-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fiscal Matters Still Grabbing The Headlines In Europe

EXECUTIVE SUMMARY

- FED’S BRAINARD: ‘RESTRICTIVE’ FED EYEING WAGE GROWTH MODERATION (MNI)

- FED'S WILLIAMS: FURTHER TIGHTENING TO BRING STABLE PRICES (MNI)

- FRENCH UNIONS CALL FOR JAN. 31 STRIKES TO HALT PENSION CHANGES (BBG)

- JEREMY HUNT WARNS NOT TO EXPECT TAX CUTS IN MARCH BUDGET (FT)

- EU TO CONSIDER MORE RUSSIA SANCTIONS DESPITE DIFFICULT DEBATES (BBG)

- UKRAINE SAYS IT'S TIME TO REVIEW PRICE CAP ON RUSSIAN OIL (RTRS)

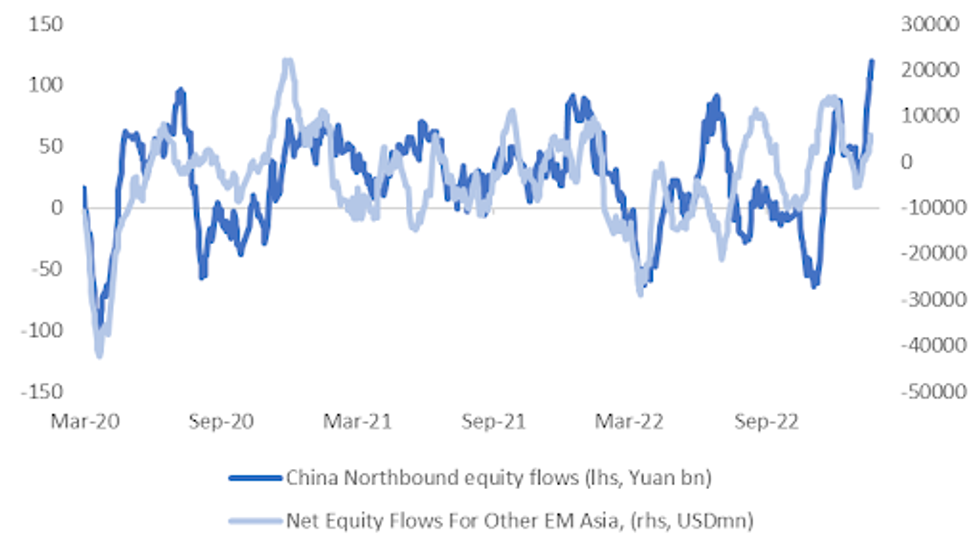

Fig. 1: Hong Kong-China Northbound Stock Connect Flows Vs. Net Equity Flows For Remainder Of EM Asia

Source: MNI - Market News/Bloomberg

UK

ECONOMY: UK employers unleashed a hiring spree at the start of 2023 even as consumer confidence about the economy stalled, two separate surveys showed. (BBG)

ECONOMY/POLITICS: Britain’s train companies have made a “best and final offer” to the RMT, one of the most prolific unions behind strikes that have rocked the rail network for months. (BBG)

FISCAL: UK chancellor Jeremy Hunt has warned Conservative MPs not to expect tax cuts in his March Budget, but Tory strategists are earmarking the equivalent fiscal event next year as the moment for a pre-election giveaway. (FT)

FISCAL: Jeremy Hunt wants to extend the 5p cut in the price of petrol and diesel for another year if the economic outlook improves, having accepted there is a “strong precedent” for freezing fuel duty. (The Times)

FISCAL/POLITICS: Tory seats have been awarded significantly more money per person from the government’s £4bn levelling up fund than areas with similar levels of deprivation, a Guardian analysis has found. (Guardian)

BREXIT: Britain and Ireland agreed to continue their bilateral cooperation and on the importance of restoring the devolved government in Northern Ireland, a joint communique from the two sides said on Thursday. (RTRS)

