-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Wind-Up To Next FOMC Hike

- MNI Fed Preview - May 2023: Moving Meeting-To-Meeting

- MNI INTERVIEW: Fed To Resume Hikes Later If Inflation Lingers

- MNI: Fed's SVB Review Focused on Fixing Regulation Flaws

- MNI US DATA: Core PCE Q1 Revisions Land Earlier In The Qtr, Supercore Services Soften

- MNI SOURCES: ECB Set For TLTRO Discussions Ahead June Maturity

- MNI: Italy Tells Brussels Will Miss June NGEU Deadlines-Source

US

FED: A 25bp hike in May could mark the end of the Fed’s hiking cycle. With rates above 5%, and sticky inflation fears offset by the tightening effect of banking sector woes, the FOMC is likely to move to a meeting-by-meeting policy beyond May, while retaining a bias toward further policy firming.

- But with widespread expectations that the Fed will change its forward rate guidance to hint at an end to the hiking cycle, or even open the door to cuts, there is a hawkish risk that guidance is left unchanged.

- There is a case for the Fed to pause at this meeting, but that would be likely to signal panic about the underlying health of the banking sector.

FED: The Federal Reserve is likely to pause its interest rate hikes after the next meeting but would not hesitate to restart them later in the year if inflation proved more persistent than officials expect, former Richmond Fed research director John Weinberg told MNI.

- “If the economy keeps chugging along and the Fed pauses but disinflation doesn’t continue then I would expect they would return to further increases,” he said in an interview.

- For now, the Fed looks increasingly inclined to pause as it takes stock of the cumulative effect of more than a year’s worth of rapid rises in official borrowing costs, and as policymakers gauge the possible drag on credit from the recent turmoil in banking. “There certainly seems to be a wait and see sentiment arising in some members of the committee,” said Weinberg.

- That could lead to some changes to the statement which don’t necessarily promise a pause but signal officials are less eager to keep hiking. For more see MNI Policy main wire at 1007ET.

FED: The Federal Reserve plans to revamp an array of supervisory and regulatory rules after releasing a postmortem of Silicon Valley Bank that collapsed in mid-March, with a focus on empowering supervisors to act more decisively in the face of clear risk management failures.

- The review published Friday concludes with blame for SVB's board of directors and management but is also critical of its own supervisors that the Fed says did not appreciate the extent of SVB vulnerabilities and did not take sufficient steps to ensure the bank fixed those problems quickly enough.

- Fed Vice Chair for Supervision Michael Barr, who oversaw the report, concludes that weaknesses in supervision and regulation must be fixed and that the central bank needs to develop a culture that incentivizes supervisors to act in a timely way in the face of uncertainty. For more see MNI Policy main wire at 1101ET.

EUROPE

ECB: The European Central Bank is likely to discuss bridging finance for the upcoming maturity of EUR500 billion in cheap TLTRO loans to banks, either at its upcoming meeting next week or in June, Eurosystem sources told MNI.

- “Given conditions, it’s not unrealistic to suggest another TLTRO bridge and I'm sure it will be discussed,” one source said. While May would be a more beneficial time for the discussion, allowing banks to position themselves ahead of time, the source accepted that even if the ECB executed such a plan, “we may not need to have it in place until June”.

- Following an EUR72 billion early TLTRO III repayment in March, June will see around EUR490 billion set for maturity. If completed, this would help get excess liquidity in the eurosystem down from current levels around EUR4 trillion to nearer EUR3.5 trillion, reducing the overall balance sheet to nearer EUR7.3 trillion from EUR7.7 trillion currently. For more see MNI Policy main wire at 1108ET.

ITALY: The Italian government has told the European Commission that it will fail to make the June 30 deadline for achieving some of 27 targets to be eligible for a EUR16 billion aide tranche under the NextGenerationEU program, an Italian government source told MNI.

