-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: JGBs Continue Squeeze

- JGBs continued their post-BoJ richening, while the rest of the core global FI space lacked meaningful conviction in Asia hours.

- The USD indices (DXY, BBDXY) are both around 0.10% higher for Friday's session so far. This keeps us comfortably within ranges seen since the start of the year. Yen weakness has been prominent, with a firmer US cash Tsy yield backdrop helping USD sentiment.

- Looking ahead, UK and Canadian retail sales data will be published on Friday, as well as U.S. existing home sales. There remains potential for commentary from central bankers and politicians in Davos. Most notably, ECB’s Lagarde will be participating in a panel discussion titled "Global Economic Outlook: Is this the End of an Era?," although she has already provided some steer on monetary policy settings this week.

US TSYS: Yields Marginally Firmer In Asia

TYH3 deals at 115-15+, -0-05, in the middle of its 0-08+ range on volume of ~95K.

- Cash Tsys are running 1-2bp cheaper across the major benchmarks.

- Tsys were marginally cheaper in early trading in a muted start to Friday's session.

- Fedspeak from NY Fed President Williams was on the wires, he noted there is still more work to do to tame inflation and that it made sense for the Fed to slow rate rises in December. He reiterated themes observed in recent communique in that the Fed has a way to go on rate rises, while not being drawn into a specific call re: the size of the hike that should be deployed at the next FOMC, alluding to market pricing that is "roughly consistent" with Fed's rate outlook.

- The early cheapening extended marginally, although there was no overt headline driver for the move. TYH3 saw support come in ahead of the high from Dec 13 and a recent breakout level, after showing as low as 115-12+.

- The pressure on Tsys then moderated, with a rally in JGBs aiding the recovery.

- ECB speak from Lagarde headlines the European session. Further out we have U.S. home sales and Fedspeak from Philadelphia President Harker and Governor Waller.

JGBS: Firm Into The Bell, Futures Breach Post-BoJ Peak

A morning bid in JGBs extended during the Tokyo afternoon, with the subdued offer/cover ratios in today’s BoJ Rinban operations adding further fuel to the fire.

- Futures are near enough +70 into the bell, a little shy of best levels, but through the post-BoJ spike peak. That breach allows bulls to turn focus to the zone that consists of the 6 Dec low & 16 Nov high.

- Cash JGBs are 2-8bp richer across the curve, led by 7s (owing to the bid in futures). Swap rates are still lagging across most of the curve, leaving swap spreads wider to near enough flat, dependent on the zone of the curve you are looking at.

- As noted earlier, there hasn’t been much in the way of meaningful headline flow to highlight, meaning continued post-BoJ adjustments and the lack of upside surprise in the national CPI data (albeit with the major metrics moving to fresh cycle highs in Y/Y terms) were likely in the driving seat early on.

- PM Kishida pointed to a desire to downgrade the government’s assessment of COVID to the same risk category as the flu, with an eye on doing so during the Spring.

- Elsewhere, Finance Minister Suzuki has noted that any review of the 60-Year debt redemption rule would not alter overall JGB issuance matters, although cautioned against making any change to the rule, owing to the positives generated re: fiscal discipline.

- The minutes from the BoJ’s Dec meeting (which saw the surprise YCC tweak) headline domestically on Monday.

AUSSIE BONDS: Meandering Into The Weekend After Giving Back Some Of Thursday’s Rally

Aussie bond futures meandered through the final Sydney session of the week, and never really detached meaningfully from late overnight session levels, after cheapening in lieu of some hawkish ECB speak and weakness in global core FI markets in overnight trade.

- That left YM -4.0 & XM -7.5, operating a little above their respective overnight bases for the duration of Sydney dealing. Wider cash ACGBs are 4-8bp cheaper across the curve, with some steepening observed.

- Swaps generally tracked bonds, leaving EFPs little changed vs. late Thursday levels.

- Bills finished +1 to -4 through the reds, twist steepening.

- RBA dated OIS is showing ~19bp of tightening for next month’s meeting, a little higher vs. levels seen yesterday, in lieu of the cheapening in bonds and perhaps an outsized move on the back of yesterday’s soft labour market data (which, when coupled with still elevated vacancies, still points to an extremely tight labour market and shouldn’t impact RBA meaningfully come next month’s meeting, nor over the longer term, at least in isolation). Terminal cash rate pricing was also a touch higher, showing ~3.55%.