BREXIT/NORTHERN IRELAND: The UK government will not rush to call new elections in Northern Ireland despite a legal deadline to form a power-sharing executive passing, as London and Brussels work to resolve a long-running dispute over post-Brexit trade rules. (FT)

BREXIT/NORTHERN IRELAND: Irish Prime Minister Leo Varadkar has told the BBC that he regrets the fact that the Northern Ireland Protocol was “imposed” on the Unionist community without their consent. (BBC)

EUROPE

FRANCE: French unions called for renewed strikes on Jan. 31 to step up pressure on President Emmanuel Macron to withdraw an increase in the minimum retirement age to 64 from 62. (BBG)

ITALY: Italy's government appointed on Thursday veteran economist Riccardo Barbieri as director general of the Treasury, replacing Alessandro Rivera in the influential position. (RTRS)

RATINGS: Potential rating reviews slated for after hours on Friday include:

- Fitch on Hungary (current rating: BBB; Outlook Stable), Ireland (current rating: Ireland at AA-; Outlook Stable) & Norway (current rating: AAA; Outlook Stable)

- DBRS Morningstar on Austria (current rating: AAA, Stable Trend), Estonia (current rating: AA (low), Stable Trend), the European Financial Stability Facility (current rating: AAA, Stable Trend), the European Stability Mechanism (current rating: AAA, Stable Trend) & Switzerland (current rating: AAA, Stable Trend)

U.S.

FED: Federal Reserve policy is already in restrictive territory though the effects of rapid monetary tightening have not yet totally permeated the economy and policymakers are watching the path of wages closely, Fed Vice Chair Lael Brainard said Thursday. (MNI)

FED: Monetary policy still has "more work to do" to tame inflation for good, Federal Reserve Bank of New York President John Williams said Thursday, signaling further interest rate increases are in store this year. (MNI)

FED: The Federal Reserve's balance sheet reduction program is expected to continue despite bank reserves falling faster than expected to around USD3 trillion, New York Fed President John Williams said Thursday. (MNI)

FED: U.S. inflation pressures are showing encouraging signs of softening and the country may avoid a deep recession and a more lasting era of stubbornly high price rises, Minneapolis Fed Research Director Andrea Raffo told MNI. (MNI)

FED: The U.S. Federal Reserve will end its tightening cycle after a 25-basis-point hike at each of its next two policy meetings and then likely hold interest rates steady for at least the rest of the year, according to most economists in a Reuters poll. (RTRS)

FISCAL: Goldman Sachs Group Inc.'s Chief Executive David Solomon expressed serious concern on Thursday that a political standoff over the U.S. debt ceiling could lead to a fiscal crisis. (RTRS)

POLITICS: President Biden on Thursday downplayed a classified documents probe after materials were found in his home and a former office, telling reporters there’s “nothing there” when asked if the investigation is complete. (The Hill)

EQUITIES: Google executives are deferring a portion of employees’ year-end bonus checks, according to documents viewed by CNBC, as the company moves toward permanently pushing back payouts. (CNBC)

OTHER

GLOBAL TRADE: The Netherlands and Japan, home to key suppliers of semiconductor manufacturing equipment, are close to joining a Biden administration-led effort to restrict exports of the technology to China and hobble its push into the chips industry. (BBG)

U.S./CHINA: A team of U.S. Treasury officials will visit China in February to prepare for a visit by U.S. Treasury Secretary Janet Yellen, two sources familiar with the plans told Reuters on Thursday. (RTRS)

JAPAN: Japan's overall government bond issuance would not change even if its 60-year debt redemption rule is reviewed, Finance Minister Shunichi Suzuki said on Friday. The fiscal rule helps Japan's government maintain fiscal discipline, Suzuki told reporters after a cabinet meeting. (RTRS)

JAPAN: Japan's Prime Minister Kishida Fumio has instructed ministers to consider steps toward recategorizing COVID-19 into the same class of infectious diseases as seasonal flu this spring. (NHK)