- Rome has decided to inform Brussels in advance so both parties have to time to seek solutions to facilitate payment of the fourth tranche of a total EUR191 billion in loans and grants allocated to Italy under the program, the source said.

- The third, EUR19 billion tranche is already delayed, after Brussels asked for an additional month to check whether Italy had met its objectives, though Rome is confident disbursement will be approved in the next few days, the source said.

US TSYS: US FI Rates, Equities Finish Strong Ahead Next Wed's FOMC

- After a rocky start, Treasury futures are trading broadly higher late Friday, short end lagging with curves running flatter, 2s10s -6.119 at -61.515. Heavy two-way flow noted after March Core PCE climbed 0.3% vs. 0.2% est, the 1Q ECI up 1.2% vs. 1.1%.

- Close to expectations, it’s technically the softest core PCE print since Nov’22 but clearly remains far stronger than the monthly rate consistent with the 2% target.

- Services eased from 0.38% to 0.23% M/M whilst Bloomberg's calculation of non-housing core services fell from 0.35% to 0.24% M/M for its softest since Jul'22.

- Treasuries marked session highs by midmorning (TYM3 115-12 (+20.5), trading sideways after a brief decline on stronger than expected Chicago Business BarometerTM, produced with MNI.

- The barometer improved by 4.8 points to 48.6 in April. This was the highest reading since August 2022. Nonetheless, the headline index remained sub-50, thus signaling an eight consecutive month of contractionary business activity.

- Focus turns to next Wednesday's FOMC policy announcement where a 25bp hike in could mark the end of the Fed’s hiking cycle. With rates above 5%, and sticky inflation fears offset by the tightening effect of banking sector woes, the FOMC is likely to move to a meeting-by-meeting policy beyond May, while retaining a bias toward further policy firming.

OVERNIGHT DATA

- It’s technically the softest core PCE print since Nov’22 but clearly remains far stronger than the monthly rate consistent with the 2% target.

- Services eased from 0.38% to 0.23% M/M whilst Bloomberg's calculation of non-housing core services fell from 0.35% to 0.24% M/M for its softest since Jul'22.

- US MAR PERSONAL INCOME +0.3%; NOM PCE +0.0%

- US MAR PCE PRICE INDEX +0.1%; +4.2% Y/Y

- US MAR CORE PCE PRICE INDEX +0.3%; +4.6% Y/Y

- US MAR UNROUNDED PCE PRICE INDEX +0.076%; CORE +0.281%

- Core PCE Unrounded - Mar'23

- MoM (SA): 0.281% in Mar; Follows 0.347% in Feb (initial 0.300%), 0.559% in Jan (initial 0.519%)

- YoY (SA): 4.598% in Mar from 4.689% in Feb

- Employment saw a marked 8.5-point boost to 51.2, the first time above 50 since August.

- Prices Paid accelerated by 4.7 points to 70.3, but remained a little below January levels and the 12-month average.

- Production rose for a second month in April, up 6.9 points to 47.9, the second highest reading since August and 1.4 points above the 12-month average.

- New Orders increased by 3.1 points, the least contractive since August 2022.

- Order Backlogs was broadly in line with the March reading, down -0.1 points.

- Supplier Deliveries gained 5.6 points, indicating lengthened lead times. Logistics issues including delays at customs, labor shortages and poor communication persist.

- Inventories dropped a notable 9.8 points back into contractionary territory in April, giving back the bulk of the March increase.

MNI US DATA: The final University of Michigan report for April confirms the 1pt jump to 4.6% for the 1Y ahead (highest since Nov’22). It also sees a one tenth upward revision to 3.0% for the 5-10Y after four months of 2.9% but still in its very stable 2.9-3.1% range seen for every month but one since Jul’21.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 162.15 points (0.48%) at 33989.3

