-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Waiting To Unwrap A Deal

EXECUTIVE SUMMARY

- BREXIT DEAL EXPECTED TO BE ANNOUNCED THURSDAY AFTER FISH COMPROMISE

- HOUSE GOP POISED TO BLOCK PELOSI'S BID FOR $2K RELIEF CHECKS (BBG)

- CHINA TO SUSPEND DIRECT FLIGHTS TO AND FROM THE U.K.

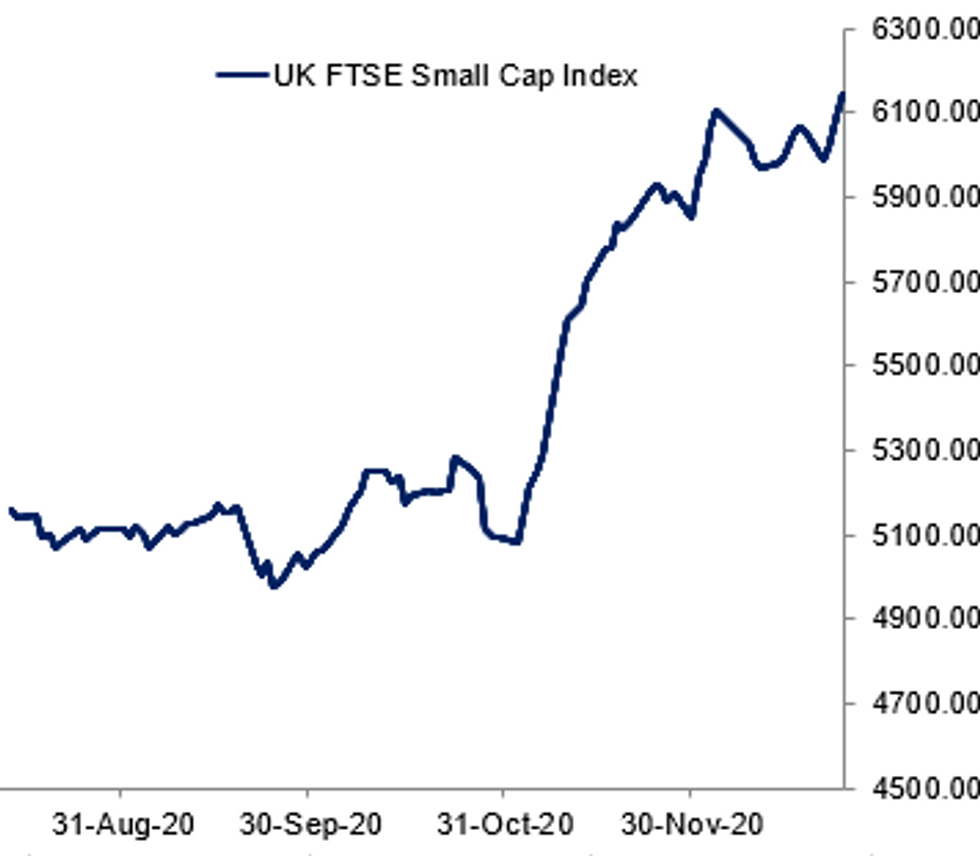

Fig.1: UK Small Cap Stocks Hit All-Time High With Brexit Deal Eyed

BBG, MNI

BBG, MNI

NEWS:

BREXIT (BBG): The U.K. and the European Union are on the verge of unveiling a historic post-Brexit trade accord as negotiators work through the night to put the finishing touches to a compromise on fishing rights. The agreement will comprise a deal for tariff and quota-free trade in goods and cooperation in areas from security to aviation. While the outline of a deal was agreed on Wednesday, an announcement is now expected Thursday morning as chief negotiators in the European Commission's headquarters in Brussels haggle over the exact wording of the final treaty.

BREXIT (BBG): One EU diplomat said the U.K. had made concessions on fisheries in recent hours that had unlocked the deal. According to two people familiar with the matter, Johnson has accepted that the bloc's share of the catch in U.K. waters should fall by 25% over a period of five-and-a-half years. Britain had initially sought an 80% reduction over just three years, but in recent days had offered a cut of 30%. The bloc had refused to accept a reduction of more than 25% in the value of fish caught, saying even that was hard for countries like France and Denmark to accept, according to officials with knowledge of the discussions.

BREXIT: Earlier it'd been reported that we could see a presser announcing the deal at 8am GMT, but equally, multiple outlets (BBC, Guardian) have said that's going to be delayed to 10am GMT or later. Times' Bruno Waterfield reporting that there's still aholdup on fish: "Christmas Eve morning and the brawl over the numbers on fishing quotas is still going on...Line by line, herring by herring, pollock by pollack takes time. Especially when there are several negotiarions going on. The big one EU-UK and then lots of internal European talks on sharing the cuts...The French are resisting cuts to the value of fish, often in UK territory waters worth less than E3.5m a year under the phase in. Predictable"

BREXIT: @rtenews "Minister for Foreign Affairs Simon Coveney said early morning briefings have been postponed and both sides are still negotiating and finalising a deal" Also Reuters reporting BRUSSELS BRIEFING ON FISH DUE AT 0830 GMT HAS BEEN POSTPONED AS TALKS CONTINUE

BREXIT: Political Website Guido Fawkes writes: "An internal government analysis of the deal set to be announced this morning scores the 65 key issues on the table during the negotiations. The government's view is that the UK has won more than twice as many victories as the EU; with 28 UK wins (43%), 11 EU wins (17%) and 26 "mutual compromises" (40%)."

