-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI US MARKETS ANALYSIS - Eurozone PMIs Flag H2 Slowdown

Highlights:

- Eurozone PMIs a warning sign of H2 slowdown

- Treasury yields sink ahead of second part of Powell testimony

- Norges Bank hike 50bps, but see little chance of further 50bps hikes this cycle

US TSYS SUMMARY: Yields Continue To Move Lower With Global Growth Risks Rising

Global recession fears - underlined by weak PMI figures out of Europe - continued to boost Treasuries overnight, with the curve belly outperforming.

- Yields have now pared most of their rise over the previous two weeks: 2-Yr yield is down 5.2bps at 3.004%, 5-Yr is down 6.5bps at 3.1656%, 10-Yr is down 4.7bps at 3.1094%, and 30-Yr is down 4.6bps at 3.203%.

- June prelim PMI readings at 0945ET will be in focus, particularly following downside surprises in European readings this morning.

- We also get jobless claims data at 0830ET and KC Fed Manufacturing Activity at 1100ET.

- Fed Chair Powell returns to Capitol Hill for his 2nd day of testimony, before the House Financial Services Committee at 1000ET. No other scheduled FOMC speakers.

- Supply includes 4-/8-week bills, with 5Y TIPS selling at 1300ET.

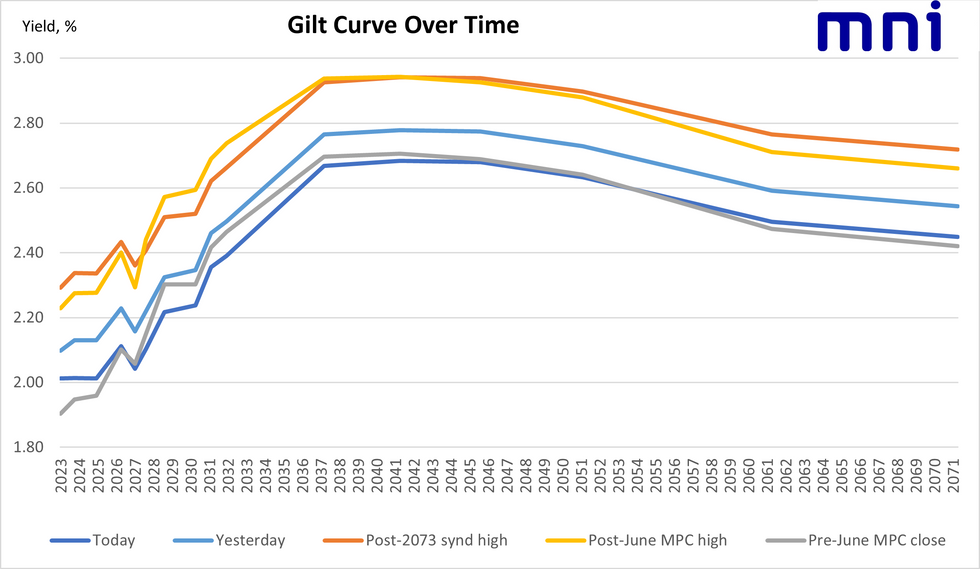

GILTS: 5-30-Year Yields Now Below Pre-June MPC levels

- As noted earlier, gilts have moved higher today. Initially driven by misses in European PMIs, but then finding a little stability as the UK PMI didn't come in quite as weak as the European data had suggested. The UK PMI also pointed to a strong labour market and continued inflationary pressures, meaning the reasons for hikes remain in place (albeit as we have long argued, not at the pace markets had priced - we still see around a 60% probability of a 50bp hike in August with the alternative a 25bp hike - markets still after today's data price 53bp for August).

- Yields at the very front-end of the gilt curve remain higher than the post-June MPC reaction, as do 30+ year yields, but between 5-30 years, yields are now lower than the initial reaction.

- As well as PMI data, this morning saw the release of public sector finance data which weren't market moving but saw borrowing at higher levels than expected.

- Overnight tonight we will receive consumer confidence data for June ahead of tomorrow morning's retail sales print for May. These will give a further update on the state of the consumer following the increase in NICs and the energy price cap - both of which came into effect in April.