- S&P E-Mini Future up 22 points (0.53%) at 4176

- Nasdaq up 48.8 points (0.4%) at 12191.5

- US 10-Yr yield is down 6.8 bps at 3.4522%

- US Jun 10-Yr futures are up 14.5/32 at 115-6

- EURUSD down 0.001 (-0.09%) at 1.1018

- USDJPY up 2.3 (1.72%) at 136.27

- WTI Crude Oil (front-month) up $1.91 (2.55%) at $76.67

- Gold is up $1.5 (0.08%) at $1989.30

- EuroStoxx 50 up 1.26 points (0.03%) at 4359.31

- FTSE 100 up 38.99 points (0.5%) at 7870.57

- German DAX up 121.93 points (0.77%) at 15922.38

- French CAC 40 up 7.66 points (0.1%) at 7491.5

US TREASURY FUTURES CLOSE

- 3M10Y +0.856, -163.061 (L: -174.74 / H: -163.061)

- 2Y10Y -5.81, -61.206 (L: -62.167 / H: -54.175)

- 2Y30Y -6.311, -38.759 (L: -40.456 / H: -30.973)

- 5Y30Y -1.619, 13.904 (L: 11.438 / H: 17.386)

- Current futures levels:

- Jun 2-Yr futures up 1.5/32 at 103-2.5 (L: 103-00.375 / H: 103-06.5)

- Jun 5-Yr futures up 8.25/32 at 109-23.5 (L: 109-11.25 / H: 109-28.25)

- Jun 10-Yr futures up 14.5/32 at 115-6 (L: 114-17.5 / H: 115-12)

- Jun 30-Yr futures up 39/32 at 131-20 (L: 130-02 / H: 131-30)

- Jun Ultra futures up 57/32 at 141-9 (L: 139-00 / H: 141-23)

US 10YR FUTURE TECHS: (M3) Bullish Outlook

- RES 4: 117-01+ High Mar 24 and bull trigger

- RES 3: 116-30 High Apr 5 / 6

- RES 2: 116-08 High Apr 12

- RES 1: 115-12/30+ Intraday high / High Apr 26

- PRICE: 115-08 @ 1520ET Apr 28

- SUP 1: 114-18+/17+ 50-day EMA / Intraday low

- SUP 2: 113-30+ Low Apr 19 and key short-term support

- SUP 3: 113-23 50.0% retracement of the Mar 3 - 24 bull run

- SUP 4: 113-08+ Low Mar 15

Treasury futures maintain a bullish tone despite the recent pullback. The recovery on Tuesday undermines a recent bearish theme and support at the 50-day EMA remains intact. The average intersects at 114-18+. A stronger resumption of gains would open 116-08, the Apr 12 high and expose the key resistance at 117-01+, the Mar 24 high. Key support is at 113-30+, the Apr 19 low. A break would reinstate the recent bearish theme.

SOFR FUTURES CLOSE

- Jun 23 +0.015 at 94.915

- Sep 23 +0.015 at 95.155

- Dec 23 +0.015 at 95.555

- Mar 24 +0.015 at 96.050

- Red Pack (Jun 24-Mar 25) +0.035 to +0.065

- Green Pack (Jun 25-Mar 26) +0.060 to +0.065

- Blue Pack (Jun 26-Mar 27) +0.065 to +0.065

- Gold Pack (Jun 27-Mar 28) +0.070 to +0.075

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.02549 to 5.01870 (+.04818/wk)

- 3M +0.03787 to 5.08132 (+.01357/wk)

- 6M +0.05826 to 5.07957 (-.00877/wk)

- 12M +0.08282 to 4.80908 (-.07339/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00086 to 4.81100%

- 1M +0.02800 to 5.06214%

- 3M +0.00329 to 5.30243% */**

- 6M +0.02014 to 5.40700%

- 12M +0.04486 to 5.36629%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.30243% on 4/28/23

- Daily Effective Fed Funds Rate: 4.83% volume: $119B

- Daily Overnight Bank Funding Rate: 4.81% volume: $282B

- Secured Overnight Financing Rate (SOFR): 4.81%, $1.337T

- Broad General Collateral Rate (BGCR): 4.78%, $545B

- Tri-Party General Collateral Rate (TGCR): 4.78%, $538B

- (rate, volume levels reflect prior session)

