suggest the Belgian government would strongly oppose) would have much more impact on the pace of the UK's vaccination scheme while also calling into question whether enough second doses could be secured within the 12 week recommended timeframe for a second dose to be administered.

US/ASTRAZENECA VACCINE: Headlines suggest that the trial data for the AZ/Oxford vaccine in the US has seen 79% of Covid-19 cases prevented with no one who contracted Covid-19 who had taken the vaccine admitted to hospital.

- Remember that AZ was awaiting a large enough "local" trial in the US in order to seek emergency use approval (EUA) of the vaccine in the US.

- To receive EUA, AZ must now file a request with the FDA.

- For the Pfizer/BioNTech vaccine, a request was filed on 20 November with EUA granted on December 11 (3 week later).

- For the Moderna vaccine a request was filed on 30 November with EUA granted on 18 December (so one working day less than 3 weeks).

EUROPE/COVID (BBG): European airlines and travel stocks fall after the EU warned it's ready to withhold vaccine shipments to the U.K. and after a U.K. government adviser said foreign holidays this summer are "unlikely." The Stoxx 600 Travel & Leisure Index falls 1.9%, the day's worst-performing sector in the broader equity gauge.

TURKEY: Turkish Pres Erdogan's surprise decision to oust CBRT Gov Agbal sent the lira tumbling in early Asia-Pac trade. USD/TRY wiped out four months worth of losses amid thin liquidity, despite touted action by Turkish state banks, before gradually trimming gains through the rest of the session.

TURKEY: The Borsa Instanbul have raised FX futures upper price limit to 20% this morning, from 10% previously. The statement notes the change is valid for today only.- Affected FX pairs are: USD/TRY, EUR/TRY, RUB/TRY, CNH/TRY and Gold/TRY

EUROPE/COVID (YOUGOV SURVEY): European confidence in AstraZeneca vaccine safety sinks after blood clot scare (changes in last 2/3 weeks)

- France safe 23% (-10) / unsafe 61% (+18)

- Italy safe 36% (-18) / unsafe 43% (+27)

- Germany safe 32% (-11) / unsafe 55% (+15)

- Spain safe 38% (-21) / unsafe 52% (+27)

ITALY (BBG): Italy's government is evaluating a further pandemic relief package for businesses worth up to EU30b in extra deficit, Il Messaggero reports on Monday without citing any source.

FED (BBG): The U.S. economy is set for a strong 2021 as the pandemic recedes that will push up prices, but there's no sign yet that this will deliver unwanted inflation, said Federal Reserve Bank of Richmond President Thomas Barkin. "We are going to see an extremely strong year and I think that strong year is going to lead to price pressures.," Barkin said Sunday in an interview on Bloomberg Television with Kathleen Hays. "I want to emphasize inflation is not a one-year phenomenon it's a multi-year phenomenon."

FED: The Federal Reserve would not be adverse to longer run inflation expectations 'just being a touch higher' Minneapolis Fed research director Mark Wright told MNI in an an interview published late Friday.

DATA:

No key data released in the European morning session.

FIXED INCOME: ECB purchase pace in focus

It's been a risk-off start to the session following the sacking of the CBRT Governor over the weekend by President Erdogan and more headlines suggesting vaccine nationalism from the EU.

- Treasuries, Bunds and, to a lesser extent, gilts are all higher on the day, erasing some of the downside moves seen last week after the FOMC meeting.

- There has been focus this morning on EU-UK relations after wires reported that the EU would block any attempts to export the AZ/Oxford vaccine to the UK. This would have only marginal impact on the UK's supply of vaccines, but of course has larger political ramifications. Any attempt to block exports of the Pfizer vaccine to the UK would have much more serious consequences for the UK's vaccine rollout with a number of second doses dependent upon imports from the EU.

- Later today, focus will be on the ECB's bond purchases in the week to Wednesday. This data is due for release at 14:45GMT/10:45ET and will give the first indication of how much faster the ECB is buying bonds following its promise to step up the purchase pace at the last Governing Council meeting.

- There are a number of key policymakers making speeches at the BIS conference this week.

- TY1 futures are up 0-12 today at 131-19 with 10y UST yields down -4.3bp at 1.680% and 2y yields down -0.9bp at 0.142%.

- Bund futures are up 0.38 today at 171.60 with 10y Bund yields down -2.4bp at -0.319% and Schatz yields down -0.9bp at -0.711%.

- Gilt futures are up 0.17 today at 127.70 with 10y yields down -1.3bp at 0.823% and 2y yields down -0.1bp at 0.084%.

FOREX: Abrupt TRY Vol Prompts Modest Risk-Off in G10

- Price action in G10 as been relatively contained so far Monday, with most major pairs trading inside the Friday range. This isn't the case in emerging markets, however, with market focus switching to Turkey after the abrupt slide in TRY after the Turkish President took markets by surprise in removing the head of the central bank just days after a 200bps rate hike.

- This prompted a slide of as much as 15% in TRY against the USD at the open. This weakness has moderated slightly, but USD/TRY remains higher by well over 6% at the NY crossover.

- This volatility has prompted some risk aversion in G10, with JPY and USD outperforming at the expense of AUD, NOK and SEK.

- Focus turns to the ECB's weekly PEPP release, in which markets watch for any increase in bond holdings as part of the bank's asset purchase programme. The release is due at 1445GMT/1045ET.

- Chicago Fed National Activity Index and existing home sales data cross, as well as speeches from Fed's Powell, Daly, Quarles & Bowman and ECB's Weidmann, Schnabel & de Cos.

EQUITIES: European Stocks Steady After Early Drop

- Asian stocks closed mixed, with Japan's NIKKEI down 617.9 pts or -2.07% at 29174.15 and the TOPIX down 22.03 pts or -1.09% at 1990.18. China's SHANGHAI closed up 38.776 pts or +1.14% at 3443.439 and the HANG SENG ended 105.6 pts lower or -0.36% at 28885.34.

- European equities are flat/down, with the German Dax up 10.59 pts or +0.07% at 14621, FTSE 100 down 19.13 pts or -0.29% at 6708.71, CAC 40 down 35.82 pts or -0.6% at 5997.96 and Euro Stoxx 50 down 5.78 pts or -0.15% at 3814.62.

- U.S. futures are mixed, with the Dow Jones mini down 89 pts or -0.27% at 32414, S&P 500 mini down 2.5 pts or -0.06% at 3897.25, NASDAQ mini up 61 pts or +0.47% at 12905.5.

COMMODITIES: Silver Underperforms With Dollar On Front Foot

- WTI Crude down $0.56 or -0.91% at $60.39

- Natural Gas down $0.02 or -0.87% at $2.509

- Gold spot down $15.15 or -0.87% at $1729.59

- Copper down $0.9 or -0.22% at $408.9

- Silver down $0.75 or -2.87% at $25.5376

- Platinum down $27.56 or -2.3% at $1170.55

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.