- Looking ahead, next week’s local docket includes Q4 (and Dec) CPI data, PPI, terms of trade, the monthly NAB business survey and flash PMI readings from Judo Bank.

NZGBS: Cheaper, Global Cues Remain Front & Centre

NZGBS ground cheaper on Friday, unwinding some of Thursday’s notable rally. That left the major NZGB benchmarks running 6-7bp cheaper at the bell, with some modest weakness in U.S. Tsys during Asia-Pac hours adding to the impetus derived from wider core global FI trade on Thursday.

- Benchmark swap rates moved in the same direction as bonds, finishing 7-9bp higher across the curve, with swap spreads widening a touch, suggesting payside swap flow may have also factored into the move in NZGBs.

- Major near-term RBNZ dated OIS pricing measures were flat to a touch firmer, showing 64bp of tightening for next month’s meeting and a terminal OCR of just over 5.40%.

- Local data saw the latest BNZ manufacturing PMI survey print in contractionary territory for a third straight month. The survey collator noted that “the negative mindset of manufacturers has picked up pace, with the proportion of negative comments at 63.5%."

- A deeper dive into the political situation in New Zealand after PM Ardern’s resignation, and ahead of Sunday’s Labour Party leadership vote, can be found here.

- Further out, Q4 CPI data headlines next week’s local docket, with domestic inflationary pressure and stagflation worry well-documented.

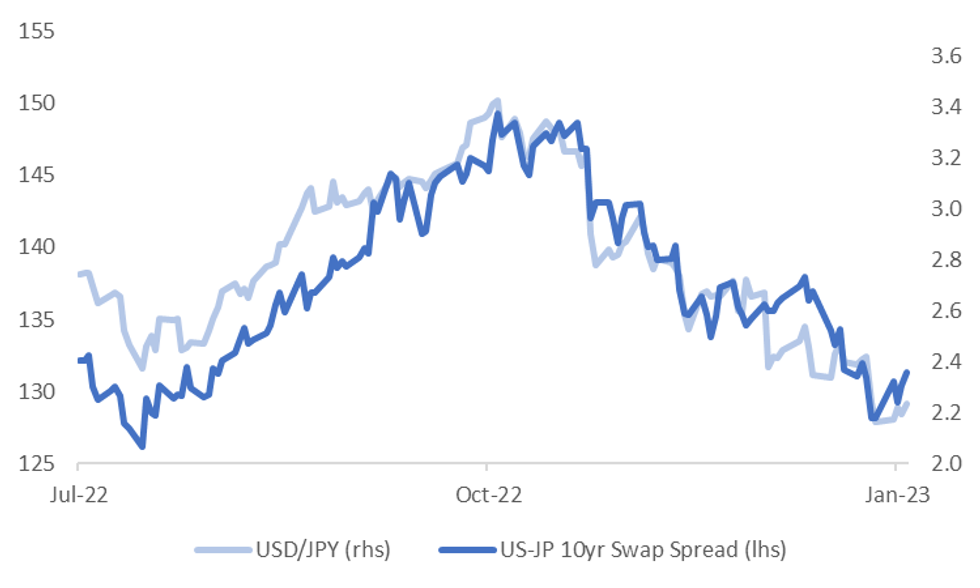

FOREX: USD Nudges Up, USD/JPY Supported BY Higher Yield Differential

The USD indices (DXY, BBDXY) are both around 0.10% higher for Friday's session so far. This keeps us comfortably within ranges seen since the start of the year. Yen weakness has been prominent, with a firmer US cash Tsy yield backdrop helping USD sentiment.

- USD/JPY is back to the 129.15/20 levels, fresh highs going back to the Wednesday's session, when the pair was unwinding its post BoJ bounce. For the week we are up 1.10% at this stage. Yield momentum is edging back in the USD's favor, +236bps for the 10yr swap spread, we were around +218bps this time last week.

- AUD/USD got above 0.6930, but is a touch lower from these levels currently, last around 0.6920/25. Commodity prices remain supportive, iron ore up to $126/ton, but correlations haven't been as firm with the A$ this past week, with yield spreads and equities ranking higher. Next week there will be strong focus on Q4 CPI out on Wednesday.

- Trade ministers from Australia and China could also meet soon, after a further break through at this week's Davos gathering in a sign of improving relations.