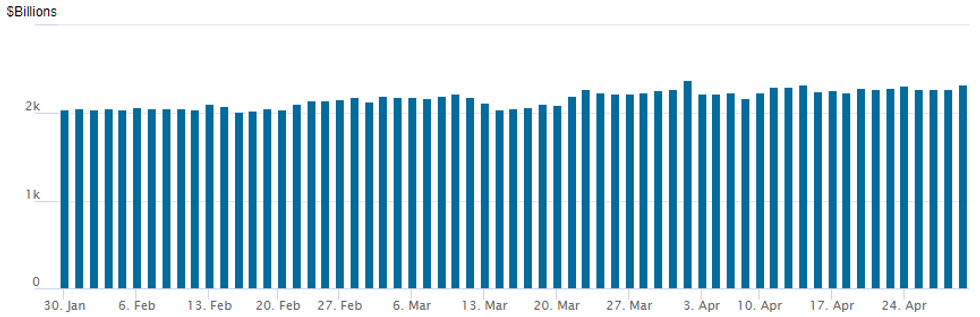

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $2,325.479B w/ 108 counterparties, compares to prior $2,273.926B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $22.1B High-Grade Corporate Debt Priced on Week

- Date $MM Issuer (Priced *, Launch #)

- 04/28 No new issuance Friday, $22.1B total priced on week

- $7.1B Priced Thursday

- 04/27 $2.45B *Philip Morris** $450M Tap 4.875% 2/13/26 +90, $550M Tap 4.8755 2/15/28 +115, $700M Tap 5.125% 2/15/30 +145, $750M Tap 5.375% 2/15/33 +165.

- 04/27 $1.25B *Eximbank -5Y +280

- 04/27 $1B *CDP (Cassa Depositi Prestiti) 3Y +200

- 04/27 $900M *Anglo American 10Y +205

- 04/27 $750M *State Bank of India 5Y +145

- 04/27 $750M *Constellation Brands 10Y +147

FOREX: EURJPY Rises Above 150.00, Highest Since 2008

- Moves in currency markets on Friday were dominated by the Japanese Yen, comfortably the weakest performer in G10 following the latest BoJ Monetary Policy decision. USDJPY (+1.67%) rose back above 136.00 to print as high as 136.56, a seven-week high for the pair. More notably, EURJPY (+1.52%) breached the 150.00 mark for the first time since 2008 after breaking above the 2014 highs and reaching 150.43.

- The BoJ removed reference to Covid in its forward guidance. It also removed reference to rates in terms of the guidance (expecting rates to remain at low or present levels was left out), but the Bank left in that is prepared to take further easing measures if necessary. The BOJ will also conduct a review, which is expected to take 1-1.5 yrs.

- The USDJPY rally initially pulled the USD index higher and some further greenback strength was seen following the firmer employment cost index data and an in-line set of PCE figures. However, an extension of strength for major equity indices throughout the US session weighed on the greenback which saw the DXY pare those gains.

- Moves/position squaring may have been exacerbated heading into month-end where there was a notable rally for GBPUSD. Cable has breached 1.2546, the Apr 14 high and the technical bull trigger. Clearance of this level would resume the uptrend and open 1.2599, the Jun 7 2022 high. Moving average studies remain in a bull mode position, highlighting the uptrend. Above here we have 1.2667, the May 27 2022 high.

- After a Uk/Europe bank holiday on Monday, US ISM manufacturing data is scheduled. The focus then inevitably turns to Wednesday’s FOMC decision where a 25bp hike could mark the end of the Fed’s hiking cycle. Next week, we also have the RBA & ECB meetings as well as Friday’s release of non-farm payrolls.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/05/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/05/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/05/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/05/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/05/2023 | 1400/1000 | * |  | US | Construction Spending |

| 01/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 01/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.