-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Waiting For The ECB

MNI US Open: Waiting For The ECB

EXECUTIVE SUMMARY:

- Chinese President Warns Against Decoupling

- UK PM Trying To Cut NI Border Checks

- UK Aerospace Warns of Loss of EU Business

Souce: MNI/Bloomberg

NEWS:

CHINA (FT): Xi Jinping has called for a new world order, using a speech at China's flagship business event to launch a veiled attack against US global leadership and to warn against economic decoupling. "International affairs should be handled by everyone," the Chinese president told the Boao Forum for Asia, an event billed as the country's answer to the World Economic Forum in Davos. Xi did not name the US in his 18-minute speech but he took aim at Washington's efforts to decouple supply chains and bar critical American semiconductors and other high-tech goods from being sold to Chinese companies such as Huawei.

UK (GUARDIAN): Boris Johnson has said he is trying to get rid of the "ludicrous" Brexit border checks in Northern Ireland by "sandpapering" the protocol he signed with the EU in January 2020. In a TV interview in Northern Ireland he also said the protocol had been misinterpreted and border checks were supposed to be light touch. "What we are doing is what I think is removing the unnecessary protuberances and barriers that have grown up and we are getting the barnacles off the thing and sandpapering into shape," he told a BBC Spotlight programme marking the centenary of Northern Ireland.

UK/BREXIT (BLOOMBERG): U.K. aerospace-industry trade lobby ADS warned that Britain could lose business to the European Union after the Brexit deal failed to resolve issues concerning design-approval for plane components. Almost four months after the trade deal was struck, firms are still struggling to secure EU signoff for British-designed parts and approval for maintenance work on planes registered in the bloc, ADS said. At the same time, the U.K. Civil Aviation Authority is granting automatic recognition to rival European players. "We're in a no man's land," Jonathan Hawkings, the industry group's policy director, said in an interview. "If U.K. companies are unable to demonstrate how they'll get approvals but a competitor in the EU can, there's a real risk that work just moves to the EU27."

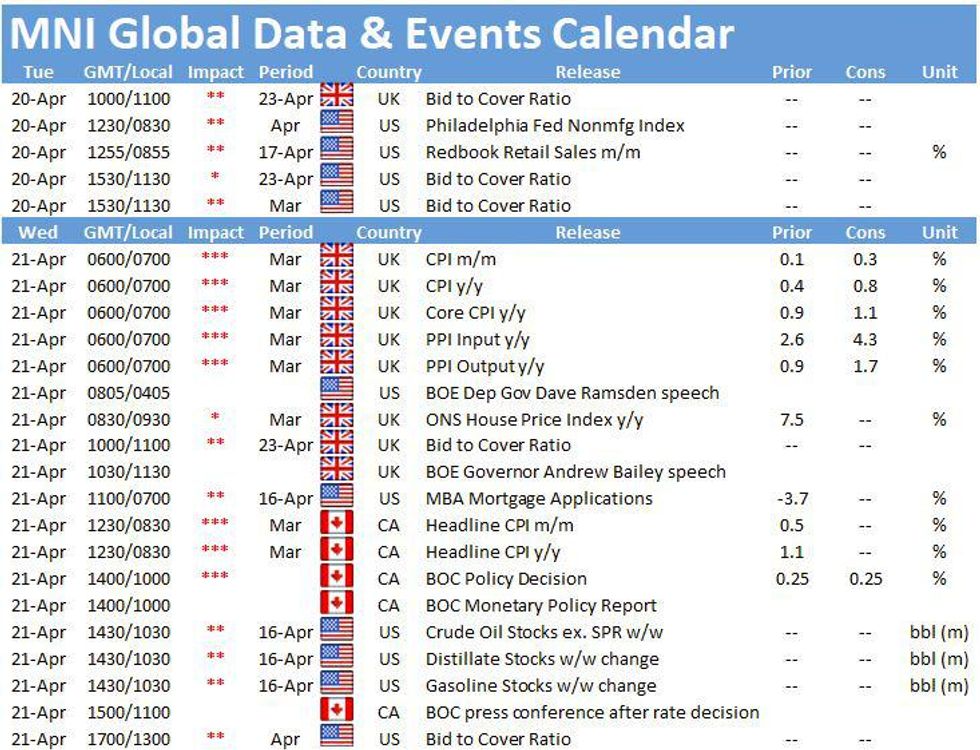

DATA

FIXED INCOME: Bunds consolidate but Treasuries continue to slowly descend

It has been a day of consolidation for EGBs and gilts which continue to remain in the range they have been in since the middle of the European morning session yesterday. Treasuries, by contrast, have continued to fall, moving to levels seen around the European open on Wednesday. The consolidation in fixed income has come against a backdrop of weaker stocks across both Europe and the US.