JAPAN: Tepco is planning to apply to raise utility prices with the regulator as soon as next week, TV Asahi reports, citing an unidentified person. Utility will be seeking an increase of up to ~30% to be implemented as soon as June. (BBG)

NEW ZEALAND: Nominations for candidates to replace Jacinda Ardern as New Zealand's prime minister must be submitted by 9am Saturday (2200GMT) ahead of a leadership vote on Sunday, the Labour Party's chief whip said in an emailed statement on Friday. (RTRS)

SOUTH KOREA: Prime Minister Han Duck-soo said Friday that South Korea plans to lift the mask mandate for most indoor spaces from Jan. 30, dropping its last remaining pandemic restriction as the daily caseload continues to decline. (Yonhap)

BRAZIL: Brazil’s budget head vowed to counterbalance leftist proposals in the new government with her moderate views, as investors grow increasingly wary about the direction of Latin America’s largest economy. (BBG)

BRAZIL: Brazil's central bank will act independently, governor Roberto Campos Neto said Thursday, adding that the formal autonomy status showed resilience and capacity to stabilize markets. (RTRS)

RUSSIA: The foreign ministers of the Group of Seven nations are arranging to meet next month in Germany to discuss the situation in Ukraine, broadcaster TV Asahi reports without attribution. (BBG)

RUSSIA: The United States said on Thursday it would send hundreds of armored vehicles plus rockets and artillery shells to Ukraine as part of a $2.5 billion military assistance package. (RTRS)

RUSSIA: CIA Director William J. Burns traveled in secret to Ukraine’s capital at the end of last week to brief President Volodymyr Zelensky on his expectations for what Russia is planning militarily in the coming weeks and months, said a U.S. official and other people familiar with the visit. (Washington Post)

RUSSIA: Germany's new Defence Minister Boris Pistorius said he did not know of any requirement that Ukraine receive U.S. and German tanks simultaneously, before a meeting on Friday at which future supplies to Kyiv will be discussed. (RTRS)

RUSSIA: The European Union will continue to consider new rounds of sanctions on Russia even though the bloc’s debates have gotten more challenging each time, said European Council President Charles Michel. (BBG)

CHILE: Chile’s beleaguered President Gabriel Boric breathed a sigh of relief Thursday after the lower house of congress rejected accusations of wrongdoing against one of his long-standing friends, Social Development Minister Giorgio Jackson. (BBG).

PERU: Peru President Dina Boluarte said Thursday on national television that her government remains “firm” despite the recent protests in Lima to try to overthrow her. (BBG)

MACRO: China’s economic reopening might boost global growth, but the business leaders and policymakers at the World Economic Forum this week are also a little anxious on its potential inflationary impact. (CNBC)

OIL: Ukraine's foreign minister said on Thursday it was time to review the $60 per barrel price cap imposed on Russian seaborne oil, on the grounds that the current market price for Russia's Urals oil blend was below that level. (RTRS)

OIL: Riyadh is engaging with Russia over keeping oil prices relatively stable, the Saudi Foreign Minister Prince Faisal bin Farhan Al-Saud told Bloomberg on Thursday. (RTRS)

OIL: TC Energy’s Keystone crude oil pipeline system has declared force majeure on shipments and cut rates after ice accumulation in Alberta caused power outages to 3 pump stations this week, according to a notice seen by Bloomberg. (BBG)

CHINA

ECONOMY: China’s vice-premier Liu He privately met a group of top corporate executives in Davos to tell them that the world’s second-largest economy was back, in an effort to rekindle economic ties damaged by the pandemic and tensions with the US. (FT)

POLITICS: Vice premier Han Zheng is expected to become China's next vice president in a surprise turn after he stepped down from a top leadership role last November. (The Standard)