- NZD/USD is around 0.6415 currently, with dips below 0.6400 supported for now. Like AUD, the focus next week will be on Q4 CPI, due out on Wednesday as well.

- Other pairs are mostly range bound so far today. Looking ahead, UK and Canadian retail sales data will be published on Friday, as well as U.S. existing home sales. There remains potential for commentary from central bankers and politicians in Davos. Most notably, ECB’s Lagarde will be participating in a panel discussion titled "Global Economic Outlook: Is this the End of an Era?," although she has already provided some steer on monetary policy settings this week.

Fig 1: USD/JPY Versus US-JP 10yr Swap Rate Differential

Source: MNI - Market News/Bloomberg

AUD: Short-Term Correlations With Yield Differentials & Equities Elevated, Less So Commodities

AUD/USD correlations are mixed over the past week and month. The table below presents correlations for the past week and month in levels terms for AUD/USD against key macro drivers.

- Correlations with yield differentials (government bond basis) are firmer for the past week, but indifferent over the past month. The 2yr AU-US differential is slightly firmer, which may remain the case as we head into next week's Q4 CPI print in Australia, which is due Wednesday.

- After trending higher for much of Dec/early Jan, yield differentials have rolled back over, the 2yr spread back to -121bps, versus early Jan highs of -84bps. Yesterday's weaker than expected employment data hasn't helped this picture through the tail end of this week.

- In the commodity space short term correlations are negative, but higher for the past month, particularly for base metals and iron ore. The general trend for is firmer for commodity prices, with China demand hopes driving a more optimistic 2023 outlook.

- Risk appetite, proxied via global equities, maintains a strong correlation for the past week and month as well.

Table 1: AUD/USD Correlations

| 1wk | 1mth | |

| 2yr yield differential | 0.67 | -0.12 |

| 5yr yield differential | 0.53 | 0.37 |

| 10yr yield differential | 0.50 | -0.15 |

| Global commodity prices | -0.18 | -0.17 |

| Global metal prices | -0.80 | 0.76 |

| Iron ore | -0.74 | 0.89 |

| Global equities | 0.91 | 0.93 |

| US VIX index | -0.73 | -0.68 |

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Jan20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E611mln), $1.0650(E1.2bln), $1.0800(E1.0bln), $1.0900(E933mln), $1.0950(E500mln), $1.1000-05(E1.4bln)

- USD/JPY: Y125.00($708mln), Y129.75-00(E1.1bln), Y130.00($1.1bln), Y133.95-05($1.3bln)

- AUD/USD: $0.6900(A$3.7bln), $0.7200(A$2.3bln)

- USD/CAD: C$1.3450($828mln), C$1.3500($1.5bln)

- USD/CNY: Cny6.8000($2.6bln)

ASIA FX: SEA Outperforms NEA Ahead Of LNY Break

USD/Asia pairs are mixed today. NEA FX is trading with a slightly weaker bias, but remains within recent ranges. USD/CNH found selling interest above 6.7900. SEA FX has done better led by THB and MYR. A reminder that LNY next week leaves a number of markets closed (China for the whole week, Hong Kong for first 3 days, Singapore the first 2).

- USD/CNH has continued to trade with a firmer bias, despite rising local equities onshore. We got close to Thursday highs, with the pair touching 6.7930/35, before selling interest emerged. We last tracked close to 6.7820. The CNY fixing bias remained close to neutral.

- 1 month USD/KRW has tracked recent ranges, with early weakness sub 1230 finding USD support. The better equity tone has helped curb upside though, with some spill over from higher USD/JPY levels. The 1 month NDF last tracked near 1235.

- USD/INR has opened dealing ~0.2% lower, last printing 81.20/25. The pair has breached lows seen earlier in the month, and is again dealing below its 100-day EMA (81.70). International flows from Global Funds, which bought a net ~$80M of Indian bonds and ~$365M of Indian equities, in the first 3 days of this week may have weighed on the pair. In the equity space, this is helping to stabilize net outflows from early in the year (we are still close to -$1.5bn YTD).

- USD/THB is back below 33.00, +0.5% for the session in baht terms and the best performer in EM Asia FX so far today. The pair touched 32.80 earlier, but we have edged back to 32.84 now. Baht bulls will be eyeing a break of Jan 16 lows close to 32.70, while on the topside, resistance is evident on moves up to the 33.10/33.20 region. The descending 20-day EMA comes in at 33.75. Note the main event risk next week is BoT's decision on Wednesday, with a +25bps hike expected. BoT commentary around baht will also be monitored for any sign of concern around baht strength.