- Tomorrow afternoon will see another speech from BOE Chief Economist Huw Pill on ‘Inflation and Debt – Challenges for Monetary Policy after Covid-19’ - an interesting topic but he has already made several appearances since last week's MPC meeting so it is unclear whether he will give much new immediate policy-relevant guidance. MPC member Jonathan Haskel also appears on a panel on the global economy tomorrow.

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXQ2 140p, sold at 23 in 11k (closing)

RXQ2 141.5p, sold at 32 in 5.5k (closing)

RXQ2 149.50c, bought for 107 in 10k (closing)

ERZ2 99.00/98.78ps, bought for 7.5 in 10k (closing)

US:

Wk1 Tontes July 114/113ps bought for 2 in 20k

This was bought in 30k yesterday.

NORGES BANK: More Hawkish Than Expected, 50bps Plus Flagged August Hike

- A more hawkish than expected rate decision - a larger hike than forecast (50bps vs 25bps) and also flagged a further 25bps hike in August.

- The rate path is steeper, but could suggest that today's 50bps hike is a one-and-done and the bank will return to 25bps increments going forward. Rates now seen as 'restrictive' I.e. North of 1.7% ahead of year-end, as expected.

- Peak of the tightening cycle is seen earlier in Q4'23 (projection at 3.10%) vs. March's assessment of 2.52% in Q3'24.

- New Norges Rate Path Projections:

FOREX: EUR/USD Marked Down on Sluggish PMIs

- JPY trades stronger for a second session, putting USD/JPY back below the Y135.50 level as markets maintain a general risk-off tone with equities on the backfoot. The e-mini S&P is well off the Wednesday highs, with core government bonds the beneficiary - pushing the US 10y yield to trade either side of the 3.10% level.

- The Norwegian central bank rate decision delivered mixed messages: the bank raised rates by 50bps - a larger hike than forecast - but indicated this more sizeable pace of tightening would not be maintained further out the curve, with just 25bps likely to follow in August. As a result, the NOK initially rallied firmly, before moderating and trading broadly flat into the NY crossover.

- EUR/USD sustains losses ahead of US hours following a very disappointing turnout from Eurozone preliminary PMI data. German and French services and manufacturing sectors grew far slower than forecast, marking EUR/USD down to 1.0483 in response.

- Weekly jobless claims and preliminary US PMI data for June are the highlights going forward, with markets looking to see if the US follows the pattern set by the Eurozone this morning, in which both services and manufacturing components fell well below forecast.

- Focus turns to the second part of Powell's semi-annual testimony later today, where the Fed chair appears in front of the House Financial Services Panel. ECB's Nagel and Villeroy are also both due to speak.

Expiries for Jun23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0455-65(E2.1bln), $1.0500(E1.8bln), $1.0595-00(E1.1bln)

- USD/JPY: Y132.00($1.2bln), Y132.80-00($1.0bln), Y134.00($641mln), Y135.00($999mln)

- GBP/USD: $1.2280-00(Gbp530mln), $1.2380-00(Gbp1.1bln), $1.2495-15(Gbp570mln)

- EUR/GBP: Gbp0.8515(E1.2bln), Gbp0.8575-90(E531mln), Gbp0.8620(E531mln)

- EUR/JPY: Y143.00(E541mln)

- USD/CAD: C$1.2800($1.4bln), C$1.2915($1.2bln)

- USD/CNY: Cny6.60($1.5bln), Cny6.70($1.6bln), Cny6.75($840mln), Cny6.80($1.4bln)

Price Signal Summary - Bund Trade Through Resistance At The 20-Day EMA

- In the equity space, S&P E-Minis continue to trade above recent lows and short-term gains are still considered corrective. The primary trend direction is down, highlighted by moving average studies that remain in bear mode condition and recent fresh cycle lows. The focus is on 3600.00 next. Initial resistance to watch is at 3843.00, the Jun 15 high. EUROSTOXX 50 futures continue to trade closer to recent lows. The trend outlook remains bearish and attention is on the 3300.00 handle next. 3567.00 is first resistance, Jun 16 high.