PBOC: China's reference lending rate remained unchanged on Friday, according to a statement on the People's Bank of China website, which was in line with market expectations as the central bank kept a key policy rate steady on Monday. (MNI)

FISCAL: Local governments have increased the use of consumption coupons to increase spending during the Spring Festival, according to the Securities Times. (MNI)

PROPERTY: Several local governments in tier two cities such as Jiujiang, Taiyuan, and Tangshan have decreased the lower limit on first time buyer mortgage interest rates to as low as 3.8%, according to Securities Daily. (MNI)

EQUITIES: Foreign investment in A-shares is expected to increase significantly in 2023, as investors seek to capture opportunities from China’s recovery and long term fundamentals, according to China Securities News. (MNI)

EQUITIES/POLICY: Chinese technology company Didi Global's domestic ride-hailing app has returned to China's domestic Apple app store, according to checks by Reuters on Friday. (RTRS)

CHINA MARKETS

PBOC NET INJECTS CNY326 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) on Friday conducted CNY62 billion via 7-day reverse repos and CNY319 billion via 14-day reverse repos with the rates unchanged at 2.00% and 2.15%, respectively. The operation has led to a net injection of CNY326 billion after offsetting the maturity of CNY55 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity stable before Chinese New Year, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.0255% at 9:47 am local time from the close of 2.3543% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 50 on Thursday, compared with the close of 45 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7702 FRI VS 6.7674 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7702 on Friday, compared with 6.7674 set on Thursday.

OVERNIGHT DATA

JAPAN DEC NATIONAL CPI +4.0% Y/Y; MEDIAN +4.0% Y/Y; NOV +3.8%

JAPAN DEC NATIONAL CPI EXCL. FRESH FOOD +4.0% Y/Y; MEDIAN +4.0% Y/Y; NOV +3.7%

JAPAN DEC NATIONAL CPI EXCL. FRESH FOOD & ENERGY +3.0% Y/Y; MEDIAN +3.1% Y/Y; NOV +2.8%

NEW ZEALAND DEC BUSINESSNZ MANUFACTURING PMI 47.2; NOV 47.2

New Zealand’s manufacturing sector saw the same level of contraction in December that it experienced the previous month, according to the latest BNZ – BusinessNZ Performance of Manufacturing Index (PMI).

NEW ZEALAND NOV NET MIGRATION +6,110; OCT +3,857

SOUTH KOREA DEC PPI +6.0% Y/Y; NOV +6.2%

UK JAN GFK CONSUMER CONFIDENCE -45; MEDIAN -40; DEC -42

MARKETS

US TSYS: Yields Marginally Firmer In Asia

TYH3 deals at 115-15+, -0-05, in the middle of its 0-08+ range on volume of ~95K.

- Cash Tsys are running 1-2bp cheaper across the major benchmarks.

- Tsys were marginally cheaper in early trading in a muted start to Friday's session.

- Fedspeak from NY Fed President Williams was on the wires, he noted there is still more work to do to tame inflation and that it made sense for the Fed to slow rate rises in December. He reiterated themes observed in recent communique in that the Fed has a way to go on rate rises, while not being drawn into a specific call re: the size of the hike that should be deployed at the next FOMC, alluding to market pricing that is "roughly consistent" with Fed's rate outlook.

- The early cheapening extended marginally, although there was no overt headline driver for the move. TYH3 saw support come in ahead of the high from Dec 13 and a recent breakout level, after showing as low as 115-12+.

- The pressure on Tsys then moderated, with a rally in JGBs aiding the recovery.

- ECB speak from Lagarde headlines the European session. Further out we have U.S. home sales and Fedspeak from Philadelphia President Harker and Governor Waller.

JGBS: Firm Into The Bell, Futures Breach Post-BoJ Peak

A morning bid in JGBs extended during the Tokyo afternoon, with the subdued offer/cover ratios in today’s BoJ Rinban operations adding further fuel to the fire.

