-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Yields Fade as Equity Bounce Moderates

Highlights:

- Treasury yields fade as equity bounce reverses

- USD/CNH plumbs a new cycle high

- Sterling outperforms as Sunak pledges smoother running of government

US TSYS: Treasuries Follow EU And Bunds In Particular Richer

- Cash Tsys are extending a swift rally early in the European session after the open, with little spillover from a subsequent small beat for German Ifo sentiment which still remains on track for a winter recession. In 10Y space, Treasuries (-7bps) match Gilts but lag EU FI and Bunds in particular (-10bps). 2s10s bull flatten -2.5bps to -28.5bps but remain near the top of the recent range.

- 2YY -4.3bps at 4.462%, 5YY -6.8bps at 4.295%, 10YY -6.9bps at 4.173%, and 30YY -4bps at 4.338%.

- TYZ2 trades 14 ticks higher at 110-05+ on low volumes, with resistance seen at 110-15 (Oct 24 high) even if the trend needle remains south with support at 108-26+ (Oct 21 low).

- Data: Second tier but potentially still of note with house prices (FHFA, S&P CoreLogic) first at 0900ET and then CB consumer confidence and the Richmond Fed manufacturing index at 1000ET.

- Bond issuance: US Tsy $42B 2Y note auction (91282CFQ9) – 1300ET

- Non-mon pol Fedspeak: Fed Gov Waller on FedNow, Vegas conf (moderated Q&A)

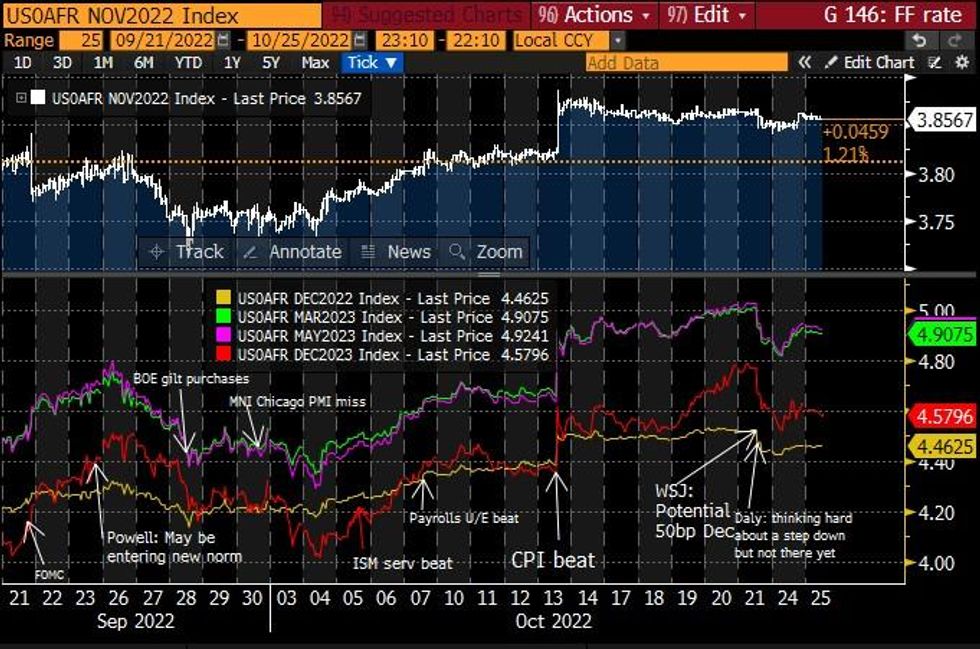

STIR FUTURES: 2023 Fed Rates Seen At Post-CPI Levels

- Fed Funds implied hikes have drifted lower for 2023 overnight but remain close to post-CPI levels.

- 77.5bps for Nov (unch), 138bp to 4.46% for Dec (unch), terminal 4.92% in May’23 (-2.5bp) and 4.58% Dec’23 (-3.5bp).

- Being in the media blackout, Gov Waller will stick to non-mon pol matters discussing the FedNow service at 1355ET.

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

ECB: Another Jumbo ECB Hike Seems Feasible In December

- A 75bp hike at this week’s meeting is close to being fully priced by the market and is the expected outcome among analysts. We have similarly opted for a 75bp move (see MNI’s ECB Preview).

- Gauging by the notes that we have seen, opinions differ more widely on whether the ECB delivers another ‘jumbo’ hike in December, or decides to slow the pace. In the latter scenario, the ECB would likely be signalling that policy rates are getting closer to the natural rate.

- At this stage, we still expect another 75bp move in December. We have yet to see a decisive end to the run of inflation surprises (and doubt that the outlook will have improved materially come December) and, given the widening spread between spot inflation and the target, we would err on the side of the caution and peg the terminal rate much higher than the ~2% level that has been touted by some members of the GC.