- In FX, recent EURUSD short-term gains are still considered corrective and the focus is on weakness towards 1.0350, May 13 low and a bear trigger. Key channel resistance intersects at 1.0654 today - the channel is drawn from the Mar 10 high and a break is required to reverse the short-term direction. GBPUSD continues to trade above last week’s low. The outlook remains bearish and the focus is on 1.1934, Jun 14 low and a short-term bear trigger. Resistance to watch is unchanged at 1.2406, Jun 16 high. USDJPY remains bullish. The pair broke to new cycle highs Tuesday, confirming a resumption of the primary uptrend to maintain the bullish price sequence of higher highs and higher lows. The focus is on 136.88 next, the Oct 30 1998 high. A bull channel is evident on the daily chart - drawn from the Mar 4 low. The top, at 139.27, is an objective further out.

- On the commodity front, Gold is consolidating but a bearish threat remains present. The focus is on $1787.0, May 16 low where a break would resume the downtrend. Key trendline resistance is at $1879.1. The trendline is drawn from the Mar 8 high and a break would signal a short-term reversal. In the Oil space, WTI futures remain vulnerable and continue to trade below the 50-day EMA. This week’s break lower has opened $100.66, the May 19 low. A breach of this level would pave the way for a move towards $95.47, the May 11 low.

- In the FI space, Bund futures are trading higher this morning and have breached resistance at 147.34, the 20-day EMA. The break strengthens short-term bullish conditions and signals scope for a stronger corrective recovery towards 148.51, Jun 10 high. On the downside, initial support to watch is at 142.56, Jun 17 low. Note that short-term gains are still considered corrective. Gilts are rallying this morning and are approaching resistance at 113.78, the 20-day EMA and the next key short-term resistance. A break would signal scope for a stronger short-term correction.

EQUITIES: Futures Off Overnight Lows

- Asian markets closed mixed: Japan's NIKKEI closed up 21.7 pts or +0.08% at 26171.25 and the TOPIX ended 0.91 pts lower or -0.05% at 1851.74. China's SHANGHAI closed up 52.947 pts or +1.62% at 3320.149 and the HANG SENG ended 265.53 pts higher or +1.26% at 21273.87.

- European stocks are sharply lower, with the German Dax down 175.67 pts or -1.34% at 12969.33, FTSE 100 down 58.58 pts or -0.83% at 7030.25, CAC 40 down 68.1 pts or -1.15% at 5848.59 and Euro Stoxx 50 down 40.29 pts or -1.16% at 3424.47.

- U.S. futures are a little higher vs overnight lows: Dow Jones mini down 105 pts or -0.34% at 30366, S&P 500 mini down 6 pts or -0.16% at 3756.75, NASDAQ mini up 21.5 pts or +0.19% at 11587.25.

COMMODITIES: WTI-Brent Steady After Recent Fall

Crude prices are drifting down further as focus remains on the potential for lower oil demand forecasts as economies struggle with high inflation. Next technical support is at yesterday’s lows of 107.03$/bbl for Brent and 101.53$/bbl for WTI.

- The future possibility of a US recession has pushed WTI prices down faster than Brent resulting in a spread as low as -5.81$/bbl. The spread has recovered slightly this morning after API data last night showed further draws at Cushing.

- Brent AUG 22 down -1.9% at 109.62$/bbl

- WTI AUG 22 down -1.9% at 104.13$/bbl

- Gasoil JUL 22 up 0.6% at 1291.5$/mt

- WTI-Brent down -0.05$/bbl at -5.5$/bbl

- Brent AUG 22-SEP 22 up 0.01$/bbl at 3.1$/bbl

- Brent DEC 22-DEC 23 down -0.34$/bbl at 11.33$/bbl

- WTI AUG 22-SEP 22 up 0.07$/bbl at 2.27$/bbl

- WTI DEC 22-DEC 23 down -0.32$/bbl at 11.96$/bbl

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/06/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 23/06/2022 | - |  | EU | ECB Lagarde at European Council Meeting | |

| 23/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 23/06/2022 | 1230/0830 | * |  | US | Current Account Balance |

| 23/06/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/06/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/06/2022 | 1400/1000 |  | US | Fed Chair Jerome Powell | |

| 23/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 23/06/2022 | 1500/1100 | ** |  | US | DOE weekly crude oil stocks |

| 23/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/06/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 23/06/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.