BREXIT (POLITICO): Playbook spoke to/WhatsApped half a dozen MPs from the European Research Group of Conservative backbenchers last night, and all but one of them were effusive with praise for the PM and his negotiating team, implying they were minded to back the deal so long as it didn't contain any especially nasty surprises. The other ERG MP was more strongly critical of the reported settlement on fish. In reality, how much of a challenge Johnson faces internally depends on whether any particularly egregious horrors are discovered in the text by eagle-eyed Euroskeptic experts and tweeters over the next few days.

U.S. FISCAL (BBG):House Minority Leader Kevin McCarthy told fellow Republicans Wednesday that House Speaker Nancy Pelosi's attempt to pass a bill boosting stimulus payments for individuals to $2,000 will fail, according to a person who participated in a private call with GOP House members. Pelosi swiftly took up President Donald Trump's demand for larger payments to individuals in the coronavirus relief package Congress passed Monday night, seeking to approve it in the House on Thursday. Pelosi's plan to seek unanimous consent to increase the direct payments to $2,000 from the $600 in Monday's bill can be blocked by a single lawmaker. Republicans planned to halt her attempt.

CHINA/UK/COVID (RTRS): China will suspend direct flights to and from the United Kingdom, Wang Wenbin, a foreign ministry spokesman said on Thursday, citing the emergence of a new coronavirus strain. "After much consideration, China has decided to take reference from others countries and suspend flights to and from UK," Wang told reporters at a daily briefing.

BOJ: The Bank of Japan should be nimble in making an effective response when needed to counter possible changes in economic activity and prices, or financial conditions. Governor Haruhiko Kuroda told a business leaders conference Thursday. Kuroda also noted that the assessment for further "effective and sustainable monetary easing with a view to achieving the price stability target of 2%. Its findings will be made public, likely at the March 2021 MPM."

FIXED INCOME: Gilts Bull Flatten With Brexit Deal Eyed

A predictably quiet session with limited hours for Christmas Eve and desks very much thinned for the holidays. Brexit still carries intrigue, with a deal expected to be announced at some point in the European morning (despite apparent delays on final details).

- Gilts opened weaker but have since strengthened, with the curve bull flattening - cooling off from significant exuberance Weds when it became clear a deal was nearing.

- Eurex closed, Bund / BTP cash not trading.

- TY1 trading within 2.5 tick range on anemic volumes. Interest in the shortened US session on House Democrats' attempt to pass change to checks to individuals to $2k via unanimous consent today, which could be derailed by a single 'no' vote.

Latest levels:

- Mar Gilt futures (G) up 36 ticks at 134.6 (L: 134.01 / H: 134.67)

- Mar US 10-Yr futures (TY) up 1.5/32 at 137-26 (L: 137-23.5 / H: 137-26)

FOREX: GBP Continues Grind Higher as EU Trade Deal Nears

Cable the notable performer as the Christmas break approaches up 0.8% at 1.3600 with EURGBP down 0.74% at 0.8964. The markets are in wait-and-see mode as details are being finalised. Reports of an imminent press conference have not been confirmed by newswires. Some betting markets are now pricing a 2020 Trade Deal at 97% with this sentiment being echoed in GBP price action.

Elsewhere G10 ranges remain subdued with the USD index down 0.2%. Aussie and Kiwi are slightly better bid amid broad optimism for an EU-UK deal to be finalised.

Canada Building Permits will be released at 1330GMT but no other major data on the docket.

EQUITIES: Stocks Gain On The Verge Of Brexit Deal

- Asian stocks closed mixed, with Japan's NIKKEI up 143.56 pts or +0.54% at 26668.35 and the TOPIX up 9.06 pts or +0.51% at 1774.27. China's SHANGHAI closed down 19.207 pts or -0.57% at 3363.113 and the HANG SENG ended 43.46 pts higher or +0.17% at 26386.56.

- European stocks are higher, with the FTSE 100 up 7.96 pts or +0.12% at 6523.41, CAC 40 up 7.6 pts or +0.14% at 5541.74 and Euro Stoxx 50 up 4.85 pts or +0.14% at 3545.38.

- U.S. futures are higher, with the Dow Jones mini up 76 pts or +0.25% at 30110, S&P 500 mini up 9 pts or +0.24% at 3690.5, NASDAQ mini up 16.75 pts or +0.13% at 12668.

COMMODITIES: Precious Metals Lead In Holiday-Thinned Session

- WTI Crude down $0.07 or -0.15% at $48.04

- Natural Gas down $0.05 or -2.03% at $2.556

- Gold spot up $5.09 or +0.27% at $1879.66

- Copper down $0.3 or -0.08% at $355.25

- Silver up $0.28 or +1.08% at $25.8102

- Platinum up $5.28 or +0.52% at $1024.68

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.