- UK labour market data was the highlight of the calendar for today and generally came in better than expected, albeit with a fall in payrolls in the experimental March data.

- The market now looks ahead to the ECB meeting on Thursday, during which the main question for markets will be how much the ECB focuses on the future potential wind down of PEPP purchases and how much it focuses on the current lockdowns and slow vaccine rollout across much of the Eurozone.

- TY1 futures are down -0-4 today at 132-03+ with 10y UST yields up 1.2bp at 1.618% and 2y yields up 0.1bp at 0.160%.

- Bund futures are down -0.15 today at 170.33 with 10y Bund yields up 0.8bp at -0.227% and Schatz yields up 0.3bp at -0.684%.

- Gilt futures are down -0.15 today at 128.40 with 10y yields up 1.3bp at 0.767% and 2y yields up 0.9bp at 0.043%.

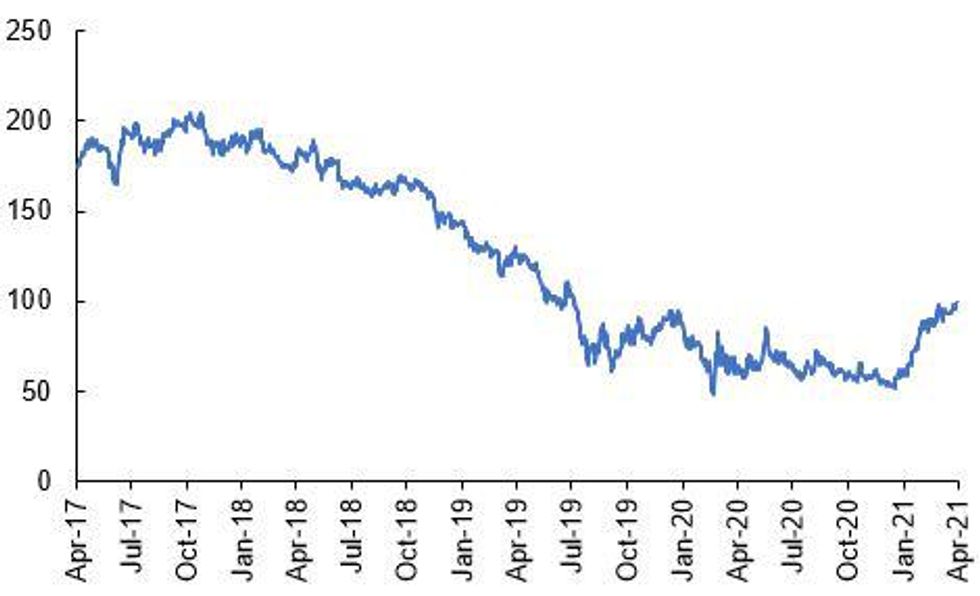

FOREX: USD Index Slips Below 100-DMA Support

- The greenback remains weak, extending the recent downtrend to hit new multi-month lows early Tuesday. The USD index now trades below the 100-dma after the level held as decent support earlier in the week, keeping the USD among the weakest in G10 in early trade.

- JPY also trades poorly, with the JPY the weakest so far despite further weakness in global equity markets. The E-mini S&P has edged lower in early European trade, with futures testing yesterday's lows at pixel time.

- Commodity-tied currencies generally held up well in the Asia-Pac / European crossover, but have come under some selling pressure ahead of NY hours as commodity markets roll off their European morning highs.

- There are no tier 1 data releases Tuesday and the central bank speaker slate is similarly quiet. ECB's de Cos is the highlight, speaking at 1350BST/0850ET.

EQUITIES: On the backfoot this morning

- Japan's NIKKEI down 584.99 pts or -1.97% at 29100.38 and the TOPIX down 30.31 pts or -1.55% at 1926.25.

- China's SHANGHAI closed down 4.606 pts or -0.13% at 3472.943 and the HANG SENG ended 29.58 pts higher or +0.1% at 29135.73.

- The German Dax is down 86.2 pts or -0.56% at 15291.79, FTSE 100 down 43.5 pts or -0.62% at 6958.68, CAC 40 down 62.77 pts or -1% at 6236.04 and Euro Stoxx 50 down 35.12 pts or -0.87% at 3988.55.

- Dow Jones mini down 47 pts or -0.14% at 33915, S&P 500 mini down 4.75 pts or -0.11% at 4152, NASDAQ mini up 3 pts or +0.02% at 13904.75.

COMMODITIES: Levels update: Platinum lower but WTI higher

- WTI Crude up $0.78 or +1.23% at $64.16

- Natural Gas down $0.01 or -0.33% at $2.74

- Gold spot down $4.52 or -0.26% at $1766.75

- Copper up $2.95 or +0.69% at $427.4

- Silver down $0.04 or -0.15% at $25.8032

- Platinum down $12.26 or -1.01% at $1203.17

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.