- Market pricing on the terminal rate has been relatively sticky around the 3% mark by mid-2023. Although, interestingly, this has started to edge down slightly with the July-23 ESTR forward now trading at 2.89, down from a September high of 3.16%.

Oil Dragging Down Broader Indices

Equities are weaker over the past hour - no particular headlines driving the move lower, nor is there much cross-asset corroboration for the move (in USD or Bonds).

- However, the drop does appear to be tracking lower oil prices, which leaves Energy stocks as the biggest sectoral underperformers this morning. Chart below shows intraday S&P futs / Brent crude / Shell share price (the biggest single drag on Euro energy stocks this morning).

- On oil, our commodities team notes no particular reason underpinning the move today. But Brent front month (off $1.35 today at $91.91) has been bouncing between 91 and 94 for a few days now, with markets weighing the balance between economic slowdown and China demand vs Russia and OPEC supply risk.

- Having retraced from resistance at the 3820/3822 bull trigger level, next support for S&P eminis is seen at 3641.50 (Oct 21 low), per our tech analyst.

Tuesday Q3 Earnings Roundup

- Tuesday pre-open:

- United Parcel Service (UPS) beat: $2.99 vs. $2.847 est;

- General Motors (GM) beat: $2.25 vs. $1.893 est;

- General Electric (GE) miss: $0.35 vs. $0.468 est;

- Valero Energy (VLO) beat: $7.14 vs. $6.823 est;

- Halliburton (HAL) $0.56 est;

- Coca-Cola (KO) $0.636 est;

- Sherwin Williams (SHW) $2.562 est;

- Archer Daniels Midland (ADM) $1.442 est;

- Biogen (BIIB) $4.194 est; 3M Co (MMM) $2.598 est;

- Pulte Group (PHM) $2.809 est;

- Corning (GLW) $0.561 est;

- Raythen (RTX) $1.142 est;

- Kimberly-Clark (KMB) $1.441 est;

- Mattel (MAT) $0.735 est;

- After the close: Chipotle (CMG) $9.233 est; Google $1.248 est; Microsoft (MSFT) $2.308 est; Texas Instruments (TXN) $2.382 est; Visa (V) $1.863 est; NCR Corp (NCR) $0.775 est

FOREX: GBP Makes Furtive Gains as Sunak Heads to No. 10

- G10 FX price action has been more muted so far Tuesday, with GBP making furtive gains as incoming PM Sunak looks to take the reins from outgoing PM Truss later today. Nonetheless, GBP holds below weekly highs printed against USD and EUR so far, making 1.1409 key intraday resistance for GBP/USD today.

- PM Sunak is expected to announce the first positions in his cabinet later today, with Chancellor, Home Secretary, Foreign Secretary and Defence Secretary expected to be confirmed.

- Meanwhile, CHF is the poorest performer in G10, extending the quiet near-term uptrend in EUR/CHF that's put the cross at a multi-month high today at 0.9901. This narrows the gap with 0.9962 - the 50% retracement of the June - September downleg and a break above here puts the cross on course for a test of the 1.0072 200-dma.

- Greenback trade has been more muted, with the USD Index either side of the 112.00 handle, keeping the USD toward the lower-end of the recent range.

- Tier one data releases are few and far between Tuesday, with US consumer confidence the highlight. Both Fed and ECB remain in their pre-rate decision media blackouts, leaving CB speaker risk very low for now. BoE's Pill is on the docket, speaking on ONS statistics.

FX OPTIONS: Expiries for Oct25 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9745-50(E1.2bln), $0.9775-90(E1.3bln), $0.9800-05(E927mln)

- USD/JPY: Y145.00($2.4bln), Y145.65($1.45bln), Y150.00($1.2bln)

- GBP/USD: $1.1435(Gbp1.0bln)

- AUD/USD: $0.6600(A$759mln)

- USD/CAD: C$1.3500($550mln), C$1.3900($500mln)

- USD/CNY: Cny7.2000($830mln), Cny7.2500($1.0bln)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/10/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 25/10/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/10/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/10/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/10/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/10/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/10/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/10/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/10/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 25/10/2022 | 1755/1355 |  | US | Fed Governor Christopher Waller | |

| 26/10/2022 | 0030/1130 | *** |  | AU | CPI inflation |

| 26/10/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 26/10/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/10/2022 | 0800/1000 | ** |  | EU | M3 |

| 26/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 26/10/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/10/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/10/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 26/10/2022 | 1400/1000 |  | CA | BOC Monetary Policy Report | |

| 26/10/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 26/10/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 26/10/2022 | 1500/1100 |  | CA | BOC Governor Press Conference | |

| 26/10/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/10/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.