- MYR has shrugged off the surprise BNM on hold decision from late yesterday. USD/MYR is down a further 0.35% to 4.2925 today. This is fresh lows in the pair back to April 2022. The formation of the so-called death cross, aiding sentiment from a technical standpoint. Dec CPI came in a touch weaker than expected at 3.8%, versus 3.9% forecast and 4.0% prior.

ASIA: Lunar New Year Holiday Exchange Schedules

A reminder that the Lunar New Year Holiday period will thin out liquidity in a notable manner during next week’s Asia-Pac sessions, resulting in market closures of varying degrees/timelines across the region. The major exchange schedules for the region can be found below.

EQUITIES: Asian Markets Tracking Higher Ahead Of Next Week's LNY Break

Asia Pac equities are tracking higher for the most part, shrugging off negative leads from US/EU markets from Thursday's session. US equity futures are tracking modestly higher at this stage, with eminis +0.20%, Nasdaq futures +0.36%. This is the final session ahead of the LNY break next week for a lot of the major EM Asia markets.

- The CSI 300 up 0.50% so far today, with the Shanghai Composite up by the same amount. Financials and consumer stocks are leading the move higher. Northbound flows are just under 7bn yuan so far today, bringing flows for the past trading month close to 119bn yuan. China markets are closed for all of next week.

- The HSI is also trading positively, up over 1% for the main index, with tech shares outperforming. As expected, Didi's ride hailing app is back in domestic app stores. Hong Kong markets are closed for the first 3 sessions next week.

- Japan shares are higher, the Nikkei 225, up 0.35%, while the Kospi has gained 0.50% at this stage.

- Thai stocks are the main laggards in the region at this stage, down 0.80%. This index has struggled closer to 1700 since the beginning of the year, last around 1675, despite continued inflows from offshore investors.

GOLD: Consolidates Post Thursday's Surge

Gold is giving back some of Thursday's impressive +1.48% gains. We last tracked around -0.35% lower, with the precious metal at $1925.00. Some resistance appears around $1935, which is around late April 2022 highs. USD indices are a touch higher today, which has likely weighed on gold at the margins, while US cash Tsy yields are around 2bps higher for most parts of the curve.

- Gold is tracking higher for the week, albeit only just at +0.25%, which compares with 2.90% for the previous week and 2.28% in the first week of the year.

- ETF holdings continue to flat line, but CFTC data shows a continued rise in long positions, which is more consistent with recent spot gold price performance.

OIL: Tracking Higher For The Week, As China Demand Optimism Continues To Dominate

Brent crude is mostly holding onto Thursday session gains. We were last around $86.30/bbl, still seeing some resistance closer to the $87/bbl level. For the session we are up a modest 0.25%, leaving weekly gains around 1.25% at this stage. Highs from Jan 18 near $88/bbl remain intact, while dips this week to $84/bbl have been supported.

- There is little impact from inventory data in NY trading showing a much larger than expected build (8.4M vs -1.3M). The increase in cushing crude stocks was the most since Apr’20.

- Demand optimism, particularly the China outlook is keeping sentiment supported at this stage. China dec oil imports from Russia fell, with Saudi Arabia taking the top spot in terms of supplies to China.

- At this stage though we are little changed for Brent crude prices versus levels at the end of last year.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/01/2023 | 0700/0700 | *** |  | UK | Retail Sales |

| 20/01/2023 | 0700/0800 | ** |  | DE | PPI |

| 20/01/2023 | 0745/0845 | * |  | FR | Retail Sales |

| 20/01/2023 | 1000/1100 |  | EU | ECB Lagarde Panellist at World Economic Forum | |

| 20/01/2023 | 1330/0830 | ** |  | CA | Retail Trade |

| 20/01/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/01/2023 | 1400/0900 |  | US | Philadelphia Fed's Pat Harker | |

| 20/01/2023 | 1500/1000 | *** |  | US | NAR existing home sales |

| 20/01/2023 | 1530/1630 |  | EU | ECB Elderson Into at European Financial Services Roundtable | |

| 20/01/2023 | 1800/1300 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.