- Futures are near enough +70 into the bell, a little shy of best levels, but through the post-BoJ spike peak. That breach allows bulls to turn focus to the zone that consists of the 6 Dec low & 16 Nov high.

- Cash JGBs are 2-8bp richer across the curve, led by 7s (owing to the bid in futures). Swap rates are still lagging across most of the curve, leaving swap spreads wider to near enough flat, dependent on the zone of the curve you are looking at.

- As noted earlier, there hasn’t been much in the way of meaningful headline flow to highlight, meaning continued post-BoJ adjustments and the lack of upside surprise in the national CPI data (albeit with the major metrics moving to fresh cycle highs in Y/Y terms) were likely in the driving seat early on.

- PM Kishida pointed to a desire to downgrade the government’s assessment of COVID to the same risk category as the flu, with an eye on doing so during the Spring.

- Elsewhere, Finance Minister Suzuki has noted that any review of the 60-Year debt redemption rule would not alter overall JGB issuance matters, although cautioned against making any change to the rule, owing to the positives generated re: fiscal discipline.

- The minutes from the BoJ’s Dec meeting (which saw the surprise YCC tweak) headline domestically on Monday.

JGBS AUCTION: 3-Month Bill Auction Results

The Japanese Ministry of Finance (MOF) sells Y4.87296tn 3-Month Bills:

- Average Yield -0.1591% (prev. -0.1283%)

- Average Price 100.0397 (prev. 100.0320)

- High Yield: -0.1443% (prev. -0.1182%)

- Low Price 100.0360 (prev. 100.0295)

- % Allotted At High Yield: 35.1758% (prev. 16.9445%)

- Bid/Cover: 2.720x (prev. 3.239x)

AUSSIE BONDS: Meandering Into The Weekend After Giving Back Some Of Thursday’s Rally

Aussie bond futures meandered through the final Sydney session of the week, and never really detached meaningfully from late overnight session levels, after cheapening in lieu of some hawkish ECB speak and weakness in global core FI markets in overnight trade.

- That left YM -4.0 & XM -7.5, operating a little above their respective overnight bases for the duration of Sydney dealing. Wider cash ACGBs are 4-8bp cheaper across the curve, with some steepening observed.

- Swaps generally tracked bonds, leaving EFPs little changed vs. late Thursday levels.

- Bills finished +1 to -4 through the reds, twist steepening.

- RBA dated OIS is showing ~19bp of tightening for next month’s meeting, a little higher vs. levels seen yesterday, in lieu of the cheapening in bonds and perhaps an outsized move on the back of yesterday’s soft labour market data (which, when coupled with still elevated vacancies, still points to an extremely tight labour market and shouldn’t impact RBA meaningfully come next month’s meeting, nor over the longer term, at least in isolation). Terminal cash rate pricing was also a touch higher, showing ~3.55%.

- Looking ahead, next week’s local docket includes Q4 (and Dec) CPI data, PPI, terms of trade, the monthly NAB business survey and flash PMI readings from Judo Bank.

NZGBS: Cheaper, Global Cues Remain Front & Centre

NZGBS ground cheaper on Friday, unwinding some of Thursday’s notable rally. That left the major NZGB benchmarks running 6-7bp cheaper at the bell, with some modest weakness in U.S. Tsys during Asia-Pac hours adding to the impetus derived from wider core global FI trade on Thursday.

- Benchmark swap rates moved in the same direction as bonds, finishing 7-9bp higher across the curve, with swap spreads widening a touch, suggesting payside swap flow may have also factored into the move in NZGBs.

- Major near-term RBNZ dated OIS pricing measures were flat to a touch firmer, showing 64bp of tightening for next month’s meeting and a terminal OCR of just over 5.40%.

- Local data saw the latest BNZ manufacturing PMI survey print in contractionary territory for a third straight month. The survey collator noted that “the negative mindset of manufacturers has picked up pace, with the proportion of negative comments at 63.5%."

