July 26, 2024 11:48 GMT

Monthly Retail Sales Volatility Obscures Still-Positive 3m/3m Trend

NORWAY

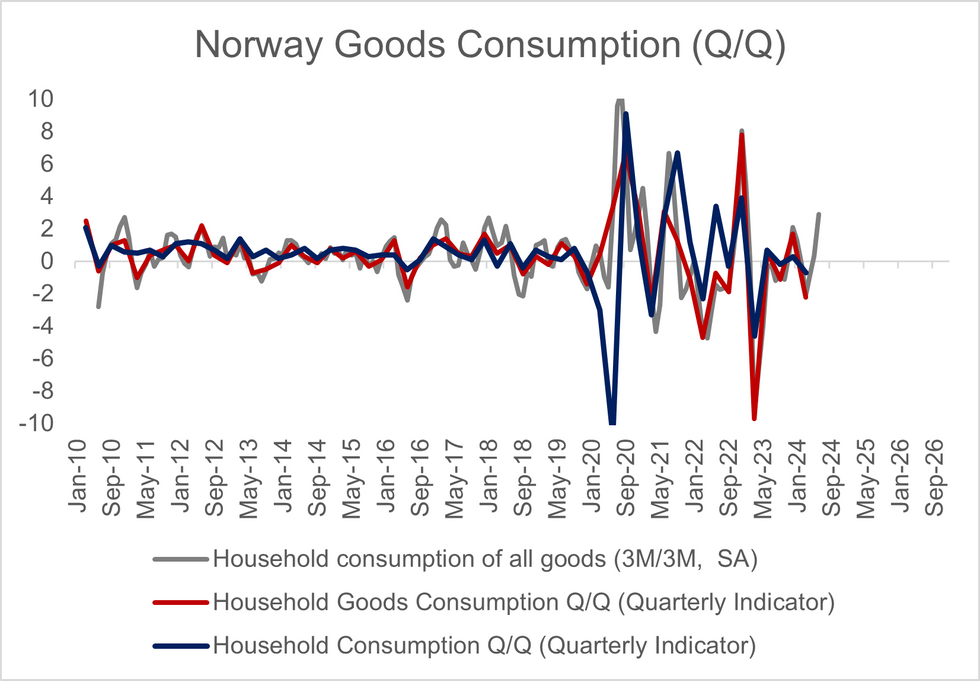

Norwegian retail sales excluding motor vehicles fell 5.1% M/M SA in June, but this followed an upwardly revised 4.7% growth in May. On a less volatile 3m/3m SA basis, sales rose 1.0% in June (vs 1.6% prior).

- The index excluding motor vehicles and fuel saw a similar development, falling sharply M/M but growing 1.5% 3m/3m (vs 2.3% prior).

- Sales of food and beverages rose 3.3% 3m/3m, while IT equipment sales were 4.2%. This was offset a little by a 1.9% fall in sales of cultural/recreational goods.

- The index of household goods consumption, which feeds directly into the GDP calculation, rose 1.6% M/M and 2.9% 3m/3m. This suggests a rebound in overall goods consumption in Q2 from the weak -2.2% Q/Q reading in Q1.

133 words