- A deeper dive into the political situation in New Zealand after PM Ardern’s resignation, and ahead of Sunday’s Labour Party leadership vote, can be found here.

- Further out, Q4 CPI data headlines next week’s local docket, with domestic inflationary pressure and stagflation worry well-documented.

EQUITIES: Asian Markets Tracking Higher Ahead Of Next Week's LNY Break

Asia Pac equities are tracking higher for the most part, shrugging off negative leads from US/EU markets from Thursday's session. US equity futures are tracking modestly higher at this stage, with eminis +0.20%, Nasdaq futures +0.36%. This is the final session ahead of the LNY break next week for a lot of the major EM Asia markets.

- The CSI 300 up 0.50% so far today, with the Shanghai Composite up by the same amount. Financials and consumer stocks are leading the move higher. Northbound flows are just under 7bn yuan so far today, bringing flows for the past trading month close to 119bn yuan. China markets are closed for all of next week.

- The HSI is also trading positively, up over 1% for the main index, with tech shares outperforming. As expected, Didi's ride hailing app is back in domestic app stores. Hong Kong markets are closed for the first 3 sessions next week.

- Japan shares are higher, the Nikkei 225, up 0.35%, while the Kospi has gained 0.50% at this stage.

- Thai stocks are the main laggards in the region at this stage, down 0.80%. This index has struggled closer to 1700 since the beginning of the year, last around 1675, despite continued inflows from offshore investors.

GOLD: Consolidates Post Thursday's Surge

Gold is giving back some of Thursday's impressive +1.48% gains. We last tracked around -0.35% lower, with the precious metal at $1925.00. Some resistance appears around $1935, which is around late April 2022 highs. USD indices are a touch higher today, which has likely weighed on gold at the margins, while US cash Tsy yields are around 2bps higher for most parts of the curve.

- Gold is tracking higher for the week, albeit only just at +0.25%, which compares with 2.90% for the previous week and 2.28% in the first week of the year.

- ETF holdings continue to flat line, but CFTC data shows a continued rise in long positions, which is more consistent with recent spot gold price performance.

OIL: Tracking Higher For The Week, As China Demand Optimism Continues To Dominate

Brent crude is mostly holding onto Thursday session gains. We were last around $86.30/bbl, still seeing some resistance closer to the $87/bbl level. For the session we are up a modest 0.25%, leaving weekly gains around 1.25% at this stage. Highs from Jan 18 near $88/bbl remain intact, while dips this week to $84/bbl have been supported.

- There is little impact from inventory data in NY trading showing a much larger than expected build (8.4M vs -1.3M). The increase in cushing crude stocks was the most since Apr’20.

- Demand optimism, particularly the China outlook is keeping sentiment supported at this stage. China dec oil imports from Russia fell, with Saudi Arabia taking the top spot in terms of supplies to China.

- At this stage though we are little changed for Brent crude prices versus levels at the end of last year.

FOREX: USD Nudges Up, USD/JPY Supported BY Higher Yield Differential

The USD indices (DXY, BBDXY) are both around 0.10% higher for Friday's session so far. This keeps us comfortably within ranges seen since the start of the year. Yen weakness has been prominent, with a firmer US cash Tsy yield backdrop helping USD sentiment.

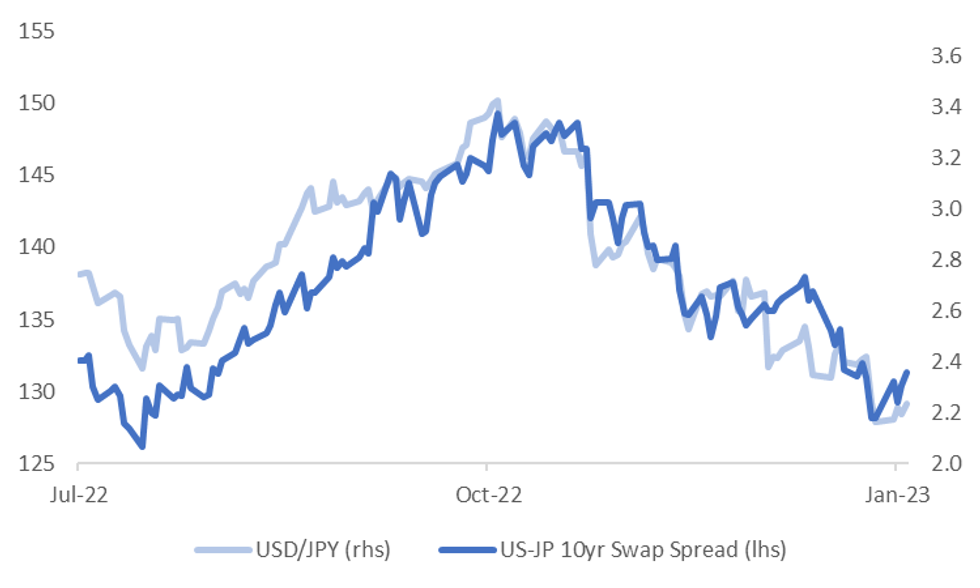

- USD/JPY is back to the 129.15/20 levels, fresh highs going back to the Wednesday's session, when the pair was unwinding its post BoJ bounce. For the week we are up 1.10% at this stage. Yield momentum is edging back in the USD's favor, +236bps for the 10yr swap spread, we were around +218bps this time last week.

- AUD/USD got above 0.6930, but is a touch lower from these levels currently, last around 0.6920/25. Commodity prices remain supportive, iron ore up to $126/ton, but correlations haven't been as firm with the A$ this past week, with yield spreads and equities ranking higher. Next week there will be strong focus on Q4 CPI out on Wednesday.

- Trade ministers from Australia and China could also meet soon, after a further break through at this week's Davos gathering in a sign of improving relations.

- NZD/USD is around 0.6415 currently, with dips below 0.6400 supported for now. Like AUD, the focus next week will be on Q4 CPI, due out on Wednesday as well.

- Other pairs are mostly range bound so far today. Looking ahead, UK and Canadian retail sales data will be published on Friday, as well as U.S. existing home sales. There remains potential for commentary from central bankers and politicians in Davos. Most notably, ECB’s Lagarde will be participating in a panel discussion titled "Global Economic Outlook: Is this the End of an Era?," although she has already provided some steer on monetary policy settings this week.

Fig 1: USD/JPY Versus US-JP 10yr Swap Rate Differential

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Jan20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E611mln), $1.0650(E1.2bln), $1.0800(E1.0bln), $1.0900(E933mln), $1.0950(E500mln), $1.1000-05(E1.4bln)

- USD/JPY: Y125.00($708mln), Y129.75-00(E1.1bln), Y130.00($1.1bln), Y133.95-05($1.3bln)

- AUD/USD: $0.6900(A$3.7bln), $0.7200(A$2.3bln)

- USD/CAD: C$1.3450($828mln), C$1.3500($1.5bln)

- USD/CNY: Cny6.8000($2.6bln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/01/2023 | 0700/0700 | *** |  | UK | Retail Sales |

| 20/01/2023 | 0700/0800 | ** |  | DE | PPI |

| 20/01/2023 | 0745/0845 | * |  | FR | Retail Sales |

| 20/01/2023 | 1000/1100 |  | EU | ECB Lagarde Panellist at World Economic Forum | |

| 20/01/2023 | 1330/0830 | ** |  | CA | Retail Trade |

| 20/01/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/01/2023 | 1400/0900 |  | US | Philadelphia Fed's Pat Harker | |

| 20/01/2023 | 1500/1000 | *** |  | US | NAR existing home sales |

| 20/01/2023 | 1530/1630 |  | EU | ECB Elderson Into at European Financial Services Roundtable | |

| 20/01/2023 | 1800/1300 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.